Risk Rotation From Policy to Geopolitical in February

February Market Key Highlight

I remember noting down a list of economic indicators to watch for in March at the end of January’s recap. The top of which was Fed movement, specifically the Fed halting its net-asset-purchases and raising rates. The list stayed valid through February 25th, then the Russia-Ukraine crisis broke out, and I had to create a whole new watch list.

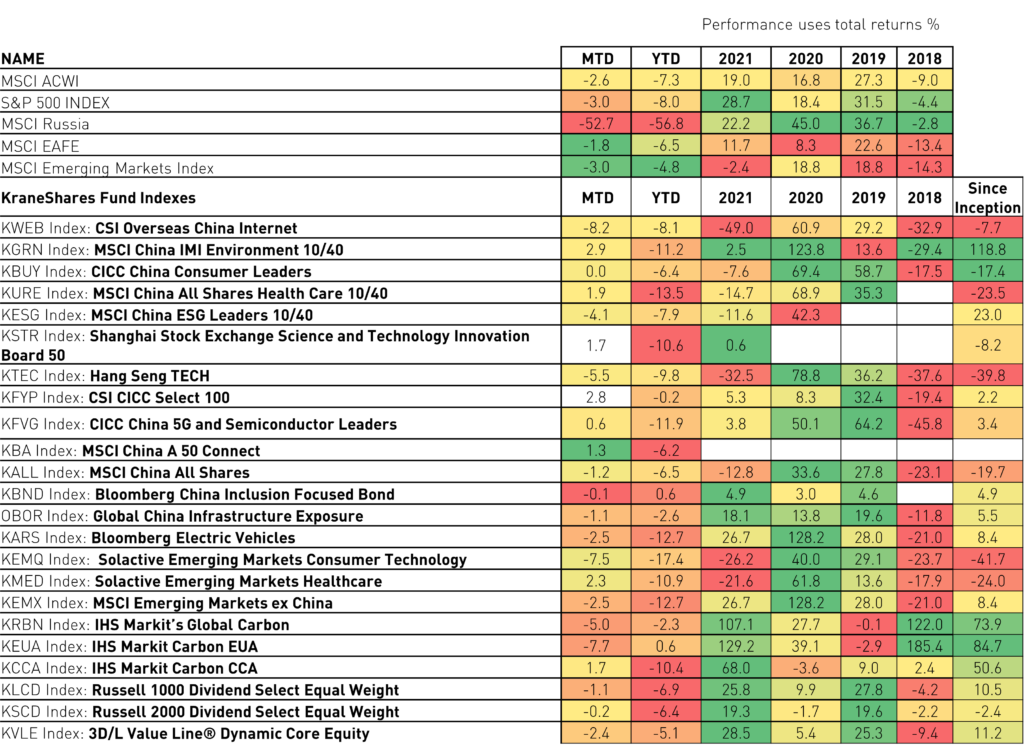

The geopolotical fear led to a global equity market selloff. The scale of the pullback resulted in breaking through some key technical levels and bringing the potential threat of the market entering correction territory. In February, MSCI ACWI returned -2.6% Month-to-Date (MTD), -7.3% Year-to-Date (YTD), SPX -3% MTD (-8% YTD), MSCI EAFE -1.8% MTD (-6.5% YTD), MSCI EM -3% MTD (-4.8% YTD) and MSCI Russia -52.7% MTD (-56.8% YTD).1 We are not without bright spots; the industries with high domestic business exposure acted more defensively, noticeable, Russell 2000 returned +1.1% MTD, and Shanghai Composite SHCOMP returned +3% MTD.1

Over the last 30 years, there were probably ten key geopolitical events that caused other pullbacks for different regional markets. We observed that China, particularly China A-Share equity, tends to be more defensive when geopolitical risk is heightened. This time around, China, like all the other equity markets, is unlikely to be immune to the volatility. Still, I believe the scale of the selloff will be relatively less compared to other markets for three reasons:

First, China has a distinctive nature in policymaking, and the Chinese policymakers have not exhausted or fully utilized their available tools to support the country’s growth. With the under-leveraged banking liquidity, last year’s underspent government budget, and trillions of dollars in reserves on hand are all the options that policymakers can easily tap into to inject into the market if needed.

