Looking For High Yield? KHYB Portfolio Manager Discusses Opportunities in Asia’s High Yield Bond Market

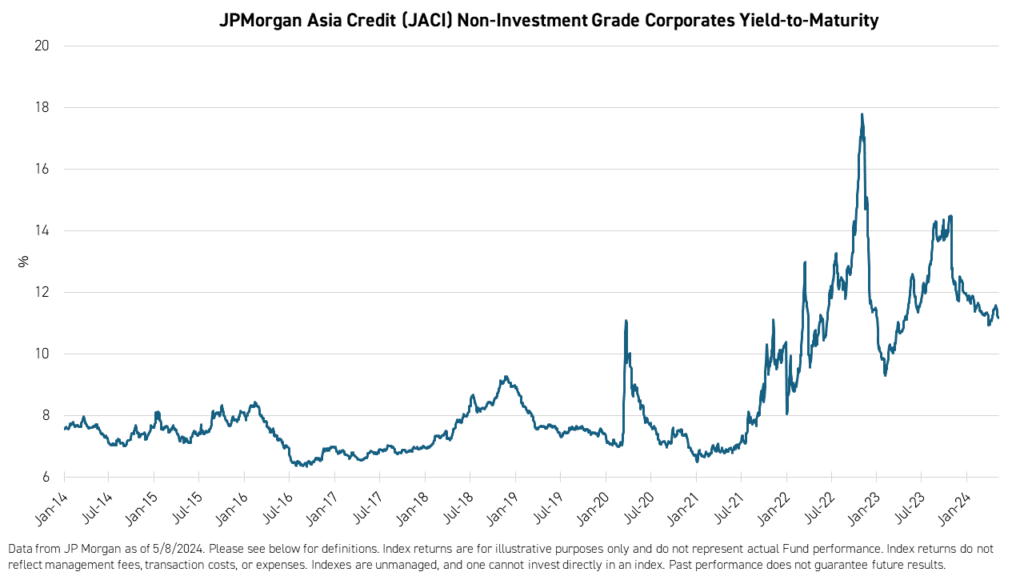

Asia’s high-yield bond market is back. After stress in China’s property sector, investors have started to see healthy returns and higher yields. In fact, the KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB) is now the highest-yielding US-listed ETF in Bloomberg’s high-yield category, with a 12-month trailing yield of 14.95% (SEC 30-Day Yield: 7.50%).1

To understand what’s driving these markets, we sat down with KHYB portfolio manager Wai Hoong Leong from Nikko Asset Management for a Q&A. Leong cites the credit cycle recovery in Asia, particularly in countries like Indonesia and India, as being a crucial component in the strategy's recent outperformance.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit our website at kraneshares.com/khyb.

Future distributions may differ significantly and are not guaranteed.

With a 12-month trailing yield of 14.95%, KHYB currently ranks as the #1 highest-yielding US-listed ETF in Bloomberg’s high yield category. What do you think makes the strategy stand apart from the pack?

The credit cycle for Asia high yield is in its recovery phase, as fundamentals for Asian credit remains supportive. Although defaults have up to this point been driven by Chinese property issuers, which were far ahead in the downturn of the credit cycle, default rates for the rest of Asia ex China remain at healthy levels, and at below forecasted levels for US high yield (HY).

With regards to China, the government’s recent announcement of a growth target of “about 5%” with larger augmented deficit and continued accommodative monetary policy, suggests policymakers are aware of the challenging environment. The recent step up in Chinese property, credit/monetary and fiscal stimulus measures may also, in our view, support near-term stabilization.

Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China have been resilient and default rates are low. Countries like Indonesia and India are increasingly attractive due to their large and growing economies, supportive governments and commitment to longer term fiscal sustainability. This has led to strong corporate earnings and increased demand for credit.

