High Yield & Trade: Why Asia Could Be A Compelling Source of Stability

Executive Summary

- High yield investors search for high income and are willing to take on risks as a result. However, with potential tariffs on imports to the US on the horizon, the cash flows of US high yield issuers that are dependent on imports could be severely impacted.

- By contrast, the issuers in the KraneShares Asia Pacific High Income USD Bond ETF (Ticker: KHYB), which is actively managed by Nikko Asset Management, have no revenue exposure to the United States, insulating them from direct tariff risks. Nikko Asset Management is a Japanese multinational investment company and one of the largest asset managers in the world, with over $235 billion in assets under management (AUM) as of December, 2024.4

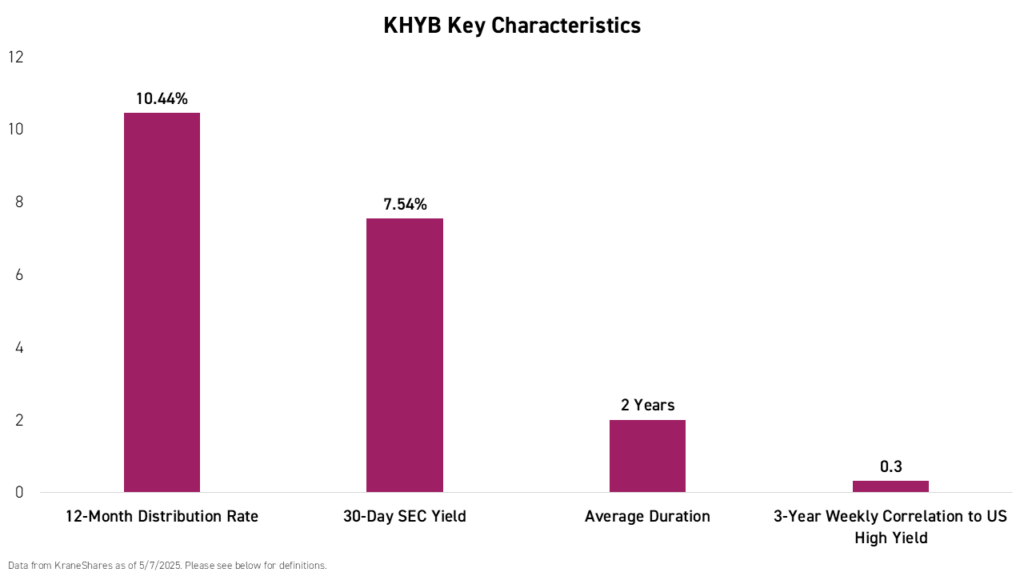

- KHYB has a 12-month trailing distribution rate of 10.32%, higher than all US-listed emerging markets bond ETFs, and a 30-Day SEC yield of 7.54% as of May 13, 2025, and all bonds held in the portfolio are denominated in USD, resulting in no direct currency risk.3

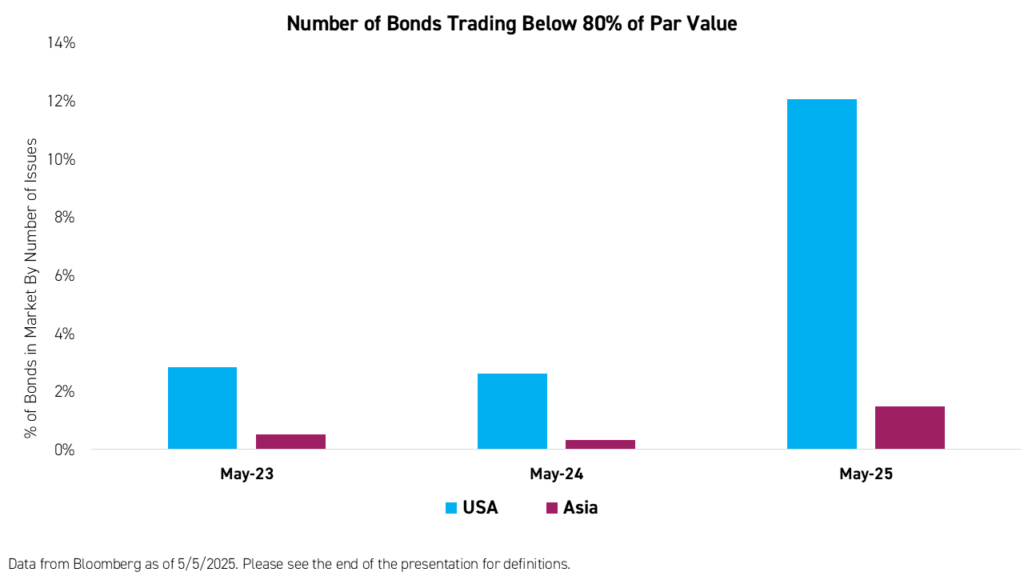

- The number of bonds trading below 80% of par value, in the United States surged year-over-year in May, and are significantly above the current levels in Asia, which means US high yield could see more defaults this year and reflecting the high risk premium placed on US companies reliant on imports.