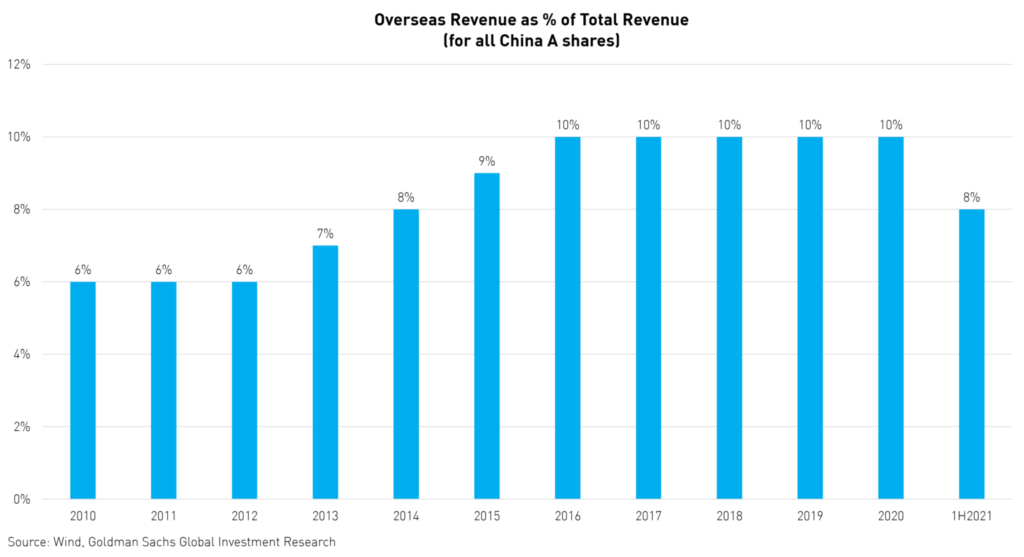

Second, Chinese companies have a domestic-focused business model and are typically fueled by millions of customers in Mainland China; revenues generated from overseas are in the single digits around 6-8%, according to Wind data.

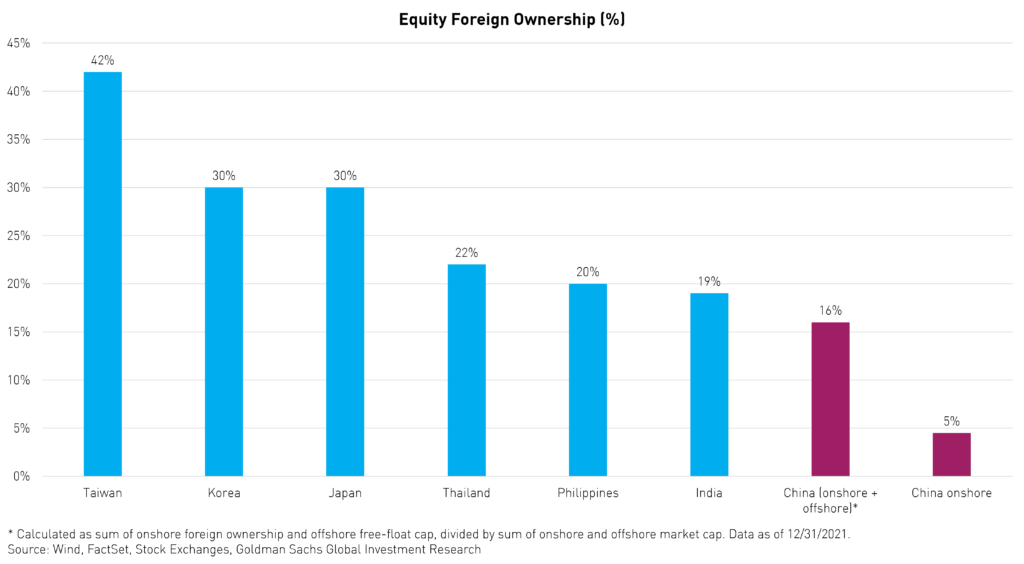

Third, the risk-off appetite is unlikely to result in any sizeable outflows from China equity as foreign ownership is still at a low level, around 4.5%, as published by Wind. Global portfolios are still underweighting China by approximately 450bps vs. the benchmark according to Emerging Portfolio Fund Research (EPFR). The combination provides the reassurance of meaningful retrieval of capital from China’s Equity market is unlikely.

