What’s The Deal With China Real Estate? Q&A With Nikko’s David Gan

Asia Credit & China Property Outlook 2022

David Gan is a Senior Credit Analyst at Nikko Asset Management, a top Asia fixed income manager and the sub-advisor for the KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB). After mega-developer Evergrande came close to defaulting on its debts last year following a regulatory revamp for China's real estate development industry, Evergrande and other developers have had difficulty securing the financing necessary for them to complete certain development projects. Many of these projects had been paid for by homebuyers who financed their purchases through mortgages. Now that the fate of these projects is uncertain, many have ceased making mortgage payments, resulting in a mortgage boycott that made international headlines.

We asked David to participate in a Q&A session to get his thoughts on the mortgage boycott and the implications it may have for China's real estate sector and credit market. He believes that although the near-term consequences are negative for the sector, this event may push the government to intervene meaningfully to ensure that projects are completed, restoring buyer confidence. Below is the video of our conversation, an executive summary of David's insights, and a detailed transcript.

Executive Summary

- In the near term, the impact of mortgage boycotts for unfinished projects will be negative, weighing on buyer confidence, reducing liquidity for developers, and leading to higher near-term default risk.

- However, in the medium to long-term, the boycotts are positive because they will encourage the government to intervene further to shore up the sector.

- Gan believes that the $1 trillion bailout fund will be sufficient to resolve issues surrounding unfinished projects. However, investors should note that the focus of this bailout fund will be at the project level and that the fund will only target developers who have already defaulted on their debts.

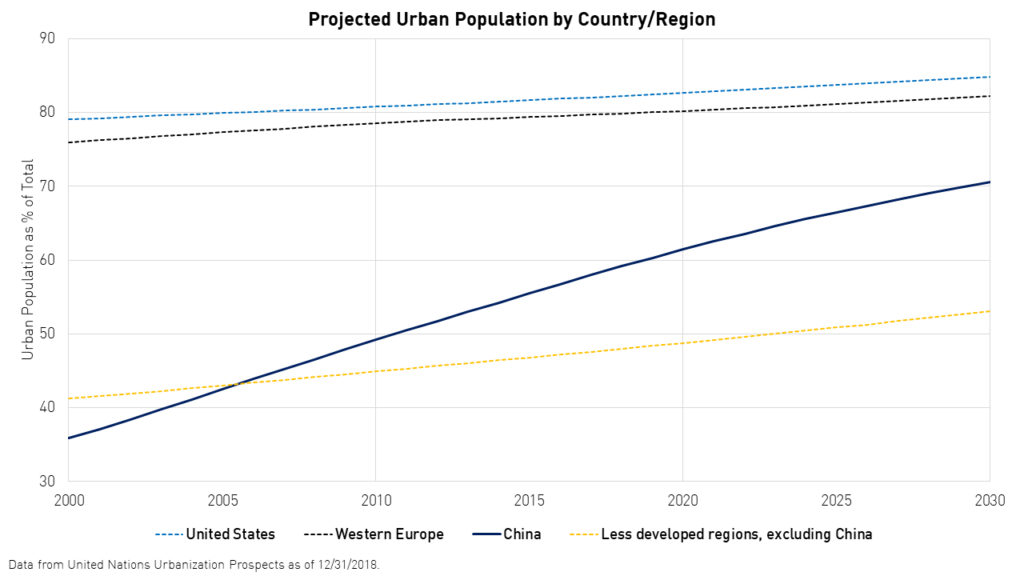

- In the short term, there is certainly oversupply in the market, driven by an overestimation of demand, which has slumped recently. Gan believes this will normalize over time as China’s urbanization rate, despite having increased remarkably over the past decade, still lags developed countries.

- Gan believes default rates will remain elevated in 2022, though they may come down somewhat in the second half of the year. While Nikko continues to be invested in the sector, the team is currently overweight higher quality credits and will continue to have a quality bias until the situation improves.

Q1: How does the news of the mortgage boycott among homebuyers for unfinished projects impact the China property sector?

