NVIDIA’s Rapid Rise Fueled by Chip Giants TSMC and SK Hynix

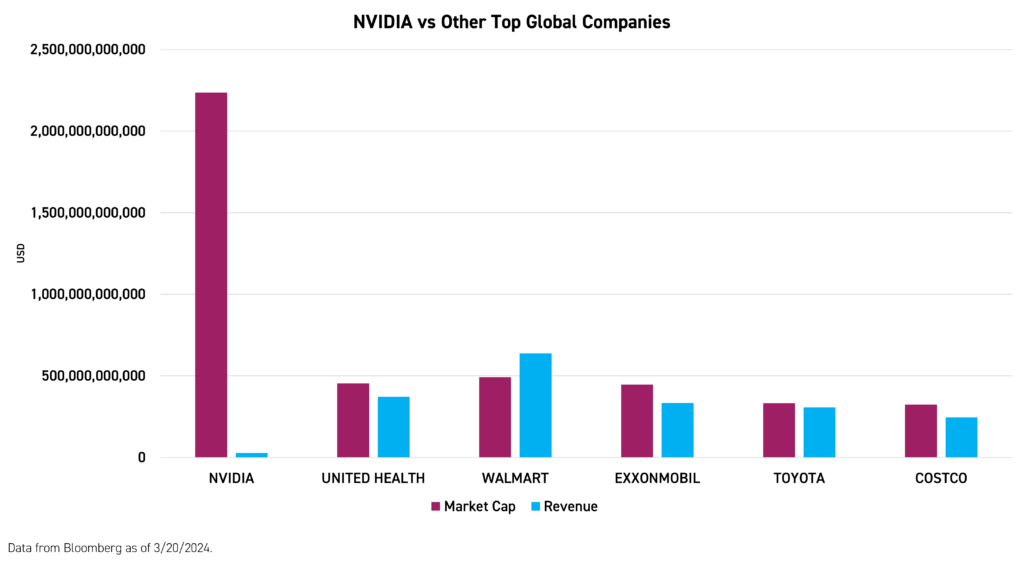

United Health, Walmart, ExxonMobil, Toyota, and Costco - five global household names with a combined market cap trailing NVIDIA by over 200 billion.1

NVIDIA’s rapid rise to become the world's third most valuable company was fueled by the transformative potential of artificial intelligence (AI). However, we don’t believe NVIDIA should be the sole beneficiary of this multi-decade opportunity. This valuation milestone would not have been possible without the fabrication prowess of two overseas semiconductor manufacturing giants: Taiwan Semiconductor Manufacturing Company (TSMC) and South Korea’s SK Hynix.

Both companies have formed a strategic "AI semiconductor alliance," combining their advanced packaging and manufacturing technology expertise to make NVIDIA's cutting-edge AI computing solutions possible. While TSMC and SK Hynix are not easily accessible to U.S. investors through direct equity ownership, the KraneShares Emerging Markets Consumer Technology ETF (KEMQ) provides exposure to both companies and others driving technological growth behind the scenes.

Fortifying Partnerships for AI Supremacy

NVIDIA has cultivated pivotal partnerships with TSMC and SK Hynix, which are integral to bringing its innovative products to market. TSMC, as the world's largest foundry, manufactures NVIDIA's high-performance GPUs using its cutting-edge 5nm and 4nm process nodes. Simultaneously, SK Hynix is the undisputed leader in high-bandwidth memory (HBM) chips, securing over 50% global market share in this specialized memory crucial for GPU-accelerated AI computation that companies like NVIDIA rely on.2

NVIDIA, Taiwan Semiconductor, and SK Hynix form a symbiotic ecosystem where NVIDIA's success hinges on the advanced semiconductor technologies that TSMC and SK Hynix have developed. This interdependence sparked their "One Team Strategy" to co-develop next-generation AI chips like HBM4 memory, enabling them to maintain a decisive technological advantage.

The semiconductor industry has become a highly globalized, collaborative chain, which we extensively covered in US Export Control – Impact & Opportunity for China’s Semiconductor Industry. We believe international cooperation is essential for scaling the advanced manufacturing capacities required to meet surging AI chip demand. KraneShares also spoke with former diplomat Susan Thornton, who shared this belief of a global semiconductor ecosystem, as well as insights from her in-person visit to Taiwan Semiconductor. We summarized her thoughts here: Susan Thornton on Navigating the Future of U.S.-China Relations.

