How to Buy the Same Stocks as China’s Sovereign Wealth Funds

China's recent rally signals a golden potential opportunity in A-shares as capital floods back under robust government stimulus. Sovereign wealth funds have ramped up their equity purchases, buying mostly mega-cap stocks and ETFs with a targeted allocation to top stocks. For this reason, we believe investors may benefit from a concentrated approach to the China A-share market.

Such direct support for the A-share market may disproportionately benefit leading names, creating a favorable environment for well-positioned investment vehicles like the KraneShares Bosera MSCI China A 50 Connect Index ETF (Ticker: KBA).

Moving The Needle

China’s government is buying stocks, not the stock market. In our previous article, we wrote, "Buying the 300th stock in an index makes no sense because it has a minimal effect on the index versus the top holdings.” The government is focused on the largest stocks because they have the greatest influence on stock market indexes.

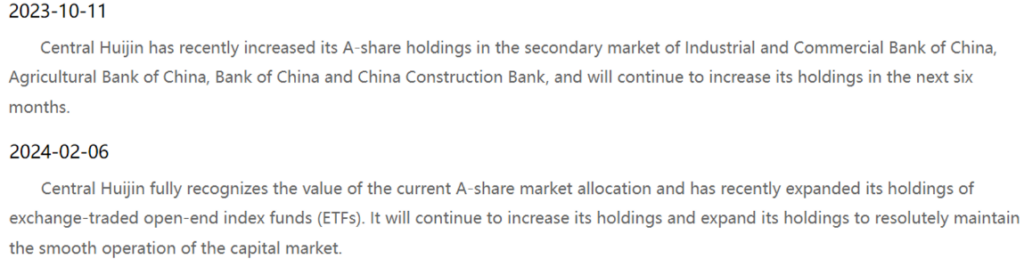

Central Huijin Investment Ltd. is an entity within China’s sovereign wealth fund that has begun publicly declaring its purchases. The investment firm issued the following press releases in October of 2023 and February of 2024:

In the US, asset managers file their positions with the SEC via 13Fs on a quarterly basis. There is similar transparency in China. Below are the top ten positions of Central Huijin Investment as of their latest filings.

As seen above, the majority of Central Huijin's top 10 holdings focus on the mega-cap stocks with the most influence on stock market indexes. While they have been buying ETFs, too, their focus has been on the mega-cap-focused Shanghai Stock Exchange 50 and 180 indexes.

For this reason, we believe the KraneShares Bosera MSCI China A 50 ETF (Ticker: KBA) has a distinct advantage versus other, broader China A-share ETFs because it focuses on a targeted exposure to 50 large and highly liquid stocks.

