Jonathan Krane’s 5 Key Takeaways for US-China Relations from The APEC Summit in San Francisco

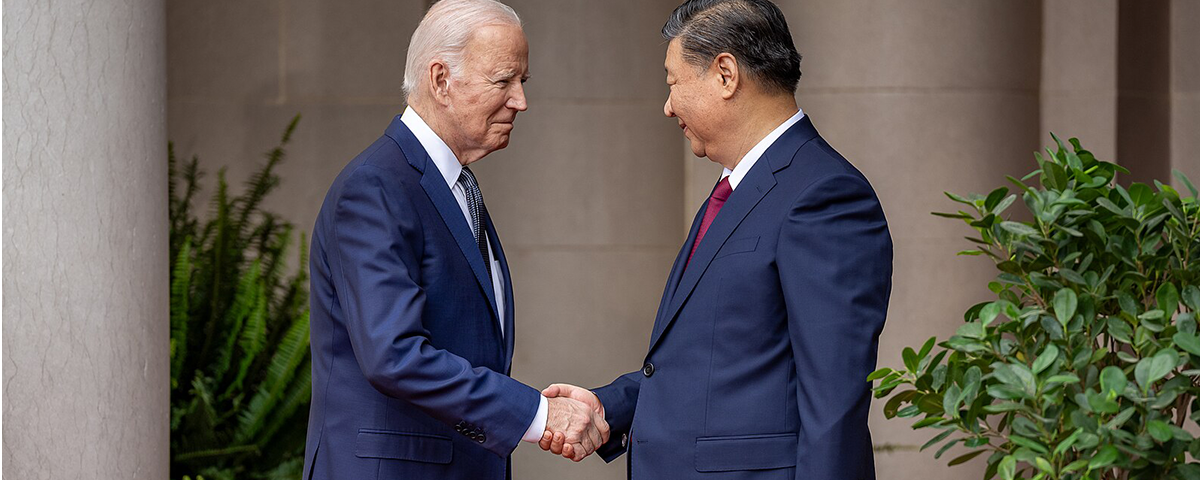

November’s Asia-Pacific Economic Cooperation (APEC) Summit in San Francisco signaled a positive turning point for relations between the world’s two largest economies. The KraneShares team and I were on the ground participating in several events, including the CEO dinner with China's President Xi Jinping.

APEC is a regional forum established in 1989 with 21 Pacific Rim member economies, focusing on trade liberalization, business facilitation, and economic and technical cooperation, culminating in an annual meeting to discuss economic issues, and set agendas.

In addition to the event with President Xi, we attended a dinner with policymakers and APEC member officials hosted by U.S. President Joe Biden and the US-China Climate Forum, hosted by the California-China Climate Institute. We also hosted our own event featuring former Iowa Governor and U.S. Ambassador to China Terry Branstad, the Asia Society Policy Institute's Rorry Daniels, and the California-China Climate Institute's Dr. Fan Dai, which was moderated by our General Counsel & former U.S. Ambassador to Singapore David Adelman.

Below are my five key takeaways from these events.

1. China is open for business

President Xi arrived in San Francisco on a Boeing 747, an iconic symbol of American aviation. Xi’s choice of plane is a reminder that China’s market presents a massive opportunity for American companies across multiple industries. Ahead of Xi’s trip, Boeing announced it is preparing to resume production of its 737 Max in China at its Zhoushan facility as soon as this month. Production has been halted there since 2018.1

During a welcome dinner with California Governor Gavin Newsom, President Xi was presented with a Golden State Warriors NBA basketball jersey. The NBA is a multibillion-dollar industry in China, which represents a fanbase of hundreds of millions for the league and is another symbol of the importance of China’s market to American businesses.2

As a show of good faith, China purchased 600,000 metric tons of soybeans the week before Xi’s arrival, one of the largest single-day purchases of 20233. Reuters reported that this move offered “a glimmer of hope for the most valuable U.S. farm export after overseas sales of the 2023 harvest had fallen well behind the normal pace.”

The importance of U.S. agriculture exports to China was echoed by former Iowa Governor and U.S. Ambassador to China, Terry Branstad, who traveled with us to San Francisco. Prior to the CEO meeting, President Xi met with Branstad and a group of his other “old friends” from Iowa who hosted Xi’s first visit to the U.S. in 1985 when he came to study its agricultural system. Branstad remarked that Xi still remembered the address of the house where he stayed nearly 40 years ago and that this meeting represented President Xi's genuine desire to cooperate with the United States and work toward a more constructive relationship.

