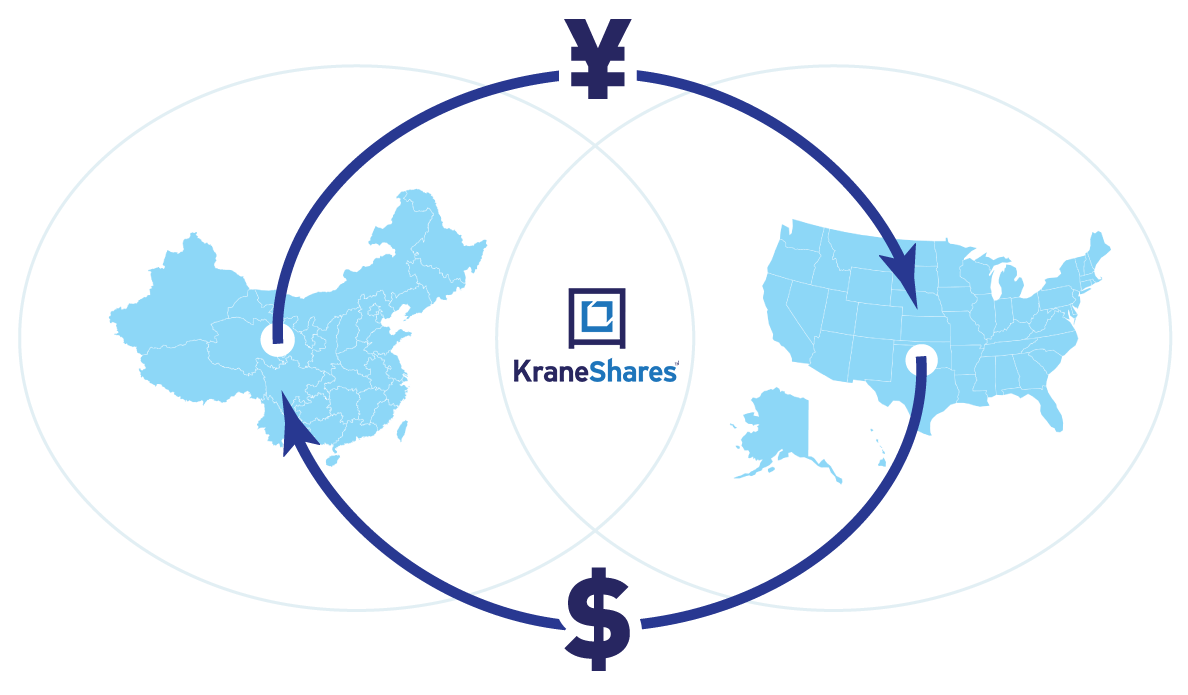

At KraneShares, we deliver research-driven, high-conviction strategies connecting investors to some of the world’s most powerful growth themes. From China’s dynamic capital markets to climate, disruptive technologies, alternatives, and fixed income, we aim to help investors position portfolios for the future. By combining innovative products, deep expertise, and trusted global partnerships, KraneShares helps investors position portfolios to capture the megatrends reshaping the global economy. We partner with leading global asset managers, and our team blends local Chinese expertise with seasoned U.S. professionals. Together, we focus on delivering exceptional client experiences and innovative solutions.

Our ETFs span global capital markets with a strong focus on China ETFs, carbon credit ETFs, and disruptive innovation, including artificial intelligence (AI) and humanoid robotics ETFs. We also offer private pre-IPO opportunities, options-based income solutions, and fixed-income strategies.

Private markets contain some of the most innovative and high-growth companies in the world, spanning industries such as artificial intelligence, humanoid robotics, aerospace, and defense. Our private funds provide accredited investors with access to a diversified portfolio of large and dynamic venture-backed private companies.

We construct differentiated, core, strategic, and thematic model portfolios within global markets, leveraging our broad suite of ETFs and our team’s investment expertise. Our portfolio solutions reflect our firm’s focus on international and alternative investments.

We believe China has become an asset class and remains central to global growth. As institutional flows into China increase and U.S.–China relations define the 21st century, our China ETFs, model portfolios, strategies, and insights provide investors with the tools to capture China’s potential.

We are committed to delivering timely research, market commentary, and investor education, empowering clients to understand and act on opportunities capturing megatrends in emerging disruptive innovation across asset classes. KraneShares connects investors with the megatrends shaping the global economy.

We are an experienced team of professionals, laser focused on providing an exceptional investment experience for our clients.

Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the websites linked hereto.

Click here to continue