Counting On Fed Rate Cuts? Consider Adding Asia High Yield Instead

Executive Summary

- Speculation that the US Fed would move swiftly to cut rates led to enthusiasm for investment grade debt going into 2024, but the Fed is moving more slowly than many had anticipated.

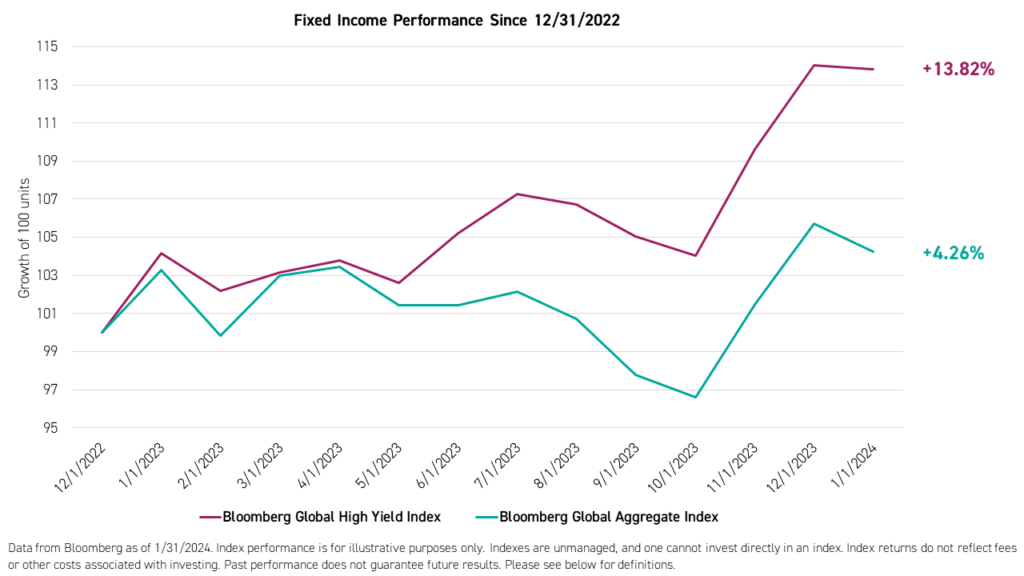

- High yield outperformed investment grade globally in 2023 and we believe this trend could continue in 2024 due to continued volatility in inflation expectations and the potential for a soft landing in the United States.

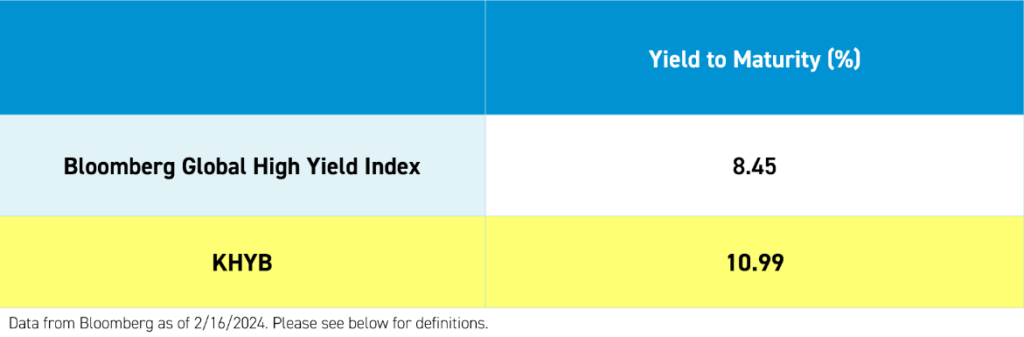

- Asia's high yield bond market, represented by the KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB) currently offers an average yield-to-maturity of 10.99% compared to the 8.45% offered by the Bloomberg Global High Yield Index.6

- We believe Asia's high yield bond market will continue to benefit from relatively low interest rate risk, improving credit quality, decreasing exposure to China's real estate industry, and economic growth in Asia for the remainder of 2024.

Introduction

With interest rates above 5% for the first time in almost two decades,1 the 60/40 portfolio is making a comeback, and investors are searching for intelligent, timely fixed income investments. In 2023, as fixed-income markets rebounded, many investors piled into investment-grade debt, taking on duration risk to bet that the US Federal Reserve would move swiftly to cut interest rates in 2024. However, the central bank did not move as quickly as traders had hoped, and we are seeing a pullback in investment grade in 2024.

We believe investors are focusing too much on interest rate risk, when they should also be focusing on credit risk. High yield beat all expectations in 2023, outpacing the broader global bond market. We believe the same could be true in 2024 due to continued volatility in inflation expectations and the potential for a soft landing in the United States.