Historically the return correlations between China A-Shares and global equity markets are low, suggesting a lower spill-over impact from a global selloff. But that doesn’t mean not acknowledging potential volatility with China equity.

- Currently, most countries are starting to relax from covid lockdowns and resuming full speed into growth mode. However, heightened inflation risk and interest rate uncertainty could lead to a tightened financial condition globally. In that context, China will not be isolated from the challenge, though the degree of the impact may turn out to be a low-beta scenario.

- Even if commodity prices continue to rise, the impact on China’s inflation is limited as China’s CPI basket is dominated by food components, and China’s imports on that are restricted.

- Domestically in China, the cross-sector return correlations have reached high levels, suggesting macro factors are driving stock returns. This may continue, in our opinion, but it will shift to be on the supportive side. That makes the National People’s Congress (NPC) meeting happening in Beijing an increasingly important event to watch to assess macro conditions in China for 2022

A Peek at the NPC

Starting March 4th/5th, China kicks off its dual sessions in Beijing, the Chinese People’s Political Consultative Committee (CPPCC), and the NPC, which last 7-10 days. The NPC is the crucial government meeting. In theory, it is the venue to endorse economic targets and release policy directions and objectives. At the opening of the NPC, Premier Li announced various economic targets and provided an overview of the 16,000-word Government Work Report. What we have learned thus far includes:

- 2022 GDP Growth target 5.5% higher than market expectation and maintain inflation target at 3%

- Create 11 million new urban jobs and manage the unemployment rate of 5.5%.

- Reiteration of pro-growth monetary policy similarly to 2021 and consistent with recent People’s Bank of China (PBOC) communications in January.

- Healthy fiscal budgeting and a stable currency.

- Stability was mentioned 76 times in the Work Report.

The geopolitical and policy events could dominate the headlines for some time. Investors are staying cautious while the market is pricing in uncertainty. I believe the downside surprise from the current level is limited, given the pullback experienced so far.

Overseas markets only account for 8% of Chinese companies’ revenue in the listed universe.

Foreign investors’ aggregate exposure to Chinese stocks, notably A shares, remains low.

Global Indices Returns at a Glance (as of 28-Feb-2022):

Index returns are for illustrative purposes only and do not represent actual fund performance. Indexes are unmanaged and one cannot directly invest in an index.

Follow the links for the most recent standard performance: KWEB, KGRN, KBUY, KURE, KESG, KSTR, KTEC, KFYP, KFVG, KBA, KALL, KBND, OBOR, KARS, KEMQ, KMED, KEMX, KRBN, KEUA, KCCA, KLCD, KSCD, KVLE.

Index Inception Dates: KWEB - 9/10/2011, KGRN - 8/23/2017, KBUY - 11/30/2020, KURE - 10/25/2017, KESG - 11/8/2019, KSTR - 7/23/2020, KTEC - 7/20/2020, KFYP - 4/30/2013, KFVG - 10/31/2020, KBA - 8/20/2021, KALL - 6/26/2014, KBND - 7/1/2015, OBOR - 5/31/2017, KARS - 5/21/2021, KEMQ - 10/11/2017, KMED - 5/15/2013, KEMX - 3/9/2017, KRBN - 7/29/2019, KEUA - 8/23/2021, KCCA - 10/5/2021, KLCD - 4/7/2019, KSCD - 4/7/2019, KVLE - 10/31/2020

Citation

- Data from Bloomberg as of 2/28/2022.

Definitions

Month-to-Date (MTD): a period starting at the beginning of the current calendar month and ending at the current date.

Year-to-Date (YTD): the period of time beginning the first day of the current calendar year or fiscal year up to the current date.