Deepening Ties for Next-Gen Memory

Underscoring the importance of this alliance, SK Hynix was the first company to mass-produce the cutting-edge HBM3 in 2022, successfully supplying NVIDIA's H100 (NVIDIA's most popular AI chip). SK Hynix is poised to further cement its dominance in the next generation of ultra-fast AI memory chips with HBM3E, a highly anticipated 5th-generation HBM product. SK Hynix is currently aiming for mass production of this chip in the first half of 2024.2

At NVIDIA's recent GPU Technology Conference (GTC) on March 18th, CEO Jensen Huang unveiled its new Blackwell GPU architecture, which will power the flagship GB200 chip designed for the next generation of AI training and inference. The GB200 will officially be manufactured by TSMC using their 4nm process node. While SK Hynix did not explicitly name the customer of its HBM3E, reports indicate that the chip's arrival will coincide with the release of NVIDIA's Blackwell accelerator family for artificial intelligence applications.

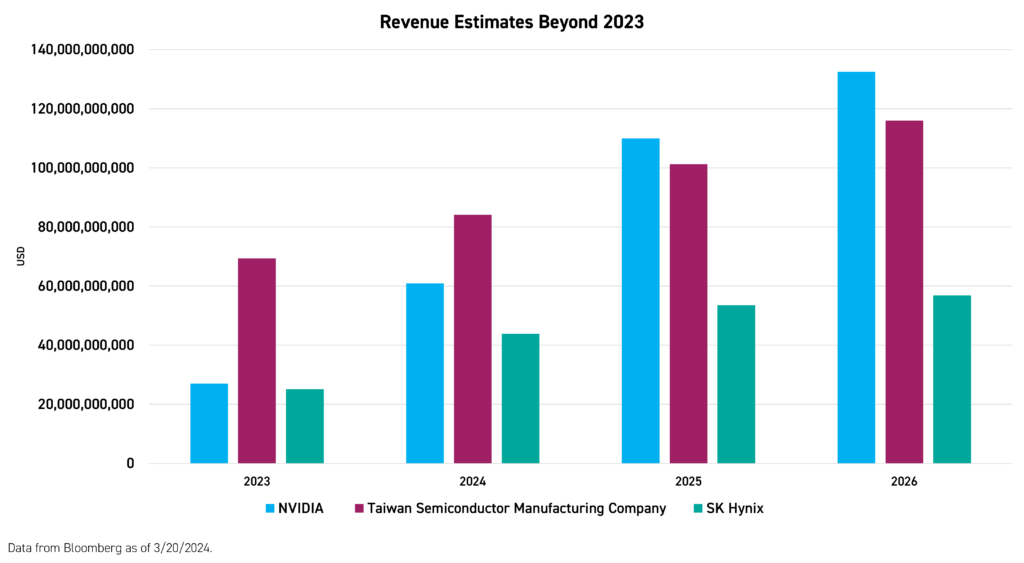

While NVIDIA has been a standout AI beneficiary, it relies on semiconductor partners like TSMC and SK Hynix for the hardware and tools enabling its AI breakthroughs. Given its advanced node chips and packaging leadership, TSMC expects its AI-related business to surge 50% annually over the next five years.3 Similarly, SK Hynix projects 40% annual AI revenue growth driven by accelerating demand for its high-end memory solutions from AI data centers.2

Propelling AI's Exponential Growth

Beyond component supply, TSMC's and SK Hynix's pioneering R&D efforts in state-of-the-art fabrication and packaging have propelled the performance and efficiency required for next-generation AI computing. TSMC's cutting-edge process nodes enable smaller, more powerful, energy-efficient chips crucial for high-performance AI applications. Complementing this, SK Hynix's mastery of HBM packaging facilitates blazing-fast data transfer with lower power consumption in NVIDIA's AI accelerators.

Both companies are aggressively investing in future AI chip technologies like HBM4, with TSMC leveraging its packaging expertise for improved compatibility. Their strategic alliance aims to outpace rivals in the fiercely competitive AI semiconductor race, shaping the trajectory of this disruptive technological transformation.

In a recent visit to Taiwan, NVIDIA CEO Jensen Huang met with TSMC's leadership to address supply challenges in this burgeoning AI environment. Huang acknowledged TSMC's indispensable role, stating, "The single greatest challenge in AI, of course, is scaling the capacity of AI. And so, we're working very hard, TSMC, all of our supply chain partners here, are working very hard to keep up with the demand."

