Electrification: 6 Essential Metals to Watch

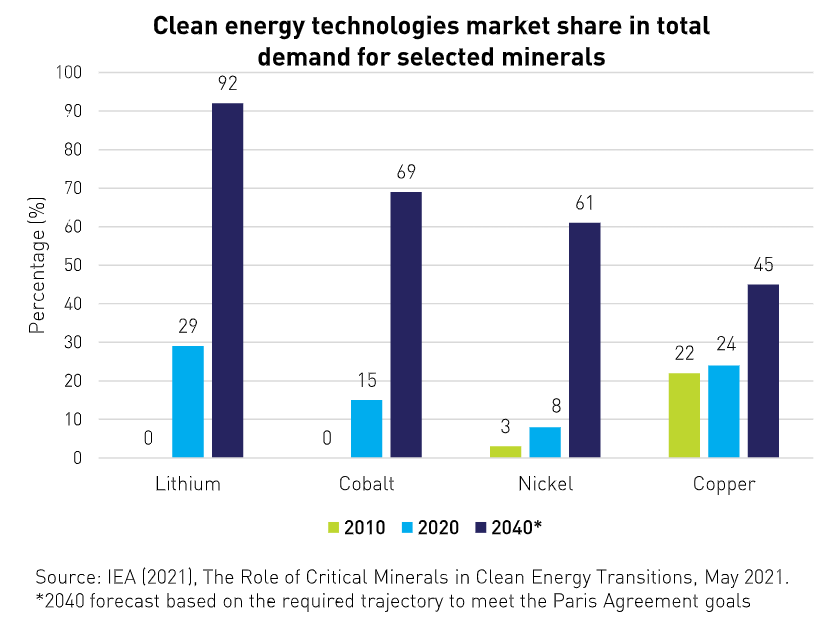

Global decarbonization efforts are straining the world’s supply of key metals, creating a unique opportunity for transitional commodities over the next decade. According to the International Renewable Energy Agency (IRENA), more than $140 trillion in investment is needed for the clean energy transition over the next thirty years. To fulfill ambitious climate goals, mineral demand from the low-carbon power generation sector is expected to triple by 2040.1 We believe transitional commodities will encounter a supply and demand imbalance over the next decade as we undergo an electrification evolution. Various resources could experience a complete value transformation with essential metals front and center.

To effectively capture the value transition in essential metals, we launched the KraneShares Electrification Metals ETF (KMET). KMET tracks the Bloomberg Electrification Metals Index, composed of futures contracts on six essential metals: aluminum, copper, zinc, lithium, nickel, and cobalt. We believe these are the key metals needed for the electrification of the global economy. As the world embraces decarbonization, we expect to see continued demand for renewable energy and the inputs needed to produce renewable-related technology. The metals included in KMET are positioned to directly benefit from strong demand for various electrification uses, from increased global electrical vehicle (EV) adoption to other climate-aligned projects such as solar panels and wind turbines.

Let’s take a closer look at each of the six metals below and how each may help power the electrification movement.

Aluminum:

Aluminum is the third most abundant element on earth. It is primarily used in consumer products, auto parts, and numerous architectural and electrical infrastructures. Aluminum possesses properties that help lower the weight of vehicles, increase fuel efficiency, and reduce carbon emissions. It is also expected to have higher utilization in EV batteries over time due to its durable and lightweight nature. In addition to aluminum’s role in EVs, it is a crucial input for solar panel and wind turbine construction.

Short-term, a concern that has weighed on the aluminum market is the Biden Administration potentially banning aluminum imports from Russia, which is responsible for 5.5% of global production.2 This could tighten the supply available to Western countries as the mining process is energy-intensive and expensive. The market may rely more on imports from China, the world’s largest aluminum maker. However, China has established an annual capacity cap of 45 million metric tons (MMT).2 China’s capacity cap combined with Russian import controls could contribute to upward pressure on the price of aluminum.

Copper:

Due to its vast utilization, copper may be the most crucial metal in the energy transition. Copper is used in infrastructure, construction, and transportation. It is integral to green technology, such as wind turbines, energy storage, and EVs.

