Electrification Metals: Investment Case & Supply/Demand Outlook

A low-carbon future is emerging before our eyes. Consumers are switching to electric vehicles (EVs) at an exponential rate. Electric grids worldwide are transforming to accommodate new renewable energy capacity. The batteries, wires, switches, and capacitors this future demands all have one thing in common: they require vast supplies of electrification metals. We believe the ensuing demand for these metals creates a compelling opportunity for investors. Beyond potential price appreciation, commodities typically exhibit low correlations to equities, so allocating to these metals may also provide significant portfolio benefits.

The KraneShares Electrification Metals Strategy ETF (Ticker: KMET) provides long exposure to many of the metals used for EVs, batteries, and the upgrading of the electrical grid. While certain metals are seeing new supply become available rapidly, the supply and demand imbalances for others are expected to persist throughout 2023. There is currently not enough supply of copper, aluminum, nickel, cobalt, and lithium to power the energy transition.

Investment Case

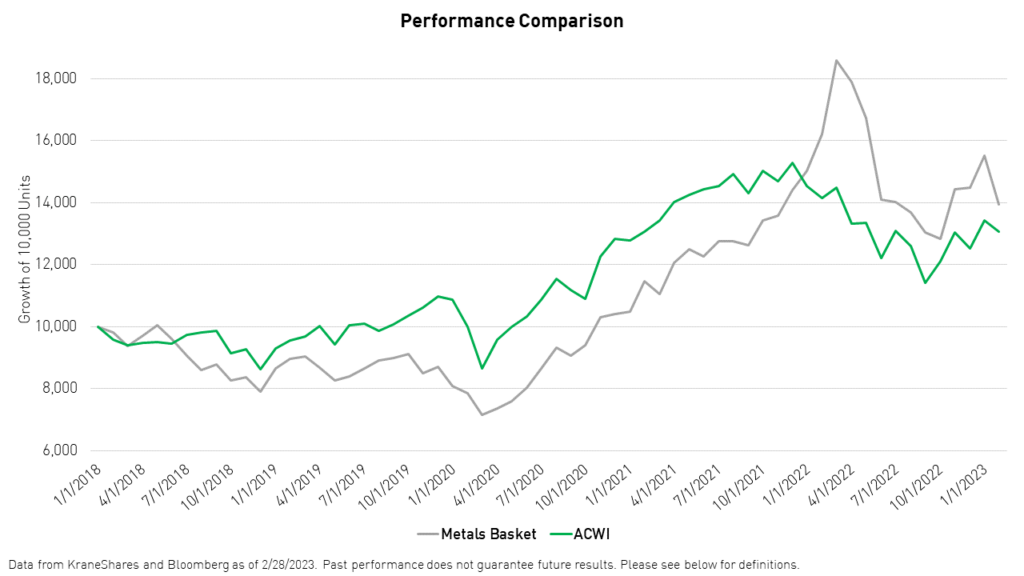

A basket of the electrification metals mentioned above would have outperformed the MSCI All Country World Index (ACWI) over the past five years.

