The Case For A Shift To Emerging Markets Consumer Technology in a Post Covid-19 World

The March 2020 stock market crash that coincided with the beginning of the Covid-19 pandemic caught investors off guard. Equally perplexing was the bull market that immediately followed as nearly all losses in broad US market indexes were recouped in a couple of months even as the pandemic continued to ravage much of the world. Whatever your current relationship is with the market, three things are clear: the equity comeback in the US has been massive, it has been powered almost entirely by big tech, and its future remains just as uncertain as it was in March.

Potential headwinds for the US market include the scaling back of Fed stimulus programs, increasing pressure on the US dollar, valuations coming back to earth, and the potential for new shutdowns due to rising Covid-19 case numbers. Needless to say, increasing global diversification in one's portfolio may be wise. We believe Emerging Markets Consumer Technology presents a ripe option for global diversification at this critical juncture.

What is Emerging Markets Consumer Technology?

While the likes of FAANG (Facebook, Amazon, Apple, Netflix, and Google) define the consumer technology market in the developed world, an entirely different group of companies defines the market in the developing world. Emerging Markets Consumer Technology refers to the online companies that facilitate the everyday activities of the middle class in Emerging Markets, one of the fastest-growing consumer groups on the planet. According to a study from the Brookings Institution, middle class consumption could reach 50% of total global consumption by the year 2030, more than doubling from 2015.1

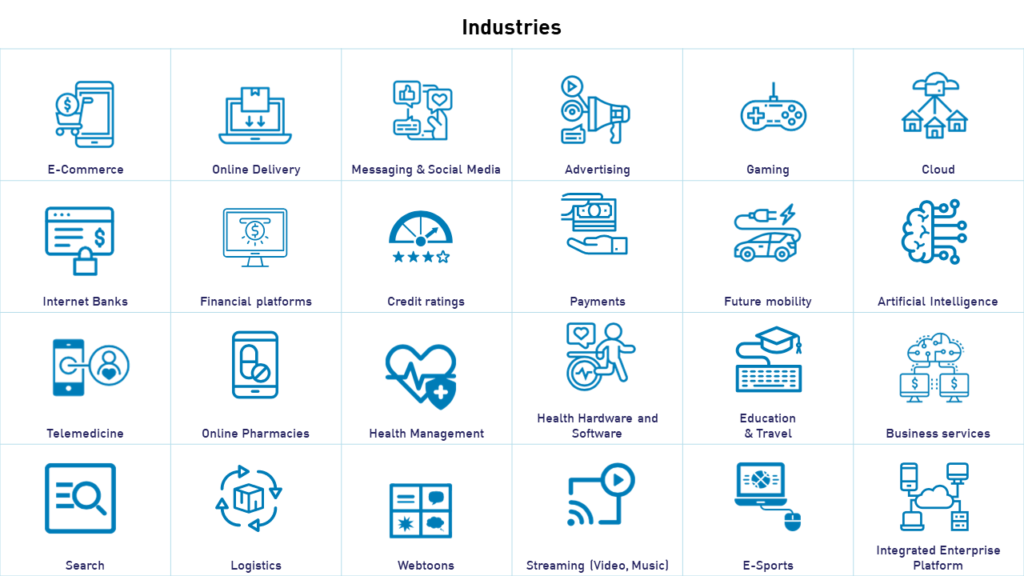

Emerging Markets consumer technology refers to companies, large and small, that are busily moving a whole host of historically brick-and-mortar functions online, often increasing efficiency, lowering costs, and improving the consumer experience in the process. These companies provide services including, but not limited to, online shopping, financial services, health care, entertainment, communications, transportation, and education.

Emerging Markets Consumer Technology includes a variety of sectors and firms that do business in many different Emerging Market countries.