But beyond symbolic gestures, President Xi made it overtly clear in his own words that China is open for business during his speech to American business leaders at the CEO summit on November 16th.

You can read or listen to a full English translation of Xi’s speech here, courtesy of the San Francisco Examiner.

President Xi stressed that China is an attractive investment destination. He emphasized China's robust economy and status as a major driver of global growth, positioning it as a prime location for American investment, stating: “The overall Chinese economy, blessed by its strong resilience, enormous potential, and ample room for maneuver, remains promising, and it will remain so in the long run.”

He also spoke about the openness and continual improvement of China’s business environment, highlighting China's commitment to an open economy with expanded market access for foreign investors. President Xi said: “China’s resolve to foster a market-oriented, law-based and world-class business environment will not change.”

President Xi concluded his speech by inviting global business communities, including American businesses, to participate in and benefit from the opportunities presented by China’s high-quality development and modernization drive. He invited “friends from business communities across the world to invest and deepen [their] footprint in China.”

There have been several notable deals announced leading up to the event and directly following it. These include:

- Meta partnering with Tencent to sell its virtual reality (V.R.) headset in China, marking the first time the company has been allowed to do business in China in 14 years.4

- U.S. chipmaker Broadcom receiving China’s regulatory approval to merge with cloud software company VMware, a move China had previously considered blocking based on the U.S. tightening rules around China’s access to foreign chips.5

- Ford restarting construction of a factory to produce batteries licensing technology from leading Chinese battery-maker CATL.6

- McDonald’s increasing ownership of its China business from 20% to 48%. China is McDonald’s second-largest market by number of locations.7

2. The world wants to see the U.S. and China get along

Another key takeaway from the APEC summit was that global business and political leaders wish to see a more productive US-China relationship. The high attendance rate of leading CEOs in the financial services, technology, and consumer industries at the dinner hosted by Xi in San Francisco speaks volumes. Attendees at the dinner included Tim Cook, Apple CEO, Larry Fink, BlackRock CEO, Steven Schwarzman, Blackstone Group CEO, Elon Musk, Tesla CEO, and Marc Benioff, Salesforce CEO.

The attendance of so many CEOs of global US companies from various industries underscored the country’s importance both for its domestic market and vital place in the supply chains for many products.

Meanwhile, Wall Street is still looking towards the world’s second-largest economy for growth in terms of both securities investments and growing their local footprints in wealth management, investment banking, among other divisions to serve more Chinese clients.

APEC is a consortium of economies, not countries. As such, the organization includes representatives from places such as Hong Kong, despite its status as a special administrative region (SAR). By definition, the organization is completely focused on economic matters. Economies along the Pacific Rim need to trade with both the U.S. and China simultaneously and interchangeably. Although many rely on the United States for security, many of these same U.S. allies rely more heavily on China for trade.

Taiwan’s representative at the summit Morris Chang complimented the Biden-Xi rendezvous as a “good meeting.”8 Meanwhile, Managing Director of the International Monetary Fund (IMF) Kristalina Georgieva said that the meeting was “a badly needed signal that the world needs to cooperate more and a positive sign for cooperation on global challenges, especially climate change.”8

3. Dialogue has resumed at the highest levels.

The mutual decision to resume regular communication between the U.S. and Chinese militaries was crucial. The U.S. and China have had a tradition of regular communication since the Cold War. However, in recent years, many of these lines of communication have gone silent. The militaries from both countries are now following Biden and Xi’s lead in resuming regular dialogue.

There were commitments to regular dialogue in other areas, too. Both governments promised to cooperate on preventing the export of the key component chemicals used to make Fentanyl in illicit labs. They also agreed to formal dialogue on the regulation of artificial intelligence (A.I.) technology.9

Finally, climate dialogue has resumed following U.S. Climate Envoy John Kerry’s visit to China in July, during which he met with his Chinese counterpart Xie Zhenhua.10 Kerry also addressed attendees during the APEC Summit.

4. There are more improvements for the US-China relationship to come. Here is what we are looking for next.

A New Trade Pact: After facing opposition from top Democratic lawmakers, Biden retracted the mention of a potential new trade pact with Pacific Rim countries, including China, from the APEC agenda.11 We would like to see the new trade pact gain more traction and applaud its potential inclusion of China.

