Charging Ahead: Investing in the Energy Transition with Electrification Metals

Essential metals are powering the $140 trillion global energy transition. Currently, the metals space presents a potential opportunity as prices are off their 2022 highs. In 2023, a combination of oversupply and the strong rate-supported dollar drove price fluctuations. That said, the acceleration of renewable energy, electric vehicles (EV), and battery storage is expected to lead to exponential growth for battery and base metals.

Critical metals used in battery storage are forecasted to increase nearly 40-fold, and those required for low-carbon electric power generation are anticipated to triple by 2050.1 At the same time, mining capacity and production constraints because of this outsized demand will likely lead to a notable supply/demand imbalance that may create significant upward price pressure. As early as 2024, analysts expect some battery metals to enter a supply deficit. With the metals valuation mismatch just starting to get noticed, we believe now is a strategic opportunity to gain exposure to the transition metals growth trend through the KraneShares Electrification Metals Strategy ETF (KMET).

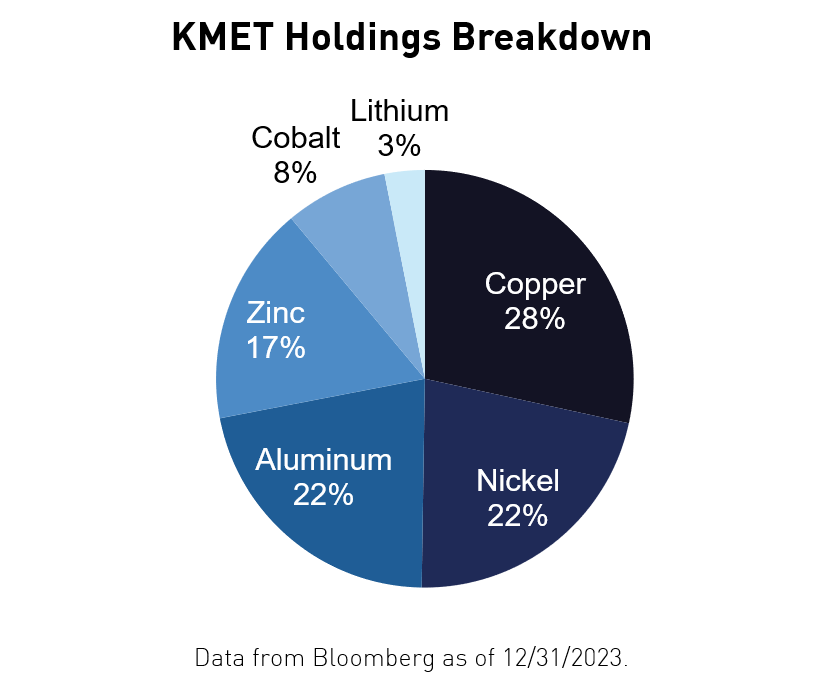

The largest holdings in KMET are base metals, with copper having the highest weighting due to its premier conductivity properties, indispensable in electrical wiring and components for a variety of uses but especially electric vehicles (EVs) and renewable energy infrastructure. Nickel's role in lithium-ion batteries, particularly in EVs, is crucial for enhancing battery performance, energy density, and driving range. Aluminum’s lightweight and durable nature makes it a key component in everything from EV frames to support structures for wind turbines. Corrosion resistance with zinc assists in galvanizing steel structures such as solar panel frames and mounting systems, as well as in batteries and electronics. Cobalt provides stability and durability to battery cells though faces some sourcing constraints, hence its smaller weighting. Lithium is the backbone of lithium-ion batteries found in EV and battery storage systems, and as liquidity in the newly established lithium futures market increases we anticipate its weight in KMET to rise proportionately.

Copper (29.3% weighting in KMET as of 12/31/2023) prices are recovering, and deficits are now expected to come earlier than forecasted. Demand remains buoyed by the energy transition, though headwinds related to the global macro environment and China’s property sector could impact the short-term price action. Analysts have mixed opinions on the market for this year, with some seeing it shift into deficit. In contrast, others view the market as more balanced or still in small surplus, contingent on any supply-side disruptions.2 Chile, the top copper supplier, has raised its price projections supported by expectations of rate cuts in the US and accelerating demand for renewables amid the energy transition policy push. There have been concerns over the closure of one of the largest copper mines, Cobre Panama. However, it will likely have a limited impact as the mine is still a relatively small percentage of the global supply, and the copper space is well-diversified.3 The country is projected to increase output by 5.7% in 2024.4 Overall, growth will likely be more muted this year, though analysts expect demand to pick up closer to year-end with more material growth by 2025.

The Nickel (22.5% weighting in KMET as of 12/31/2023) market is currently oversupplied, though demand growth remains the strongest of the base metals. Supply cuts are needed to help rebalance the market and boost prices. Last year, Chinese battery-grade nickel production and consumption were lower than expected, primarily due to supply chain destocking from price declines. There was also a more significant trend toward non-nickel-based lithium iron phosphate (LFP) batteries, particularly in China. Analysts see the market continuing to be in surplus through 2026 for most of the metal’s main products. Indonesia is expected to provide the largest supply growth in the near term.

