Zero to One: The Rise of China’s Semiconductor Industry

By Derek Yan, Henry Greene, and Megan Gummer

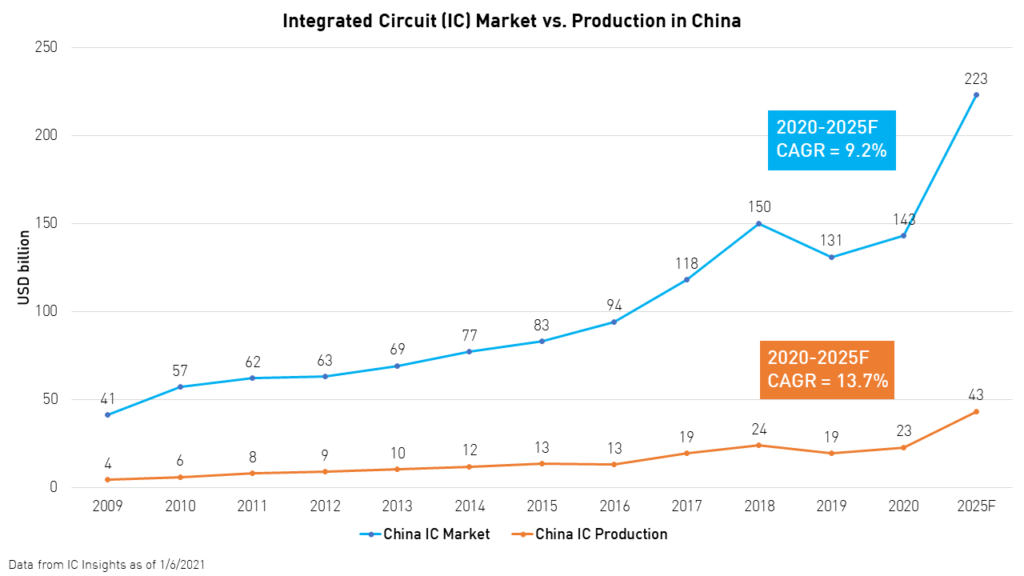

The pandemic-fueled race toward digitalization has given rise to a global chip shortage. While the shortage is causing headaches around the globe, China’s situation is unique because it coincides with the massive proliferation of electric vehicles and 5G networks in the country. These areas demand a healthy supply of powerful chips. As a result, China has made developing its domestic semiconductor manufacturing capability a national priority; we believe this may present an opportunity for investors.

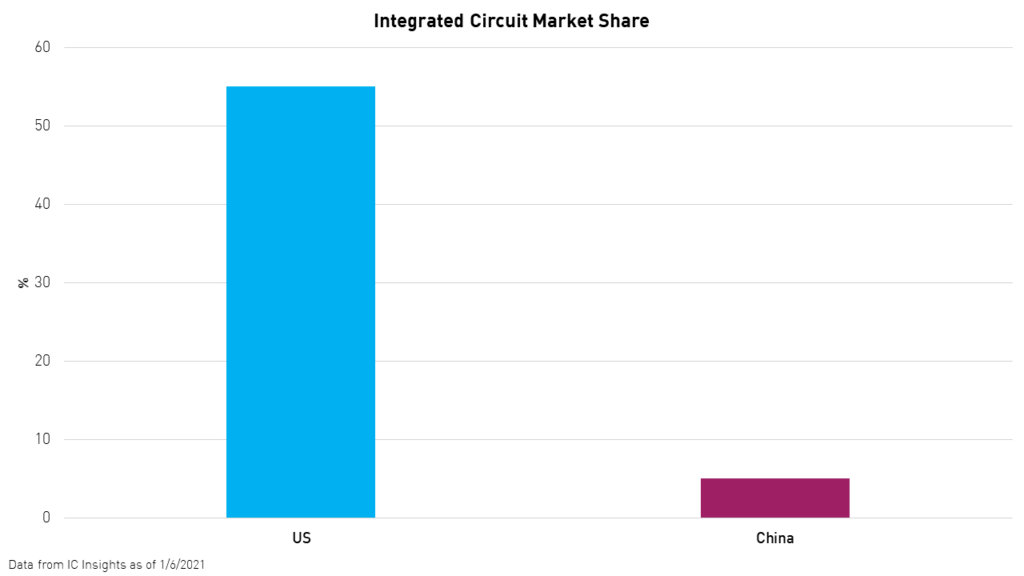

While both the US and China are committing tens of billions of dollars to their domestic semiconductor industries1, there is still a wide gulf between them. The US is already home to dominant global manufacturers like Intel and Nvidia. Meanwhile, China has only recently begun developing its capacity to produce the types of advanced semiconductors that are in highest demand right now. While China's global market share is essentially starting from zero, we believe there is upside potential in the space and a healthy crop of companies positioned to tackle the challenge.