The most immediate impact of this mortgage boycott on the China property sector is certainly negative, and I’ll highlight three main drivers of these negative impacts. But, in the medium term, this may conversely help in the sector’s recovery as the boycott pushes the government to intervene and support the sector.

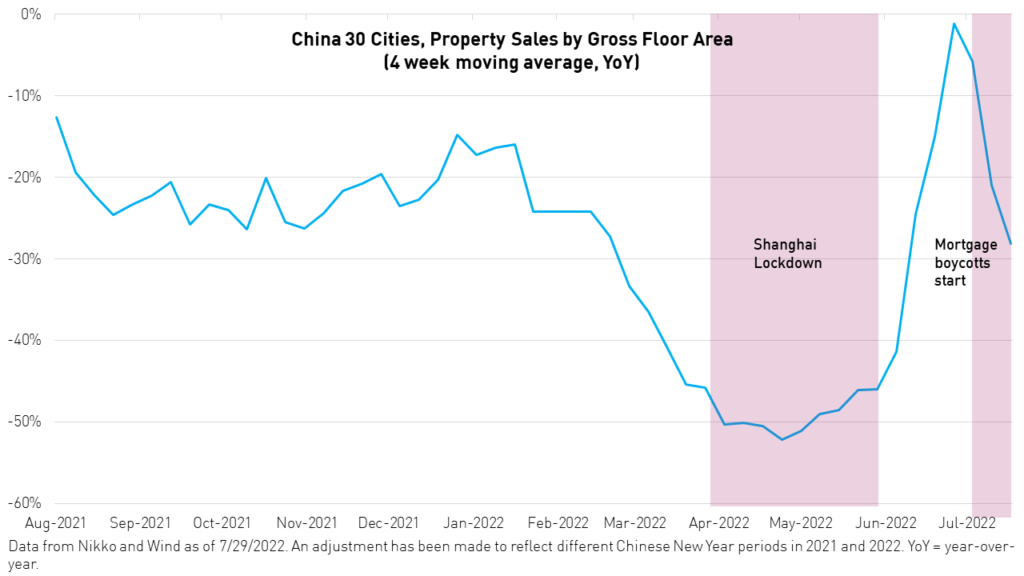

In the near term, the negative impact is driven, firstly, by an immediate hit to homebuyer confidence. Property sales had begun to recover in June. However, high-frequency data after the mortgage boycott already suggests a significant weakening of property sales, probably as potential homebuyers are concerned that properties may not be completed.

Secondly, local governments may more strictly enforce the management of developers’ escrow accounts. This will force developers to have more of their liquidity locked up at their projects, reducing their financial flexibility and ability to repay their bonds

Thirdly, banks may become more cautious in granting mortgages and loans to real estate developers

So, the combined effect of this in the near term will be weaker sales, weaker liquidity, and higher near-term default risks

However, as mentioned earlier, this boycott may conversely help in the sector's recovery subsequently. The boycott, as a very significant and nationwide social issue, is likely to push the government to intervene.

What we have seen in the past year, even as the property sector weakened significantly, the magnitude and speed of the government policy response have generally been below expectations and insufficient to address the downturn. The government stuck to the policy of “housing is for living, not for speculation,” despite the economic cost.

With the recent mortgage boycott, however, the sector weakness has now also demonstrated a very visible social cost. We see this social cost to the government as heavier than the economic one and thus likely to generate a stronger policy response that could help in the sector's recovery.

So far, there have already been preliminary signs of a stronger policy response, and this will be a key driver for the China property sector in the coming months

Q2: There are reports the government is setting up a RMB 1 trillion real estate fund, but some estimate that unfinished projects are worth nearly RMB 2 trillion in total. Will RMB 1 trillion be enough to fix the problem?

I think the important question in the near term is whether this RMB 1 trillion fund really does get implemented and whether the size does reach that magnitude. So far, this has only been reported by the media, with heavy speculation regarding the potential size of the fund, from different sources. As of yet, there has been no official confirmation and minimal details.

