The Case For Asia High Income Bonds In 2023 & How to Invest

We believe it could be time for investors to revisit one of the most downtrodden sectors from 2022: the Asia high yield bond market. This market is currently rebounding from historical lows and yielding more than other global bond markets. Below, we explain what happened and why we believe most of the pain is in the past. We also discuss how Nikko, one of the largest Asian asset managers and foremost experts in the Asian fixed income market and the sub-adviser to our KraneShares Asia High Income Bond ETF (Ticker: KHYB), was able to outperform the Fund's benchmark in 2022.

Why are Asia high income bonds rebounding in 2023?

Asia’s bond market has witnessed steady growth over the past decade, increasing in market capitalization by over 200%.1 Following a liquidity crunch in China's real estate development industry, high yield spreads in Asia have reached five-year highs. Currently, KHYB offers a 30-day SEC yield of 9.6% compared to 7.6% for US high yield.2

China’s real estate industry experienced a taper tantrum in late 2021 as regulators dramatically lowered the maximum leverage that developers could take on through the “Three Red Lines” policy. This led to a multitude of defaults, the most famous of which came from mega-developer China Evergrande Group. This spate of defaults led, in turn, to heavy losses in the Asia high yield bond market. However, at the end of last year China’s government made progress at reinstating developers’ borrowing capabilities after many restructurings. Furthermore, the country rescinded its zero COVID policy, increasing consumer confidence and boosting demand in the consumer and real estate sectors. And, after 16 consecutive months of price declines, home price in China stabilized in January.3

We believe this market could be an attractive choice for bond investors in 2023 because it offers yields that are competitive with high US interest rates and may also see price appreciation as it benefits from China’s reopening and high economic growth in Asia.

How to Invest: KHYB 2022 Performance & Portfolio Management Overview

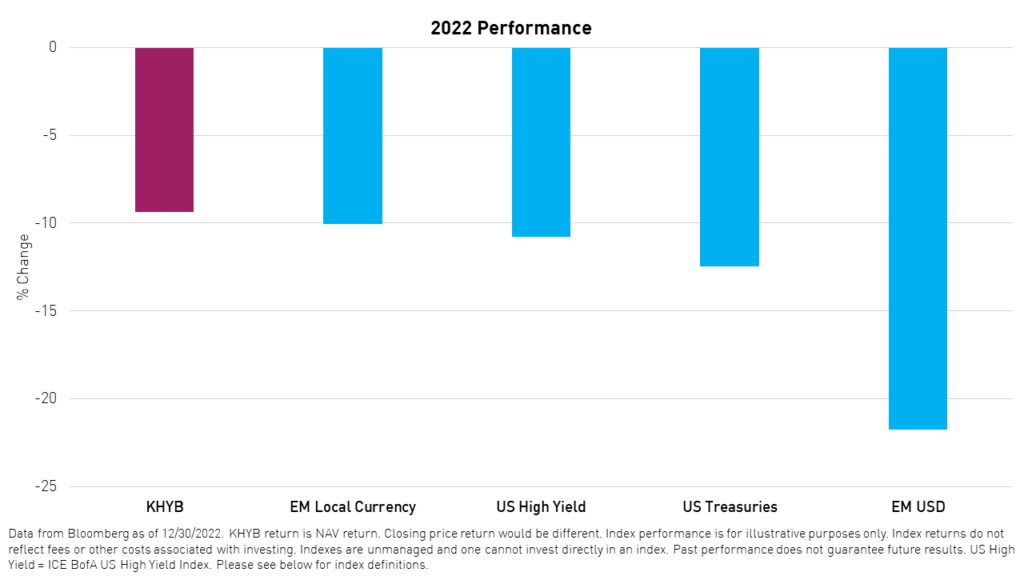

KHYB provides cost-efficient and risk-managed access to this market. KHYB is actively managed by our partner Nikko. Portfolio manager Wai Hoong Leong and his team were able to successfully navigate a challenging market environment over the past 18 months, leading to KHYB’s 4% outperformance in 2022 versus its benchmark: the JACI USD Non-Investment Grade Corporate Index.

Please click here for KHYB standard performance and top ten holdings.

