US Export Control – Impact & Opportunity for China’s Semiconductor Industry

By Derek Yan, CFA and Cole Wenner

Semiconductors are a critical component of our day-to-day lives. Ranging from the cars we drive to the phones in our pockets, none would function without semiconductors. In 2021 alone, global consumers purchased about $600 billion in semiconductors, with that number estimated to reach $1 trillion by the end of this decade.1 The future of next-generation technology is also dependent on the development of semiconductors, including cloud computing, artificial intelligence (A.I.), 5G, and electric vehicles (EVs).

The semiconductor industry has become highly globalized and many countries participate in the production of chips. A chip today could be designed in the United States, manufactured in Taiwan using equipment from the Netherlands, Germany, and Japan, and eventually assembled and tested in China. A hiccup in the global supply chain could result in a chip shortage, which we experienced after the start of the pandemic.

Over the past decade, China has grown to become one of the largest semiconductor consumption markets in the world. To meet demand, China has not only been importing semiconductor equipment from the United States and other countries, but it has also been fostering innovative, domestic chip makers and foundries. While the United States recently imposed a set of export controls on China’s access to US semiconductors, we believe that its impact on China could be smaller than the headlines suggest. In an attempt to curb China’s technological progress in the field, the US may be hurting its own companies more than their Chinese equivalents.

According to its SEC filing, Nvidia, the California-based graphics and A.I. chip leader, will be unable to sell its A100 and H100 A.I. chips to the fast-growing data center businesses of China. This will cause a $400 million loss in Nvidia’s revenue in Q3 2022.2 AMD, the duopoly central processing unit (CPU) maker in the US, has also been restricted, now unable to sell its MI200 and MX250X chips. Lam Research and Applied Materials, the leading US chip equipment manufacturers, lowered their revenue estimates due to the new policy restricting China sales.

Implementing export controls could be complicated and put US chip producers at a disadvantage. To limit revenue losses, the industry is attempting to find alternative solutions. In early September, following the A.I. chip ban announcement, Nvidia said the US government will allow it to keep developing its H100 computer graphics processing unit (GPU) and systems at its plant in China and use its Hong Kong facility for its A100 and H100 order fulfillment and logistics through September 1, 2023.3 The Korean company, S.K. Hynix, just secured a one-year waiver from the US government on chip equipment for its facilities in China.4 Likewise, Taiwan Semiconductor (TSMC) has reported receiving a waiver for their chip manufacturing facilities in China during their Q3 earnings call.

As high-end chip demand grows in China, the impact of US export controls will be exponentially detrimental to companies selling into the Chinese market. China imported $432.5 billion of integrated circuits in 2021.5 Boston Consulting Group (BCG) estimated in 2020 that by 2025, US companies could lose 18% of their global market share and 37% of revenues if the US completely bans semiconductor companies from selling to Chinese customers, resulting in a loss of 15,000 to 40,000 highly skilled jobs within the US semiconductor industry.6

We believe these new decoupling policies could disrupt the semiconductor industry, making an economic recovery more difficult and potentially creating further inflation. The Semiconductor Industry Association estimates that converting the current highly integrated global semiconductor supply chain to fully "self-sufficient" local supply chains would require at least $1 trillion in incremental upfront investment. This would result in higher costs for global consumers, with a 35% to 65% overall increase in semiconductor prices.7

While the new rule has clear negative implications for US chipmakers and the global economy, we believe its near-term impact on China’s chip manufacturing companies may actually be muted. The new policy directly targets the advanced chip manufacturing capabilities of Chinese companies and their international suppliers. These types of advanced facilities are still a small proportion of Chinese chip makers, as we outlined in our previous article: Zero to One: The Rise of China’s Semiconductor Industry. Still, China is forced to seek greater semiconductor independence and play catch up in high-end chip design, automation tools, and fabrication equipment if they desire to develop leading-edge chip manufacturing.

However, as China decreases its dependency on semiconductor imports, the Chinese chip industry may continue to expand what’s known as “trailing-edge capacity.” Trailing-edge capacity is the production of less complicated chips that are still in high demand across a range of applications, including cars and medical equipment. Trailing-edge chips do not require leading-edge manufacturing technology, allowing China to increase chip production without having to import more advanced manufacturing technology. Currently, China imports most of its trailing-edge chips, so by implementing an import-substitution strategy, China can achieve greater semiconductor independence. In addition to aiding with import substitution, implementing a trailing edge strategy may also allow China to increase semiconductor exports. In 2020, China captured 9% of global semiconductor sales.8 In time, China may be able to significantly increase its share of global semiconductor sales and become a larger player within the industry.