If it does get implemented, we think that RMB 1 trillion would be sufficient to resolve the unfinished projects and, most importantly, would go a long way in restoring confidence in the sector

The estimates of these unfinished projects generally range from a few hundred billion up to 2 trillion, so 1 trillion would really be in the middle of this range. That said, we believe the amount would still be sufficient to resolve these projects, as many of these projects still have significant unsold portions, which could be sold if confidence in the projects is restored.

Nonetheless, it is important for investors to note that the focus of this fund is likely to be on resolving problems at the project level and developers who have already defaulted or extended their debts.

There are several developers who have not defaulted and are surviving under significant stress. The relief fund will not directly target such developers. However, such developers will still benefit indirectly, especially those that are privately owned. If the government shows they can ensure project completion, customers will no longer have to worry about buying a project from a private developer and the project subsequently stalling, so these surviving developers are likely to see a recovery in sales even if they are not included in the fund directly.

For the past few months, we have observed a divergence in property sales performance, with customers much less willing to buy projects from private developers, even those who remain current on their liabilities, compared to projects from state-owned developers as customers are worried about uncompleted projects if the private developer runs out of liquidity subsequently.

Overall, as earlier mentioned, central government actions over the past year have been below market expectations, but this real estate fund, if implemented, would be a big step forward and key to stemming the downward spiral in confidence.

Q3: What are your thoughts on over-supply, especially in lower-tier cities?