The supply-demand gap in copper is massive. Copper demand is projected to grow from 25 MMT today to about 50 MMT by 2035, a record-high level that is projected to be sustained and continue to grow to 53 MMT by 2050. Power and automotive applications will have to be deployed at scale by 2035 to meet the 2050 net-zero targets set by the United Nations.3 Supply may not be able to catch up with increasing demand, creating a medium to long-term “structural deficit".3

The three biggest producers of copper by country are Chile, Peru, and the Democratic Republic of the Congo (DRC), accounting for 46% of global production.4 All three countries face increasing fiscal and political uncertainty, which could strain future copper supply. According to the World Bank, Chile's public debt to GDP ratio in 2021 reached its highest level in three decades, Peru has experienced high inflation due to rising commodity prices, and the DRC is also struggling with rising inflation with an average inflation rate of 9.1% in 2021. In political news, Peru's Ministry of Interior released details of a failed coup attempt by former President Pedro Castillo. We believe copper futures contracts do not yet reflect its threatened state of supply and can experience noticeable price inflation as expectations of shortages become more prevalent.5

Zinc:

Zinc is largely used as an anti-corrosive agent when galvanizing steel or iron and is used to stabilize batteries. Zinc batteries may be considered an alternative to lithium batteries and may serve as an important resource for the energy transition.

Zinc faces an interesting dynamic as it is the only metal experiencing a fall in supply and demand. An estimated 3.0% drop in global usage marginally outpaced a 2.6% slide in global production of refined metal.6 It should be noted that these are preliminary observations and are subject to change.

The demand hit has come largely from China, where a troubled property sector has depressed demand for steel, including zinc-coated galvanized steel. On the supply side, smelters continue to struggle with power prices soaring.

While Zinc is experiencing difficulties on the demand side due to China’s troubled property sector, China’s Securities Regulatory Commission has recently outlined five measures to support the real estate sector. Of these five measures, the most significant is to allow non-public refinancing for companies including those listed in Hong Kong, which gives hope that usage of zinc-coated galvanized steel will recover.

Lithium:

Lithium’s top uses are for manufacturing EV batteries and for power storage technology. Lithium batteries offer reliable, stable, and long-lasting power to EVs, homes, and electronics. Lithium is needed to produce virtually all batteries currently used in EVs and consumer electronics because of it is both the lightest metal and the least dense solid element. That means that batteries made with lithium have a high power-to-weight ratio, which is important when dealing with transportation.13 Lithium-ion batteries are widely used in many other appliances as well.

Demand is expected to rise from approximately 500k metric tons of lithium carbonate equivalent (LCE) in 2021 to 3-4 million metric tons in 2030.7 Conventional lithium supply is expected to expand by over 300% over the same period.4 Moreover, direct lithium extraction (DLE) and direct lithium-to-product (DLP) technologies are still in their infancy but show great promise to increase the industrial demand for lithium.

Supply and demand seem to be balanced for the short term; however, long-term forecasts state that a chronic shortage is possible. Current capacity growth is projected to meet anticipated demand until 2025 and potentially through 2030 if enough recycling programs become available. After 2030, expectations are that a noticeable imbalance between supply and demand may drive lithium prices higher.8 This may be problematic, as noted by Tesla CEO Elon Musk, who recognized that lithium prices have already grown almost 20x since 2012 without a supply imbalance.14

Price of lithium has gone to insane levels! Tesla might actually have to get into the mining & refining directly at scale, unless costs improve.

— Elon Musk (@elonmusk) April 8, 2022

There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.

Nickel:

Nickel’s large use case is for stainless steel manufacturing and electronics. Nickel has also seen an increased role in energy storage for rechargeable battery systems.

Production of Nickel is dominated by Indonesia, which outputs two times more than the second largest supplier, the Philippines. Russia, New Caledonia, and Australia round out the top five producers. Like aluminum, there have been some supply concerns related to Russia as they deliver 9% of the world’s nickel supply and close to 33% of nickel sulfide ore used to produce the nickel sulfate used in EV batteries.9

Global demand for nickel is projected to increase 44% by 2030 due to high demand for use in batteries that power EVs3 and grow as much as fourfold over the next 30 years.10

Cobalt:

Cobalt is primarily used in metal alloys and batteries. Cobalt increases battery life and energy density, allowing the battery structure to remain stable throughout its lifetime and increasing the mileage range of EVs.

