Carbon Allocation in Practice: 5 Real Examples from Institutional Portfolios

Compliance carbon allowances are an emerging asset class whose strong performance has recently captured significant attention. Compliance carbon is based on cap-and-trade programs, also known as Emissions Trading Systems (ETS), which regulate emissions for mandated industries in their respective jurisdictions, forming a new type of investable asset class called carbon allowances or carbon credits. Over the past three years, KraneShares has built an $800 million1 asset base across its suite of carbon ETFs:

- KRBN, KraneShares Global Carbon Strategy ETF - Global blend of the four most liquid carbon markets

- KCCA, KraneShares California Carbon Allowance Strategy ETF - Largest US market, 5th largest global economy

- KEUA, KraneShares European Carbon Allowance Strategy ETF - World's largest, most liquid carbon market

Carbon allocations can provide investors access to robust and uncorrelated performance potential and direct climate impact. As the wave of carbon investment grows, clients want to know how their peers utilize carbon within traditional portfolios.

What our investors say:

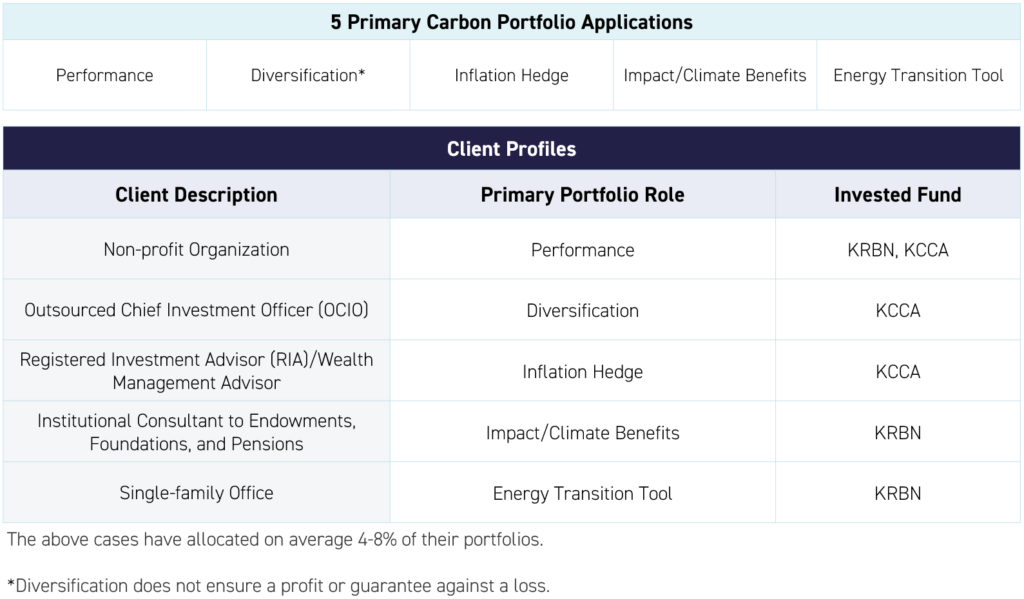

We spent time with a select group of institutional investors to discuss why they allocate to KraneShares' carbon ETFs and the merits of carbon investing as part of a robust investment portfolio. This exercise identified five primary portfolio applications for carbon allocations. In the following guide, we describe those five objectives and the profiles of the clients who are putting carbon to work in their portfolios today.

