Asia Dividend Aristocrats® Q&A With Rupert Watts of S&P Dow Jones Indices

Investors know the S&P 500 Dividend Aristocrats® Index well. However, many are unaware that S&P also has indexes tracking Dividend Aristocrats® internationally. We believe these indexes are becoming more appealing as the decade-long era of US outperformance appears to be over. Dividend indices' lower volatility and reduced drawdown in declining markets may be especially attractive in international and emerging markets.

After launching the KraneShares S&P Pan Asia Dividend Aristocrats Index ETF (Ticker: KDIV), we sat down with Rupert Watts, a Senior Director at S&P Dow Jones Indices to discuss KDIV’s Index, its history, and the potential benefits it can provide investors.

Below, you will find a video recording of our conversation as well as an abridged summary of the discussion.

Brendan: What are the key benefits of dividend strategies, specifically passively managed dividend strategies, to investors?

Rupert: Dividends are a source of income and a significant portion of the long-term total return of stocks. Since 1936, more than a third of the long-term total return of the S&P 500 can be attributed to dividends. Dividends can also play an important role during periods of increased volatility by providing a positive income and offsetting a portion of negative equity market returns, while also providing the opportunity to capture the upside potential of equities.

Brendan: Please tell us about the methodology behind the S&P Pan Asia Dividend Aristocrats Index and how the index provides a quality tilt compared to other Asia exposures in the market.

Rupert: The "Dividend Aristocrats®" is a category of dividend growth strategies that focuses on companies that have a track record of consistently increasing dividends every year. The S&P Pan Asia Dividend Aristocrats is an index that aims to achieve a balance between high dividend yield and dividend sustainability and growth by using stocks from developed and emerging markets in Asia. To qualify for the index, companies must have followed a managed dividends policy of increasing dividends for at least seven consecutive years, with a one-year constant dividend growth buffer, have positive earnings and a non-negative dividend payout ratio, and not have a indicated annualized dividend yield above 10%. The top 100 stocks are selected and weighted proportional to the yield subject to constraints such as a 5% weight cap on single stocks and 30% weight cap across countries and sectors. This strategy is considered to have a quality bias and tends to exhibit defensive qualities and outperform during periods of market stress.

Brendan: How does a dividend growth strategy differ from a high dividend strategy?

Rupert: Dividend strategies can be classified into two categories: high dividend and dividend growth.

Brendan: So, it seems that what the Aristocrats suite is really offering is consistency, rather than simply high yields, which can lead investors into the proverbial “dividend trap,” in which they are invested in companies that pay high dividends only because they have no other way to make use of that capital. Can you speak to the performance of the S&P Pan Asia Dividend Aristocrats Index versus its parent index and other dividend strategies?

