KWEB China Internet Market Volatility FAQ

We believe China's internet industry presents one of the most compelling long-term growth opportunities for investors today. However, given that our KraneShares CSI China Internet ETF (ticker: KWEB) targets a single sector and companies based in China, it tends to have greater volatility than broader categories or developed market investments. To help potential investors make more informed decisions, we have compiled the following responses to the top frequently asked questions we receive from our clients. Additionally, we provide daily market updates through our blog China Last Night. Please click here to subscribe.

What are some options for investors that are concerned about KWEB's volatility?

We believe the following are feasible options for investors who believe in the China internet industry's long-term prospects but are concerned about short-term volatility in KWEB and its underlying holdings.

- Dollar Cost Average*: Rather than allocating to KWEB all at once, investors can spread their investments over time, buying at designated intervals or following KWEB price declines. For investors unfamiliar with this practice, Schwab has an excellent personal finance article that covers the topic in-depth.

- Put volatility to work with a covered call strategy: Investors can purchase shares in the KraneShares China Internet & Covered Call ETF (Ticker: KLIP) alongside their KWEB investment. With covered call ETFs, increases in volatility typically see corresponding increases in the yields these strategies provide. KLIP exchanges the uncertain upside of KWEB for premium income that helps to shield the downside. Please click here to learn more.

- Use our new defined outcome strategies: The KraneShares 100% KWEB Defined Outcome January 2026 ETF (Ticker: KPRO) aims to match the performance of KWEB to a predetermined cap of 22.69%, with a 100% downside buffer. Meanwhile, the KraneShares 90% KWEB Defined Outcome January 2026 ETF (Ticker: KBUF) aims to match the performance of KWEB to a predetermined cap of 41.20%, with a 90% downside buffer.

KPRO and KBUF have characteristics unlike many traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Funds is right for you, please read the Funds' prospectuses including "Investor Suitability Considerations".

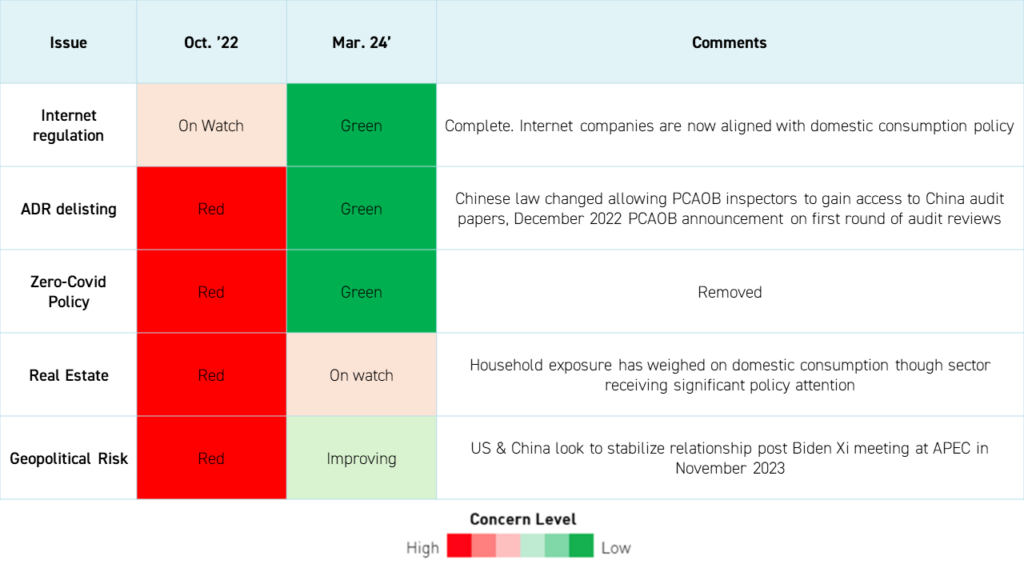

How have the issues facing KWEB and China's capital markets evolved over time?