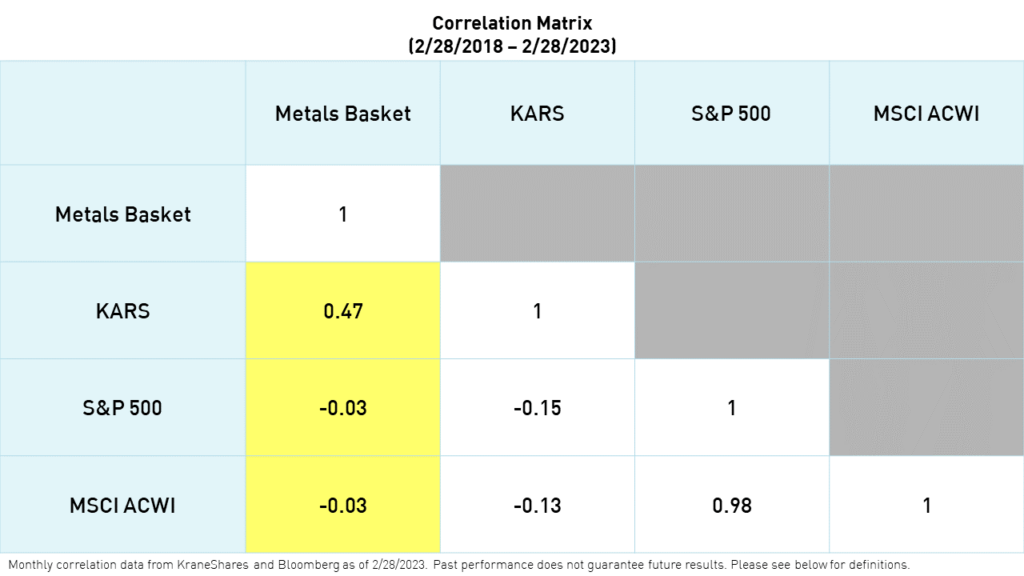

The metals basket has also exhibited low and even negative correlations to both global equities and EV ecosystem equities, represented by the KraneShares Electric Vehicles & Future Mobility ETF (Ticker: KARS), over the same period. The metals basket had a negative correlation to major global equity indexes such as the S&P 500 Index and the MSCI All Country World Index (ACWI), at -0.03 for both, and a low, but positive correlation to the more thematically aligned EV ecosystem equities (KARS) at 0.47.

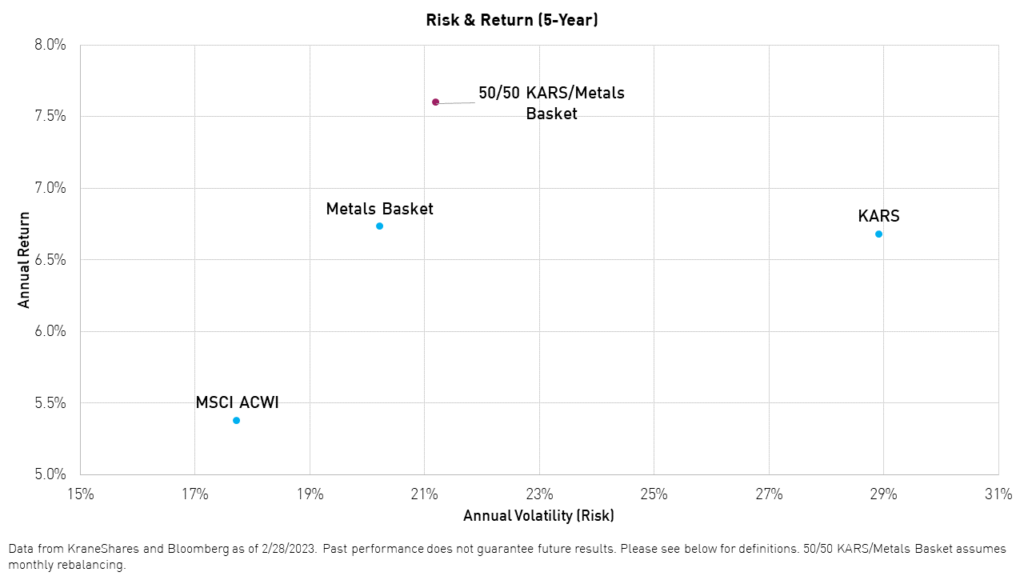

Coupling your equity exposure to the EV ecosystem with an allocation to electrification metals may improve returns and reduce volatility. Both the Metals Basket and KARS had similar annualized returns, at just over 6.5%. Interestingly, a hypothetical portfolio consisting of 50% KARS and 50% Metals Basket, rebalanced monthly, increased annualized return over both KARS and the Metals Basket by themselves and significantly decreased annualized volatility compared to KARS alone.

For KARS standard performance, please click here.