Index Definitions

MSCI ACWI: captures large and mid-cap representation across 23 Developed Markets (DM) and 23 Emerging Markets (EM) countries.

The S&P 500 (SPX): is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

MSCI EAFE: is an equity index that captures large and mid-cap representation across 21 Developed Markets countries

around the world, excluding the US and Canada.

MSCI EM: captures large and mid-cap representation across 25 Emerging Markets (EM) countries.

MSCI Russia: is designed to measure the performance of the large and mid cap segments of the Russian market.

The CSI Overseas China Internet: selects overseas-listed Chinese Internet companies as the index constituents; the index is weighted by free-float market cap.

Russell 2000: measures the performance of the small-cap segment of the US equity universe.

Shanghai Composite: tracks the daily price performance of all A-shares and B-shares listed on the Shanghai Stock Exchange.

MSCI China IMI Environment 10/40: designed to measure the performance of securities with the country of classification as China comprising of large, mid, and small market cap segments.

CICC China Consumer Leaders: consists of the investable universe of publicly traded China-based companies whose primary business or businesses are in the consumption-related industries such as home appliance, food & beverage, apparel & clothing, hotels, restaurants, and duty-free goods.

MSCI China A Net Return USD: captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips, and foreign listings (e.g. ADRs).

Hang Seng Tech: represents the 30 largest technology companies listed in Hong Kong that have high business exposure to technology themes and pass the index's screening criteria.

CSI CICC Select 100: is designed to select 100 A-Shares companies with high and stable ROEs, high dividend yields, and high earnings growth rates amongst a stock pool which is comprised of the A-Shares companies with higher size, liquidity, and operating revenue in each Industry Group according to CSI Industry Classification Standard.

CICC China 5G and Semiconductor Leaders: designed to track the performance of companies engaged in the 5G and semiconductor-related businesses, including 5G equipment, semiconductors, electronic components, and big data centers.

MSCI China A 50 Connect: seeks to represent the performance of the top 50 large-cap China A-shares using a sector-neutral approach.

MSCI China All Shares: captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐

chips, P‐chips, and foreign listings (e.g. ADRs).

MSCI China All Shares Healthcare 10/40 Net Return USD: captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips, and foreign listings (e.g. ADRs).

Bloomberg China Inclusion Focused Bond: designed to track the performance of China’s onshore renminbi-denominated government and high-quality corporate bond market.

Global China Infrastructure Exposure: designed to represent the performance of listed companies within Developed, Emerging, and Frontier markets with high revenue exposure to China infrastructure development from within a specified set of industries relevant to what has become known as the ‘One Belt, One Road’ (“OBOR”) investment program and development strategy promoted by China.

Bloomberg Electric Vehicles: designed to track the performance of companies engaged in the production of electric vehicles and/or their components, or engaged in other initiatives that may change the future of mobility.

Solactive Emerging Markets Consumer Technology: selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transact.

Solactive Emerging Markets Healthcare: seeks to track the equity market performance of companies engaged in the health care sector in various emerging markets.

MSCI Emerging Markets ex China: tracks large-cap and mid-cap companies within emerging market countries, excluding China.

IHS Markit’s Global Carbon: offers broad coverage of cap-and-trade carbon allowances by tracking the most traded carbon credit futures contracts.

IHS Markit Carbon EUA: tracks the most traded EUA futures contracts.

IHS Markit Carbon CCA: tracks the most traded CCA futures contracts.

Russell 1000 Dividend Select Equal Weight: takes a smart beta approach to investing in US Large Cap companies.

Russell 2000 Dividend Select Equal Weight: takes a smart beta approach to investing in US Small Cap companies.

3D/L Value Line® Dynamic Core Equity: introduces a market adaptive approach to investing in US large-cap companies.

MSCI China ESG Leaders 10/40 NET USD: aims to provide exposure to companies with high Environmental, Social and

Governance (ESG) performance relative to their sector peers.

SSE Science and Technology Innovation Board 50: is comprised of the 50 largest securities listed on SSE Science and Technology Innovation Board (STAR Market) as determined by the highest market capitalization and liquidity.

R_KS_SEI