We believe we have seen a significant progress on the issues facing KWEB and China's capital markets more broadly since the third quarter of 2022. Below, we have compiled a list of the top five risks to China's capital markets and their current status, in our view. We have seen progress on internet regulation, American depositary receipt (ADR) delisting risk, China's approach to COVID containment, and the slump in China's real estate market, which has weighed on consumer confidence. Although geopolitical tensions remain an issue, we have seen a marked improvement with recent diplomatic overtures, discussed below.

What is the Holding Foreign Companies Accountable Act?

Congress passed the Holding Foreign Companies Accountable Act (HFCAA) in December of 2020. The law requires all US-listed foreign companies to allow the Public Company Accounting Oversight Board (PCAOB) to inspect their audit books, disclose government ownership, if any, or face delisting. The law only applies to listed stocks, not ETFs, so KWEB is not at risk of being delisted under this law.

On December 15th, 2022, auditors from the Public Company Accounting Oversight Board (PCAOB) gained complete access to inspect and investigate auditors in Hong Kong and Mainland China, bringing these auditors and the companies that they audit, which include KWEB holdings, into compliance with the law.1 We believe this historic development significantly reduced the delisting risk for US-listed Chinese stocks.

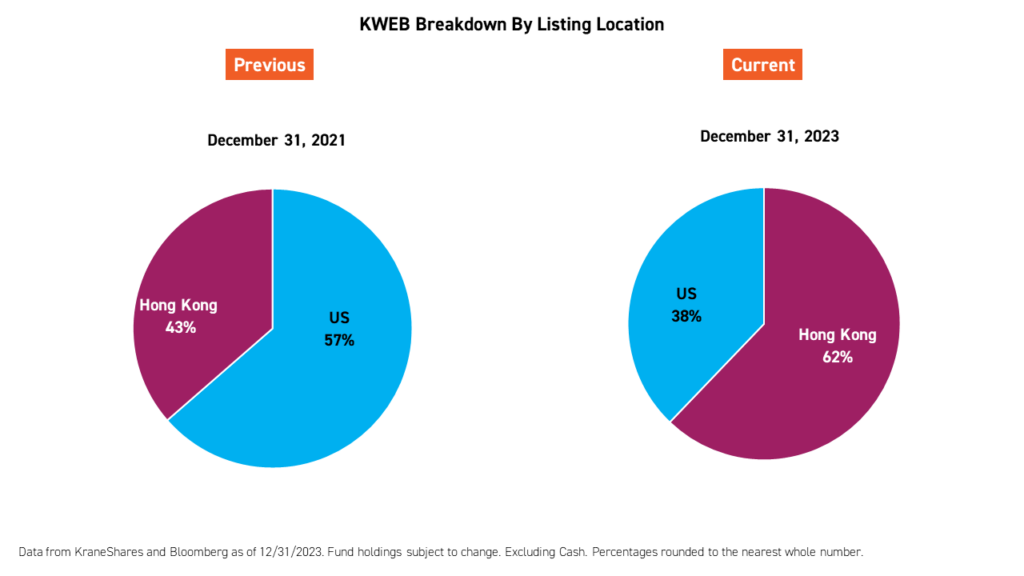

Is KWEB still converting US listings of holdings to Hong Kong listings?

Following the improvement in audit access in China, which is described above, KraneShares will maintain its current level of exposure to US listings. This decision also follows our conversations with executives from multiple KWEB holdings, who are confident in the status of their US listings. Furthermore, many companies that were originally planning on either cross-listing in Hong Kong for the first time or converting their existing secondary listing in Hong Kong to a dual-primary listing, as was the case with Alibaba, have put their plans on hold. As such, KraneShares has paused the conversion of American depositary receipts (ADRs) into Hong Kong-listed shares, a process that began in 2021. We may resume conversions at a later date if these conditions change.

Nonetheless, a majority of the Fund (62%) is currently (as of 12/31/2023) allocated to Hong Kong listings.

What are the potential benefits to companies listing in Hong Kong?