- Nikko believes Asian economies are relatively well-positioned to weather a potential global economic downturn and increased trade protectionism in the US and Europe due to continued easing of monetary and fiscal policies from central banks, low inflation, and large and growing regional markets.

- We believe KHYB can complement any global fixed income allocation due to its relatively high yield, low average duration, and low correlation to global fixed income markets.2

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed or sold, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. For performance data current to the last month-end, please visit kraneshares.com/etf/khyb.

Most Asian nations run trade surpluses with the United States. As such, many were targeted by US President Trump’s “Liberation Day” reciprocal tariffs. Many Southeast Asian countries and China face potentially over 30% reciprocal tariffs. Within Asia, China, the Philippines, India, and Malaysia are likely to be more insulated as domestic demand comprises between 60% and 70% of gross domestic product (GDP). China responded with significant tariffs on all US imports, which led the US to escalate the situation, raising the tariff rate on China-made goods to 145%. Although a 90-day pause was announced as the US negotiates with China and other trading partners, trade uncertainty could remain.

In a recent report titled Trade Policy Impacts On Asian Fixed Income, Nikko stated that technology hardware issuers and consumer goods-focused industrial companies, including auto and electric vehicle (EV) batteries, with sizable revenue exposure from the United States, could be directly affected by tariffs. However, they noted that these issuers are nearly all investment grade, leading to their more favorable view of high yield in the current environment.

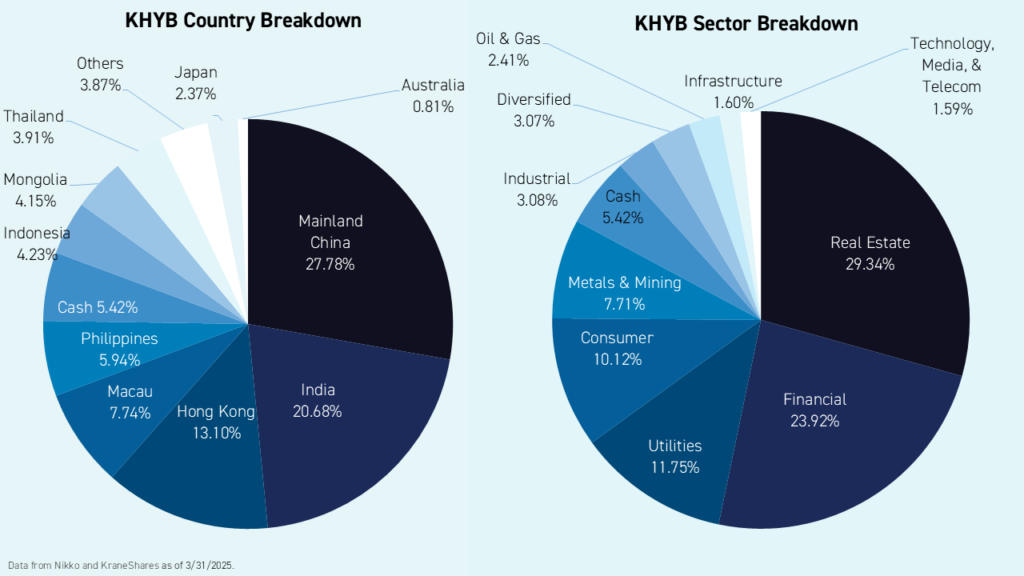

Asian high yield bonds are dominated by issuers focusing on domestic and regional business with limited direct exposure to the United States, and as of March 31, 2025, financials, real estate, utilities, and Macau casino operators accounted for over 70% of the JP Morgan Asia Credit Index (JACI) Non-Investment Grade, KHYB's benchmark. These sectors derive a limited revenue contribution from the US. Based on bottom-up screening, issuers in the high yield index whose businesses are likely affected by the reciprocal tariff (i.e., more than 20% revenue comes from the US market) are a handful of healthcare and supply chain companies, representing only 1% of the index. KHYB, which is actively managed by Nikko Asset Management, a leader in Asia fixed income with over 30 years of experience,4 does not currently have a position in any of these companies.

The top 5 issuers within KHYB are Ping An Real Estate (4.3%), Wynn Macau (3.8%), Greentown China Holdings (3.6%), Standard Chartered (3.6%), Vedanta Resources Finance (3.3%).2 None of these companies export goods to the US. Therefore, we expect a limited fundamental impact from announced reciprocal tariffs. However, the indirect impact will likely hit most sectors and issuers, with the heightened risk of a global recession depending on how long the trade conflict lasts. Banks will have profitability impacted by lower interest rates and higher credit costs. Meanwhile, commodities-related credits will likely be impacted by lower commodity prices.

