Asia High Yield Update With Portfolio Manager Wai Hoong Leong

It has been a turbulent 18 months for global bond markets. We sat down with Nikko’s Wai Hoong Leong, the portfolio manager for the KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB) for an update on Asia’s high yield bond market and to see how his team has been managing the portfolio so far this year. With a 30-day SEC yield of 10.48% (as of 6/9/2023) and the potential for a pause in global central banks’ aggressive rate hiking cycle, we believe Asia’s high yield bond market looks attractive on both a relative and absolute basis.

Wai Hoong has 23 years of experience in managing Asia credit. He leads a team of 16 investment professionals, including eight CFA charter holders. Nikko Asset Management boasts one of the largest fixed income teams in Asia.

Please click here for KHYB standard performance.

How could a potential fall in the value of the US dollar versus local currencies affect Asia’s high yield bond market?

Most Asian corporates have local currency income and US dollar-denominated liabilities. This means that a rise in the value of the local currency versus the US dollar tends to decrease financing costs for these corporates and improve their profit margins in dollar terms. Furthermore, if firms rely on imports, then they are likely to see their costs fall along with the value of the US dollar.

Moreover, a falling dollar helps emerging market (EM) economies from a macroeconomic perspective. This could lead to a significant boost to economic growth overall. EM overall would be a major beneficiary of a decline in the value of the US dollar versus local currencies.

How has the Fund’s benchmark index, the JP Morgan Asia Credit Index (JACI) Non-Investment Grade, changed over the past three years?

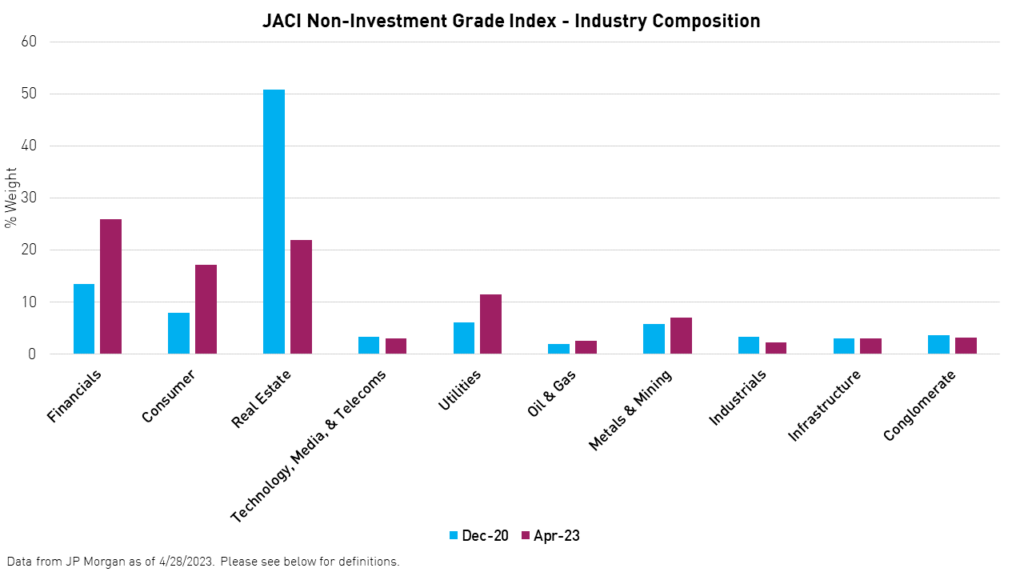

The Fund’s benchmark index has changed quite considerably over the past three years. These changes have been primarily driven by two trends: deleveraging in China’s real estate industry and the rise of the consumer in emerging Asia. The result of these changes is a more diversified universe in terms of sectors and countries.