There are many potential advantages for a US-listed company to have a secondary of dual primary listing in Hong Kong. US and Hong Kong share classes are fungible, meaning shares can be freely converted from one listing location to another, as long as your broker allows for such a conversion. KraneShares' professional management team handles the conversion of US-listed stocks into Hong Kong shares for KWEB's holdings on behalf of our clients.

One key benefit of having a dual primary or primary listing in Hong Kong is that having such a listing enables Mainland Chinese investors to access these stocks, often for the first time, via Southbound Stock Connect. This could mean significant inflows to companies, should they decide to make their Hong Kong listing their primary listing, which is a requirement for a stock to be eligible for Southbound Stock Connect. For reference, Tencent is primarily listed in Hong Kong and accessible to Mainland investors via Southbound Stock Connect. As of February 13, 2023, Mainland investors held 9.3% of Tencent's shares outstanding.4

How do US-China relations affect KWEB?

Headline news surrounding the US-China relationship can negatively impact investor sentiment around KWEB and its underlying holdings, injecting volatility into the China internet space. However, the revenues of KWEB companies are mostly derived from China's consumer economy and do not depend on trade with the US.

Since the end of last year, US-China relations have improved markedly. As well-known China political scholar Jessica Chen Weiss said at our conference in November 2022, both countries are likely to create a breathing space and take tentative steps toward creating what Weiss called a “floor” for US-China tensions this year.

We believe evidence of Chen Weiss' view has emerged in a series of diplomatic overtures that have occured since the beginning of 2023. Xie Feng, China's newly appointed ambassador to the US visited Washington in May alongside Commerce Secretary Wang Wentao, who held a meeting with US Commerce Secretary Gina Raimondo that was described as "candid and substantive" by the US Commerce Department.5 Meanwhile, US Secretary of State Antony Blinken visited China on June 18th and Treasury Secretary Janet Yellen followed up with a trip of her own.6 This all culminated in a meeting between Xi Jinping and US President Joe Biden in San Francisco in November, 2023.

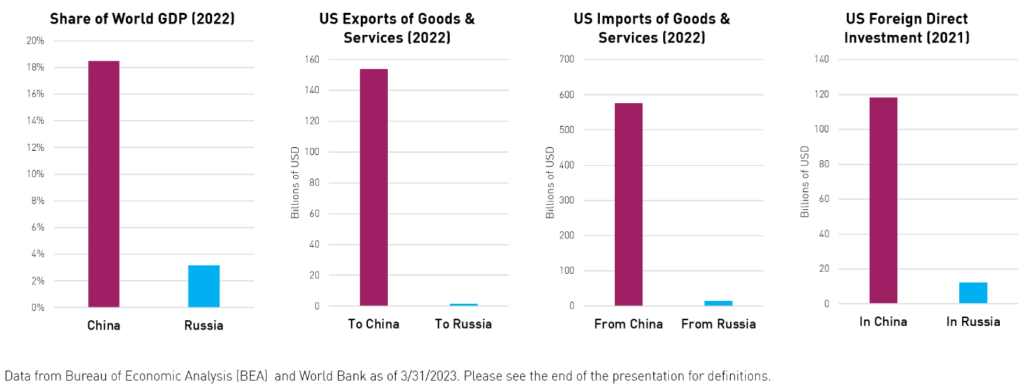

Could China be vulnerable to similar geopolitical risks as Russia?

No. China and Russia are very different from one another economically, culturally, and geographically.

China is an integral part of the global economy, accounting for a far larger share of global GDP, US imports and exports, and US foreign direct investment. China accounted for over 18% of global GDP in 2022 while Russia only accounted for 3%. The US imported over $500 billion worth of goods and services from China in 2022. Meanwhile, prior to Russia's invasion of Ukraine, the US imported less than $50 billion worth of goods and services from Russia in 2021.

As the world’s largest trading partner, ensuring that global trade is stable and healthy is a top priority for China. Freezing trade with China could potentially cause a global depression, not just a bout of market volatility.