Client Description: Non-profit Organization

Primary Portfolio Role: Performance

Invested Fund: KRBN, KCCA

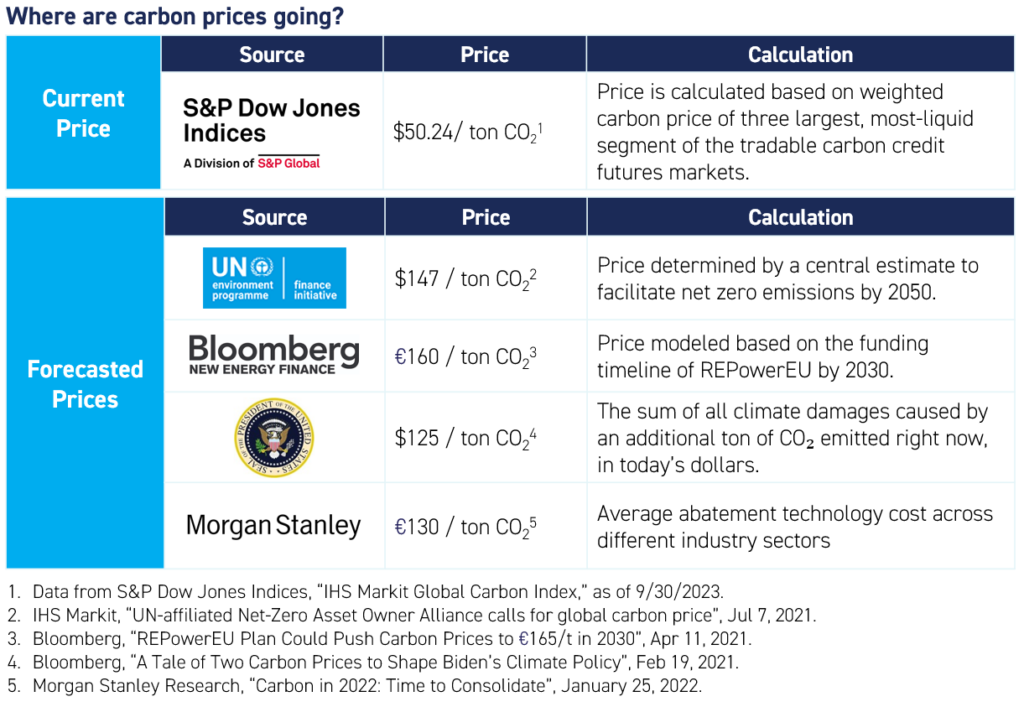

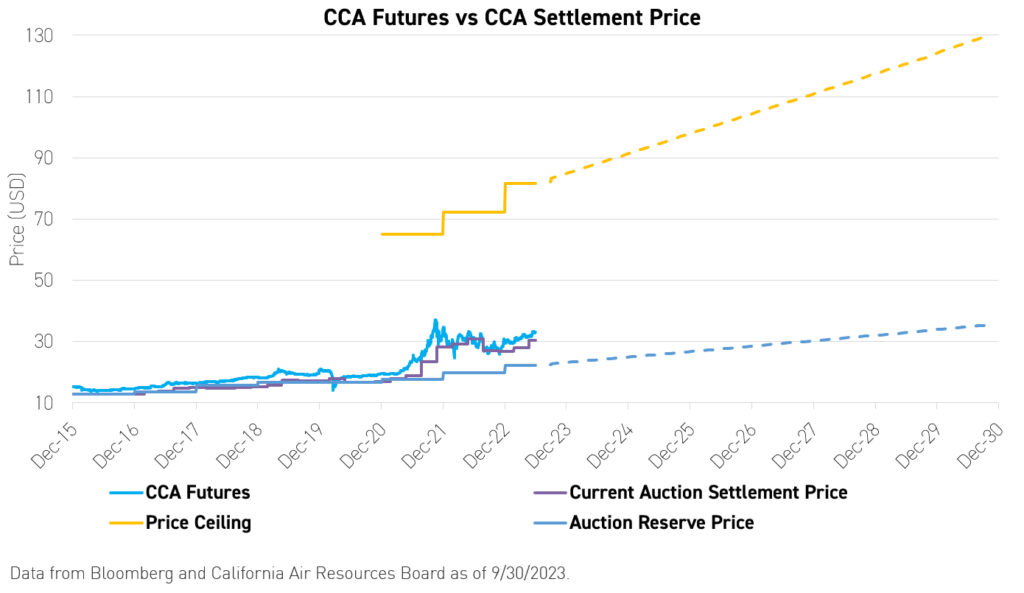

Today, the blended carbon price is $50 and is forecasted to rise to $120-160 over the coming years.2 This potential move forms the basis of many investors' interest in global compliance carbon markets. The reason for these expanding forecasts is that carbon markets are structured to rise in price to act as a catalyst to decarbonize the global economy and enable governments to hit their emissions targets. Europe, for example, now tightens by over 4% per year, plus has a market stability reserve that can absorb 24% of excess auction supply. California tightens at approximately 8% per year and is discussing shifting from a 40% to a 48% reduction in emissions below 1990 levels by 2030, which puts more upward pressure on the market.3