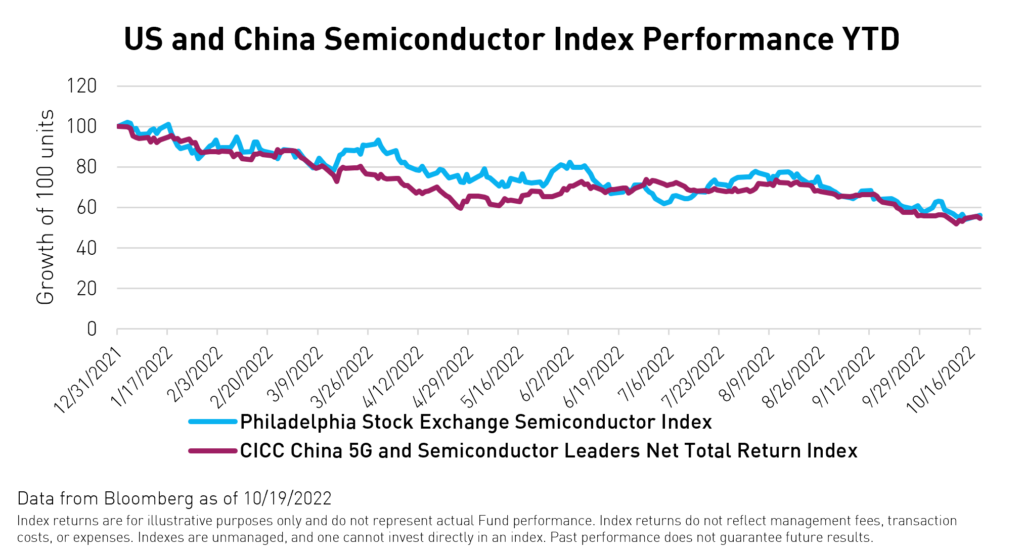

We believe that the market has largely priced in concerns for US and Chinese semiconductor companies. The Philadelphia Stock Exchange Semiconductor Index, which captures the 30 largest US-listed semiconductor companies, is down 42% YTD. CICC China 5G and Semiconductor index (CNY) fell 40% year-to-date (YTD).

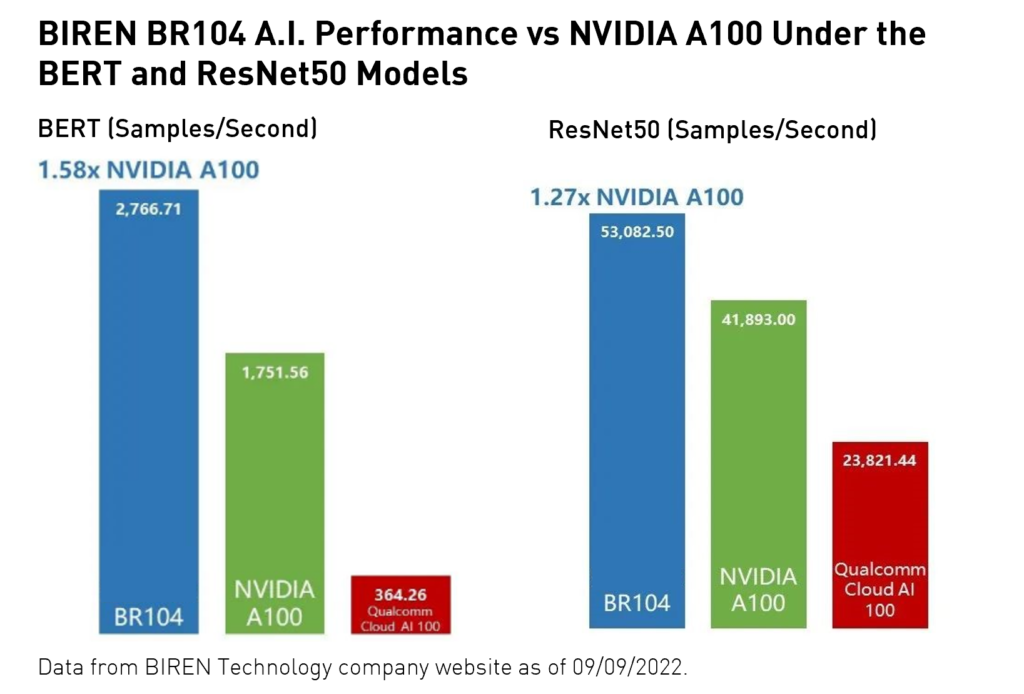

Data centers and supercomputing centers operating in China, whether owned by Alibaba or Microsoft, would now need to find replacement advanced chip solutions from local suppliers. One example of a Chinese company that is leading the pack in advanced chip production is BIREN technology, which recently released its BR104 A.I. chip. The global authoritative A.I. benchmark, MLPerf, released data showing the BR104 is better than Nvidia's A100 A.I. chips in natural language understanding (BERT model) and image classification (ResNet50 model).9 We could see more companies trying to fill the gap as innovation is now an industry-wide consensus in China.

