MSCI’s Historic June 14th Announcement

The global index provider is weighing the inclusion of onshore Chinese equities in the near future, which could have a significant impact on the targeted markets

MSCI’s June 14th announcement on the inclusion of the onshore A share markets (stocks listed on the Shanghai and Shenzhen stock exchanges) has received a great deal of media attention lately. As the announcement approaches, some analysts have downplayed both the likelihood of inclusion and its potential market impact. It is our belief, however, that MSCI could move to include onshore equities in the near future and that the impact on the targeted markets may be significant.

Likelihood of Inclusion

We visited MSCI in late May with a team from Bosera Asset Management, the sub advisor for the KraneShares Bosera MSCI China A ETF (ticker: KBA). KBA tracks the MSCI China A International Index, which is composed of the exact securities MSCI will eventually include within their most popular indexes.

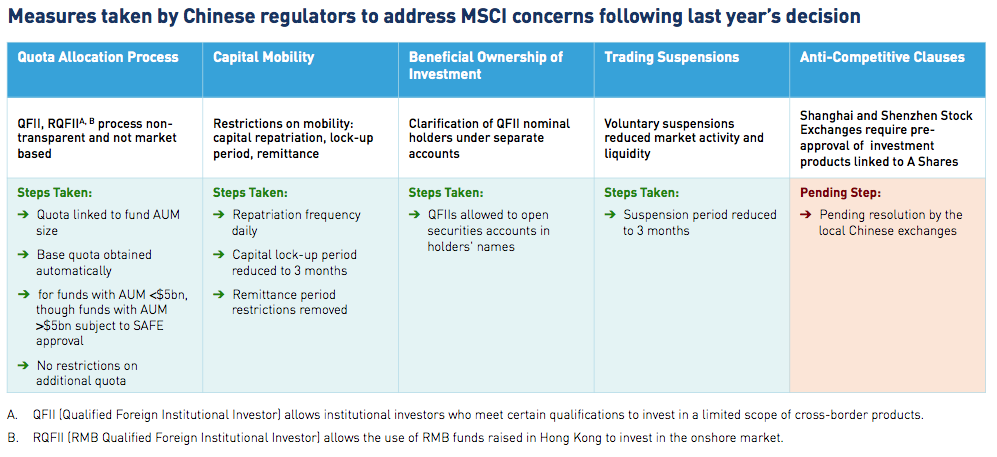

During our visit MSCI said that the majority of their concerns have been rectified on paper with only a few lingering issues. They informed us that they were in the process of conducting a survey of their clients to verify that these measures were also working in practice. Below we have included a chart of the issues MSCI identified and the measures taken to alleviate them.

Outside the issues mentioned in the chart, we believe that MSCI may be under pressure to add the onshore markets to their indexes because some competing index providers have already done so ahead of them. MSCI is a global leader in international indexing, the firm's indexes are tracked by some of largest funds and financial institutions in the world. As of June 2015, some competing index providers have already moved to include the onshore markets in their funds.1 In order for MSCI to maintain its role as a leader in international indexing, we believe it may finally include A shares this year.

Inclusion's Potential Effect on the Market

MSCI estimates that there are $10.5 trillion in both passive and active fund assets that track various global MSCI indexes.2 The inclusion of the onshore markets will impact the All Country World Index (ACWI)3, Emerging Market Index (EM)4, the MSCI AC Asia ex Japan Index5, and other Asia specific MSCI indexes, which have a combined AUM of $4.5 trillion.6

MSCI said they will include onshore equities in phases, beginning with 5% of the onshore's free-float market capitalization (market cap)7, which would make up 1.1% of MSCI's Emerging Market Index.4 This initial step in inclusion may translate to around $21 billion of inflows from funds tracking the ACWI, EM and Asia Indexes, which could grow to around $360 billion as the full weight is allotted.8 These numbers are large, however they may overestimate the size of inflows as some actively-managed funds tracking MSCI indexes may not follow the inclusion on day one.

There are varying estimates about what the market impact will be. On the surface, onshore equities represent a $6.9 trillion9 aggregate market cap10, so a $21 billion inflow would only amount to 0.3% of the total market cap. However, when looking at the free float market cap of the securities MSCI is expected to include, we believe the market impact may be more significant than what this statistic predicts. The free-float market cap, which only measures freely tradable shares, is considerably smaller than the aggregate market cap in the onshore markets due to high levels of state ownership.

The MSCI China A International Index11, which defines the exact securities MSCI will be adding to its broader indexes, aims to capture mid to large cap companies with readily available long and short-term liquidity as defined by MSCI's Global Investable Market Indexes methodology. This index is comprised of 420 constituents, representing a free float market cap of $813 billion dollars.12 A $21 billion dollar inflow into this smaller pool of assets represents a much larger gain at 2.6% of the index. The full $360 billion dollar inclusion would represent 44.3% of the entire index.

We will be conducting a live webinar on Wednesday, June 15th from 11:00am to 12:00pm EST where we will review the results of MSCI’s announcement and discuss its impact on the onshore Chinese markets. Click here to subscribe to the webinar.

- Press Release, [Jun 02 2016] "Four Vanguard International Equity Index Funds to Broaden Diversification With All-Cap Exposure", Forbes

- Aidan Yao, [Jun 02 2016] "China A-Share MSCI Inclusion Not a Done Deal", Barron's

- The MSCI ACWI Index captures large and mid cap representation across 23 Developed Markets (DM) and 23 Emerging Markets (EM) countries. With 2,476 constituents, the index covers approximately 85% of the global investable equity opportunity set. (Start Date: May 31 1994)

- The MSCI Emerging Markets Index: Captures large and mid cap representation across 23 Emerging Markets (EM) countries. With 834 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. (Start Date: Jan 1 2001)

- The MSCI AC Asia ex Japan Index: captures large and mid cap representation across 2 of 3 Developed Markets countries (excluding Japan) and 8 Emerging Markets countries in Asia. With 622 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- Free float market capitalization: Free-float methodology market capitalization is calculated by taking the equity's price and multiplying it by the number of shares readily available in the market. Instead of using all of the shares outstanding like the full-market capitalization method, the free-float method excludes locked-in shares such as those held by promoters and governments.

- Data from MSCI as of April 1, 2016.

- Data from World Exchanges as of April 30, 2016.

- Aggregate Market Capitalization: Is the aggregate valuation of the company based on its current share price and the total number of outstanding stocks. It is calculated by multiplying the current market price of the company's share with the total outstanding shares of the company.

- The MSCI China A International Index: A free-float adjusted market capitalization weighted index that is designed to track the equity market performance of large-cap and mid-cap Chinese securities listed on the Shanghai and Shenzhen Stock Exchanges. The Index is based on the concept of the integrated MSCI China equity universe with mainland Chinese securities included. (Start Date: Nov 28 2008)

- Data from MSCI as of April 29, 2016.