The non-profit organization, which was an early investor in KRBN and KCCA, allocates to carbon primarily for its structural growth opportunity and also for diversification as a secondary benefit. The investor allocates roughly 75% of its position to California carbon and the remainder to the global basket. They have a heavy overweight to the California market because it is still considered in its early stages, and they see a long runway for potential growth, especially with its unique market mechanisms and current market tightening reform expected to be finalized by year-end. That said, the blended basket also holds appeal because each market has its own unique growth story and return potential. The European market, which is the oldest and highest priced, still offers a steady return profile. BloombergNEF expects EUA prices to more than double by the end of the decade, revising their forecast after the EU passed its recent Emissions Trading System (ETS) reform.4

Client Description: OCIO ($10 Billion AUM)

Primary Portfolio Role: Diversification

Invested Fund: KCCA

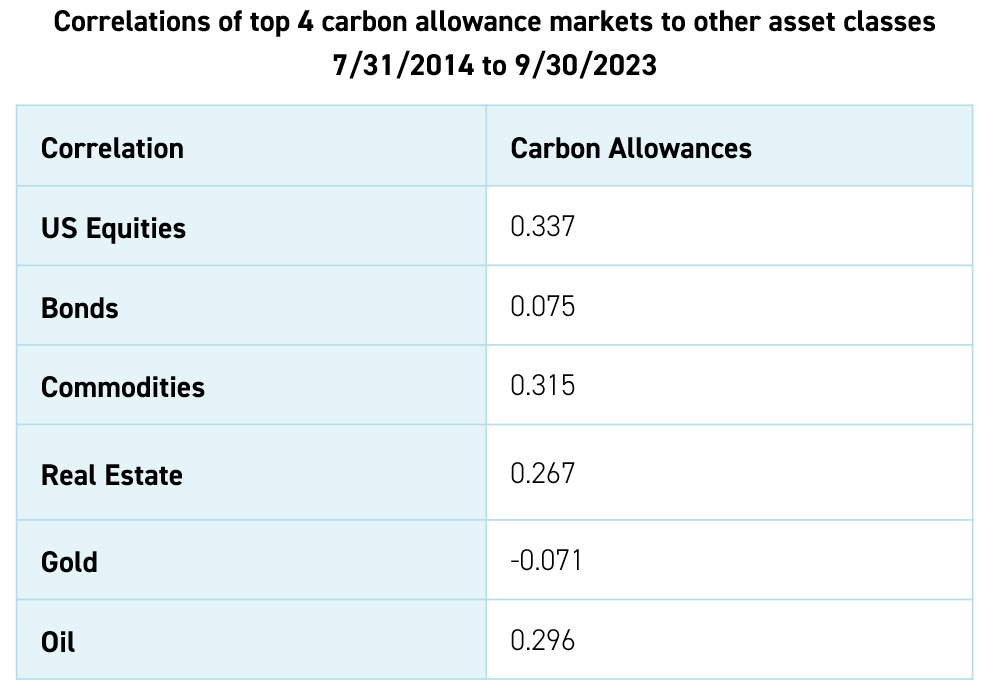

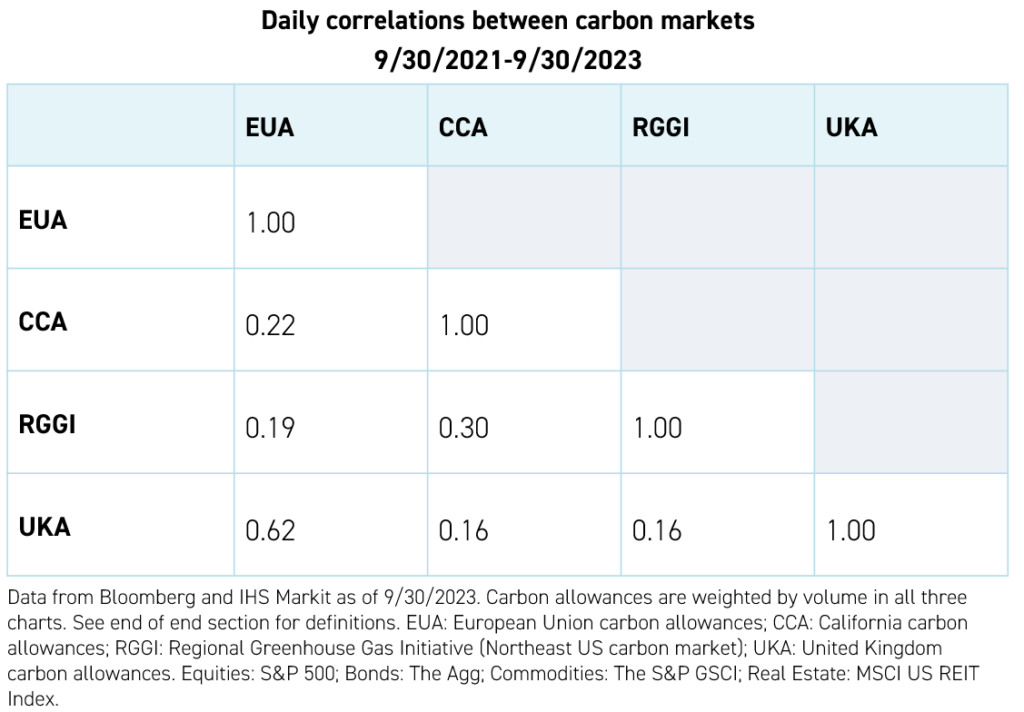

Historically, carbon markets have demonstrated low correlations to other asset classes. We believe these correlation benefits will continue as carbon prices increasingly reflect the policy tightening schedule more so than economic factors, meaning a carbon allocation, despite its own volatility, can bring down overall portfolio risk. Since 2014, carbon allowances have maintained a correlation of 0.3 or lower to other major asset classes.5 The correlation across the different carbon markets is also notably low because each has unique regulatory structures and regional influences.

An outsourced CIO (OCIO) that invested in KCCA took a more capital markets perspective rather than viewing carbon through a sustainability/impact lens. Based on today's opportunity, carbon credits are a good option to diversify and enhance portfolios through positive risk-adjusted returns.

The investor believes the California market is desirable for two main reasons: diversification and returns. The market's embedded mechanisms, with its low correlation to other asset classes, attractive return profile, and increasing floor and ceiling prices, are particularly compelling factors.