Valuation Disparities Amid Catalyzed AI Growth

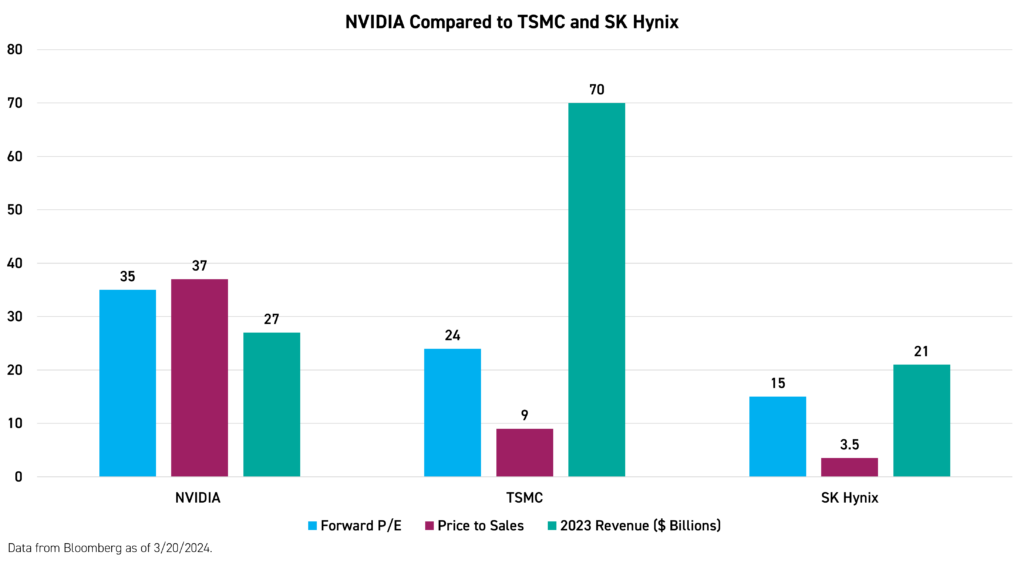

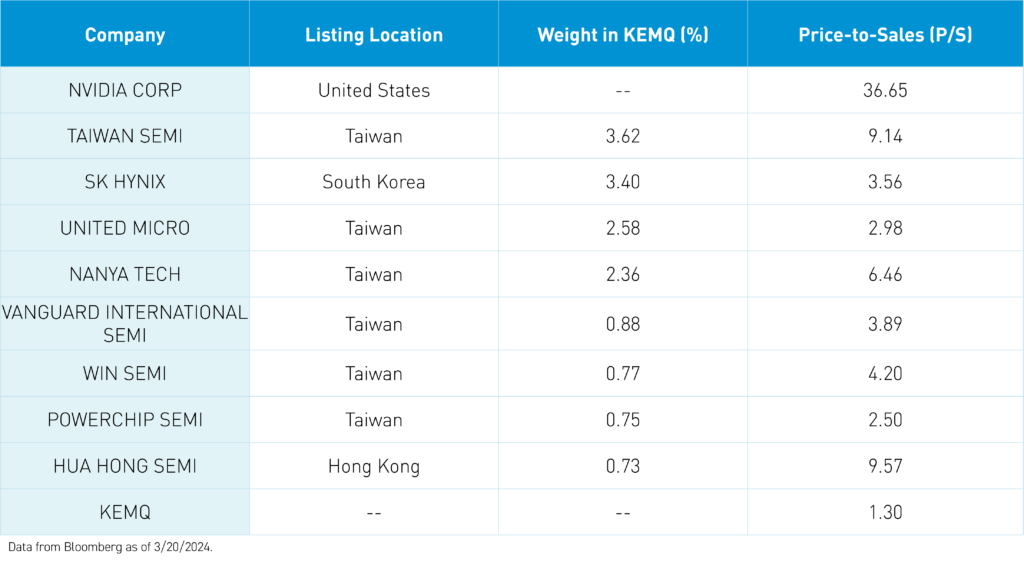

While TSMC and SK Hynix play instrumental roles in powering NVIDIA's AI breakthroughs, their valuations and financial metrics highlight a substantial disconnect. NVIDIA commands a staggering market capitalization of well over $2 trillion, trading at a forward price-to-earnings (P/E) ratio of 35, price-to-sales of about 37, and generating $27 billion in annual revenue as of the end of 2023.1

In contrast, TSMC, the world's largest contract chipmaker, has a market cap of around $600 billion, trading at a more modest forward P/E of 24 despite generating a substantial annual revenue of $70 billion in 2023 (over 2x that of NVIDIA) and trading at a price-to-sales ratio of about 9.1 Similarly, SK Hynix, the clear leader in high-bandwidth memory solutions critical for AI computing, has a market capitalization of just under $100 billion with a forward P/E of 15, price-to-sales of about 3.5, and $21 billion in annual revenue for 2023.1

