China Market Connect February 2024: The Arrow Is Nocked, It Must Fly

By Dr. Xiaolin Chen, Head of International

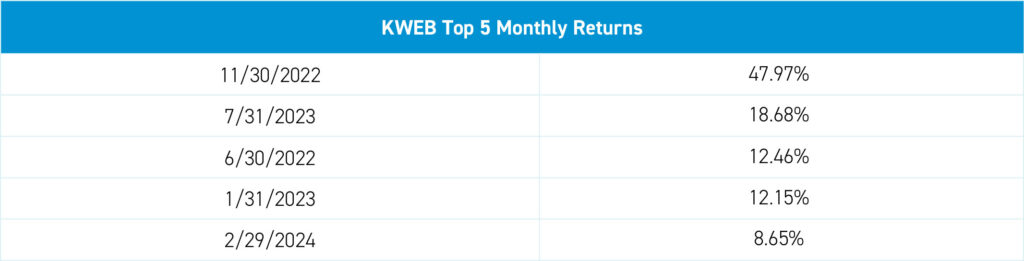

The Chinese equity market experienced a volatile start in January, as last year's GDP figures and doubts about implementing Chinese policymakers' commitments weighed heavily on investor sentiment. This uncertainty caused a sharp pullback and led to a considerable downturn in the equity market at the outset of 2024. Consequently, forced liquidations were triggered for approximately 90% of Snowball-structured products, with a market capitalization of roughly 100 billion.1 In an unusual intervention compared to historical precedents, Chinese authorities stepped forward to alleviate market anxieties, announcing a 2 trillion RMB market stabilization fund dedicated to purchasing shares in the Chinese equity market.2 In February, analysts estimate that over 410 billion RMB of the funding has already been deployed, with expectations of further investments. Reflecting on this, the KraneShares CSI China Internet ETF (Ticker: KWEB) has rebounded as of February, registering its fifth-best monthly return for the past 36 months.3

For KWEB standard performance, top 10 holdings, risks, and other fund information, please click here.

The market experienced a welcome respite during the Chinese New Year (CNY) in February, with the domestic market closing for eight days (February 9–16). This CNY signified the first full-scale New Year celebration post-pandemic, presenting an opportunity for individuals to reunite with their families. It also served as a critical gauge for evaluating whether households would resume spending, especially during such a significant period for China’s population.

Released data indicated that 474 million people traveled domestically during CNY, surpassing the 2019 level by 19%.4 Ridesharing apps, including Didi, the Uber of China, catering services, and retail sales, all saw an increase of over 30% year-over-year.5 Notably, the collection of express parcels surged by 145%, which explains why China dispatched 120 billion parcels in 2023.5

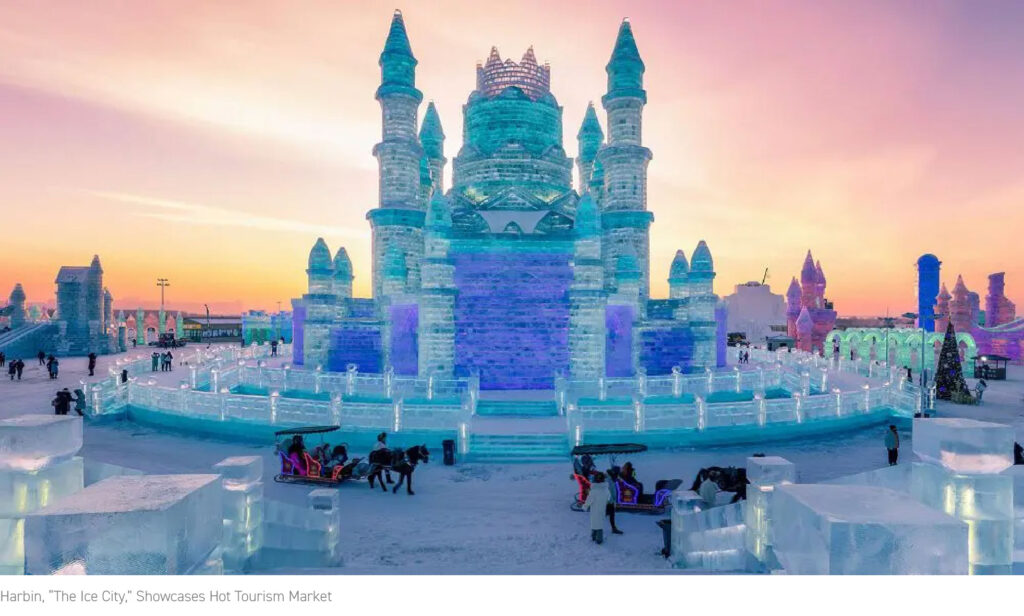

Tourism revenue experienced a 47% year-over-year growth5, and I take particular pride in my hometown of Harbin, known as the "Ice City" in China. Harbin welcomed 3 million tourists in just three days and generated approximately RMB 6 billion in tourism revenue, with its renowned ice sculptures gaining widespread attention. The International Ice and Snow Festival has been a staple in Harbin for 31 years. The festival spans 750,000 square meters and features themed zones that showcase sparkling interpretations of architectural marvels, folklore, and traditional crafts. One of the most impressive ice carvings in recent years was the Flamenco Ice Tower in 2018.