Going forward, Nikko's base case is for most economies to negotiate with the US to lower tariffs and thus mitigate some of the impact from the initial announcement. However, significant uncertainty surrounds this, and there is a risk of increased tit-for-tat measures in the near term. Partially mitigating these risks, most Asian economies entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions, which should provide a good buffer to withstand the challenges ahead, according to Nikko. Notably, China’s policymakers have already begun discussing stimulus measures. In addition, most regional central banks retain room to ease monetary policy to support domestic demand, and inflation has declined in the region. Also, thanks to easy access to fast-growing regional markets, Asian high yield bonds are less exposed to trade with the US than other Emerging Market bonds.

Nikko expects Asian central banks to continue their current path of rate cuts to mitigate growth risks. They see domestic funding for Asian issuers to remain favorable and Asia high-yield companies to benefit from lower interest expenses domestically. In addition, many Asia high yield companies have tapped the offshore dollar market for refinancing and extended their maturity ladder in the past year. Nikko expects most high yield issuers will not face imminent repayment risk, supporting continued lower default rates in the space.

However, the situation is still playing out in performance. The announcement of the reciprocal tariffs on April 2nd led to an initial selloff in Asian high yield bonds. Nikko believes that their strong balance sheets and relatively low exposure to US trade become apparent, Asian bonds may re-rate to the upside. Bonds trading below 80% of par value, in the United States surged year-over-year in May, and are significantly above the current levels in Asia, which means US high yield could see more defaults this year.

KHYB, an access vehicle for Asia's high yield bond market, offers an average duration of 2 years and a correlation of only 0.3 to US high yield over the past three years.

KHYB, an access vehicle for Asia's high yield bond market, offers an average duration of 2 years and a correlation of only 0.3 to US high yield over the past three years.

Conclusion

Unlike investment grade issuers, high yield issuers mainly focus on domestic markets with limited US revenue exposure. As such, the holdings in the KraneShares Asia Pacific High Income Bond ETF (Ticker: KHYB) would have a minimal direct impact from tariffs. We believe Asian economies are relatively well-positioned to weather a potential global economic downturn and increased trade protectionism in the US and Europe due to continued easing of monetary and fiscal policies from central banks, low inflation, and large and growing regional markets. This makes Asia’s high yield bond market an attractive option for investors compared to other emerging debt markets. We also believe KHYB can complement any global fixed income allocation due to its relatively high yield, low average duration, and low correlation to global fixed income markets.

This material must be preceded or accompanied by a current prospectus. Investors should read it carefully before investing or sending money.

Citations:

- Data from Bloomberg as of 3/31/2025.

- Data from KraneShares as of 3/31/2025. Please click here for underlying data as of the most recent quarter-end. Holdings are subject to change.

- Data from Bloomberg and KraneShares as of 5/2/2025. The 12-Month Distribution Rate includes return of capital. For more information on the sources of the Fund’s latest distribution, please refer to the Fund’s 19a Notice.

- Data from Nikko Asset Management as of 12/31/2024.

Definitions:

JP Morgan Asia Credit Index Non-Investment Grade: The J.P. Morgan Asia Credit Index Non-Investment Grade Index consists of liquid US-dollar denominated debt instruments issued out of Asia ex-Japan. It is based on the composition and established methodology of the J.P. Morgan Asia Credit Index (JACI), which is market capitalization weighted. The index is limited to issuers classified as non-investment grade based on the middle rating between Moody’s, Fitch, and S&P.

Bloomberg US Corporate High Yield Index ("US High Yield"): The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody's, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg’s EM country definition, are excluded.

Association of Southeast Asian Nations (ASEAN): ASEAN is a regional grouping of 10 states in Southeast Asia that aims to promote economic and security cooperation among its ten members.

Gross Domestic Product (GDP): The total value of all goods and services produced within a country in a given timeframe, usually one year.

Default Rate: The default rate is the percentage of all outstanding loans that a lender has written off as unpaid after a prolonged period of missed payments.

Investment Grade: The term ‘investment grade’ refers to a company's credit quality. To be considered an investment-grade issue, the company must be rated at 'BBB' or higher by Standard and Poor's or Moody's. Anything below this 'BBB' rating is considered non-investment grade or high yield.

High Yield: The term ‘high yield’ refers to the quality of a company's credit. To be considered a high yield issue, the company must be rated lower than ‘BBB’ by Standard and Poor's or Moody's. Anything 'BBB’ or above is considered investment grade.

30-Day SEC Yield: A standard yield calculation developed by the U.S. Securities and Exchange Commission (SEC) that allows for fairer comparisons of bond funds. It is based on the most recent 30-day period covered by the fund's filings with the SEC. Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect.

12-Month Trailing Distribution Rate: The distribution yield an investor would have received if they had held the fund over the last twelve months, assuming the most recent NAV. The 12-Month Distribution Rate is calculated by summing any income, capital gains and return of capital distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the same period. 12-Month Distribution Rate includes return of capital. For the Fund’s fiscal year to date, please refer here for the SEC 19a Notice with a breakdown of each monthly distribution.

Tariff: A levy or tax charged on imports into a country from abroad.