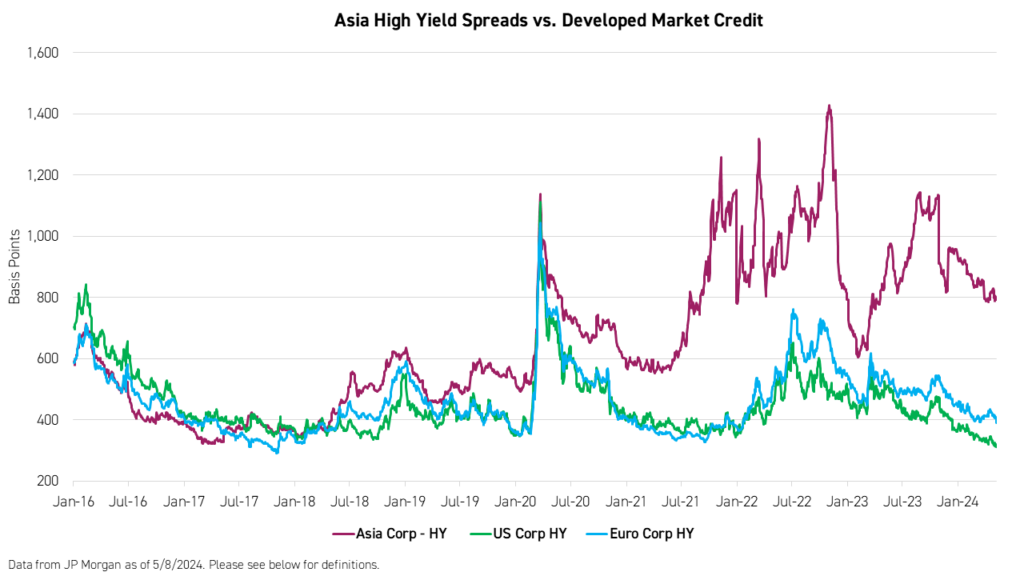

Asia High Yield currently exhibits wider spreads compared to US and European high yield.

Compared to US and European HY corporates, Asia corporate HY market offers a higher spread between the yield on high yield bonds and that on government/investment grade bonds. Excluding China, Asia ex-China HY corporates also offer higher spreads for similar ratings than US HY corporates. This makes Asia HY spreads relatively more attractive and provides opportunities for credit selection among investors.

Support technicals also support a bull case.

The current Asia HY market is characterized by strong technicals with subdued net new supply amidst robust demand from regional institutional investors. New issuance has been dampened for the following reasons:

- Borrowers’ stronger access to local banks and local bond markets, often at lower yield levels.

- Regulatory approvals and government limits applicable in various countries.

- A large drop in China property issuances.

Demand-side technicals have also remained supportive:

- Local investors dominate new issuance allocation historically.

- Private banks tend to be under-allocated at primary issuance, boosting demand in secondary markets.

- While fund flows have remained weak, demand remains robust from regional investors looking to lock in attractive yields.

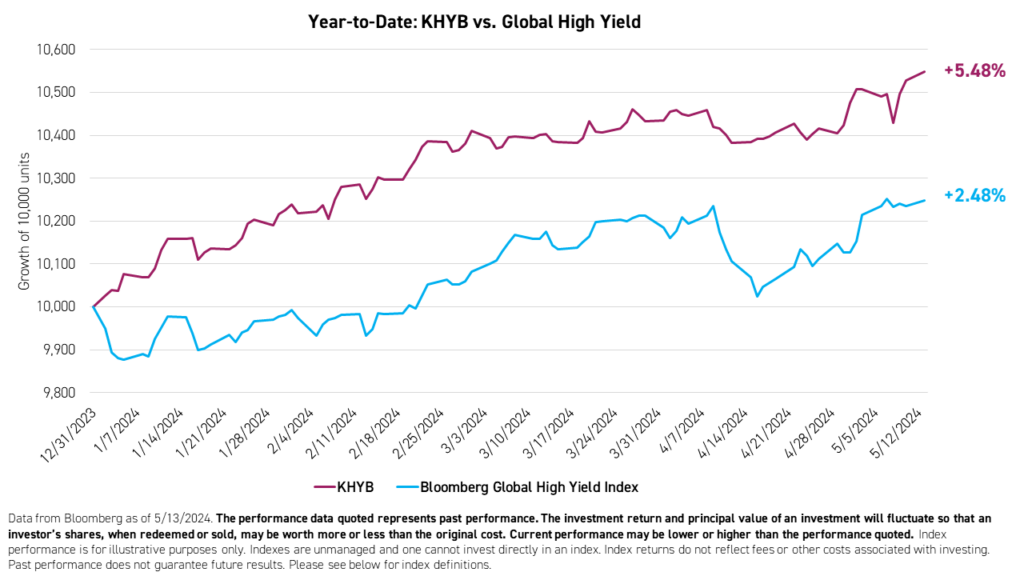

KHYB has outperformed most US and global fixed income benchmarks so far this year. What are the main contributors to this outperformance?

The factors that we have highlighted in Question 1 are primarily the main contributors to the outperformance of Asian HY this year. After recent years of underperformance, primarily due to the stress in the Chinese property sector, the Asia HY market has performed well since Q4 last year, outperforming other credit markets.

What is your view of India’s bond market? Which sectors do you find most interesting there?

We are constructive and see good risk-reward in India’s high yield US dollar bond market. This market has provided strong returns over the past few years and continues to provide higher spreads for similar ratings when compared to US HY corporates.

Corporate fundamentals overall remain healthy, with adequate buffers despite slight weakening expected this year. Since 2021, there has only been one USD bond default, and one USD bond restructuring. We continue to expect minimal defaults in India this year.

We are especially positive on the renewable energy sector in India, given structural demand growth for renewable energy, favorable government policies, and continuing institutional investment into this sector.

Technicals also remain very well supported, with much subdued new supply since 2021. This is expected to continue given strong domestic deposit growth and cheaper onshore funding from both banks and the bond market.

Are there any key risks in the market that you are currently monitoring?

The US interest rate cycle is one of the main drivers for investment return in the coming years. Delays in rate cuts may potentially (1) hurt future growth; (2) increase business cost; and (3) result in a strong USD, which is generally not positive for EMs.