More “All Clear” Signals From The PCAOB: The U.S. Public Company Accounting Oversight Board (PCAOB) visited Hong Kong this year for another round of audit reviews. We are looking forward to the release of its findings, which can be expected early in the new year. This is the second round of reviews since the PCAOB was granted full audit access in 2022, satisfying the requirements of the Holding Foreign Companies Accountable Act (HFCAA). We believe that the findings of this year’s audit review will show that US-listed Chinese companies and their auditors continue to fulfill their legal obligations to U.S. investors.

Clarity On Semiconductor Trade: During a meeting with U.S. Commerce Secretary Gina Raimondo in San Francisco, China's Commerce Minister, Wang Wentao, expressed concern about U.S. restrictions on semiconductor exports to China, sanctions on Chinese firms, and tariffs on Chinese imports. Wentao emphasized the importance of discussing the boundary between national security concerns and trade and economic cooperation. As a step towards addressing these concerns, Wang and Raimondo agreed to hold the first meeting of a commerce working group at the vice minister level in the first quarter of 2024, according to China's commerce ministry.

Pandas Back at US Zoos: During his speech at the CEO dinner, Xi conveyed China's readiness to “continue cooperation with the United States on panda conservation,” which we believe to be a strong signal of subsiding tensions. Xi emphasized their role as "envoys of friendship between the Chinese and American peoples” and expressed his intention to send new pandas to the U.S. after its loan agreement with Zoo Atlanta expires this year. While Xi did not provide specific details on the timing or location of the panda transfer, there is speculation that the next pair could be sent to the Bronx Zoo in New York or the San Diego Zoo in California.

5. Investors have money on the sidelines and are watching China closely. There is a lot of interest in how China can fit into investors’ portfolios.

As Wall Street Analysts begin to publish their 2024 outlooks, China, and particularly China internet, are top ideas for the new year and researchers have been vocal about this in the media recently. Kinger Lau, the Chief Equity Strategist at Goldman Sachs, discussed his firm’s views on China in a CNBC interview. Goldman’s house view is that China could see its first annual equity index gains in four years in 2024.12 Upgrades to China stocks could lead to a reversal in US managers’ underweighting of the market.

Conclusion

We believe November’s Asia-Pacific Economic Cooperation (APEC) Summit in San Francisco signaled a positive turning point for relations between the world’s two largest economies. Although there is more work to be done, the resumption of formal and sincere communication on a range of issues including security, climate, and AI is highly encouraging. Meanwhile, President Xi has personally assured US businesses that China is open to them. In the coming years, we hope both countries can turn encouraging words into effective actions.

Citations:

- Mondal, Pollock. "Boeing set to resume operations at Zhoushan facility amid thriving Chinese aviation market," Associated Press. November 16, 2023.

- Roberts, Daniel. “Why the NBA really needs China,” Yahoo Finance. November 01, 2019.

- Plume, Karl. “Exclusive: China makes largest US soy purchases in months -traders,” Reuters. November 7, 2023.

- Huang, Raffaele. “Meta Strikes Deal to Return to China After 14 Years,” The Wall Street Journal. November 9, 2023.

- “Tech war: China approves Broadcom-VMware merger with conditions, in sign of thaw with US,” South China Morning Post. November 22, 2023.

- White, Joseph “Ford scales back Michigan battery plant, restarts construction,” Reuters. November 21, 2023.

- Escobar, Sabrina “McDonald’s Buys Back Minority Stake in China Business,” Barron’s. November 20, 2023.

- Lawder, David. “APEC leaders divided on Ukraine, Gaza wars, back WTO reform,” Reuters. November 18, 2023.

- “Readout of President Joe Biden’s Meeting with President Xi Jinping of the People’s Republic of China,” The White House. November 15, 2023.

- Mazzocco, Ilaria. “Assessing Special Envoy Kerry’s Visit to China,” Center For Strategic & International Studies (CSIS). July 20, 2023.

- Swanson, Ana. “Biden’s Pacific Trade Pact Suffers Setback After Criticism From Congress,” The New York Times. November 13, 2023.

- Tan, Clement. “Goldman Sachs expects China stocks to make first annual gain in 4 years in 2024,” CNBC. November 21, 2023.