Turning from Harbin hometown pride, back to business now.

Reflecting on the period from March to December of 2023, Chinese policymakers introduced over 24 key pro-market policies. Led by the People's Bank of China (PBoC), these initiatives included cutting various interest rates to provide liquidity across the front, middle, and long end of the yield curve. This action aimed to assist corporations and households in reducing borrowing costs and mortgage payments. Additionally, the government announced an expansion of the fiscal budget, injecting 1 trillion RMB to bolster infrastructure investment.6

The year concluded with the announcement of another 1 trillion RMB dedicated to funding real estate developers and projects in China.7 What message do these measures send to investors? In the second year of President Xi's third term, achieving robust economic results is the top national priority—full stop.

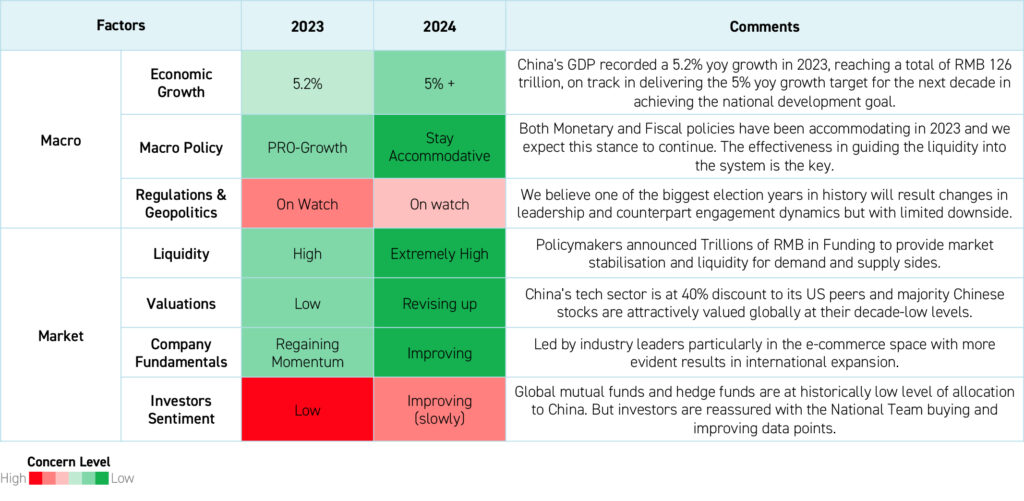

Did these measures help to enhance investor sentiment? Certainly, though, gradually. Just as Rome wasn't built in a day, neither is the restoration of investors' confidence in considering China as an investment opportunity. Therefore, maintaining an up-to-date checklist for the asset class proves helpful. In the vein of the "Magnificent Seven," here is my own "Magnificent Seven" checklist for China's capital market. It may not be exhaustive or align perfectly with your criteria, but I believe it captures the essential elements to monitor:

- Economic Growth - In 2023, China posted a GDP growth of 5.2% year-on-year, amounting to 126 trillion RMB.8 Labelling this performance as disappointing seems unduly harsh to me. In fact, this outcome is set to keep the country on course to meet its 5% year-on-year growth target over the coming decade, which is in line with achieving its national development objectives. This result is good enough in that sense.

- Macro-Policy - Both monetary and fiscal policies have maintained an accommodative stance, and we anticipate this approach to persist. The critical factor is the efficacy with which liquidity is channeled into the system. There is ample liquidity present, if not an abundance.

- Geopolitical – This year marks one of the most significant election years on record in the US. Patience is required while awaiting the outcome. However, the truth remains that China is approaching the challenges it currently faces—and those that lie ahead—with a pragmatic mindset. These issues won't be resolved instantaneously, but there is a preparedness to tackle them. Maintaining a practical approach simplifies matters.

- Liquidity - Trillions of RMB have been announced, and bonds have been issued to support the economy's supply and demand sides fundamentally.