They also noted that physical CCAs can be hard to access, but futures contracts and ETFs offer an elegant way to get exposure. An investor must set up a Compliance Instrument Tracking System Service (CITSS) account or work with someone with a CITSS account to own physical allowances. Delays have made this a lengthy process, as California's market is currently backlogged with nearly 250 investor applications to buy physical units.6 However, an ETF such as KCCA simplifies market access and, in their view, is the best use of capital for their clients in portfolios. Our paper on the use of futures demonstrates the merits of this low-cost, efficient vehicle.

Client Description: RIA/Wealth Manager ($20+ Billion AUM)

Primary Portfolio Role: Inflation Hedge

Invested Fund: KCCA

Compliance carbon allowances are designed to rise with and outperform inflation. Allowances are intrinsically valuable to corporations, who must purchase them for every ton of emissions generated in day-to-day business activity. For this reason, carbon takes on some of the characteristics of real assets as they are an input in the business' production, similar to energy, copper, real estate, and other resources. However, compliance carbon has the significant benefit that it is designed to rise above inflation as carbon prices must increase in real terms to reduce emissions. This design means carbon can provide an inflation hedge plus real return while also providing similar diversification benefits as traditional alternatives. Many investors also highlight California's market because it has a Consumer Price Index (CPI) plus a 5% adjustment to its reserve price (floor price) and its liquidity tiers, signifying the regulator's intention for prices to maintain an above-inflation trajectory.

A large US RIA invests in KCCA for inflation protection. At the firm, every investment on its platform has to fit three objectives: growth, capital preservation, or inflation protection. In their view, California carbon allowances naturally fit into the inflation hedge bucket because of its floor price mechanism. While inflation protection is the leading investment case, the firm also considers carbon a pure play climate investment. In their view, carbon presents a double win for its inflation protection and sustainable impact factor.