Long-Term Outlook

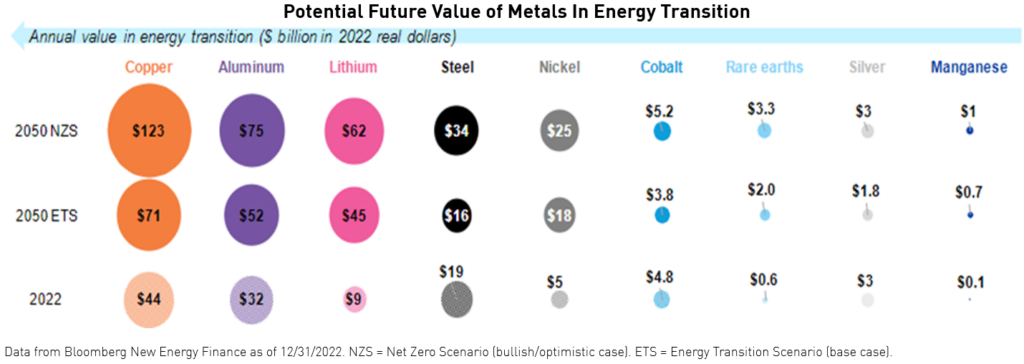

According to Bloomberg New Energy Finance (BNEF), $6 trillion worth of metals will be needed to achieve the energy goals set by the Paris Agreement. While this may sound like a high figure, some consider it a conservative estimate. BNEF’s alternative forecast for the metals market under its adjusted Net Zero Scenario (NZS) is closer to $10 trillion.

Copper is expected to be the most valuable among these key metals. According to BNEF, the price paid for the metal is expected to reach 5.5 times today's market value by 2050. Other metals markets are also expected to grow substantially between now and 2050. Aluminum prices are expected to increase by 2.8 times, lithium prices are expected to increase by 7 times, and Nickel prices are expected to increase by 5 times.1

While battery recycling may help ease the supply glut, it will take a long time for battery recycling to become a significant contributor to metals supply. Furthermore, new battery chemistries will likely only create demand for different metals.

The long-term outlook for electrification metals is clear. The demand from the energy transition may continue to create upward pressure for the prices of the metals needed for the transition. The sourcing, processing, and recycling of these metals are complex issues that require innovative solutions and collaborative efforts across the supply chain. While supply might fall short today, we may see surpluses in the future due to the construction of excess capacity, which occurs during shortages. While electrification metals are not immune to the boom-and-bust of the commodity cycle, we believe that the energy transition means demand for these metals could remain elevated for years to come.

2022 Recap

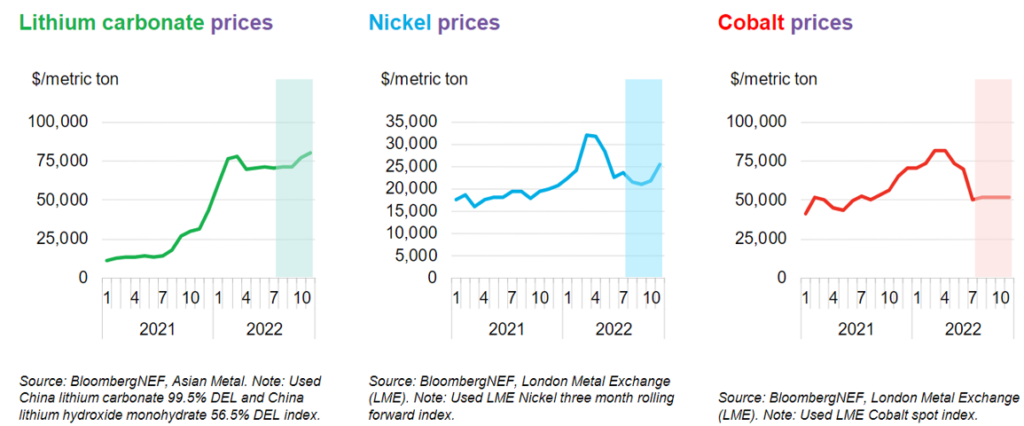

Metal prices drove the performance of the EV ecosystem in 2022. Prices rose sharply during the first half of the year following the invasion of Ukraine and the lockdowns in China. However, most metals corrected lower as the year went on, such as Nickel and Cobalt, during the second half, except for Lithium, which ended the year at a new high. The volatility in metal prices impacted battery makers’ bottom lines in a significant way. It also led to a rise in battery prices for the first time in 10 years.1