One constraint unique to cobalt is that there is no dedicated cobalt mining. It is a byproduct of copper and nickel mines, which is a restricting factor on the supply side.

In 2021, the cobalt market showed unprecedented annual demand growth of 22% due to the lithium-ion battery market's rapid growth and strong EV sales5, which are expected to keep growing as cobalt-containing batteries are the technology of choice for many major car manufacturers globally. Cobalt demand is expected to rise rapidly as part of the global energy transition and shift to EVs. Demand growth and supply restrictions may result in continued price hiking of Cobalt.

Supply chain constraints have remained challenging, even though overall mined production has increased. Supply has not been able to keep up with demand, with short-term supply growth expected to average 8% compared to 12% growth in demand.11 Shipping container rates have soared, supply has been limited due to COVID restrictions and delays, and geopolitical import/export controls may create further supply issues.

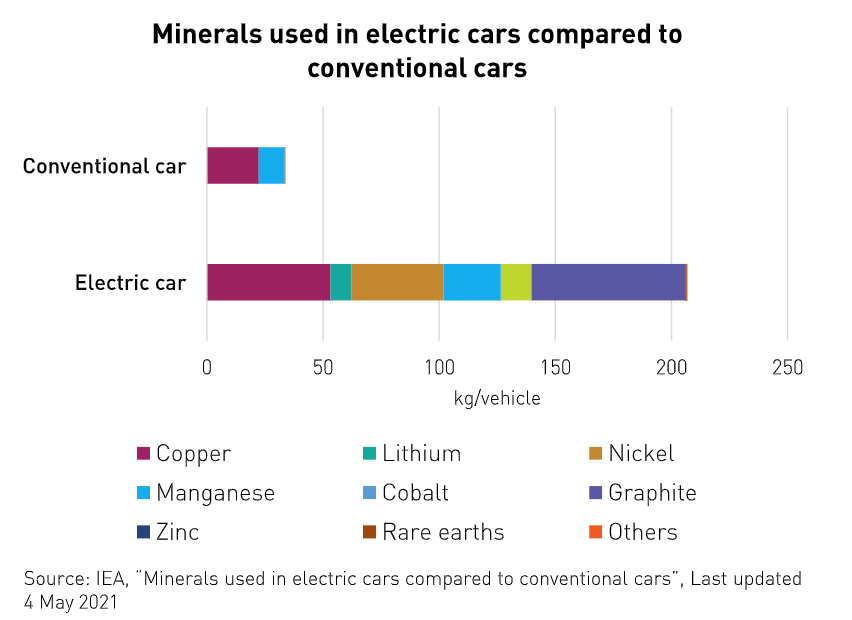

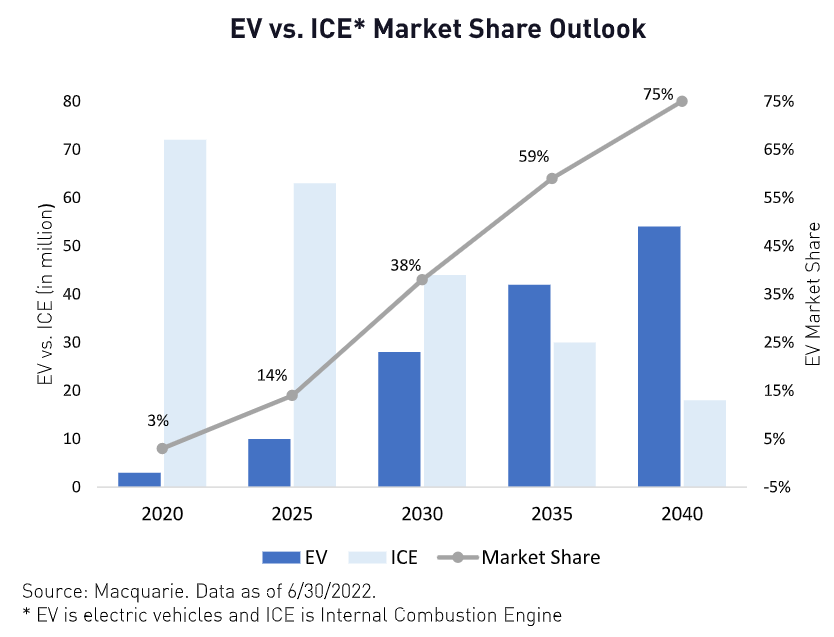

Global Demand Growth

There is significant overlap in the demand for these metals. For example, practically every metal listed in KMET has a role in the Electrical Vehicle manufacturing process. The global EV market is growing continuously at a compounded annualized growth rate (CAGR) of 21.7% and is expected to grow from 8.1 million units sold to 39.21 million units sold by 2030.12 BHP Group boldly predicts that nine in ten cars sold by 2040 will be EVs. The demand for these metals may grow as a result.

While these metals may be purchased primarily for EV-related production, other outlets can generate increased demand. As mentioned, batteries are used not only to power EVs but also for various consumer products. In addition, these metals are heavily utilized in many cleantech projects that are also rising. As technology and environmental awareness rapidly develop, the supply for these metals will not be able to keep up with demand, creating an imbalance over the short to medium term, from which the investors can potentially benefit.

Conclusion

The clean tech revolution cannot happen without electrification metals. The six metals included in KMET play a critical role in this transition and will only increase in importance as technology continues to evolve. KMET provides a unique thematic exposure to these electrification metals, which have an increasingly important role in the global economy's decarbonization story and the fight against climate change, paired with rising inflation and supply-side constraints. We believe KMET is a climate-aligned investment tool that may provide portfolio diversification*, as it may act as a non-correlated source of return not driven by the traditional economic cycle.

*Diversification does not ensure a profit or guarantee against a loss.

Citations

- Bloomberg News, "Aluminum Heads For More Supply Chaos as Biden Weighs Russia Ban," Bloomberg. October 12, 2022.

- Daly, Tom, Nguyen, Mai, "China's primary aluminum output seen peaking in 2024," Nasdaq. June 3, 2021.

- Reuters, "Vale sees 44% increase in global nickel demand by 2030," Reuters. September 7, 2022.

- Cunningham, Tom, "Copper: Looming Supply Shortfall To Support Strong Prices Over The Long Term," Seeking Alpha. October 27, 2022.

- Petkova, Mirela, "Weekly data: Copper demand is outrunning supply," Energy Monitor. October 31, 2022.

- Home, Andy, "Column: Zinc caught between weakening demand and sliding supply," Reuters. September 18, 2022.

- Azevedo, Marcello, Baczyńska, Magdalena Hoffman, Ken, Krauze, Aleksandra, "Lithium mining: How new production technologies could fuel the global EV revolution," McKinsey & Company. April 12, 2022.

- Wurzbacher, Christine, Gilbert, Marc, McAdoo, Michael, Niese, Nathan, Smilkstins, Arturs, Reed, Erik, "The Lithium Supply Crunch Doesn’t Have to Stall Electric Cars," BCG. August 23, 2022.

- Allcot, Dawn, "LME Suspends Trading on Nickel: Why Did the 250% Price Spike Cause so Much Concern?" Yahoo. March 8, 2022.

- Fernyhough, James, "BHP Sees Nickel Demand Rising Fourfold by 2050 on EV Boom," Bloomberg. November 2, 2022.

- Cobalt Market Report 2021.

- K. Vij, Rajiv, "Top 5 Reasons Why Electric Vehicles Are The Future Of Driving In 2022," Outlook India. June 12, 2022.

- Goonan, Thomas, "Lithium Use in Batteries," USGS. 2012.

- Clifford, Catherine, "Elon Musk says Tesla may have to get into the lithium business because costs are so ‘insane’," CNBC. April 8, 2022.