Another wealth management advisor shared the same objective of hedging inflation with KCCA, adding that they see compliance carbon as the only true inflation beneficiary. They believe other inflation hedges (i.e., TIPS & REITS†) are too rate sensitive and, therefore, serve as more of a tactical hedge but can lead to an eventual reversal. Beyond inflation protection, they invest in KCCA because of what they view as an asymmetrical return profile inherent in CCAs.

Client Description: Institutional Consultant to Endowments, Foundations, and Pensions

Primary Portfolio Role: Impact/Climate Benefits

Invested Fund: KRBN

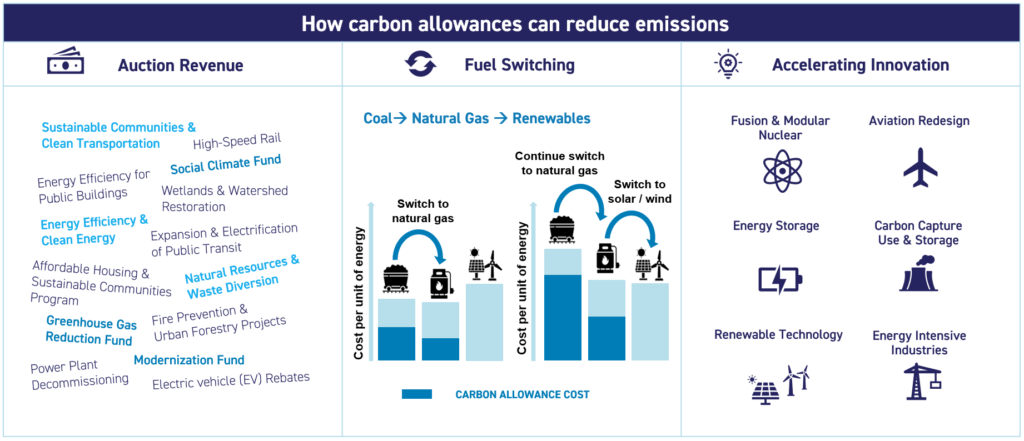

Compliance carbon can offer a pure exposure to climate action and align with impact investment goals. The markets have one purpose: to reduce carbon emissions within the economies in which they operate. By participating in these markets, investors help accelerate price discovery, add liquidity, and make the markets more efficient and effective. As carbon prices rise, polluters are incentivized to decarbonize their business operations or incur higher costs to source allowances. These higher prices also drive fuel switching and more capital investment in green innovations.

An institutional consultant working with endowments, foundations, and pension funds has included KRBN as a real asset option for some mission-oriented clients. This firm views KRBN as a component/segment of a diversified real assets portfolio for mission-oriented investors and serves as a way to hedge increasing climate risk and expense pressures in their broader equity portfolios.

Client Description: Single-family Office

Primary Portfolio Role: Energy Transition Tool

Invested Fund: KRBN

Regardless of views on climate change, the global energy transition is underway. Global governments are adopting policies that raise compliance carbon prices and increase economic incentives, such as the US Inflation Reduction Act or the European Green Deal Industrial Plan. McKinsey puts this capital cycle at $275 trillion in the coming decades.7 For investors, this means that almost all equities and bonds are exposed to this tightening regulation and added transition costs. That said, there will be a number of opportunities arising from the energy transition. However, investors are increasingly finding that simply adopting ESG approaches or divesting from heavy carbon footprint companies that actually form a critical part of the global economy is not an effective approach. Instead, investors could use compliance carbon as an overlay to traditional portfolios to manage these transition risks in an intuitive and portfolio-additive way.

A single-family office has been using KRBN as a liquid tool for its clients as part of an energy transition strategy. The firm sees the energy transition as a significant investment theme, and carbon as a tactical way to get exposure. Carbon can fit seamlessly within existing well-balanced, diversified portfolios and investment sleeves while providing an added level of risk mitigation and exposure to an emerging investment opportunity.