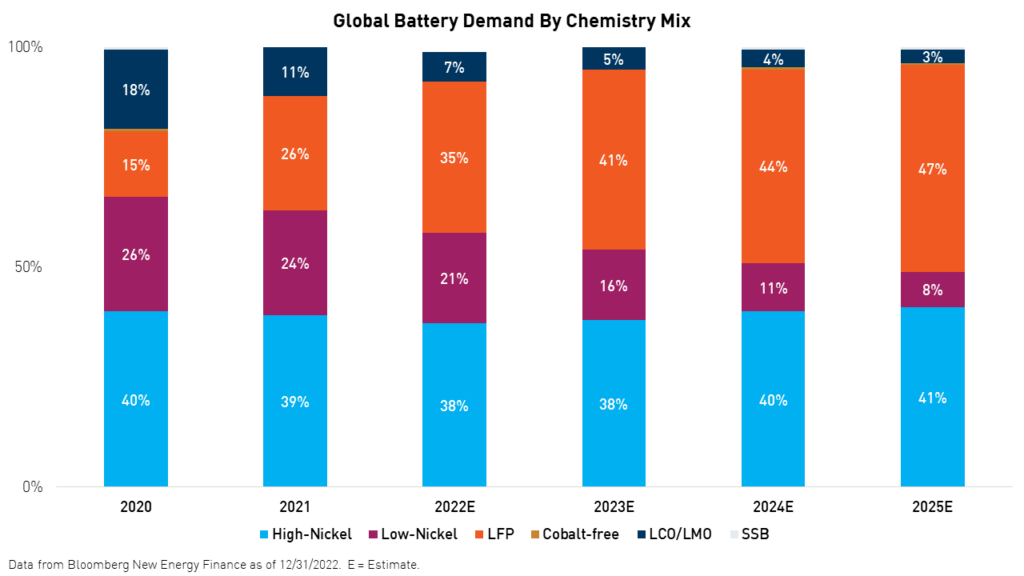

The shift towards lithium-based chemistries such as lithium-ion phosphate (LFP) continued in 2022, reaching 35% of total batteries, up from 15% in 2020 according to JP Morgan. Demand for Lithium-based batteries (LCO/LMO) increased by 55% in 2022 from 496 Gigawatt-Hours (GWh) to 769 GWh.2 Meanwhile, demand for solid state batteries (SSBs) remains low.

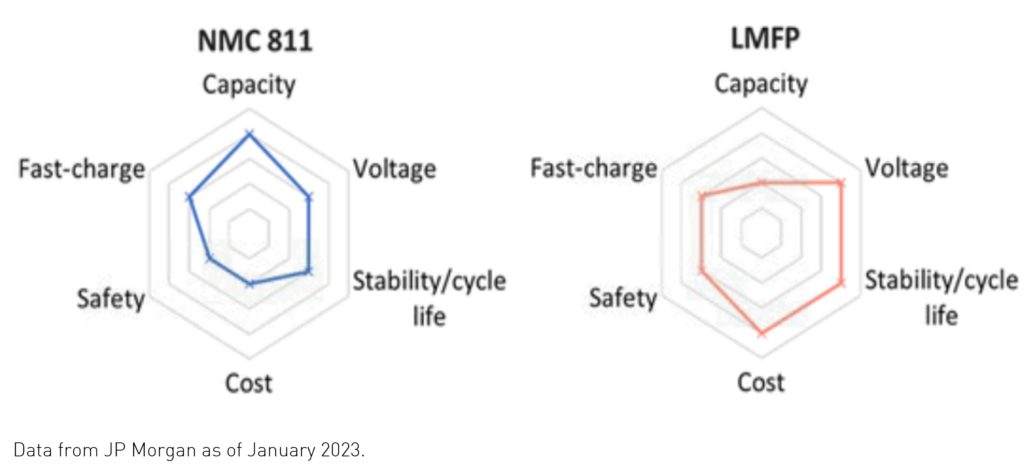

While Nickel based batteries can produce a longer range than lithium, they have a lower safety profile, lower voltage, and are more expensive.3 Tesla, which originally used Nickel-based chemistries for its EVs, announced in 2021 that it would be shifting to Lithium-based chemistries for most of its cars.4 However, we are seeing some new companies like ONE in the US offering a hybrid battery pack that uses both Nickel (NMC 811) and Lithium chemistry (LMFP). The battery alternates between chemistries depending on the use of the EV and can achieve an impressive range of 600 miles per charge.5

