How to Capture a Potential Rally in China’s Property Bonds

China’s recent regulatory shift to provide underlying monetary support for property developers and the rollback of its zero-COVID policy have resulted in one of the largest rallies in recent history for China’s property bonds and high-yield bonds market, according to a recent WSJ article.1

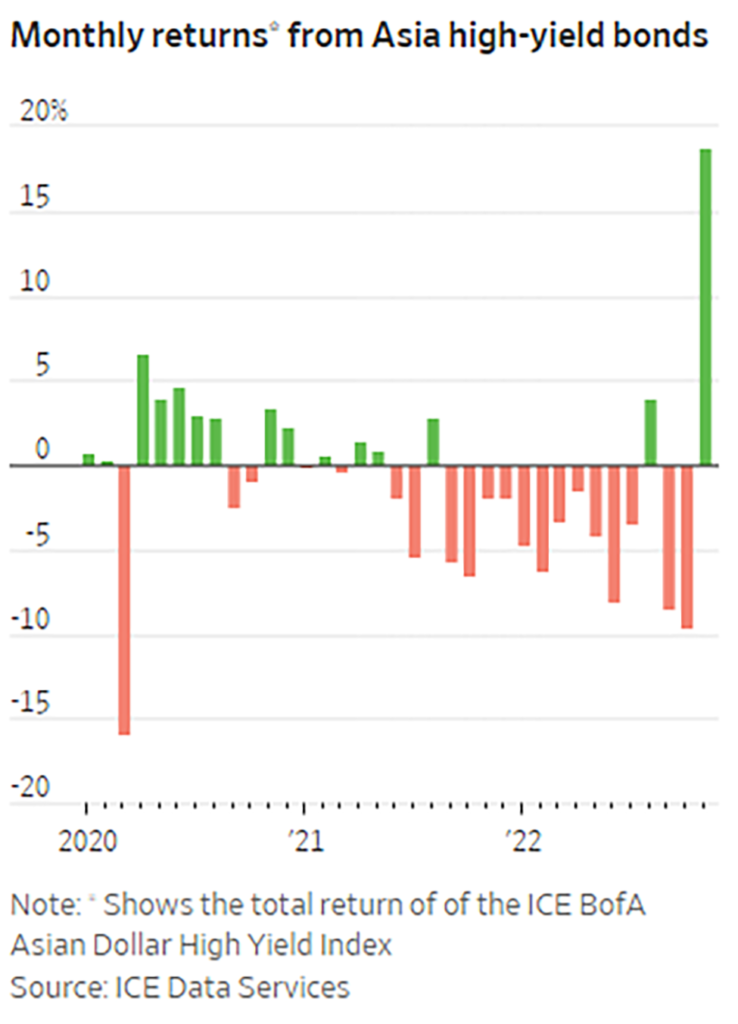

High-yield bonds in Asia gained 18% in total returns in November, the best month for the property bond market in Asia in a decade, prompted by the recent regulations designed to support real-estate developers and the gradual rollback of China’s zero-COVID policy.1

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

As of the end of October, a $1 billion bond that matured in January 2024 from Country Garden Holdings Ltd, a Chinese property developer based in Guangdong and one of the largest apartment sellers in China, was bidding at $0.14, in the typical default range for bonds. That same bond bid at $0.74 this month, reflecting growing investor optimism in the space.1

In mid-November, financial regulators in China released 16 measures aimed at providing underlying support for real estate developers and the property market for both public and private developers.1

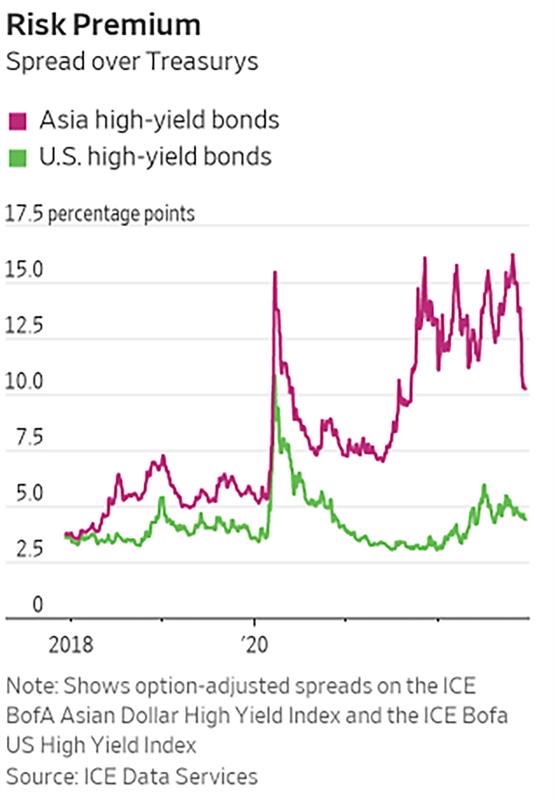

Many investors have sidestepped the Asian bond market, specifically emerging market bonds, because of their exposure to China in the last year. For investors that started the year with high-yield bonds in Asia, those investments are still down cumulatively for the year. Still, the recent recovery and the recovery trajectory looking ahead could mean strong opportunity.

Past performance does not guarantee future results.

“We have been pounding the table on this trade for months. Pain trade is higher as no buyers. None.” tweeted Brendan Ahern, CIO of KraneShares. “China’s policy changes on COVID-19 and the property sector have sparked a big junk-debt rally.”

Investing in Asian High-Yield Bonds With KHYB

The KraneShares Asia Pacific High Yield Bond ETF (KHYB) is an actively managed fund that invests in USD-denominated high-yield debt securities from companies in Asia, excluding Japan. The fund is poised to capture the recovery and growth of the Asian bond market.

KHYB is benchmarked to the JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index and invests in high yield fixed income securities, or “junk bonds,” that are rated below the four highest categories (Ba1/BB+ or lower) by at least one credit rating agency, or, if unrated, are determined by the sub-advisor to be of similar quality.

Nikko, the sub-advisor of the ETF, uses top-down macro research and bottom-up credit research to create the portfolio and a proprietary process combining qualitative and quantitative factors to value an issuer’s credit profile.

By moving the credit curve up, KHYB will be more defensive against the benchmark and have shorter duration bonds than the index. When the bonds mature, Nikko can decide how and when to redeploy and invest in new bonds, depending on market conditions.

This article originally appeared in the Vettafi China Insights Channel, authored by Karrie Gordon. Please click here to view the original.

For KHYB's top ten holdings, standard performance, and prospectus please click here.

Citation:

Ng, Serena. "Chinese Property Bonds Are Suddenly a Huge Winner," The Wall Street Journal. December 16, 2022.

Index Definitions:

The JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index tracks the performance of USD-denominated high-yield debt securities issued by companies in Asia.

The ICE BofA Asian Dollar High Yield Index tracks the performance of USD-denominated high-yield debt securities issued by companies in Asia and was launched on December 31, 1996.

The ICE BofA US High Yield Index tracks the performance of USD-denominated high-yield debt securities issued by companies incorporated in the United States and was launched on May 31, 1992.