The Rise of China’s Spending Class

Brendan Ahern Interviews Gianni Kovacevic, Author of "My Electrician Drives a Porsche"

Brendan: China’s economy continues to experience tremendous growth even as it shifts focus from manufacturing to domestic consumption. Regardless of this fact, it can be hard to counter the media’s fixation on the parts of China that are slowing as this transition occurs. In today’s environment where negative news articles abound, I always pay close attention to anyone who is able to effectively communicate China’s growth story. One such person is the Canadian investor and author, Gianni Kovacevic, who recently released the book “My Electrician Drives a Porsche”.

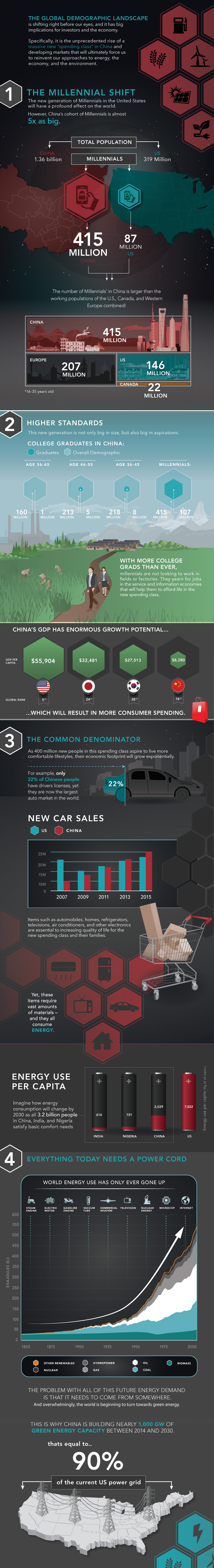

The book deals with the rise of a massive new “spending class” in China and the link between the proliferation of green energy and China’s growing consumption needs. I had an opportunity to meet with Gianni and he graciously agreed to share his views on China and an interesting infographic he commissioned to illustrate China's growth story.

Brendan: There has been a lot of news about China’s growth slowing down, should we be concerned about these reports?

Gianni: First, I would like to point out that China has been a front page story for the past couple years due to the “slow down” that is occurring as the overall GDP growth rate declines. With China comprising such a huge part of total global GDP growth, it’s no surprise that these numbers are watched closely and that the declining rate of growth is highly publicized.

What is often missed by these reports is when China was growing by 14% in 2006 the economy was much smaller than it is now at just over $3 trillion dollars. In 2015 China’s GDP was over $10 trillion dollars, according to China’s National Bureau of Statistics, that makes the 6.9% growth rate in 2015 far more valuable than the 14% growth rate was 10 years ago.

Brendan: One of the key trends you discuss in the book is China’s urbanization over the last three decades. Why is this trend so important?

Gianni: If you only pay attention to Western news reports the transition occurring in China may seem rather clumsy with reports of ghost cities, etc. For those skeptics of the China growth story I counter with this question: when it comes to urbanization, hasn’t the government done exactly what they said they would do?

Twenty-five years ago the government stated they would invest trillions of dollars in urbanization, lift hundreds of millions of people out of abject poverty and transition to a services economy. Fast-forward to 2016, China is about 55% urban, and there are 400-500 million "new spending class consumers".

Brendan: Some of the statistics around China are staggering. Can you give us a summary of the points you illustrate in the infographic?

Gianni: The reason I commissioned the graphic was to try and condense all the statistics I was uncovering while researching the book into an easily digestible format. The main idea is that most people underestimate or blatantly ignore the power and influence of the millennial generation in China.

This new “spending class” grew up post-cultural revolution, with the urbanization trend firmly in place, they are college educated and the thought of working on a farm or in a factory is out of the question for them. The “spending class” is going to take the domestic consumption story and put it on steroids. They will be buying cars, homes, refrigerators, air conditioners and other electronics at rates we have never seen before in the Western world. The surge in consumption is going to require a lot of energy, which will force China to rethink the modern power grid and drastically expand its green energy capacity.

Brendan: How can investors take advantage of the rise of the “spending class” in China?

Gianni: I think in the near term investors should seek exposure to China’s consumer discretionary sector because those companies are going to benefit from the rise of the “spending class”. Additionally, the China technology sector is equally as important because ecommerce is the fastest growing segment of the retail market. In the long term China clean energy companies have a lot of potential for growth because China needs to account for the increased energy demand that the “spending class” is generating.

Brendan: Thank you for sharing this Gianni. The KraneShares CSI New China ETF (ticker: KFYP) offers an overweight exposure to China's technology and consumer discretionary sectors, which we believe will be the beneficiaries of the rise of China's "spending class".

Data in the infographic from kovacevic.com as of 12/31/2015

Krane Funds Advisors, LLC (KFA) has included links to unaffiliated third parties for informational purposes only. The links and the views of the third parties do not necessarily reflect the views of KFA, its management, employees, officers, and affiliated entities. All opinions, evaluations, descriptions and statements do not purport to be complete and are subject to change. KFA makes no representation as to the adequacy of information and should not be construed as an endorsement by KFA, its affiliated entities, management, officers, employees and agents.