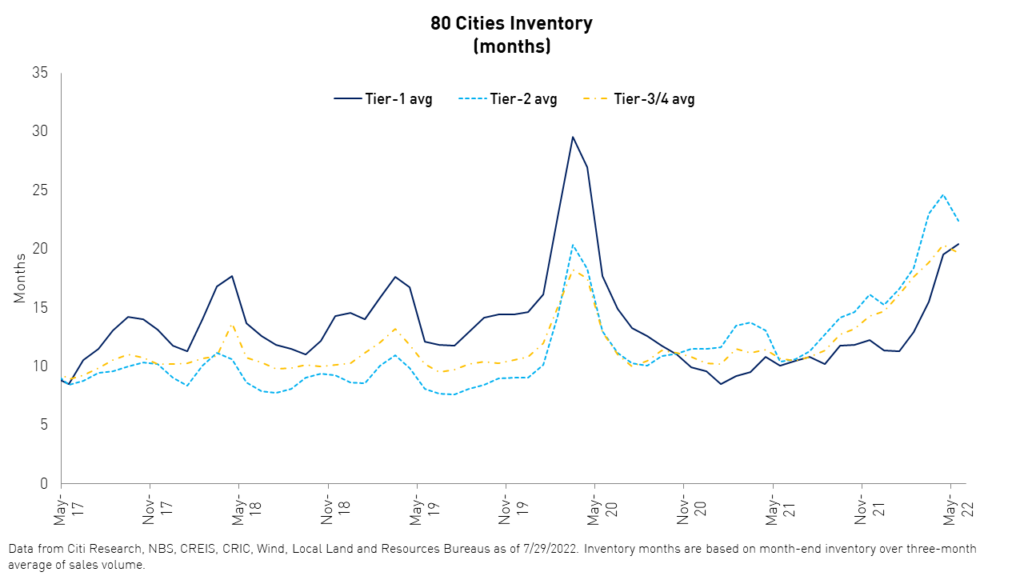

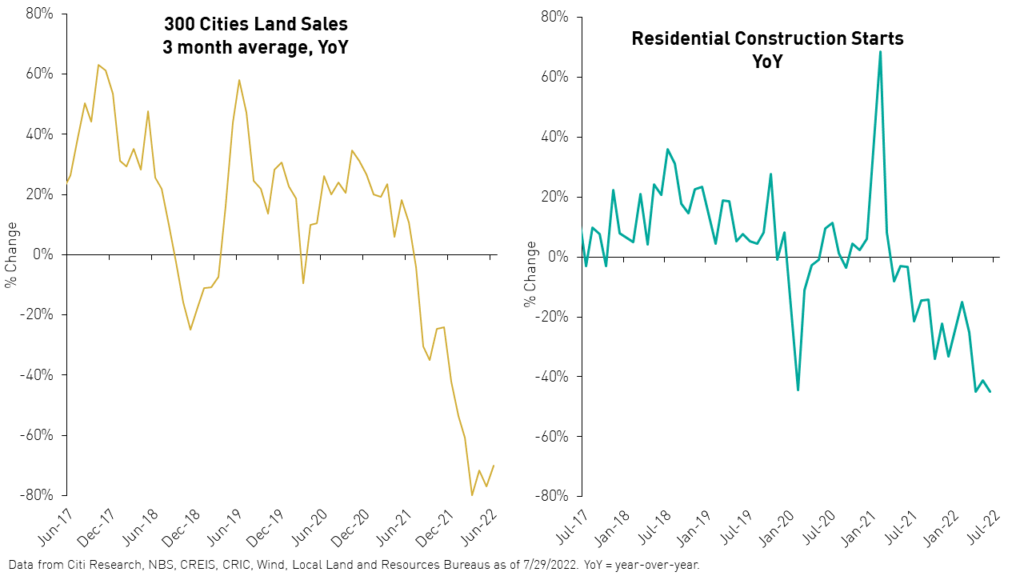

Oversupply will indeed be an issue in the short term. This has been driven primarily by a significant fall in demand for properties while absolute inventory levels have built up slightly over the past year. This is a risk, especially for lower-tier cities, where demand is structurally weaker due to the flow of residents toward upper-tier cities.

That said, we expect this oversupply situation to normalize over time. The new supply of houses will certainly drop, and developers are already cutting land acquisitions and construction significantly.

On the demand side, in the long-term, we expect urbanization to support the market, alongside the usual annual household formation. China’s urbanization rate is still catching up to that of developed countries, so this is a long-term trend. In the short term, demand is likely to recover, but slowly, driven by pent-up demand from homebuyers who have delayed purchases over the past few months.

Q4: What do you see as the path of default rates? How are you positioned within China property?

We have seen a very elevated default rate in the sector since the start of 2021. We still expect more defaults to come, unfortunately, including several default candidates over the rest of this year, but we expect this pace to slow down from what we have seen in 2021 and 1H of this year.

Given this backdrop of slowing but continuing defaults, as well as an expectation for a slow recovery, balanced by a likelihood of substantial upcoming government support actions, we continue to stay invested in this sector but with a focus on stronger credits

There are bonds issued by companies within the sector that we see as having stronger fundamentals and, most importantly, stronger liquidity compared to peers, but, at the same time, their bond prices trade at attractive levels given the sector sell-off over the past year. We do see value in some bonds of these issuers.

The KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB)

KHYB is an active ETF managed by sub-advisor Nikko Asset Management Americas, Inc. (“Nikko”). The fund provides exposure to USD-denominated high-yield debt securities issued by companies in Asia. Nikko's team has provided significant downside protection through their management of the portfolio this year. The fund has outperformed the JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate Index by over 5% over the past six months, returning -12.16% versus the index's return of -17.47% as of July 29, 2022.1 With a 30-day SEC yield of 12.48% and an average duration of fewer than 2 years,2 we believe the fund is attractive in the current rising rate environment in the US. Furthermore, we believe the Asia high yield bond market may provide meaningful diversification* for fixed income investors.

For KHYB current standard performance, please click here.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate such that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit our website at www.kraneshares.com or call +1 (855) 8KRANE8.

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- Data from KraneShares as of 7/29/2022.

- Data from Nikko as of 6/30/2022.

Nikko Asset Management Americas, Inc. and its affiliates (“Nikko AM”) are not affiliated with KraneShares and are not involved in any marketing, distribution, or offering of any KraneShares products. The information presented herein is for informational purposes only and should not be construed as an offer or solicitation of any security or product. Reference to any particular sector is purely for informational purposes only and does not constitute a recommendation to buy, sell or hold any security or product, or to be relied upon as financial advice in any way. Any prediction, projection, or forecast on the economy, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. Past performance does not guarantee future returns.