With overestimated credit risks and low interest rate risk, we believe Asia high yield could outperform US and developed markets investment grade in 2024. The Asia-Pacific region currently offers a better value proposition than most global high-yield bond markets. This is due to an aggressive selloff in 2022 due to real estate woes in China that are just now beginning to work themselves out, strong regional corporate and economic fundamentals pointing to a rebound in multiple economies and industries, and exposure to economies that may cut rates sooner than the Fed.

Investors can easily access Asia’s high-yield bond market through KHYB, which is actively managed by Nikko Asset Management, a leader in Asia fixed income with 30+ years of experience in the market. Please click here to read Nikko's latest commentary on Asian fixed income markets.

Asia Pacific High Yield: Low Interest Rate Risk, Improving Credit Profile

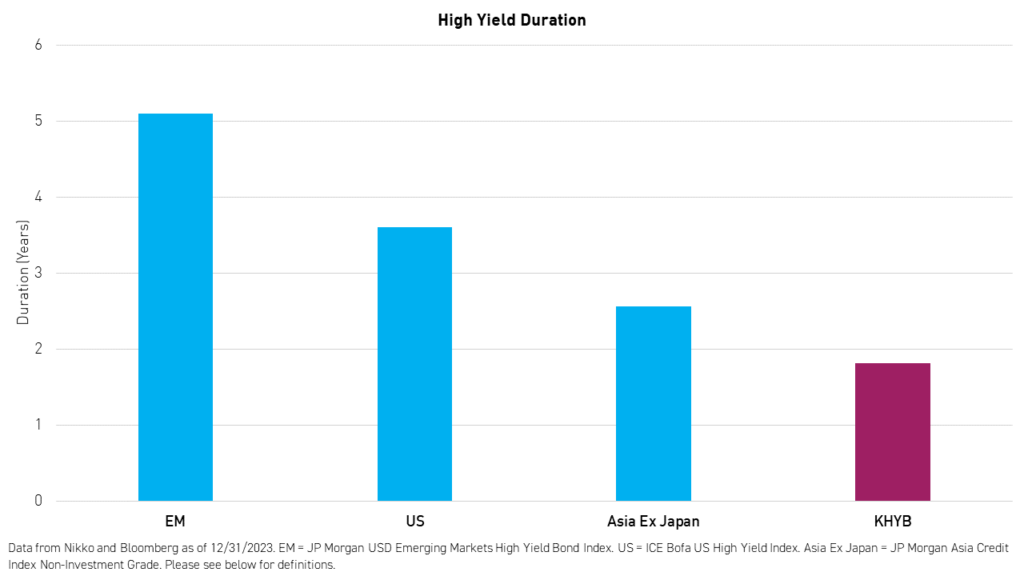

Asian high yield, represented by the KraneShares Asia-Pacific High-Income Bond ETF (Ticker: KHYB), has a considerably lower average duration than high-yield bond markets in Emerging Markets and the United States, which means its sensitivity to changes in interest rates in significantly less. This is perennially the case thanks to the region’s cultural preference for shorter-term borrowing.2

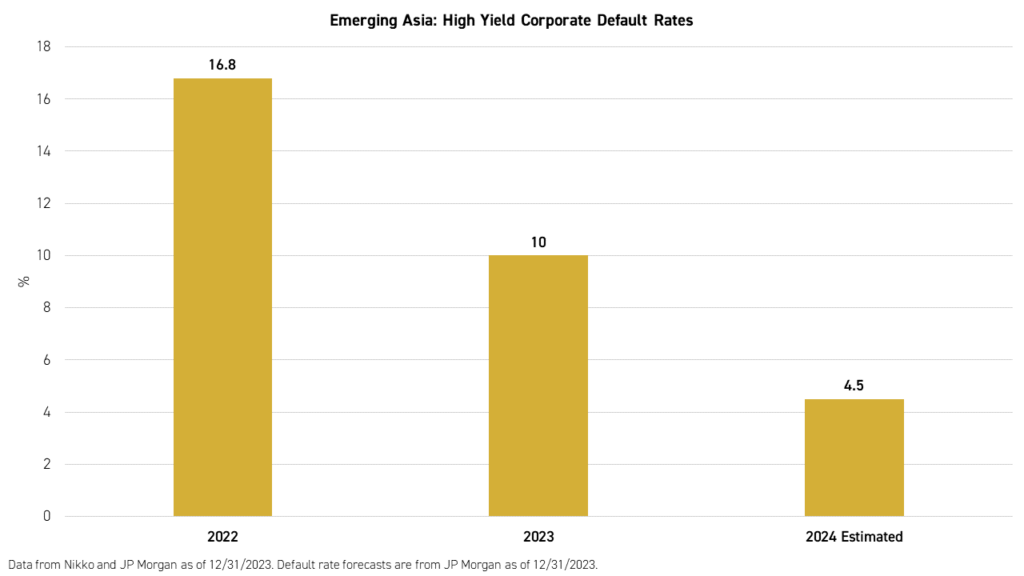

Meanwhile, corporate default rates in Asia are expected to plummet in 2024. This can be primarily attributed to struggling real estate development firms leaving the market and improving economic fundamentals in the region.