We believe the new law may be a sign of a potential peak in US-China tensions. A spokesman from the 20th National People's Congress of China, Sun Yeli, recently signaled that China wants to work with the US to restore relations. The spokesman also proposed that the key for both countries to find a solution and avoid escalating tensions is to instill mutual respect, a peaceful coexistence, and win-win terms. Directly after the recent Party Congress where President Xi clinched a third term in office, he stated that “China stands ready to work with the United States to find the right way to get along with each other", and President Biden responded by saying the US does not seek conflict with China.

These positive comments have paved the way for a meeting in Indonesia at the G-20. A Biden-Xi meeting could lead to continued cooperation between the US and China. While it often goes unreported, such collaboration does still exist. A Standford university report that measures trends in artificial intelligence found that from 2010 to 2021, the US and China produced the greatest number of AI publications together compared to any other country pair in the world, and the number of collaborative reports published increased five-fold since 2010.10

Cooperation between the US and China is necessary now more than ever. China plays an essential role in the global supply chain and controls most global critical mineral refining facilities. Globally it refines 68% of nickel, 40% of copper, 59% of lithium, and 73% of cobalt.11 China accounts for much of the world's manufacturing of EV batteries, wind turbines, solar panels, as well as energy storage. The world is highly dependent on sourcing from China to advance the energy transition and meet decarbonization goals. China ranked as the world's leading producer of 16 minerals and metals that were considered crucial. Additionally, China is a dominant producer of yttrium (99%), gallium (94%), magnesium metal (87%), tungsten (82%), bismuth (80%), and rare earth elements (80%).12 The US recently banned all aluminum imports from Russia, the second-largest aluminum producer after China. As the largest trading partner with the US, China could help ease hiking aluminum prices by exporting more aluminum to the US. The Biden administration may not desire further decoupling because of the existing supply chain and inflation issues.