Aluminum (22.4% weighting in KMET as of 12/31/2023) saw less volatility in Q4, with substantial Chinese demand outweighing softer demand from developed countries. Demand from China’s power sector, mainly to support the ramp-up of solar installations, is estimated to have grown roughly 58% year-over-year.5 Going into 2024, there will likely be a modest surplus in the overall global market, though China should remain in a deficit. Analysts see the global market returning to a structural deficit by 2025, when there is expected to be tighter supply due to China’s capacity cap, stronger global economic picture, and secular demand growth from the energy transition.

Zinc (17.5% weighting in KMET as of 12/31/2023)prices have traded in a fairly tight range, hovering around $2,500/t over the last several months. Overall, investor sentiment remains net long given the recent and potential future mine cuts (Nyrstar's Middle Tennessee & Toho Zinc's Rasp in Australia) and optimism over China's infrastructure investment. With many consumers currently holding excess inventory and at the lower zinc price levels, we could see more smelter closures. For the facilities that have closed and may close in the future, their buyers will have to source new supplies. These closures could also mean declining overall stock levels, leading to a squeeze and prices breaking out. On the demand side, utilities and transport offset weaker demand from the property market. Roughly 50% of zinc end demand comes from construction, where housing investment and construction have been down, particularly in Europe.6 Overall, investor sentiment remains net long given the recent and potential future mine cuts (Nyrstar's Middle Tennessee & Toho Zinc's Rasp in Australia) and optimism over China's infrastructure investment. While the market will likely be in a surplus until 2027, analysts have revised price forecasts higher this year on the mine cuts so far.7

The Cobalt (8.2% weighting in KMET as of 12/31/2023) market has seen a slow start to the year, trading on low volume. The metal is oversupplied from the Democratic Republic of the Congo (DRC) and Indonesia’s expanding production activity, as well as more muted demand from EV-makers that have turned to new battery make-ups without the metal. In China, lithium-iron-phosphate batteries (which do not contain cobalt). However, cobalt-based batteries still outshine alternatives as the most advanced technology for EVs, which solidifies their place in the market. Furthermore, its use in other sectors, particularly for US national defense purposes, is growing, which should increase investment in the metal and help further support prices. In the short term, refined cobalt supply is expected to grow this year, up 15.8% from 2023. The industry also needs to address the labor issues in the DRC, where its national production accounts for 60% of the total global production. Meanwhile, cobalt exploration in other areas is on the rise, particularly in Australia, where their cobalt exploration budget increased 78% in 2024 to $30 million.8

Lithium (3.2% weighting in KMET as of 12/31/2023) prices softened in 2023, after coming off their all-time highs the year prior. Lithium miners have been ramping up production in the last few years to keep up with the explosive interest in EVs. However, EV demand in 2023 was slightly less than expected, largely driven by China’s phase-out of its direct EV subsidies at the end of 2022 and higher interest rates. Battery makers started going through their stockpiled lithium inventories rather than making new purchases in response to this reduced demand. At the same time, over 20 lithium mines opened last year (a process that can take up to 15 years), creating new lithium capacity in the market. The combination of these factors shifted the market into a supply surplus, putting downward pressure on prices. The market is expected to be tightly balanced in the near term and is forecasted to shift back into a material deficit by 2027. The long-term growth story remains intact, with demand projected to grow at a compound annual growth rate (CAGR)* of around 15% between 2021 and 2026, primarily driven by the electric vehicle (EV) market.9 Government regulation also supports propping up the market through decarbonization efforts, with nearly 25% of countries announcing plans to phase out gas-powered vehicles between 2025 and 40.10

We believe there will be a correction to the upside in metal prices as the global energy transition marches forward. Despite recent market volatility, analysts project exponential growth in battery and base metals over time. The impending surge in metal prices appears inevitable, marking a pivotal moment investors can capitalize on with the KraneShares Electrification Metals Strategy ETF (KMET).

KMET tracks the Bloomberg Electrification Metals Index, composed of futures contracts on aluminum, copper, nickel, zinc, cobalt, and lithium. From Electric Vehicles (EVs) and batteries to renewable energy infrastructure, the metals exposures within KMET are experiencing strong demand from a range of electrification uses. We believe these metals' value will increase alongside accelerating global decarbonization efforts.

For KMET standard performance, top 10 holdings, risks, and other fund information, please click here.

This should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the fund.

*CAGR: the annual growth rate over a specified period of time (longer than one year)

Citations:

- Columbia University Center on Global Energy Policy, “Q&A | Critical Minerals Demand Growth in the Net-Zero Scenario,” February 22, 2023.

- WSJ, “Copper Outlook for 2024 Dominated by Uncertain Supply, Green Demand,” December 14, 2023.

- Diversification does not ensure a profit or guarantee against a loss.

- Bloomberg, “Top Copper Supplier Chile Raises Price Forecast on Rate Cuts, Clean Energy.”

- Macquarie, “Commodities Compendium Opposing forces,” December 7, 2023.

- Macquarie, “Commodities Compendium Opposing forces,” December 7, 2023.

- Macquarie, “Commodities Compendium Opposing forces,” December 7, 2023.

- S&P Global, “Oversupply, low prices for cobalt to persist in 2024 as demand slips,” December 27, 2023

- Macquarie, “Commodities Compendium Opposing forces,” December 7, 2023.

- Statista, Coltura, “Combustion Going Bust: Global Phase-outs of Gasoline Cars,” Feb 22, 2023.