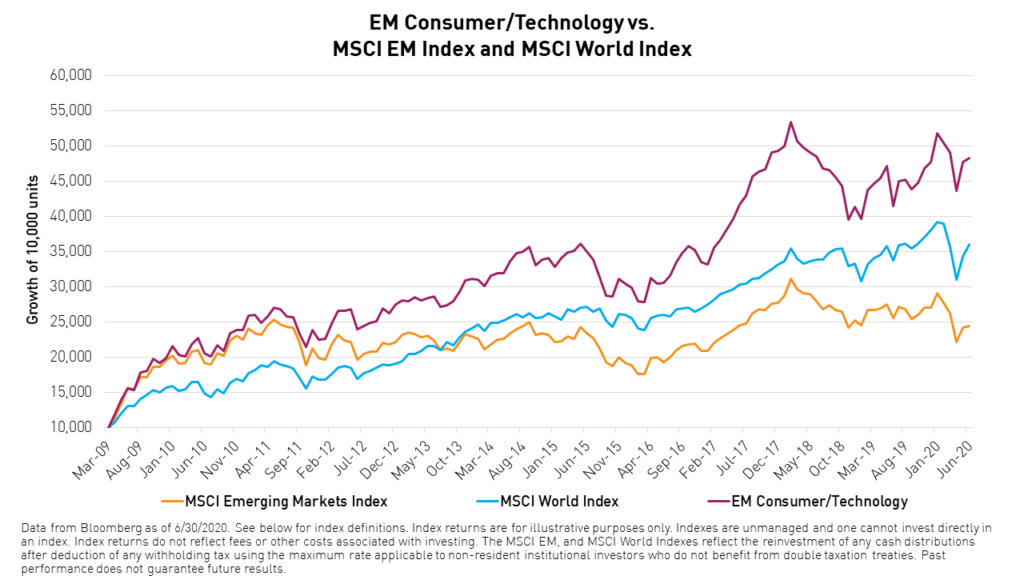

Given the recent outperformance of FAANG in the US, many investors are looking to Emerging Markets Consumer Technology companies for similar opportunities.

These companies have a strong track record of outperforming broad Emerging Markets (EM).

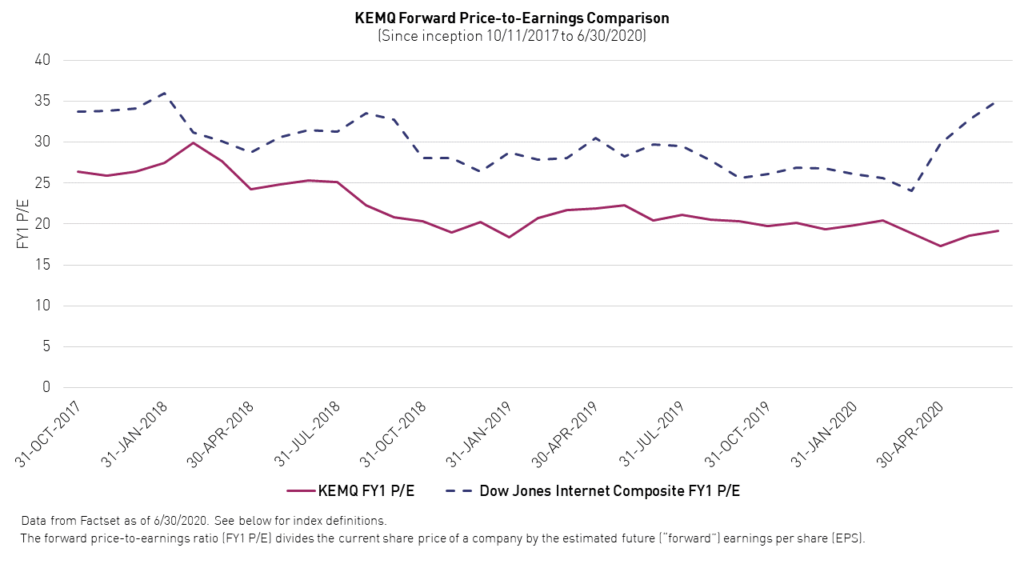

These companies remain undervalued compared to their US peers as evidenced by comparing the KraneShares Emerging Markets Consumer Technology ETF to the Dow Jones Internet Composite Index.