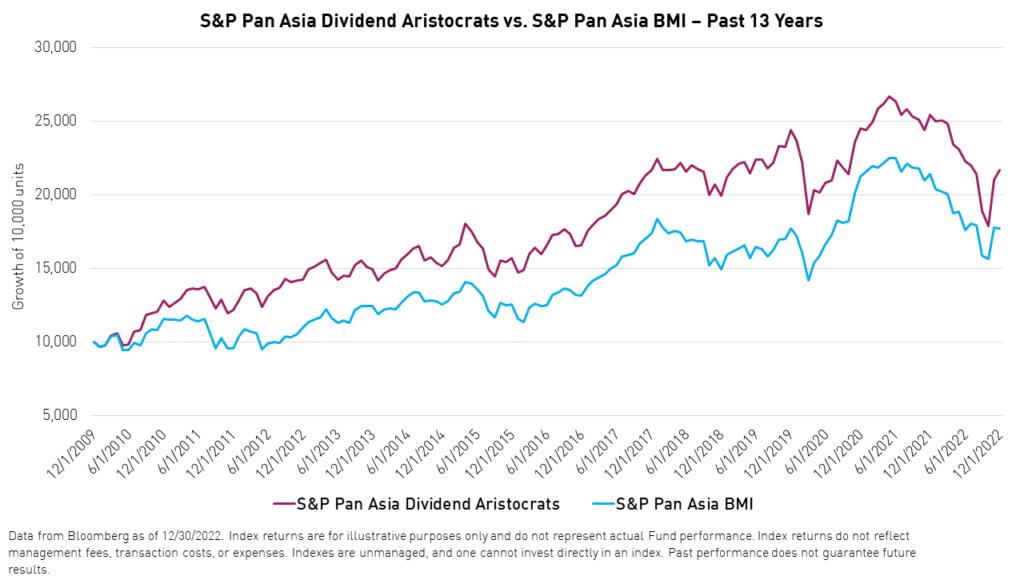

Rupert: The S&P Pan Asian Dividend Aristocrats has generated an annualized return of 9.1% compared to 6.8% for its benchmark, the S&P Pan Asia BMI, from December 2001 through the end of 2022. The index has also exhibited lower volatility, at 15.7%, compared to the benchmark. In 2022, the index outperformed its benchmark by 2.2%. Historically, the index has demonstrated defensive qualities, as evidenced by its lower maximum drawdowns and lower downside capture ratio of 1.3, indicating that it loses less than its benchmark during negative market conditions. The index has also had a higher dividend yield on a 12-month trailing basis, averaging 3.3% over the same period, compared to 2.5% for the benchmark, with a more pronounced difference in yield in 2022, at 1.4%.

Brendan: That is impressive. I know that there have been periods in which markets were declining and dividends were the only source of return.

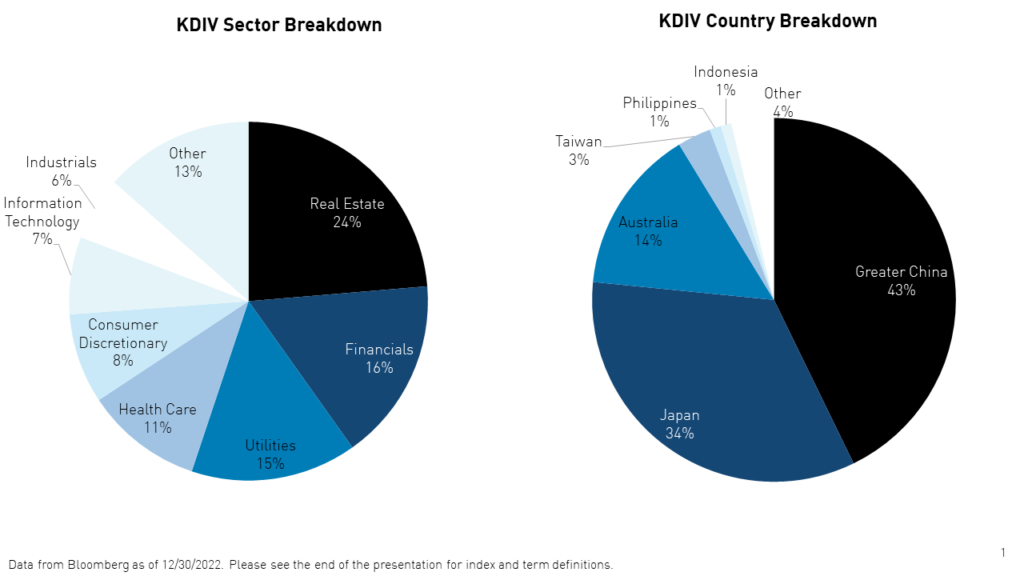

Henry: I think that one of the most interesting aspects of the Pan Asia Dividend Aristocrat® basket is that it straddles both emerging and developed markets, potentially generating a unique risk profile. Would you please speak to the sector and country composition of the index compared to its parent?

Rupert: The S&P Pan Asian Dividend Aristocrats® is overweight to Greater China, particularly Hong Kong, and Australia, and mirrors the weight to Japan in the parent index. These three countries account for over 93% of the index. In terms of sectors, the index is overweight utilities and real estate and underweight in consumer discretionary and industrials, which is not surprising as these sectors tend to be comprised of companies that pay consistent dividends.

Brendan: To me, this strategy is clearly something that has worked in the past and may work again, especially given the bias over the past decade to both growth stocks and US stocks. I think the Pan Asia Dividend Aristocrats® Index basket could benefit from the reversal of this trend.

Rupert: I think it is a nice complement to our Pan Asia BMI benchmark as well the US-exclusive S&P 500 Dividend Aristocrats®.

Henry: One of the attributes that attracted us to the Index in the first place was its relatively long performance history. We believe S&P DJI was quite forward-looking to launch a Pan Asia benchmark that early on. Moreover, we noted the trust that investors continue to have in the Dividend Aristocrats® brand overall. Would you please speak to the history of the Dividend Aristocrats® suite?

Rupert: Yes. The S&P 500 Dividend Aristocrats Index began in the early 2000s and has been widely followed by market watchers ever since. The subsequent rise of the ETF industry further increased interest in the index suite. The Pan Asia version was launched in 2009, but we were surprised at the lack of interest from a product launch perspective at the time and are glad that KraneShares has developed a product to track the index.

For Fund standard performance, top 10 holdings, risks, and other fund information, please click here.