Krane Funds Advisors, LLC is the investment manager for KraneShares ETFs. KraneShares offers innovative investment solutions tailored to three key pillars: China, Climate, and Uncorrelated Assets. Our team is determined to provide industry-leading, differentiated, and high-conviction investment strategies that offer access to key market trends. Our mission is to empower investors with the knowledge and tools necessary to capture the importance of these themes as an essential element of a well-designed investment portfolio.

July 26, 2024 – Strict Export Controls on China Can Have ‘Unintended Consequences’

July 26, 2024 – KraneShares Launches Ultra Short Duration Investment Grade Bond ETF (KCSH) Designed for Sustainable Impact

July 18, 2024 – KraneShares Launches AGIX: An Artificial Intelligence & Technology ETF That Provides Investors Exposure to Companies Across the AI Ecosystem

July 16, 2024 – KraneShares Launches KSPY Tracking an Index Powered by Hedgeye Research Designed to Reduce Volatility and Provide a Downside Hedge on S&P 500®

Our semi-monthly topical research reports. Subscribe to our weekly mailing list for more.

July 9, 2024 – Revisiting Hong Kong: Optimism Still Improving Even As Rally Gets Tested

July 5, 2024 – Rhetoric vs. Reality: Trump’s “Man in Beijing” Weighs in on The Future of US-China Relations

June 26, 2024 – Remember Acid Rain?

June 18, 2024 – How to Buy the Same Stocks as China’s Sovereign Wealth Funds

Information about KraneShares ETFs, China's markets and culture, and general investing resources.

Our market update is a collaboration between the KraneShares internal research department, our local Chinese partners, and select China thought leaders from around the world. Our goal is to deliver a differentiated perspective on Chinese capital markets, business, government, and culture.

280 Park Avenue, 32nd Floor

New York, NY 10017

1 Embarcadero Center, Suite 2350

San Francisco, CA 94111

181 Queen Victoria Street

London EC4V 4EG

美国金瑞基金(KraneShares)是一家总部位于纽约的资产管理公司,专注于为全球投资者在三个关键领域提供创新的投资解决方案:中国、气候变化和低相关资产。

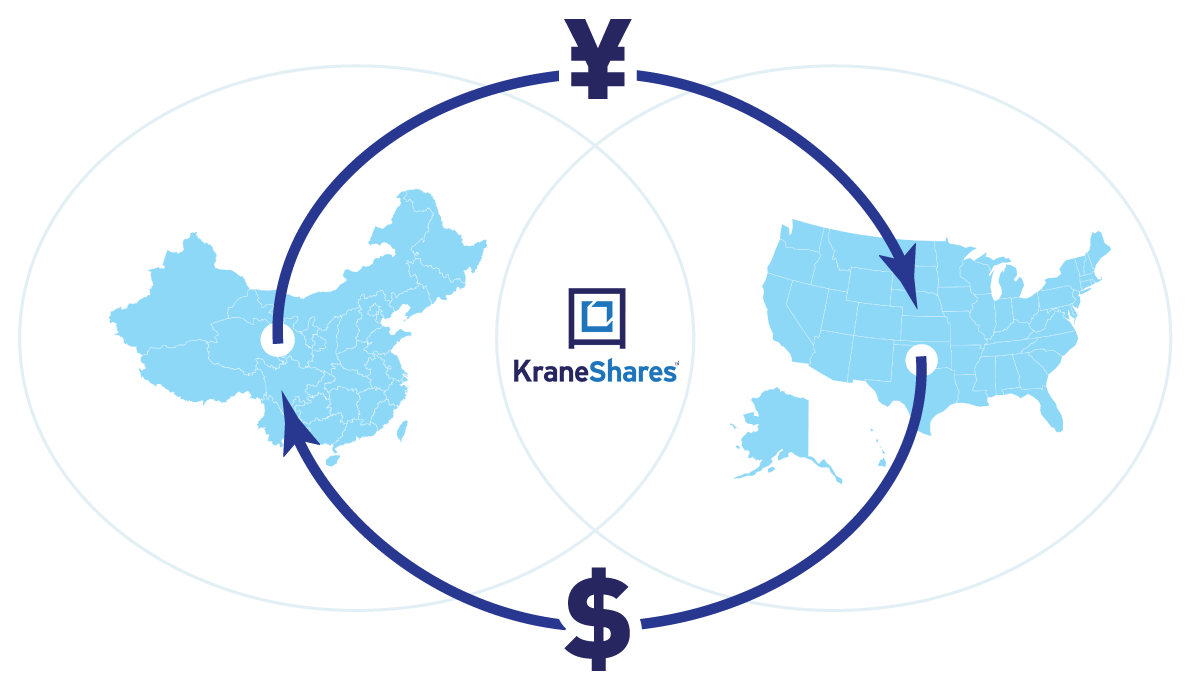

我们坚信,中国与美国是当前全球最为重要的经济合作伙伴。我们的交易所交易基金(ETF)帮助全球投资者深入了解中国市场,并在资产配置中提升其重要性。鉴于中国在应对全球气候危机中的关键地位,我们的气候变化ETF是我们对中国市场关注的延申。如今,我们成为了全球最大的碳排放/气候变化ETF管理人之一。我们在全球碳排放市场拥有深厚的专业知识,对于这一重要而新兴的资产类别,我们承诺致力于在行业研究与投资者教育方面发挥核心作用,构建研究、投教与产品的三位一体。此外,我们还推出了一系列低相关资产ETF,向投资者开放通常仅供机构投资者使用的资产类别和策略。这些ETF代表了我们与杰出合作伙伴及投资顾问的长期投资理念,这些差异化的投资策略可显著增强投资者的资产组合表现。

进一步开放金融市场,吸引更多国际投资是中国十三五计划的首要目标。为了完成这个目标,作为一家专注于中国投资机会的美国公司,美国金瑞一直在努力促进中美双边金融合作,增进双方互信。

我们在中国与多家大型资产管理公司有着紧密的合作关系,包括博时基金与易方达基金。我们团队和合作伙伴都是来自侨民和美国的资深投资专家。我们把中国本土的分析视角向全球投资者展示。

我们认为全球投资者应使用低成本的,透明的工具来投资中国和新兴市场。为了满足投资者的需求,我们团队凭借资深的全球市场和指数投资经验为全球投资者提供更完整的被动投资机会并创造"Smart Beta*"投资工具。我们致力于为全球投资者提供最优质的低成本多元投资决方案。

中国资本市场可被分为两个板块:大陆的“仅限本地人投资”的股票和固定收益市场,以及离岸的国际投资者可投的香港和美国市场。我们相信合理投资中国所有的投资领域会带来有意义的多元投资,并可能提高投资者投资组合的收益表现。

我们的核心理念来自团队在美国投资管理行业丰富经验和在中国成功经营的实践真知。这些经验让我们认为,对全球投资者带来说,中国将是一个强有力的经济增长点而且适于多元投资,这一点在可以预见的将来不会改变。因此我们专注于中国投资机会,并为投资者开发投资组合中缺少的投资模块。

*Smart beta是这样一种投资策略,基金经理被动地按照利用可预测的系统性偏差或低效的某种指数进行投资。

Hyperlinks on this website are provided as a convenience and we disclaim any responsibility for information, services or products found on the websites linked hereto.

Click here to continueThis website uses cookies to help us enhance your browsing experience. By using this website you consent to our use of these cookies. You can customize your preferences by clicking “Cookie Preferences” below. To find out more about how we use cookies and how to manage them, please see our Terms & Conditions and Privacy Policy.