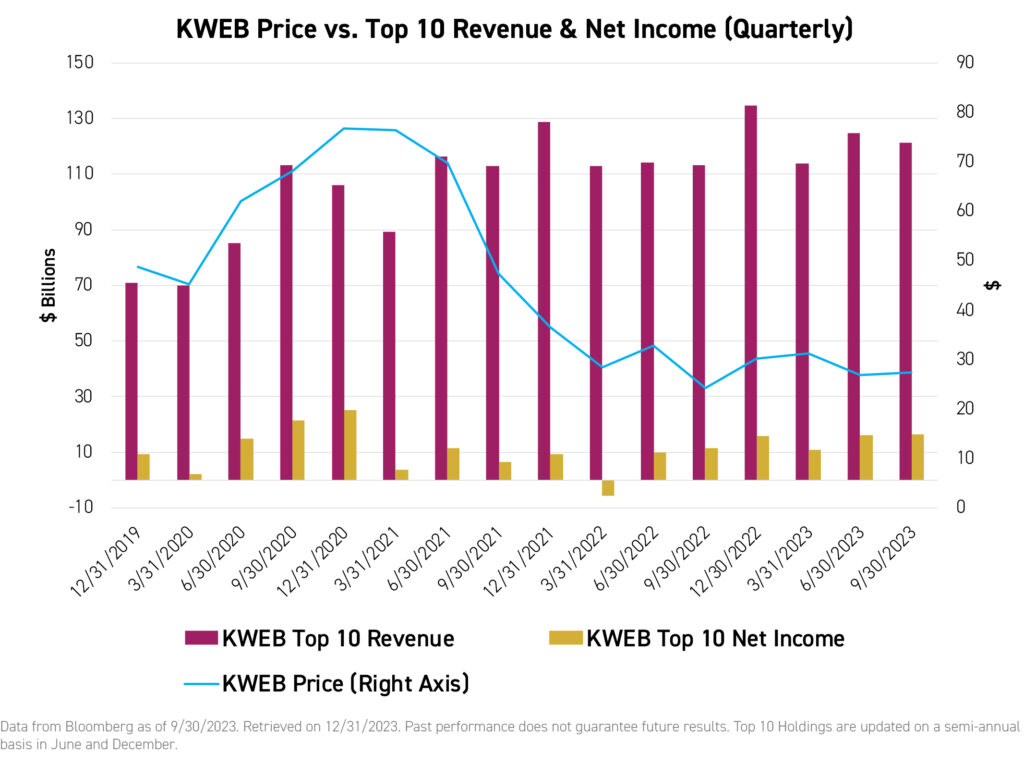

- Valuations – Valuations may sometimes be low for specific reasons, yet in this case, China's valuations seem disconnected from the fundamentals. We observe consistent earnings improvements among Chinese companies; however, their performance and price-to-earnings (P/E) ratios continue to consolidate. This suggests that macroeconomic factors are influencing the current trend. If the macro environment remains stable and corporate liquidity increases, supporting business growth, there is potential for a significant re-rating of these valuations.

- Company Fundamentals - Efforts by Chinese companies to internationalize are beginning to yield positive economic outcomes. For instance, in its latest financial report, Alibaba reported a 44% year-over-year growth in its international business segment.9 Industry leaders, especially those in the e-commerce sector, Smart EV, are demonstrating more tangible results from their international expansion initiatives.

- Investors Sentiment - Global mutual funds and hedge funds currently have historically low allocation levels to China, suggesting that Chinese assets are under-allocated and under-owned as an asset class. With investor sentiment toward the asset class and index gradually improving due in part to a rebalancing of its constituents, we anticipate a return of capital flows to this asset class.

The unfolding progress within China's capital market has convinced us that the crucial 'arrows' necessary for an economic revival and the resurgence of consumer strength are drawn and ready. These 'arrows' are poised, awaiting the decisive release from none other than the Chinese policymakers. Their role is pivotal in catalyzing a significant shift in momentum. This context positions the forthcoming National People's Congress (NPC) as a timely and critical gathering. The market is perched on a peak of high expectations, and on a personal note, I am eager for disclosure from China's policymakers during the NPC. Specifically, I anticipate clarity on two fronts: firstly, the magnitude of the central government's intended expenditure, and secondly, the targeted areas for this investment and spending. Such insights will be critical in providing Chinese corporations with the guidance they need to strategically channel the abundant liquidity within the system into concrete actions.

Patience is key. In less than three weeks, we expect to understand the path ahead better.

Definitions:

"Magnificent Seven" - Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, the seven US companies that have generally produced excellent stock market returns.

Citations:

- China ‘Snowball’ Derivatives Worth $13 Billion Near Loss Levels”. Bloomberg News. 1/11/2024

- “Everything China’s Doing to Rescue Its Battered Stock Market.” Bloomberg News. 2/20/2024

- Data from Bloomberg as of 2/29/2024

- “China's domestic tourism market surges during Spring Festival holiday.” Xinhua. 2/18/2024

- Data from Goldman Sachs as of 2/18/2024

- “China set to approve $137 bln in extra sovereign debt on Tuesday –sources.” Reuters. 10/23/2023

- "China Mulls $137 Billion of New Funds to Aid Housing Market”, Bloomberg News. 11/14/2023

- Leahy, Joe. Lockett, Hudson. Chassany, Anne-Sylvaine. “Li Qiang says China’s economy grew an ‘estimated’ 5.2% in 2023”. Financial Times. 1/16/2024

- Chiang, Sheila. “Alibaba bets on overseas e-commerce unit amid sluggish growth in China.” CNBC. 2/19/2024