Private investors are already seizing this opportunity. US venture capital firms including Sequoia, Matrix, and Walden International, among other US-based private investors, participated in 58 investment deals in China’s semiconductor industry from 2017 to 2020, which is more than twice the number of deals inked the prior four years.2 We believe China’s semiconductor industry is drawing investors for three key reasons: strong government support, lower costs with additional supply chain efficiency gains, and digitalization trends that are outpacing the rest of the world.

Strong Government Support

Despite being an important node in the global technology supply chain and a vast consumer market, China remains far from self-reliance in chips. IC Insights estimates that China can only satisfy 16% of its demand for integrated circuits from local sources,3 outpacing crude oil as the country’s largest product import.4

China’s government, like the US government, views its reliance on chip imports as a serious national security liability. The government has made the development of the semiconductor industry a national priority in its 14th Five Year Plan and is targeting 70% import substitution by 2025 and complete import substitution by 20304. The government is already putting capital to work in achieving its objective. China established a National Semiconductor Fund in 2014, raising an initial $35 billion and another $21 billion in 2019. Furthermore, 15 local government semiconductor funds have been established and have already raised a total of $25 billion.5

The government is also offering support to the industry through favorable policy. In August 2020, China exempted advanced nodes semiconductor companies from paying taxes for 10 years.6

The establishment of Free Trade Zones (FTZs) in Shanghai, the home of Tesla’s Gigafactory, and the Greater Shenzhen Bay Area also bodes well for the development of the industry. Within FTZs, semiconductor manufacturers can enjoy access to cross-border financial services and unfettered access to customers globally.

Efficiency Gains & Low Costs

Many global technology companies, such as Tesla and Apple, choose China as a key node in their supply chains. Thus, the proximity of China-based semiconductor companies to the hubs of production for global technology companies could give China-based firms an advantage over multinationals. Also, domestic companies’ deep understanding of customers and market dynamics in China gives them an additional advantage over multinationals when it comes to selling into China’s market.

