Asia High Yield: Low Issuance In 2024 Creates Appreciation Potential

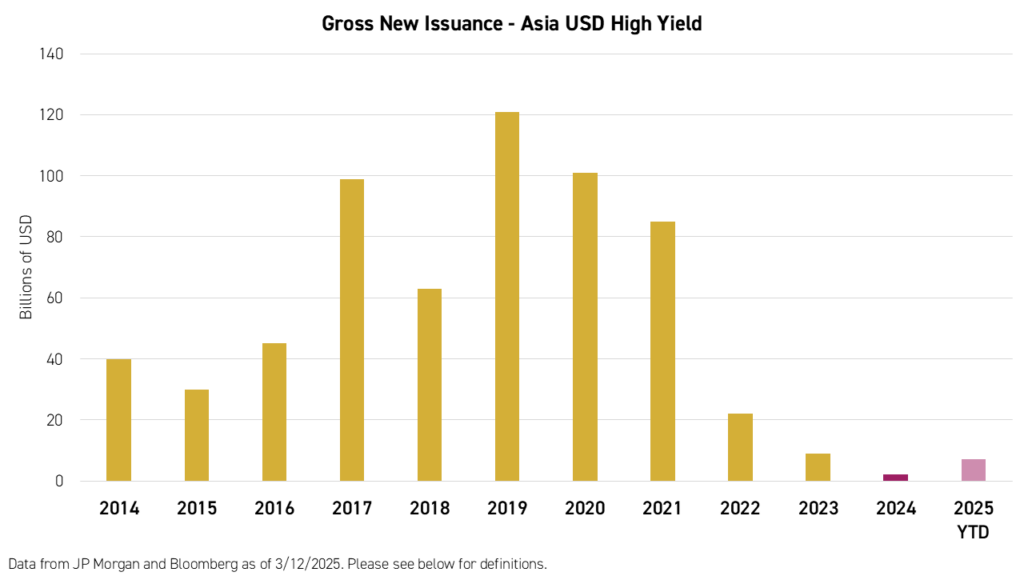

In 2024, Asia’s high yield, USD-denominated bond market saw the lowest new issuance in a decade. The rock-bottom issuance rate, or the rate at which new bonds are added to the market, was driven by uncertainty surrounding rates, the availability of cheaper funding in local currency markets, and subdued merger and acquisition activity. We believe the resulting low supply of new bonds in the market, combined with improving credit conditions, may result in price appreciation in 2025 and beyond. Although issuance has picked up again in the first two months of the year, it is unlikely to reach the highs seen in 2019 and 2020.

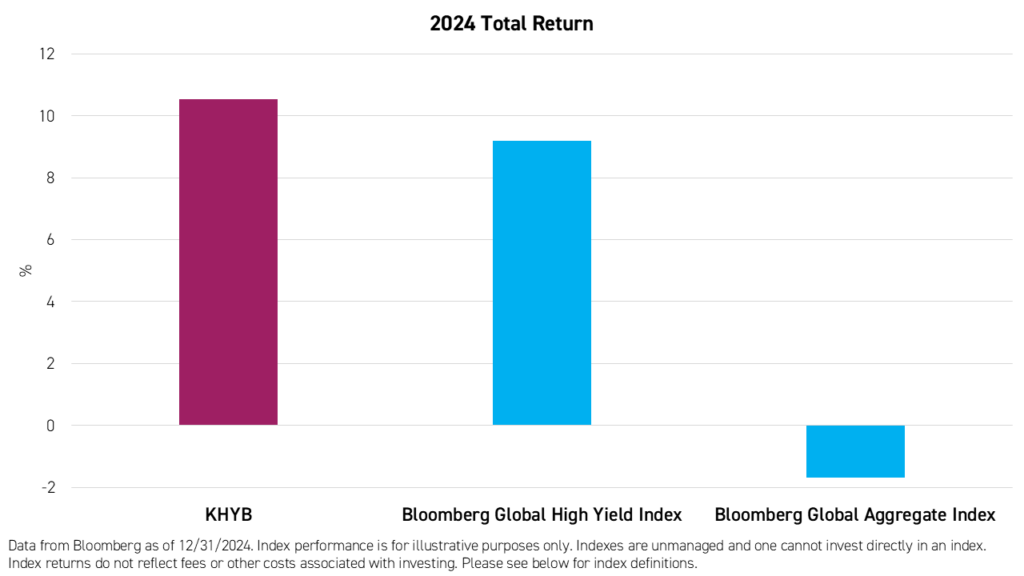

The KraneShares Asia Pacific High Income USD Bond ETF (Ticker: KHYB) provides exposure to USD-denominated high yield debt securities issued by companies in Asia. In 2024, Asia’s high yield bond market, as defined by KHYB, outperformed both the global investment grade and high yield bond markets on a total return basis.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/khyb.

KHYB's strong total return was primarily driven by income from the fund's monthly distributions, which accounted for 7.1% of the fund's 10.5% total return. Meanwhile, price appreciation accounted for the remaining 3.4%.

We believe that could change in 2025. The bonds held by the portfolio may see meaningful price increases over the next 7 months. Investor interest in the bonds may increase due to lower interest rates in local markets in Asia, especially in China and Japan, generating significant demand for substantially fewer bonds.

Meanwhile, the average default rate in the Emerging Markets Asia high yield segment is expected to fall from 4.7% in 2024 to 3.0% in 2025.1 This could indicate a substantial improvement in the credit quality of the bonds currently in the market, which could lead to price increases.

At the same time, local currencies may shed their value against the US dollar as central banks recalibrate monetary policies to sustain the potential impact of tariffs on goods exports to the United States. This, in turn, may increase investor demand for USD cash flows in Asia.