However, KHYB is relatively well insulated from this risk due to its low duration. KHYB has a weighted-average duration of only 1.7 years compared to 3.9 years for the Bloomberg Global High Yield Index.1

What about China real estate? The UBS analyst who called Evergrande’s default six months in advance recently turned positive on the industry for the first time since then. Do you plan to allocate to developer bonds with significant potential upside?

So far, property relaxation measures have failed to revive the property market in China, where property sales in both primary and secondary markets remain weak and home prices have been under pressure amid the surge in property listings in the secondary market.

Financing access for most POE (private-owned enterprise) developers remains challenging despite new financing schemes announced including the relaxation of “use of proceeds” restrictions of investment property-backed loans and property whitelist program.2 Amid weak sales and limited new financing, bond repayment for some POE developers continues to entail high uncertainty and we continue to see the likelihood of bond exchange or default from some issuers.

However, we do believe China’s recent Politburo statement pledging to reduce housing stockpiles and marks a departure from past stances, is a positive signal. While details remain to be seen, there has been market speculation about potential supportive measures from the authorities to directly facilitate housing destocking, which could lend support to home prices and developers’ property sales.

Overall, our portfolio investments in China’s real estate space continues to be guided by bottom-up security selection. When we identify opportunities that offer favorable risk-reward prospects, we will consider increasing our allocation.

The Fund currently has 7% of the portfolio in cash. Are there any other near-term opportunities that you are looking at to potentially put more capital to work within the Fund?

Given the strong outperformance in Macau’s gaming sector, we have taken profits by selling our positions and have since redeployed some proceeds into commodity-related credits as a hedge to the stronger-than-expected economic growth. We will also be keeping an eye on the effectiveness of China's policy stimulus plan to evaluate whether to increase our China allocations.

This material must be accompanied by a current prospectus. Investors should read it carefully before investing or sending money.

Citations:

- Data from Bloomberg and KraneShares as of 5/8/2024.

- Project Whitelist. January 2024.

Definitions:

Bloomberg Global High Yield Index: The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high yield debt market. The index represents the union of the US High Yield, the Pan European High Yield, and Emerging Markets (EM) Hard Currency High Yield Indices. The high yield and emerging markets sub-components are mutually exclusive. The index was launched on January 1, 1990.

JP Morgan Asia Credit Index (JACI) Corporates Non-Investment Grade Index (Asia Corp - HY): The JP Morgan Asia Credit Index Corporates Non-Investment Grade Index consists of liquid US-dollar denominated debt instruments issued our of Asia ex-Japan. It is based on the composition and established methodology of the JP Morgan Asia Credit Index (JACI), which is market capitalization weighted. The index is limited to issuers classified as non-investment grade based on the middle rating between Moody's. Fitch, and S&P.

JP Morgan US High Yield Index (US Corp - HY): An index that consists of fixed rate, non-investment grade debt. Pay-in-kind bonds, Eurobonds, and debt issues from countries designated as emerging markets are excluded, while Canadian and SEC registered global bonds of issuers in non-emerging markets countries are included. Original issue zeroes, step-up coupon structures, and 144-A securities are also included. All issues in this index must have at least one year to final maturity and at least $150 million par amount outstanding. The index was launched in November of 2021.

ICE BofA Euro High Yield Index (Euro Corp - HY): The ICE BofA Euro High Yield Index tracks the performance of Euro denominated below investment grade corporate debt publicly issued in the euro domestic or euro bond markets. Qualifying securities must have a below investment grade rating (based on an average of Moody's, S&P, and Fitch). Qualifying securities must have at least one year remaining term to maturity, a fixed coupon schedule, and a minimum amount outstanding of Euro 100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the euro bond and euro domestic markets), 144a securities and pay-in-kind securities, including toggle notes, qualify for inclusion in the Index. Callable perpetual securities qualify provided they are at least one year from the first call date. Fixed-to-floating rate securities also qualify provided they are callable within the fixed rate period and are at least one year from the last call prior to the date the bond transitions from a fixed to a floating rate security. Defaulted, warrant-bearing and euro legacy currency securities are excluded from the Index. The index was launched on December 31, 1997.

12-Month Trailing Yield: Sum of dividend per share amounts that have gone ex-dividend over the prior 12 months, divided by the current fund price. This figure may include return of capital, investment income, or realized capital gains. Distributions may coincide with a decline in NAV. The 12-Month Trailing Yield does not indicate total return.

SEC 30-Day Yield: A standardized measure of a fund's yield that allows for comparison between different mutual funds and exchange-traded funds (ETFs). It is calculated by annualizing the fund's income distributions over the past 30 days and dividing that number by the fund's net asset value (NAV) at the end of the period.

Duration: Duration can measure how long it takes, in years, for an investor to be repaid a bond’s price by the bond’s total cash flows. Duration can also measure the sensitivity of a bond’s or fixed income portfolio’s price to changes in interest rates.