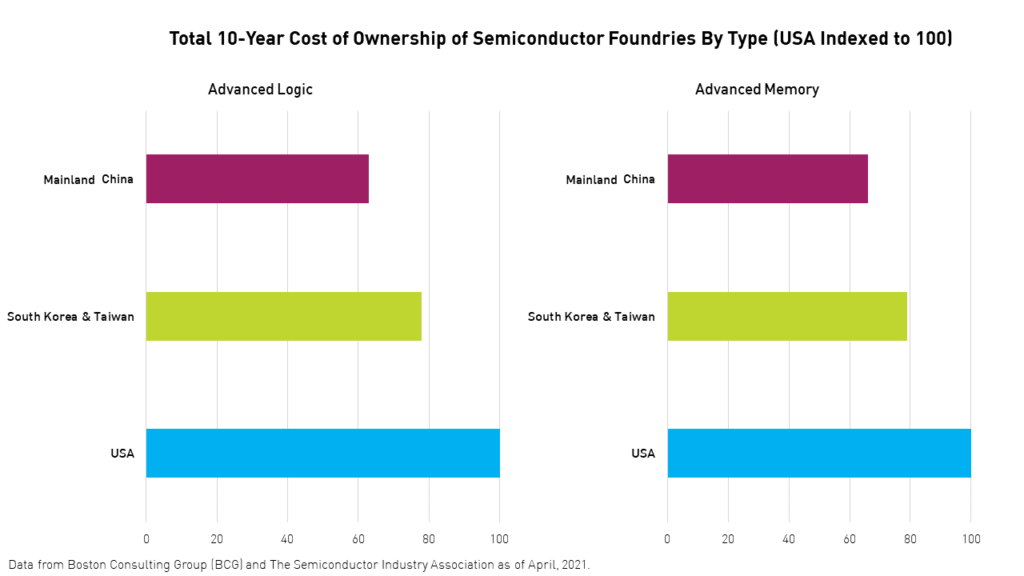

Furthermore, tax breaks and lower labor costs make semiconductor manufacturing more economical in China compared to the US. According to Boston Consulting Group, the 10-year cost of ownership of a semiconductor manufacturing facility is, on average, 34% less in Mainland China than in the U.S. South Korea and Taiwan, which are currently world leaders in semiconductors, do not offer as steep a discount as Mainland China when it comes to operating semiconductor foundries.

5G & Tech-Heavy Automobiles to Drive Demand

China is currently experiencing two key digitalization trends: the adoption of 5G network technology and electric vehicles. China is outpacing the rest of the world in its rapid adoption of both new technologies. The adoption of these technologies, in turn, may cause semiconductor demand growth to outpace the rest of the world over the next five years.

China currently leads the world in its rollout of 5G network technology. The country now boasts more than one million 5G base stations, covering most major metropolitan areas. Furthermore, shipments of 5G-enabled smartphones from January to August of 2021 have increased by 80% year-over-year, reaching 168 million units.7 China is projected to have over 430 million 5G users by 2025, compared to an expected 178 million in the US.8 Digitalization trends bolstered by 5G adoption will include smart home devices, smart cities, and personal devices other than smartphones, all of which will require more advanced semiconductors.

Vehicle digitalization is also a key demand driver for semiconductors. China is the largest electric vehicle (EV) market globally and more than 1.4 million EVs were sold in the country in 2020, accounting for over 40% of the EVs sold worldwide.9 China is also outpacing the world when it comes to autonomous vehicles as robo-taxis are already in use in five cities.

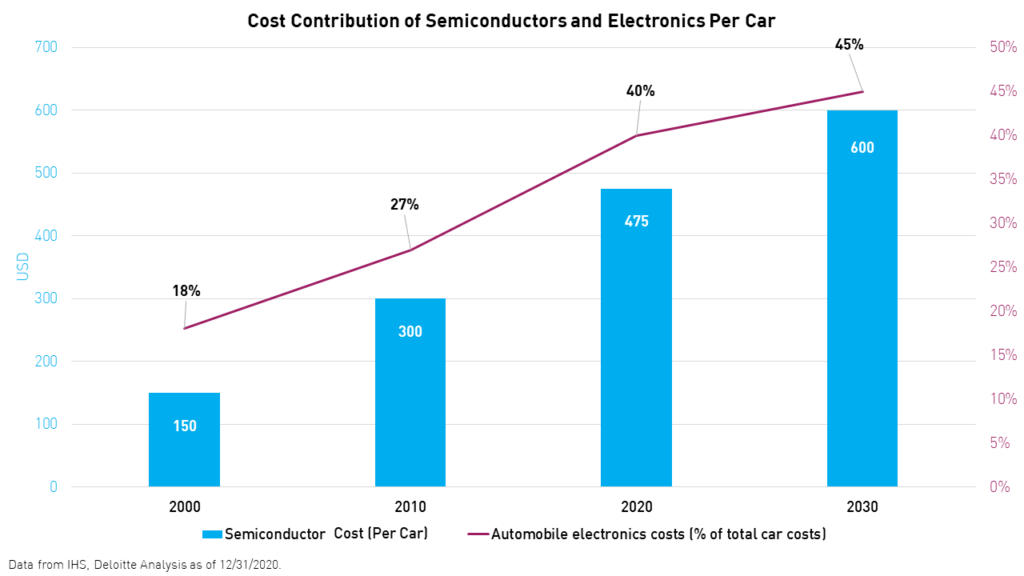

New vehicles, both internal combustion engine (ICE) vehicles and EVs, will require more extensive semiconductor components as vehicle technology progresses, especially as more autonomous driving features are introduced. Electronics are expected to reach nearly half of the cost of new vehicles by 2030.

KFVG offers access to China’s leading semiconductor companies

The KraneShares CICC China 5G & Semiconductor ETF (Ticker: KFVG) offers access to the leading chipmakers in China and the companies spearheading the development of the country’s 5G networks, which we believe will be a significant driver of demand for chips for decades to come.