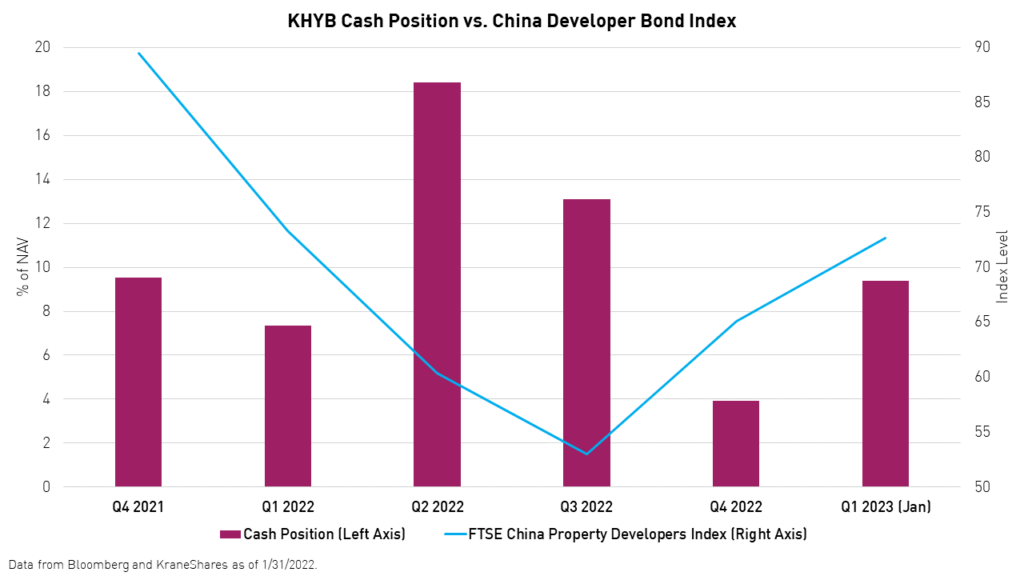

The portfolio management team at Nikko was able to adjust their cash position as conditions worsened and then improved later in the year.

Despite the deluge in China’s real estate sector, KHYB also outpaced other major bond markets, emerging, and developed, amid last year’s global fixed income rout.

“The fund’s overall returns since 2021 have been significantly impacted by the stress in China’s property sector, the Zero COVID policy, along with weak global risk sentiment from persistently high inflation and aggressive tightening of central bank monetary policy,” Wai Hoong Leong told KraneShares. “Though, towards the end of the year in 2022, China pivoted on both property sector support and Zero COVID, while inflation in developed economies in recent months has been softer-than-expected.”

Wai Hoong Leong attributes KHYB’s outperformance to the below factors:

- Sector Allocation - In the earlier part of 2022, when the team thought that the COVID outbreak would continue to impact consumption-related industries, they went underweight to the consumer discretionary and transportation industries and overweight to more defensive industries such as financials.

- Duration – The team was also underweight perpetual bonds for the period, lowering duration risk amid rising long and short-term interest rates. Perpetuals with no step-up coupon are essentially the bonds with the largest spread duration and, hence, suffered the most in 2022.

- Security Selection – The team found it difficult to remain invested in China’s real estate development industry due to mounting risks in 2022. However, strong bottom-up credit research allowed them to select the most likely winners within the sector, and thus contributed significantly to the outperformance of the fund compared to the JACI Non-Investment Grade Corporate Index.

Nikko has a long history of managing Asian Fixed Income. Nikko’s credit philosophy is premised on capital preservation and thorough credit research with the goal of protecting investors’ portfolios, first and foremost. Security selection through their time-tested credit research and internal credit rating model is where they differentiate themselves. Nikko’s team also benefits from their on-the-ground presence in most Asia markets, their knowledge of local languages, and deep understanding of local business environments. Wai Hoong also attributes his team’s prowess to their experience in navigating past financial crises, including the Asian Financial Crisis of 1997.

Conclusion

With higher yields compared to global bond markets and exposure to China’s reopening and high economic growth in Asia, we believe Asia’s high yield bond market presents a compelling opportunity for investors. Having only begun to rebound from 10-year lows in 2022, we believe that now could be an attractive entry point for long-term investors. KHYB provides cost-efficient* access to this market with the benefit of an experienced active manager.

*Buying and selling shares of KHYB can result in brokerage commissions.

Citations:

- Data from JP Morgan as of 12/31/2022.

- Data from JP Morgan, and Bloomberg as of 2/14/2023. US High Yield = Markit iBoxx USD Liquid High Yield Index.

- Economy. “China Home Prices Hold Steady After Falling for 16 Months,” Caixin Global. February 16, 2023.

Index Definitions:

JP Morgan Asia Credit Index (JACI) USD Non Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar denominated debt instruments issued out of Asia ex Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.

ICE BofA US High Yield Index (US High Yield) : The ICE BofA US High Yield Index provides a comprehensive, accurate representation of the US high yield market and its components.

Markit iBoxx USD High Yield Index: The Markit iBoxx USD High Yield Index seeks to track the performance of liquid, US dollar-denominated, high yield corporate bonds, selected to provide a balanced representation of the USD high yield corporate bond universe. The index is an integral part of the global Markit iBoxx index family, which provides the marketplace with accurate and objective indexes by which to assess the performance of bond markets and investments. The index is market-value weighted with an issuer cap of 3%. The index was launched on April 4, 2007.

Markit iBoxx GEMX Local Currency Bond Index (EM Local Currency): The Markit iBoxx GEMX Index represents the market for accessible local currency emerging market sovereign debt. The index includes only fixed and zero-coupon bonds, sinking funds, and amortizing bonds with a fixed redemption schedule, including bonds whose principal and coupon are linked to a domestic consumer price index. The index was launched on December 31, 2003.

Bloomberg US Treasury Index (US Treasuries): The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint. STRIPS are excluded from the index because their inclusion would result in double-counting. The index was launched on January 1, 1973.

JP Morgan USD Emerging Markets Bond Index (EM USD): The JP Morgan Emerging Market Bond Index tracks the total returns for external debt instruments in emerging markets that are denominated in US dollars. The index was launched on December 31, 1992.

FTSE Russell China Property Developers Leading USD Bond Index: The FTSE Russell China Property Developers Leading USD Bond Index focuses on measuring the performance of US dollar debt issued by Chinese real estate developers. The index is based on the FTSE China Dollar bond Index and the Top 100 list of the China Real Estate Top 500 list issued by the China Housing Association and was jointly designed by CRIC Securities and FTSE Russell. The index was launched on March 18, 2019.