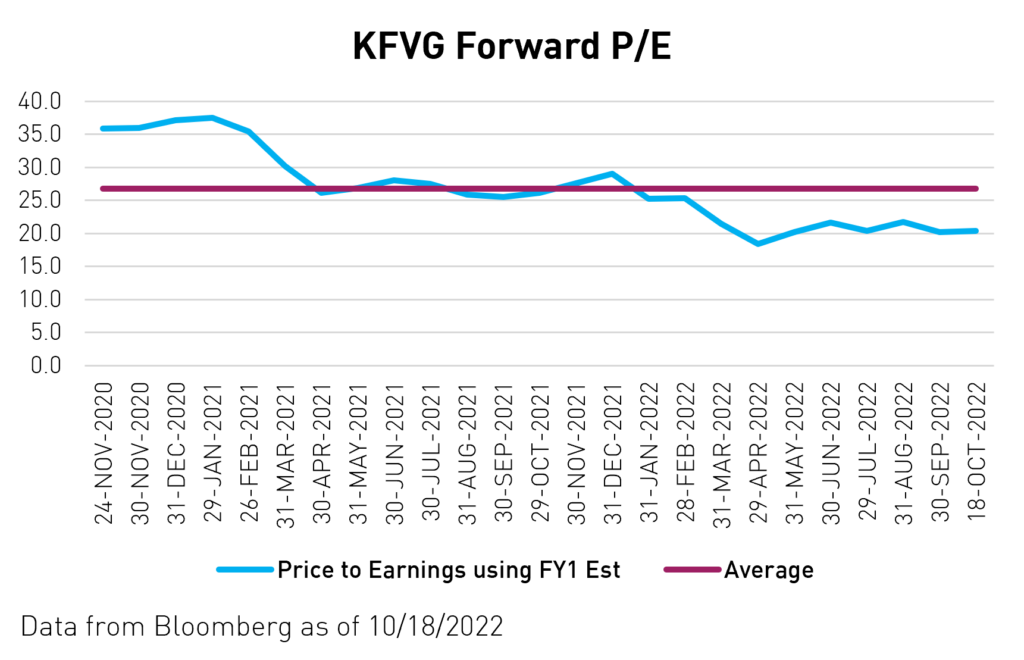

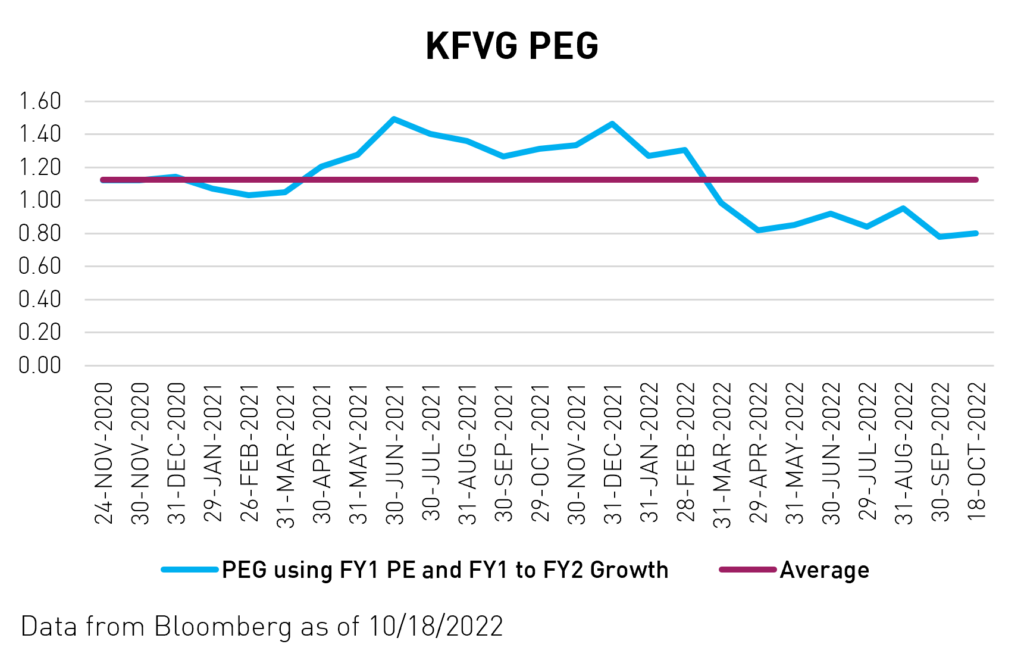

Semiconductor manufacturers are the backbone of our digital economy. The fundamental demand for the chips these companies produce continually grows along with technological advancements. Regardless of whether or not the US and China can resolve their current trade tensions, we believe record low valuations in the sector have created a once-in-a-decade buying opportunity. As shown in the charts above, the forward price-to-earnings and price-to-earnings growth ratio of China's semiconductor industry are well below their 2-year averages, despite its significant growth potential. The KraneShares CICC China 5G & Semiconductor ETF (Ticker: KFVG) provides exposure to companies engaged in the 5G and semiconductor-related businesses, including 5G equipment, semiconductors, electronic components, and big data centers in China.

For KFVG standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- "The semiconductor decade: A trillion-dollar industry", McKinsey & Company, 04/01/2022.

- SEC Archives, NVIDIA Corporation, 08/31/2022.

- "Nvidia says US government allows A.I. chip development in China", CNBC, 09/01/2022.

- "SK Hynix gets one-year waiver on chip gear in China, showing difficulties for US 'harshest' ban", Global Times, 10/12/2022.

- General Administration of Customs of the People's Republic of China, 2022.

- "How Restricting Trade with China Could End US Semiconductor Leadership", BCG, 03/09/2020.

- "Strengthening the Global Semiconductor Value Chain", BCG and SIA, April 2021.

- "China’s Share of Global Chip Sales Now Surpasses Taiwan’s", SIA, 01/10/2022.

- Biren Technology, 09/09/2022.

- "2022 AI Index Report", AI Index and HAI.

- "China’s Role in Supplying Critical Minerals for the Global Energy Transition", LTRC, July 2022.

- "The Not-So-Rare Earth Elements: A Question of Supply and Demand", KCEP, 09/23/2021.

Definitions:

Forward Price-to-Earnings (P/E): Forward price-to-earnings (forward P/E) is a version of the ratio of price-to-earnings (P/E) that uses forecasted earnings for the P/E calculation. While the earnings used in this formula are just an estimate and not as reliable as current or historical earnings data, there is still benefit in estimated P/E analysis.

Price to Earnings to Growth (PEG): The price/earnings to growth ratio (PEG ratio) is a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period.

Forward looking ratios for the fund are not a forecast of the fund's future performance.