2023 Outlook

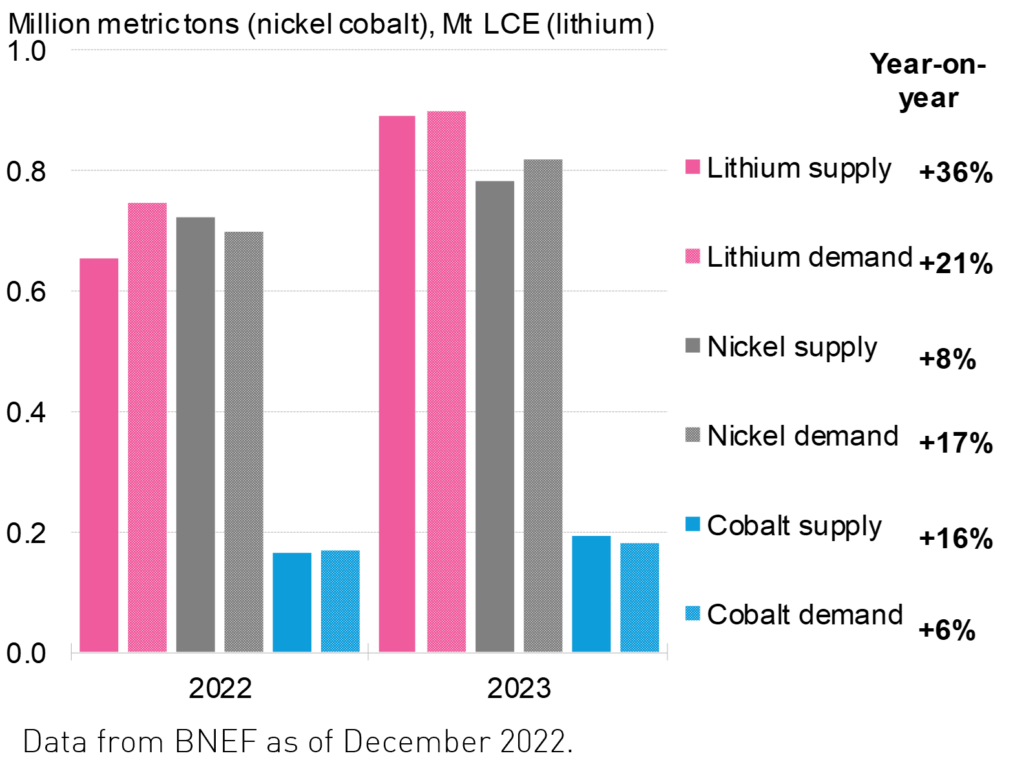

In 2023, lithium supply is expected to grow by 36% (compared to 41% in 2022), barely meeting demand for the same period. Nickel supply growth is expected to dip below demand growth in 2023 as the shift to lithium-iron-phosphate (LFP) continues and miners redirect their focus to adding lithium capacity instead. Cobalt supply will also continue to be tight, rising 16% in 2023 compared to a 6% rise in cobalt demand.6

It is important to note that breakthroughs in battery chemistry or technology can change supply and demand dynamics. Cobalt use in battery chemistries has declined dramatically over the past couple of years as EV companies looked to avoid importing the metal from the politically fraught Democratic Republic of the Congo (DRC).