The US and China have too much to lose to fully decouple from one another. As such, we believe the risk that similar economic sanctions are applied to China is low. On March 25th, 2022, US Treasury Secretary Janet Yellen told CNBC that she does not believe that sanctions on China are “necessary or appropriate.”2

Despite its neutral official stance, China has expressed its disapproval of the invasion through various soft power measures. China state-backed banks, including the mammoth Asian Infrastructure Investment Bank (AIIB), have suspended Russian activity. Meanwhile, China has urged “constraint” from all parties through multilateral channels.

What are some potential near-term catalysts for KWEB?

- China is currently easing monetary conditions while most of the developed world faces the highest interest rates in over a decade. While the cost of capital for US internet companies is likely to remain high in the medium-term, the cost of capital for KWEB companies is falling.

- China’s government seeks to achieve an ambitious 2024 GDP Growth target of "over "around 5%" and dramatically reduce unemployment.3 China’s internet giants will play an integral role in achieving these goals.

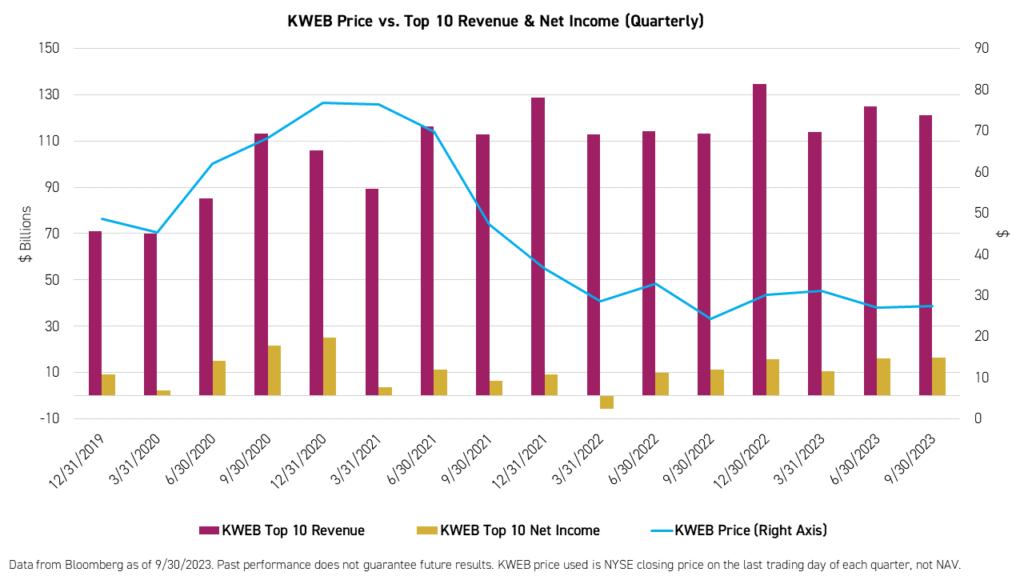

- KWEB’s long-term growth story remains intact. China’s internet population continues to grow, and China’s internet companies continue to grow their revenues.

- The continued beneficial impact of China's reopening on the revenues of China's E-Commerce and internet-related industries, the transmission engines of China's consumer economy.

What about KWEB's fundamentals?