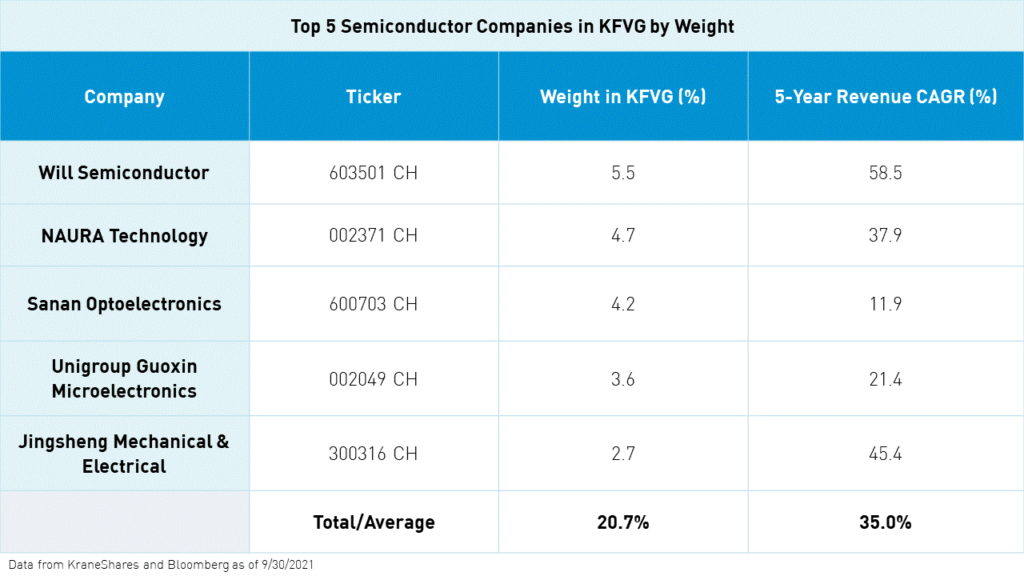

Revenues among the top five semiconductor holdings in KFVG (as of Q3 2021) have increased at a compound annual growth rate (CAGR) of 35%, on average, for the past five years. Furthermore, several China-based semiconductor companies are well on track to gain greater global market share within their respective industries. In particular, Will Semiconductors’ CMOS image sensors (CIS) pipeline is central to the extensive camera-enabled systems being added to automobiles. HSBC estimates that Will Semiconductor’s OmniVision will likely overtake OnSemi (a US CIS company and not a holding of KFVG) to become the top image sensor supplier in 2022 by market share.10

Conclusion

While both the US and China are spending heavily to ramp up their domestic semiconductor industries, China’s industry remains underdeveloped compared to that in the US, representing a greater potential upside for investors. Furthermore, we believe that strong government investment, favorable policy, low costs, and the potential for domestic demand to skyrocket due to digitalization trends from 5G development and vehicle technologies that are outpacing the rest of the world make China’s semiconductor industry an attractive long-term investment.

Citations

- For US, based on $54 billion proposal in the Senate-passed US Innovation & Competition Act. For China, based on the sum of capital raised by established state funds.

- O’Keeffe, Kate. “U.S. Companies Aid China’s Bid for Chip Dominance Despite Security Concerns,” The Wall Street Journal. November 12, 2021.

- “China Forecasts to Fall Short of its “Made in China 2025” Goals for ICs,” IC Insights. January 6, 2021.

- US Chamber of Commerce. “Made in China 2025: Global Ambitions Built on Local Protections,” 2017.

- "Taking Stock of China's Semiconductor Industry," Semiconductor Industry Association. July 13, 2021.

- Zhang, Jane. “China unveils major tax incentive policy to encourage innovation in domestic semiconductor industry,” South China Morning Post. August 5, 2020.

- Si, Ma. “More than 1m base stations up by end of August,” China Daily. September 13, 2021.

- “5G – Opportunities and Challenges,” CICC Research. October, 2019.

- Data from Evvolumes.com, CLSA, Macquarie, and the International Energy Agency (IEA) as of 12/31/2020.

- “Will Semi (603501 CH) Buy: Value Emerges,” HSBC Equity Research. October 11, 2021.

r-ks-sei