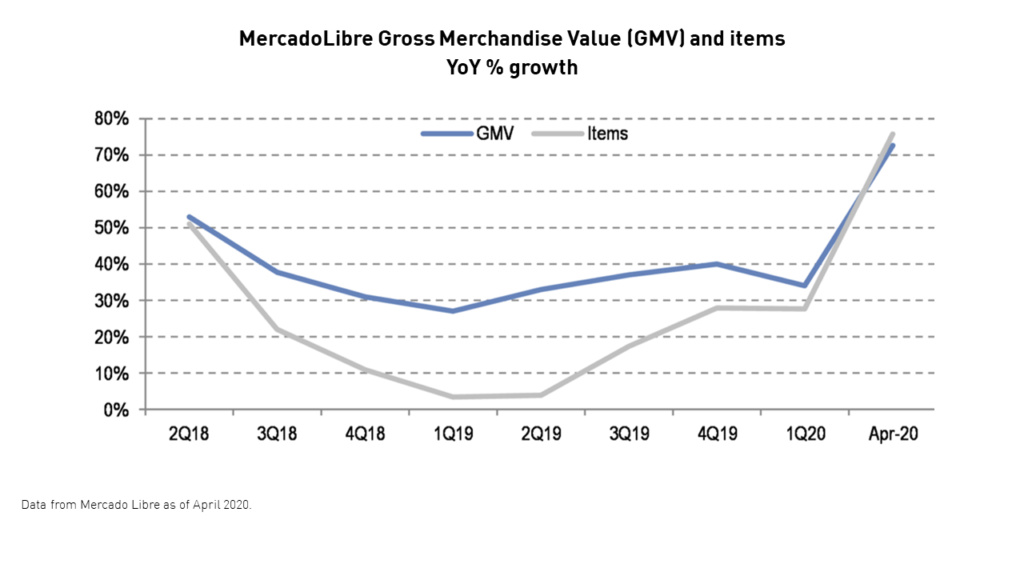

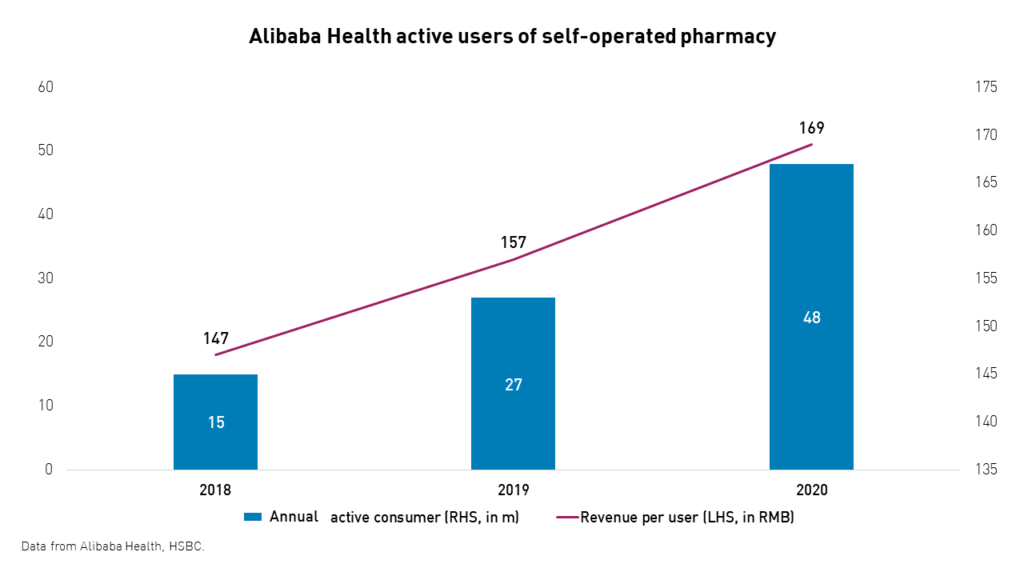

These companies saw their user numbers skyrocket during the Covid-19 pandemic.