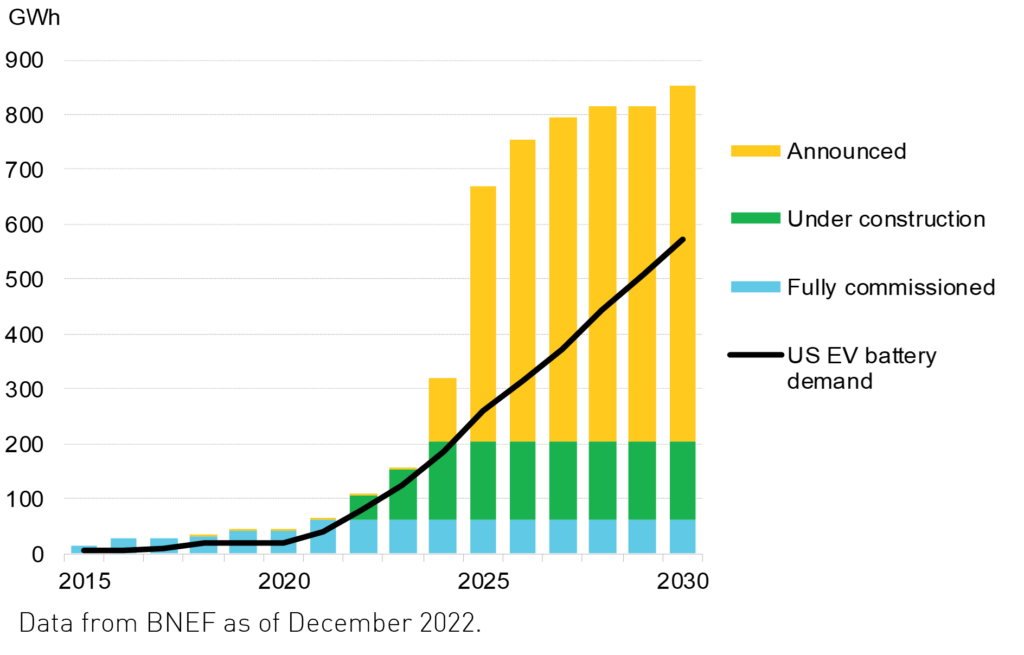

The race for pure EV companies to lock in supplies has been well underway for many years. The passing of the Inflation Reduction Act (IRA) in the US only intensified the race. Major original equipment manufacturers and battery makers are investing directly in upstream raw materials companies.

Tesla is considering building a lithium refinery in Texas despite its many contracts and investments in raw materials companies such as Albemarle, Glencore, Ganfeng Lithium, and others. Elon Musk is following his own advice as he believes the refining business can achieve software-like margins for the foreseeable future. However, Tesla is not alone in this as China-based CATL, the world's largest battery maker, Eve Energy, Ford, and General Motors have all invested in new metals supply.7

Conclusion

In conclusion, demand for copper, aluminum, nickel, cobalt, and lithium, which are all essential for the electrification of transportation, battery production, and upgrading the power grid, is poised to increase as the world continues to shift towards a more sustainable energy future. We believe long exposure to these metals presents a compelling opportunity for long-term investors, especially when you consider their potential diversification* benefits. Furthermore, with metal prices correcting and China reopening this year, now may be an opportune time to begin investing in these essential metals for the long term.

* Diversification does not ensure a profit or guarantee against a loss.

For KMET standard performance, top 10 holdings, risks, and other fund information, please click here.

For KARS standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations:

- Data from BNEF as of 12/14/2022.

- Data from Statista as of 1/6/2023.

- "Competitive Technologies to High Nickel Li-ion Batteries – The Pros and Cons", Nickel Institute, February 2020.

- "Tesla Hints at Transition of All Energy Storage to LFP Batteries", Inside EVs, January 2022.

- Data from ONE as of 2/28/2023.

- Data from BNEF as of December 2022.

- "Ford to Build a Battery Plant in Michigan with Chinese Firm", IER, February 2023.

Definitions:

MSCI All Country World Index (ACWI): The MSCI ACWI captures large and mid cap representation across 23 Developed Markets and 24 Emerging Markets countries. With 2,882 constituents, the index covers approximately 85% of the global investable equity opportunity set. The index was launched on January 1, 2001.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Metals Basket: This is a basket of rolling metals futures contracts (live, actively traded contracts) with static weights as follows: 25% copper, 20% Aluminum, 25% Nickel, 15% Zinc, 10% Cobalt, and 5% Lithium. The target metals weights are revised on an annual basis. As no data is available for Lithium and Cobalt until June 30th, 2021 and July 30th, 2021, respectively, the other four metals for which there is data are used at pro-rated weights.

Bloomberg Electrification Index: The Bloomberg Electrification Index aims to track the performance of holding a long position of a basket of commodities reflective of the energy transition theme. The index rebalances on the close of the 4th index business day quarterly, in January, April, July, and October, resetting each commodity to their target weight. Target weights will be rounded to 8 decimal places. The composition and weights were determined by Bloomberg Index Services Limited (BISL) in consultation with Bloomberg New Energy Finance (BNEF), based on projected supply and demand of each commodity. The composition and weights are reviewed on an annual basis and the updates to the target weights are implemented each January. The index was Launched on August 8, 2022.

50/50 KARS/Metals Basket: This is a portfolio consisting of a target weight of 50% the Metals Basket (defined herein) and 50% the KraneShares Electric Vehicles & Future Mobility ETF (Ticker: KARS). The portfolio is rebalanced monthly beginning on February 28, 2018.

Correlation: Correlation refers to the degree to which the prices or returns of two or more assets move in relation to each other. A positive correlation indicates that the prices or returns of the assets move in the same direction, while a negative correlation indicates that they move in opposite directions.