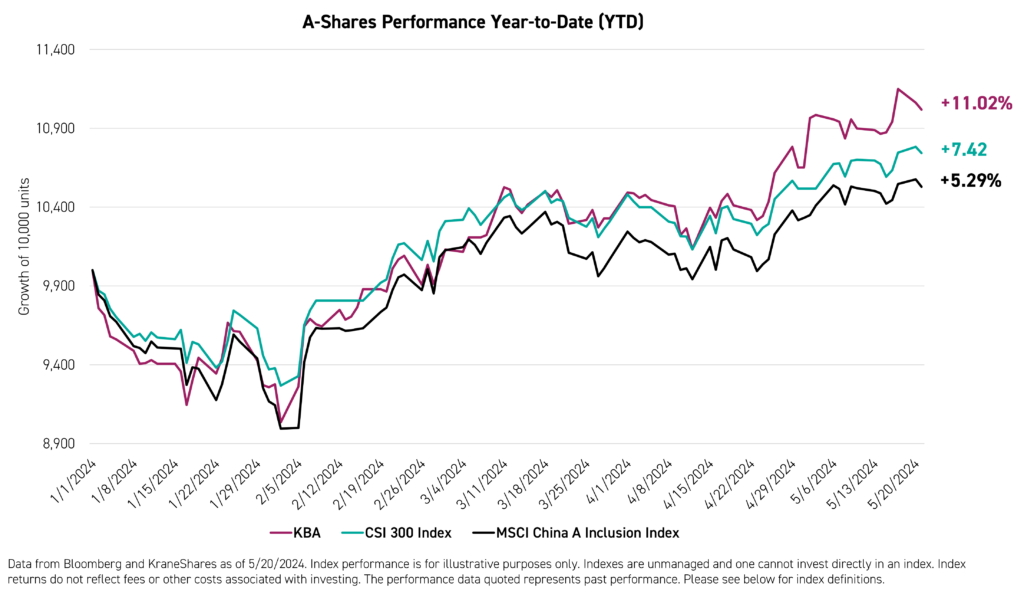

The year-to-date performance of KBA versus the CSI 300 and MSCI China A indexes speaks to the potential for such a concentrated approach to outperform in the current environment.

Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please click here for KBA.

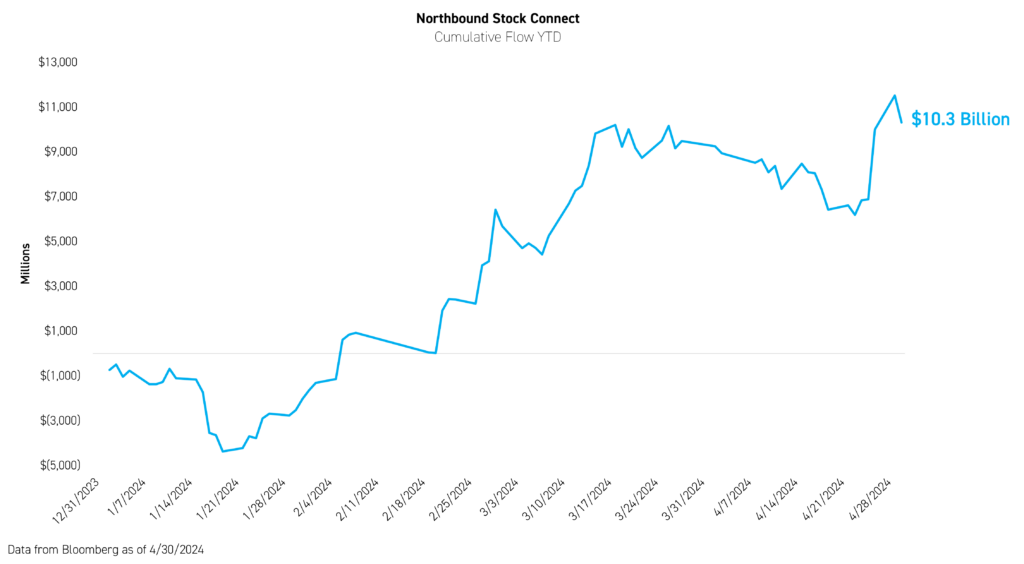

Foreign Investors Are Coming Back

At the same time, foreign flows into China's Mainland stock market have picked up this year. Northbound Stock Connect is a mutual market access program that allows foreign investors to purchase A-shares using accounts in Hong Kong. So far this year, investors have poured over $10 billion into Mainland stocks through the program.