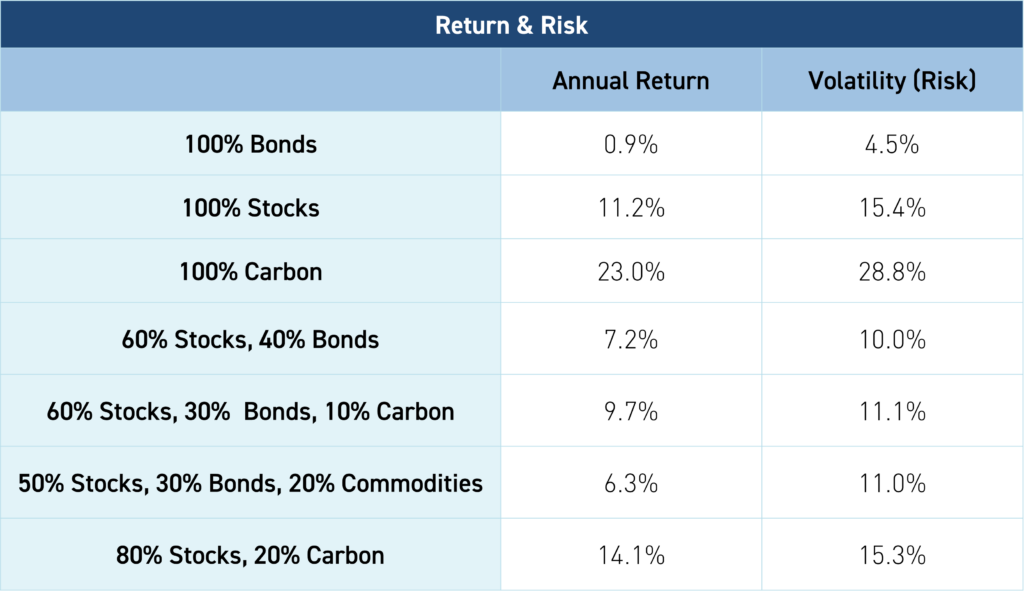

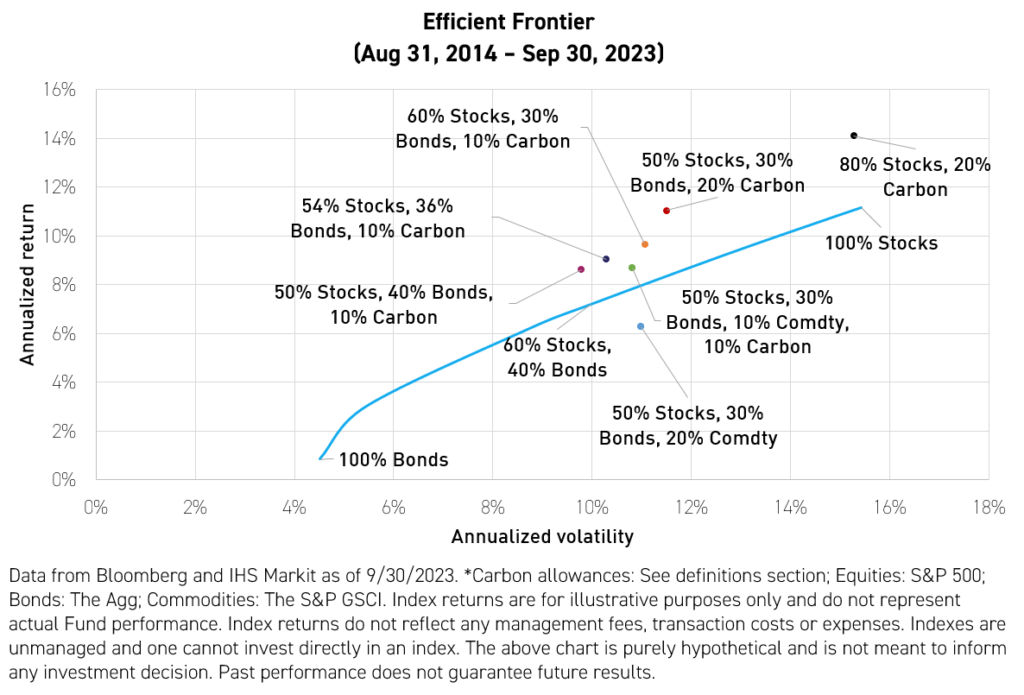

Historical Portfolios

We believe the investment characteristics outlined in these case studies offer investors a way to increase diversification with significant upside potential. Allocating to carbon also contributes to global cap-and-trade systems, which many scientists and governments agree is the most potent tool in the fight against climate change. The charts below illustrate that allocating just 10% to carbon can have meaningful portfolio benefits.