These valuation discrepancies underscore the market's perception of NVIDIA as the primary beneficiary of the AI revolution. However, the success of NVIDIA's products is inextricably linked to the cutting-edge semiconductor manufacturing capabilities and technological innovations of TSMC and SK Hynix. Most of the leading fabless semiconductor companies, such as AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Qualcomm, and Nvidia, are customers of TSMC, as are emerging companies such as Allwinner Technology, HiSilicon, Spectra7, and UNISOC. Similarly, Apple is SK Hynix's top customer, further highlighting these companies' unparalleled industry significance. While NVIDIA's market capitalization reflects its position as a pioneering force in the AI realm, we believe the relatively lower valuations of TSMC and SK Hynix do not reflect their indispensable contributions to the technology industry. These semiconductor giants are vital components in the global innovation ecosystem, driving advancements across various sectors, from consumer electronics to cloud computing and beyond.

Conclusion

The semiconductor expertise of partners like TSMC and SK Hynix helped catalyze NVIDIA's $2 trillion valuation and AI leadership. However, the relatively low valuations of these semiconductor giants compared to NVIDIA may represent a potential opportunity for investors seeking exposure to the companies driving technological growth behind the scenes.

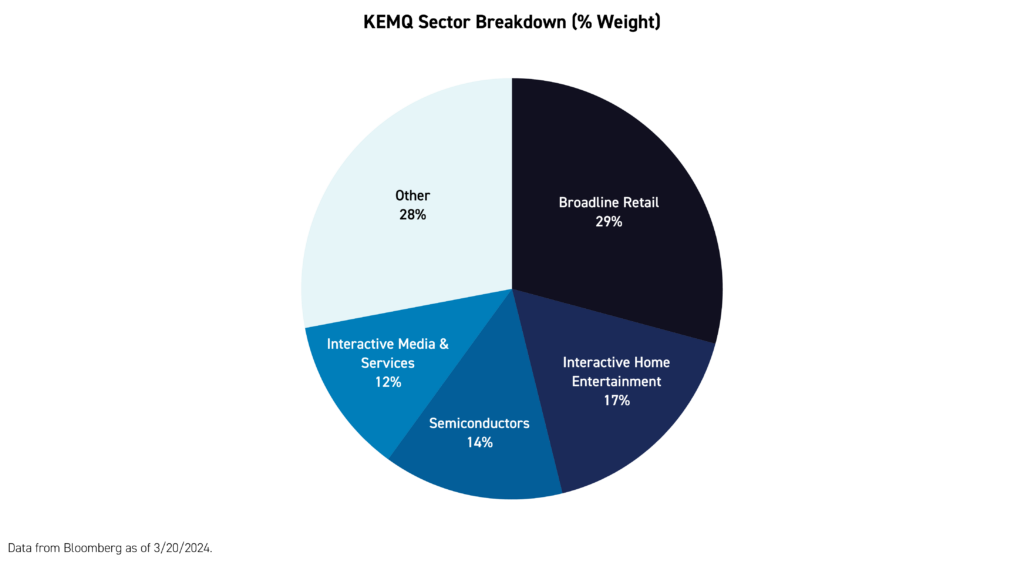

While TSMC and SK Hynix are not easily accessible to U.S. investors through direct equity ownership, the KraneShares Emerging Markets Consumer Technology ETF (KEMQ) provides a way to invest in these critical AI enablers, currently trading at low valuations compared to NVIDIA. With TSMC and SK Hynix as top holdings, KEMQ offers investors an avenue to tap into the companies fueling NVIDIA's transformative breakthroughs and many other technological leaders across emerging markets.

For KEMQ standard performance, top 10 holdings, risks, and other fund information, please click here.

This should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund.

Citations:

- Data from Bloomberg as of 3/20/2024.

- Data from SK Hynix company website as of 3/20/2024.

- Data from Taiwan Semiconductor company website as of 3/20/2024.

Definitions:

Market Capitalization: the value of a company that is traded on the stock market, calculated by multiplying the total number of shares by the present share price.

Forward Price-to-Earnings Ratio (Forward P/E): The Forward Price to Earnings (PE) Ratio is similar to the price-to-earnings ratio. The regular P/E ratio is a current stock price over its earnings per share. The forward P/E ratio is a current stock's price over its "predicted" earnings per share.

Price-to-Sales Ratio (P/S): The price-to-sales (P/S) ratio shows how much investors are willing to pay per dollar of sales for a stock. The P/S ratio is calculated by dividing the stock price by the underlying company's sales per share.