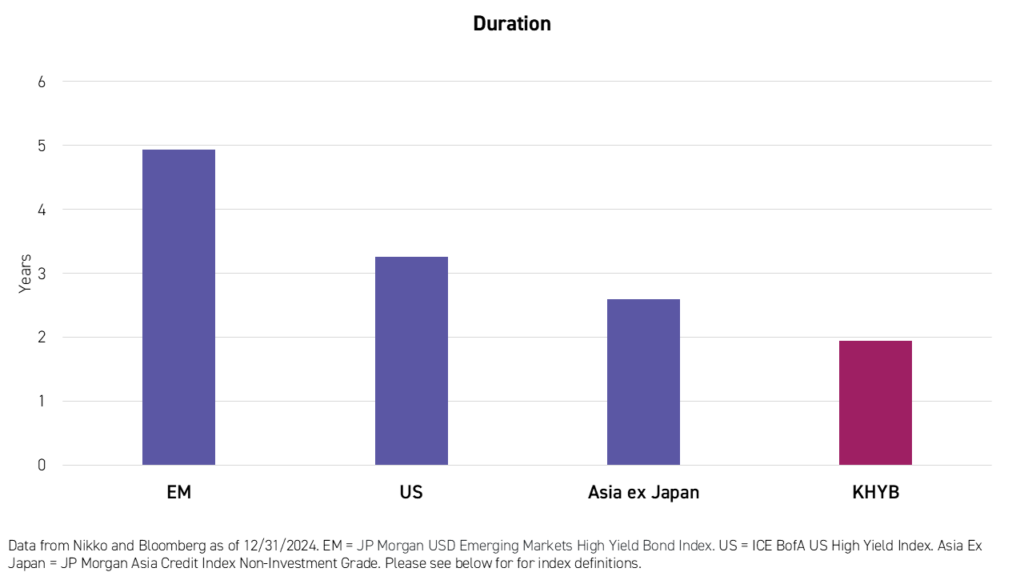

Interest rates are the main risk to this outlook. A further run-up in developed market rates, which could be likely for Japan, could apply downside pressure on prices. Fortunately, Asia high yield, USD bonds tend to have lower duration (interest rate risk) compared to both US and Emerging Markets USD high yield bonds. Currently, the average duration of the bonds held in KHYB is even lower than the market overall.

Conclusion

We believe Asia high yield USD bonds could be an attractive investment in 2025, especially from a price return perspective due to new issuance reaching a 10-year low in 2024. This is thanks to potentially high interest from regional investors due to lower local currency rates and the potential for local currency depreciation versus the US dollar, and improving credit conditions in the market. Meanwhile, the market’s low duration (interest rate risk) shields prices somewhat from rising developed market rates.

Citation:

- Data and forecast from JP Morgan as of 12/31/2024.

Definitions:

Duration: The weighted average of the times to maturity of each coupon, and/or principal payment made by a bond. This metric considers that expected cash flows will fluctuate as interest rates change and is, therefore, a measure of interest rate risk.

Interest Rate Risk: The risk that bond prices will fluctuate with changes in prevailing interest rates.

Default Rate: The default rate is the percentage of all outstanding loans that a lender has written off as unpaid after a prolonged period of missed payments.

Investment Grade: The term ‘investment grade’ refers to the quality of a company's credit. To be considered an investment grade issue, the company must be rated at 'BBB' or higher by Standard and Poor's or Moody's. Anything below this 'BBB' rating is considered non-investment grade or high yield.

High Yield: The term ‘high yield’ refers to the quality of a company's credit. To be considered a high yield issue, the company must be rated lower than ‘BBB’ by Standard and Poor's or Moody's. Anything 'BBB’ or above is considered investment grade.

Gross New Issuance: The total face value of new bonds issued by a specific market segment, in this case USD-denominated, publicly-traded debts of companies in Asia with an S&P rating of BBB- or lower, during a specific period, without accounting for any redemptions or retirements of existing securities.

JP Morgan Asia Credit Index Non-Investment Grade: The J.P. Morgan Asia Credit Index Core (JACI Core) consists of liquid US-dollar denominated debt instruments issued out of Asia ex Japan. The JACI Core is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. JACI Core includes the most liquid bonds from the JACI by requiring a minimum $350 million in notional outstanding and a minimum remaining maturity of 2 years. JACI Core also implements a country diversification methodology. Historical returns and statistics for the JACI Core are available from December 30, 2005. The non-investment grade version of the index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.

ICE BofA US High Yield Index: The ICE BofA US High Yield Index provides a comprehensive, accurate representation of the US high yield market and its components.

Bloomberg Global Aggregate Index: The Bloomberg Barclays Global Aggregate Index is a flagship measure of global investment grade debt from twenty-four local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers. The index was launched on January 1, 1990 .

JP Morgan USD Emerging Markets High Yield Bond Index: The JP Morgan USD Emerging Markets High Yield Bond Index tracks liquid, US Dollar emerging market fixed and floating-rate debt instruments issued by corporate, sovereign, and quasi-sovereign entities. The index tracks instruments that are classified as non-investment grade (HY) in the established JP Morgan EMBI Global Diversified Core and JP Morgan CEMBI Broad Diversified Core indices, and combines them with a market capitalization based weighting. The returns and statistics are available since December 2011.

Bloomberg Global High Yield Index: The Bloomberg Global High Yield Index is a multi-currency flagship measure of the global high yield debt market. The index represents the union of the US High Yield, the Pan-European High Yield, and Emerging Markets (EM) Hard Currency High Yield indexes. The high yield and emerging markets sub-components are mutually exclusive. The index was launched on January 1, 1990.