Get in Touch

We would love to hear from existing investors if there are additional use cases you have found. Additionally, we would like to hear from prospective investors if they need any support in executing their carbon strategy.

- S&P 500: Standard & Poor's Index is a capitalization-weighted index of 500 stocks.

- Bloomberg Barclays US Aggregate Bond Index (" The Agg" ): A broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Inception date: January 1, 1986

- The S&P GSCI: A composite index of commodities that measures the performance of the commodity market. Inception date: May 7, 2007

- MSCI US REIT Index (daily price return USD): A free float-adjusted market capitalization-weighted index that is comprised of equity Real Estate Investment Trusts (REITs). Inception date: June 20, 2005

- MSCI All Country World Index (Gross USD): The MSCI All Country World Index is a market capitalization-weighted index designed to provide a broad measure of equity-market performance throughout the world. Inception date: May 31, 1990

- LBMA Gold Price PM: The global benchmark price for unallocated gold delivered, IBA operates electronic auctions for spot, unallocated loco London gold.

- Oil: S&P GSCI Crude Oil Index: Provides a publicly available benchmark for investment performance in the crude oil market. Inception date: May 1, 1991

- S&P Global Clean Energy Index: Designed to measure the performance of 30 companies from around the world that are involved in clean energy-related businesses. Inception Date: February 22, 2007

- Carbon allowances: Top 4 carbon allowance markets by constituent trade volume. IHS Markit's Global Carbon Index is used since the index start date July 25, 2019. From 11/30/2016 to prior to the index start date, 60% and 5% were respectively assigned to EUA futures prices (current year and next year December vintages) using Intercontinental Exchange daily published settlement prices, 20% and 5% were respectively assigned to CCA futures (current year and next year December vintages) using IHS Markit OPIS's daily Carbon Market Report published prices, and 10% was assigned to RGGI (current year December vintage) using IHS Markit OPIS's daily Carbon Market Report published prices. Prior to 11/30/2016, 60% and 5%, respectively, were assigned to EUA futures prices (current year and next year December vintages) using Intercontinental Exchange daily published settlement prices, and 35% was respectively assigned to CCA futures (current year December vintage) using IHS Markit OPIS's daily Carbon Market Report published prices. For the two ranges developed prior to the index start date, Intercontinental Exchange and IHS Markit OPIS's Daily Carbon Market Report publish daily pricing for each contract vintage for all relevant days when the futures trade.

- Market Stability Reserve: The Market Stability Reserve (MSR) holds allowances out of the auction when excess volumes are available on the market and reinjects them when there is low circulation. There is no predetermined price floor or ceiling; however, this mechanism creates stability in the market and improves resilience to future spikes in supply/demand.

*Diversification does not ensure a profit or guarantee against a loss.

†Treasury Inflation-Protected Securities (TIPS): are a type of Treasury security issued by the US government that are indexed to inflation, which provides protection from rising inflation. Real Estate Investment Trusts (REITS): companies that own, operate, or finance income-producing real estate across a range of property sectors.

Citations:

- Data from Bloomberg as of 9/30/2023.

- Bloomberg, “REPowerEU Plan Could Push Carbon Prices to €165/t in 2030”, Apr 11, 2021; Bloomberg, “A Tale of Two Carbon Prices to Shape Biden’s Climate Policy”, Feb 19, 2021; IHS Markit, “UN-affiliated Net-Zero Asset Owner Alliance calls for global carbon price”, Jul 7, 2021.

- California Releases First First Carbon Market Cap Models to 2045," Oct 9, 2023.

- BloombergNEF, “REPowerEU Plan Could Push Carbon Prices to €165/t in 2030”, Apr 11, 2021.

- Data from Bloomberg and IHS Markit as of 3/31/2023. Carbon allowances are weighted by volume. See index definitions section for full definition of each asset class: Equities: S&P 500 ; Bonds: The Agg; Commodities: The S&P GSCI ; Real Estate: MSCI US REIT Index. Index returns are for illustrative purposes only and do not represent actual Fund performance.

- California Air and Resource Board, as of 9/30/2023.

- McKinsey & Company, "The net-zero transition," Jan 2022.