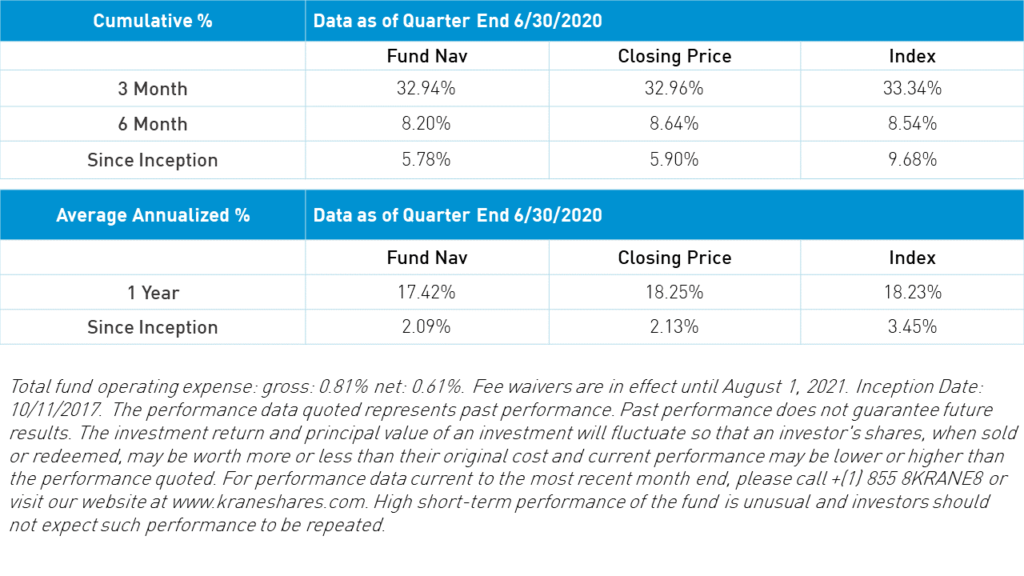

Investors can gain exposure to EM consumer technology through the KEMQ ETF. The Fund has returned over 30% in the past three months as of 6/30/2020.

The post-COVID-19 world may provide long-term benefits for these companies.

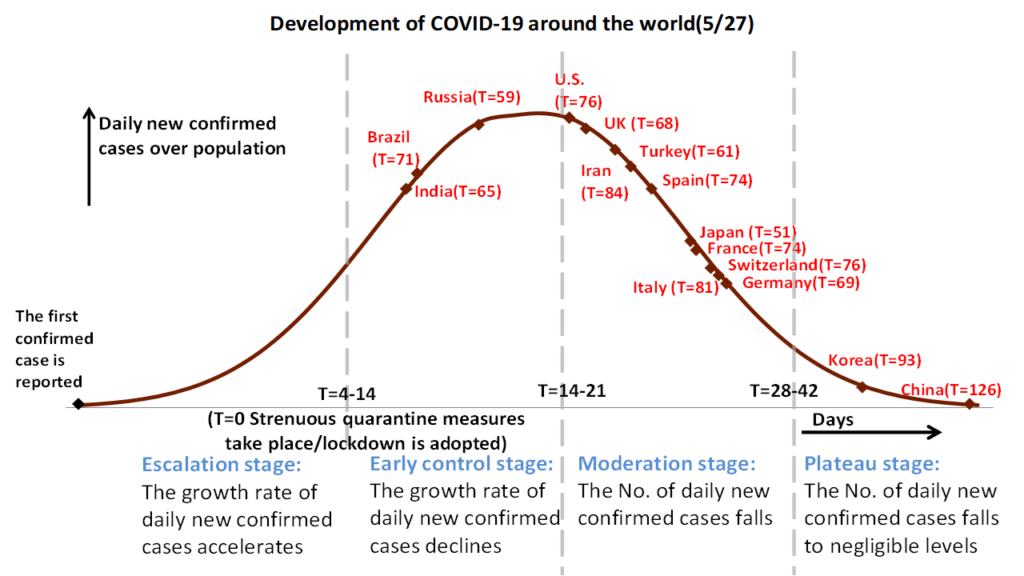

The countries that make up the majority of KEMQ's holdings, such as South Korea and China have been more successful than the US so far at curbing the spread of the virus. Furthermore, South Korea and China have the advantage of having been the first to experience major outbreaks of Covid-19. This advantage is what is known as “first in, first out.” Their economies are further along on the road to recovery. Moreover, the continued spread of the virus in regions that have not recovered is likely to increase demand for these services.