Despite lower duration and rapidly declining default rates, the Asia Pacific high yield bond market, as represented by KHYB, currently offers a yield pickup compared to global high yield markets.

Please click here for KHYB standard performance, 30-day SEC yield, risks, and top 10 holdings.

China Real Estate: A Decreasing Risk Factor in 2024

In January, a Hong Kong court ordered former megadeveloper Evergrande to liquidate its offshore assets.3 We believe this is a positive indication that the saga of the fall of China’s overleveraged real estate developers is finally ending.

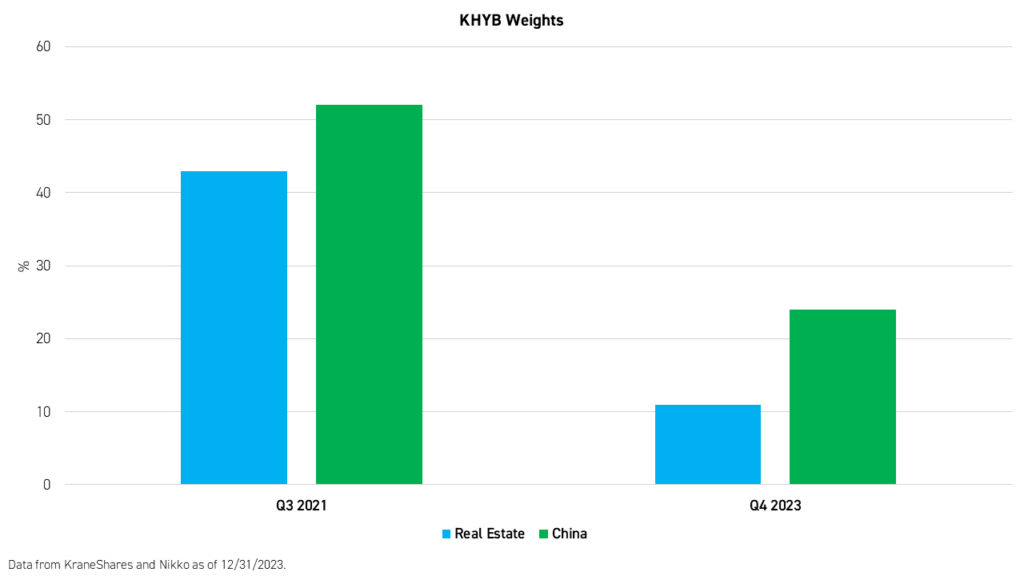

Nonetheless, the lasting impact of the real estate taper tantrum on Asia’s high-yield bond market will be a lower weight on the industry in benchmark indexes. This may lead to better country and industry diversification* and less default risk. China real estate issuers currently make up less than 10% of KHYB’s net assets as of January 31, 2024.4

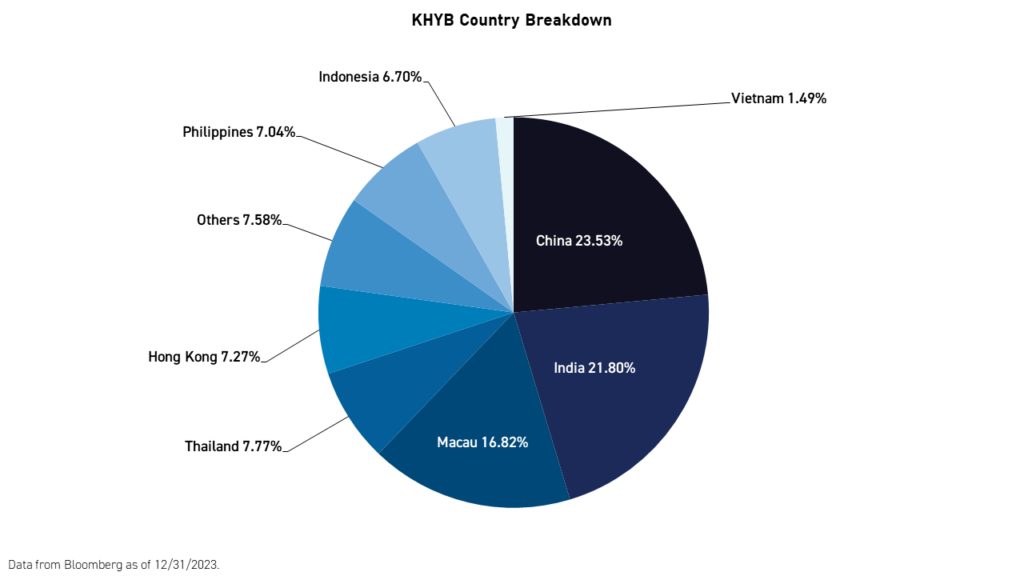

We believe KHYB has become better diversified* among emerging Asian economies. India accounts for nearly one-quarter of the portfolio, which also has significant weights to Thailand, the Philippines, and Indonesia.