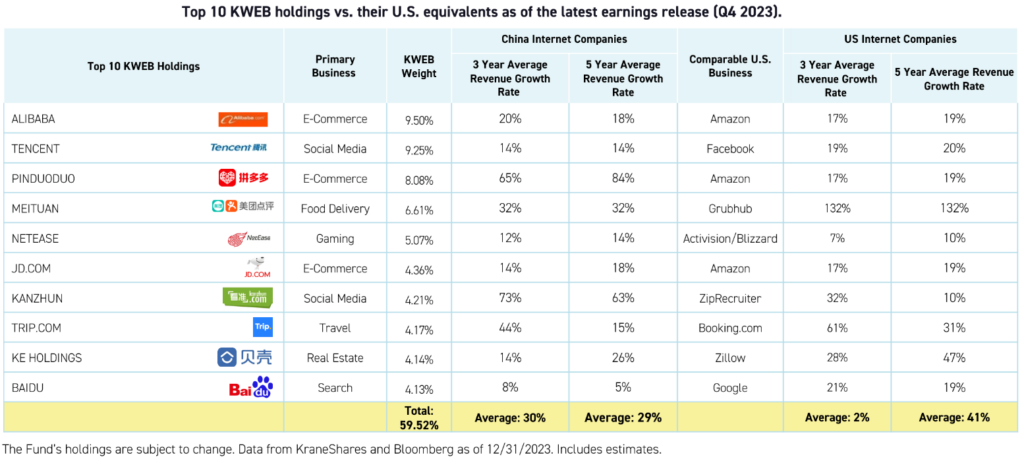

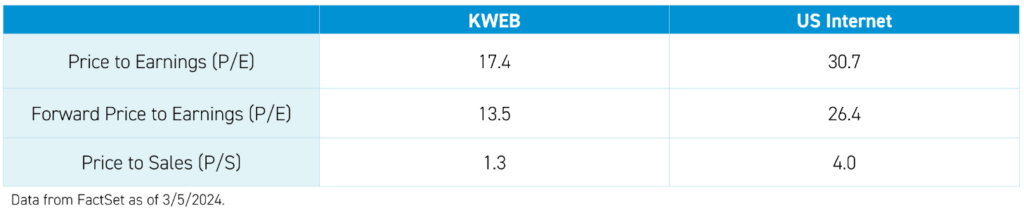

- The 3 & 5-year average revenue growth rates for China internet companies are similar to those of many U.S. internet companies.

- However, companies in KWEB continue to trade at, on average, 50% lower multiples versus their US peers.

- We believe that most of the price action in KWEB over the past 18 months has not been fundamentally driven.

*Dollar cost averaging does not guarantee against a loss and is not solution to investment risk. As markets tend to rise over time, you may do better if you invest a lump sum earlier.

Citations:

- . Williams, Erica Y. “PCAOB Secures Complete Access to Inspect, Investigate, Chinese Firms for First Time in History,” Public Company Accounting Oversight Board (PCAOB) News Release. December 15, 2022.

- Franck, Thomas. “Treasury Secretary Yellen sees no need for China sanctions as US tries to deter aid to Russia,” CNBC. March 25, 2022.

- Release From the People's Republic of China, National Party Congress (NPC) dated March, 2024.

- Data from Hong Kong Exchanges & Clearing as of 3/6/2024.

- Lawder, David. "U.S., Chinese commerce chiefs raise complaints on trade, investment, export policies," Reuters. May 25, 2023.

- Pamuk, Humeya. "Blinken to be in Beijing for talks on June 18," Reuters. June 9, 2023.

Definitions:

Dow Jones US internet Composite Index ("US Internet"): The Dow Jones Internet Composite Index is designed to measure the performance of the 40 largest and most actively traded stocks of U.S. companies in the internet industry. To be eligible for the index, a company must derive at least 50% of cash flows from the internet. The index was launched on February 18, 1999.

CSI Overseas China Internet Index: CSI Overseas China Internet Index selects overseas listed Chinese Internet companies as the index constituents; the index is weighted by free float market cap. The index can measure the overall performance of overseas listed Chinese Internet companies. The Index is within the scope of the IOSCO Assurance Report as at 30 September 2018. The index was launched on September 20, 2011.

Price to Earnings: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS). The price-to-earnings ratio is also sometimes known as the price multiple or the earnings multiple.

Forward Price to Earnings: Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. While the earnings used in this formula are just an estimate and not as reliable as current or historical earnings data, there is still benefit in estimated P/E analysis.

Price to Sales: The price-to-sales ratio is a valuation ratio that compares a company’s stock price to its revenues. It is an indicator of the value that financial markets have placed on each dollar of a company’s sales or revenues.

r-ks-sei