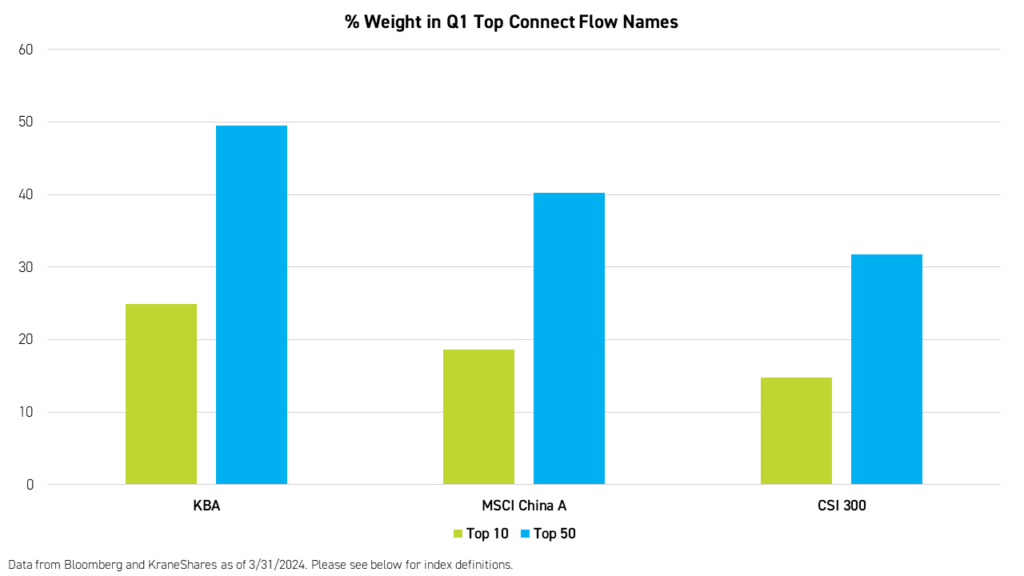

Compared to the CSI 300 Index and MSCI China A Inclusion Index, KBA has a significantly higher weight to both the top 10 and top 50 most heavily purchased stocks via Northbound Stock Connect in the first quarter of 2024.

Local Investors Returning May Lead To More Foreign Flows

In our previous article, we also mentioned that foreign investors are starting to return to the Chinese equity market, but in the reverse order in which they left. Foreign investors were the first to exit the A-share market and are now the last to return. Local investors, who were the last to scale back their A-share positions, are now the first to return and reallocate to the A-share market to capitalize on the recent rally.

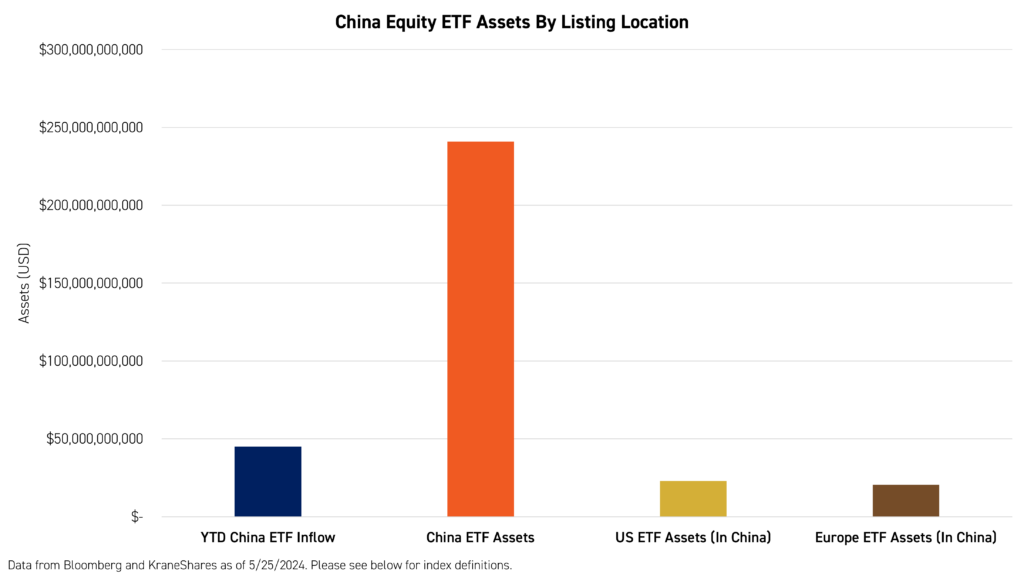

China equity ETFs listed in China have seen significant inflows from local investors so far this year, to the tune of over $45 billion. That is more than twice the size of all China equity ETFs listed in the US.1

Conclusion

We believe KBA is well-positioned to benefit from purchases driven by Central Huijin and other government-related entities. The continued direct support for the A-share market is likely to benefit the top names the most. Meanwhile, the significant flows into China-listed local equity ETFs may help garner confidence among foreign investors to re-allocate.

Citations:

- Data from Bloomberg as of 5/25/2024.

Index Definitions:

CSI 300 Index: This index consists of the 300 largest and most liquid A-share stocks and aims to reflect the overall performance of the China A-share market.

MSCI China A Inclusion Index: This index captures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges.