KWEB Defined Outcome FAQ

How do defined outcome strategies work?

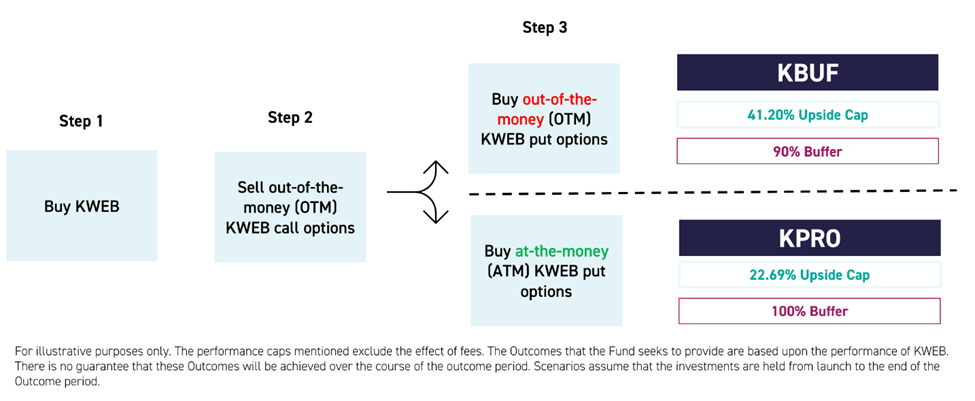

Defined outcome strategies take long positions in their reference asset, in this case KWEB, and then use options to adjust the risk and return characteristics of that position. Please refer to the diagram below, which outlines the process that is initiated every time units in KPRO and KBUF are created.

Will I still receive the buffer and cap if I invest when the outcome period has already started?

Your results will be closest to what is described if you invest at the beginning of the outcome period. However, you can still achieve buffered gains if you invest within the period. As long as the funds have not reached their respective caps, there is still upside potential. At the same time, if you invest at a point where the funds are higher than the starting price, the downside could be greater than the stated buffer.

You can view the daily outcome period performance by clicking here for KPRO and here for KBUF. This convenient tool will show you where KPRO and KBUF current prices are relative to the cap and buffer.

Are KBUF and KPRO guaranteed to reach their stated caps?

No. Their performance is tied to the price of KWEB. They can only reach their stated caps if KWEB’s return for the outcome period reaches or exceeds the caps.

KWEB’s performance so far this outcome period has not hit the cap or buffer. Why does the fund’s performance not match KWEB’s?

Because KPRO and KBUF are comprised of both KWEB and options, its performance will be correlated with, but not equal to, the performance of KWEB itself during the outcome period. Below we have outlined the Fund’s characteristics during its two key stages.

Intra-Period: When KWEB rises in value intra-period, the calls that have been sold rise in value and the puts currently held decline in value. Conversely, when KWEB declines, the calls that have been sold decline in value and the puts currently held increase in value. This means that, during the outcome period, the fund will rise or fall with the value of KWEB, but likely in smaller increments than KWEB itself.

At Period End: The cumulative return of the fund from the beginning of the period will be one of the following.

- Equal to the buffer, if KWEB has declined in value by more than or an amount equal to the buffer.

- Somewhere in between the buffer and the cap and equal to the return of KWEB, if KWEB’s cumulative return is also in between the buffer and the cap.

- Equal to the cap, if KWEB’s return is equal to or exceeds the cap.

Does the outcome period reset?

Yes. On January 16th, 2026, the periods for both funds will reset to a new 2-year period with the same buffer and a new cap, the level of which will be determined by market conditions at that time.

What are some strategies for customizing my China exposure using KPRO and KBUF?

KPRO and KBUF can have a variety of potential portfolio applications. For example, investors can add KPRO and/or KBUF to their existing China, China Internet, and/or Emerging Markets allocations, which can lower the overall risk of such a portfolio. Alternatively, investors can simply replace their existing exposure to China and/or China Internet with KPRO and/or KBUF.

Investors can also pair KPRO and KBUF together to customize their KWEB downside risks and upside cap. For example, a 50/50 split between KPRO and KBUF would result in a maximum drawdown of -5% and an upside cap of approximately 32%, minus expenses and fees.

Investors may also want to consider complementing their position in KPRO and/or KBUF with the KraneShares China Internet & Covered Call Strategy ETF (Ticker: KLIP), which provides monthly income distributions that rise and fall according to KWEB’s volatility.

The Funds have characteristics unlike many other traditional investment products and may not be suitable for all investors. For more information regarding whether an investment in the Funds is right for you, please read the Funds' prospectuses including "Investor Suitability Considerations."