Tracing The Economic Rebound in Asia

According to Nikko Asset Management, fundamentals continue to support Asian credit.2 We believe the strong performance of South and Southeast Asian stock markets may be complemented by strong fixed-income performance in 2024 as currencies gain strength versus the US dollar and the economic rise benefits downstream sectors.

Southeast Asian equity markets performed well in 2023, especially India, which could lead to strength in fixed income in 2024. India’s red-hot equity market is benefitting from secular growth trends and improvements in infrastructure, business climate, and quality of life.

While the rally in Indian equities garnered attention in 2023, we believe that Indian bonds, especially financials, could offer a better value proposition in 2024. The 2023 rally did not benefit all sectors equally.4 According to HSBC analysts, Indian banks offer a better relative value proposition than growth equities following the 2023 rally.5 We believe that Indian banks are benefitting from an economic boom and have strong balance sheets to support higher interest payments. India financial bonds are held in the portfolio at a 3% weight as of January 31, 2024, while India overall sits at a weight of over 20%.4

Meanwhile, Asian central banks may move more swiftly than the US Federal Reserve to cut interest rates as many are seeing inflation moderate and growth increase significantly. The Reserve Bank of India raised its GDP growth forecast to 7% from 6.5% at its December meeting, though inflation continues to run high in the South Asian country. Meanwhile, banks in Indonesia and the Philippines held rates steady at December meetings but cut their inflation forecasts.2 Moreover, China has been cutting rates and may export deflation into the region, increasing the likelihood of rate cuts for certain countries.

Conclusion

We believe 2024 could be shaping into a year of higher returns and lower volatility for Asia’s high-yield bond market. This is thanks to strong economic fundamentals in Asia, decelerating inflation, and stronger currencies. We believe that Asia's high-yield bond market has the potential to outperform US and developed market investment grade markets due to low valuations stemming from an overestimation of credit risks arising from the real estate taper tantrum in China. Moreover, we believe Asia's high-yield bond market is a great potential component of a well-rounded bond allocation, especially as the 60/40 portfolio comes back into vogue.

For more information on KHYB, please visit kraneshares.com/khyb.

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- Data from the Federal Reserve Bank of St. Louis as of 2/14/2024.

- Data from Nikko Asset Management as of 12/31/2023.

- Leung, Kanis. “China Evergrande has been ordered to liquidate. The real estate giant owes over $300 billion,” Associated Press. January 29, 2024.

- Data from KraneShares and Bloomberg as of 1/31/2024.

- Data from HSBC Research as of 1/31/2024.

- Data from KraneShares and Bloomberg as of 2/16/2024.

Term Definitions:

Duration: A measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates. In general, the higher the duration, the more a bond's price will drop as interest rates rise.

Yield to Maturity: An estimated rate of return that assumes the bond buyer holds the bond until its maturity date.

Index Definitions:

Bloomberg Global High Yield Index: The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high-yield debt market. The index represents the union of the US high yield, the Pan-European high yield, and Emerging Markets (EM) hard currency high yield indexes. The high yield and emerging markets sub-components are mutually exclusive. The index was launched on January 1, 2009.

Bloomberg Global Aggregate Index: The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from developed and emerging market issuers. The index was launched on January 1, 1990.

JP Morgan Asia Credit Index Non-Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar-denominated debt instruments issued out of Asia ex-Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is a market capitalization-weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum of $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.

ICE BofA US High Yield Index: The ICE BofA US High Yield Index provides a comprehensive, accurate representation of the US high-yield market and its components.

JP Morgan USD Emerging Markets High Yield Bond Index: The JP Morgan USD Emerging Markets High Yield Bond Index tracks liquid, US Dollar emerging market fixed, and floating-rate debt instruments issued by corporate, sovereign, and quasi-sovereign entities. The index tracks instruments classified as non-investment grade (HY) in the established JP Morgan EMBI Global Diversified Core and JP Morgan CEMBI Broad Diversified Core indices. It combines them with a market capitalization-based weighting. The returns and statistics have been available since December 2011.