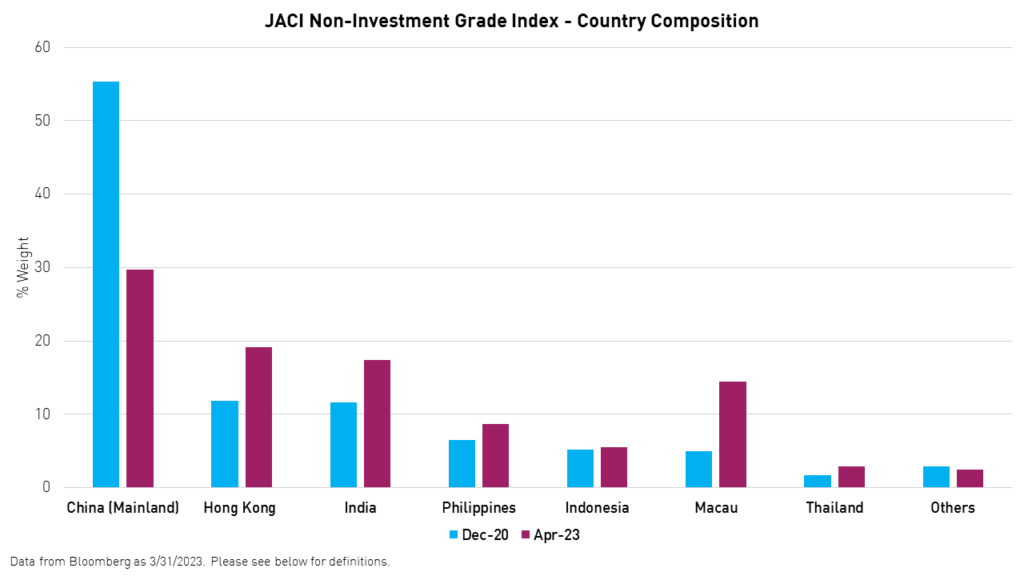

Historically, the Asia high yield bond market was driven by China’s real estate sector, but that is no longer the case. China’s weight in the index has decreased from over 50% in 2020 to less than 30% in 2023. Meanwhile, the weight of real estate issuers in the index has also decreased from over 50% to less than 30% over the same period.

From a country perspective, weights to India, the Philippines, and Thailand have increased considerably. Both countries are increasingly favored by bond investors because of their large and growing economies, young populations, and rising incomes. India, in particular, has been benefitting from increasing domestic consumption and services exports. Meanwhile, Thailand is benefitting from the return of tourism from China.

Governments in these countries are also becoming more supportive of economic development, on the one hand, and fiscally responsible, on the other. Central banks in India, the Philippines, and Thailand have followed the US Federal Reserve in raising interest rates and cooling red-hot inflation over the past year. Foreign direct investment in both economies has also been on the rise thanks to supportive government policies.

From a sector perspective, the weights of the Consumer and Financial Services sectors within the index have risen considerably over the past three years. This is primarily due to the significant increase in domestic consumption and demand for domestic financial services that many Asian economies have experienced in recent years. Furthermore, the 1997 Asian Financial Crisis resulted in a high degree of fiscal conservatism among Asian banks, which served them well this year amid the turmoil in the US and Swiss banking industries.

We believe that long-term investors may benefit from the increasing diversity of Asia’s high yield bond market, as measured by the JP Morgan Asia Credit Index Non-Investment Grade.

How have you been managing the portfolio lately?

Asia high yield bonds saw a broad rally in the first quarter, though the market has corrected so far in the second quarter. The Fund mostly reflects this price action, though we were able to outperform the benchmark in April.

At the beginning of the year, we went overweight China’s real estate sector, mostly focusing on the issuers that we thought would see the most improvement in the first quarter based on our bottom-up credit research. In the second quarter, we took profits in most of our overweights in China real estate, which is why the Fund currently has a relatively high cash position. We also reversed out underweight to Indonesian issuers to overweight compared to the benchmark index as we are positive on the country's economic growth compared to regional and EM peers as well as the stability of global demand for its rich natural resources, such as palm oil.

Going forward, we hope to redeploy this cash into consumer-oriented issuers in Macau and Thailand. We believe these issuers could see healthy cash flows this year stemming from the return of tourists from Mainland China.

From a credit rating perspective, we remain conservative in our view and are tilting towards issuers with ratings at the higher-grade end of the high yield spectrum. As of March 31st, the average credit rating in the portfolio was BB compared to BB- for the benchmark.

Moody’s recently upgraded their outlook on China’s property sector from negative to stable. Does this impact how you are managing the Fund?

No. We mostly rely on our bottom-up credit research and proprietary ratings system to manage the Fund. While positive for the China real estate space, we do not find the Moody’s upgrade to be forward-looking enough for our purposes. Furthermore, we are limiting our exposure to certain issuers with stable cash flows and outperformance potential within the China real estate space. Nonetheless, we believe the upgrade was a validation of our view from the first quarter, which enabled us to overweight China real estate.

What is your view on the energy and industrial sectors in Asia?

We have a mostly neutral view on these sectors given the uncertain outlook for global growth. These sectors are included in the fund mostly to serve as a counterweight to our more active investments in issuers in the Consumer and Real Estate sectors and to satisfy the Fund’s benchmark alignment requirements.

We are currently positive on renewable energy in Asia. We are looking to be selective when it comes to issuer exposure in this industry. We like the renewable energy sector particularly because of its government support and detachment from the trajectory of the global economy.

Conclusion

Asia’s high yield bond market has gone through some monumental changes over the past three years. Most notably, after having been mostly driven by the real estate industry in China over the past decade, the market is now driven by a diverse tapestry of industries and economies. While the outlook for China’s real estate developers has improved, Wai Hoong’s team prefers consumer-oriented issuers in tourist hotspots such as Macau and Thailand. Meanwhile, the entire market could benefit from a decline in the value of the US dollar versus local currencies.

|

Wai Hoong Leong is a senior member of the Asian Fixed Income Investment team at Nikko Asset Management Asia. Wai Hoong oversees the management of Asia credit portfolios and is responsible for overall credit strategies. He manages portfolios that include high grade bonds, high yield bonds across both absolute return funds and benchmarked funds. He is based in Singapore. |

Definitions:

JP Morgan Asia Credit Index (JACI) USD Non-Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar denominated debt instruments issued out of Asia ex Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.