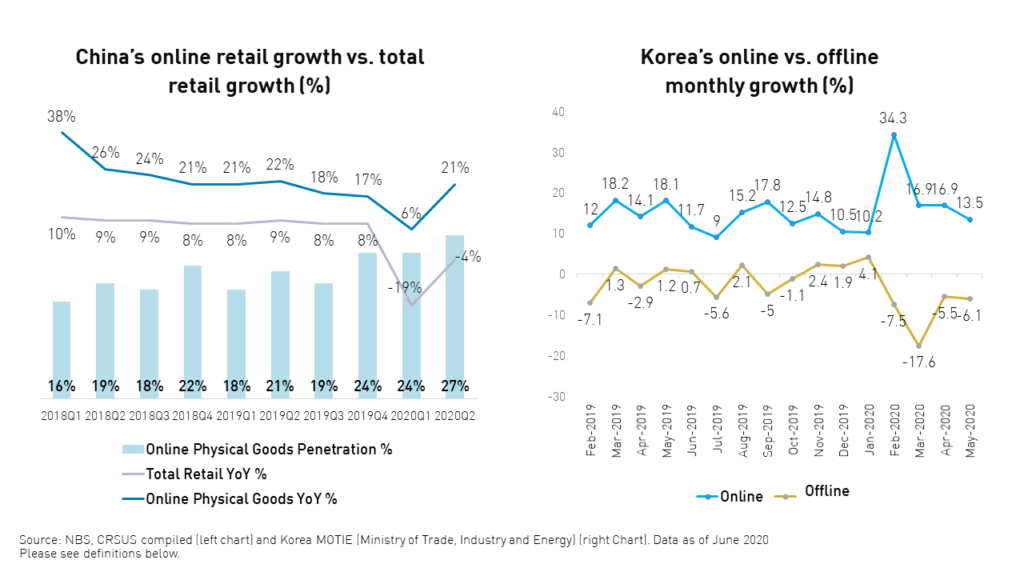

In both China and Korea, online retail sales significantly outpaced offline retail sales during the Covid-19 pandemic.

Although the short-term pandemic effect on these companies will not last forever, we believe that many of the changes in consumption habits brought on by the pandemic may remain, leading to a long-term catalyst for these companies.

Emerging Markets Consumer Technology In Portfolios

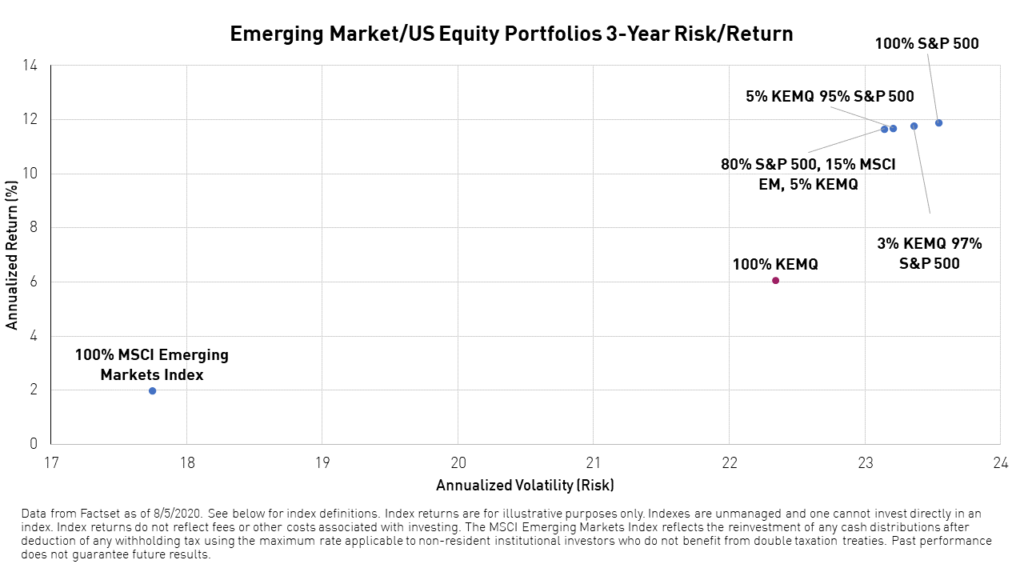

For investors who are underweight Emerging Markets and would like to balance their portfolio with an alternative to US growth/tech, taking a more concentrated approach and allocating to EM consumer technology instead of or in addition to broad EM may provide performance benefits.

In our last note on emerging market investing, we presented hypothetical EM portfolio allocations using KEMQ that represent an EM weight of 20% in an overall portfolio. In one, we discussed replacing broad EM with KEMQ entirely and in another, we discussed using KEMQ as a complement to an existing broad EM allocation. We analyzed the risk and return profile of those strategies compared to investing 100% in broad EM, as measured by the MSCI Emerging Markets Index, over the past three years since the inception of the KEMQ ETF.

Allocating to Emerging Markets Consumer Technology through the KraneShares Emerging Markets Consumer Technology ETF (Ticker: KEMQ) may provide meaningful diversification for US investors while maintaining many attractive attributes of FAANG-type companies that have driven technology's outperformance in the US.

1. Homi Kharas, “The Unprecedented Expansion of the Global Middle Class” Brookings Institution, February 2017, retrieved 6/30/2020.

Index Definitions

MSCI Emerging Markets (EM) Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

The Solactive Emerging Markets Consumer Technology Index (KEMQ's Index): The Solactive Emerging Markets Consumer Technology Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transactions.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Emerging Markets (EM) Consumer/Technology: Prior to the GICS reclassification in October 2018, this is defined as 28% MSCI Emerging Markets Information Technology Index, 10% the MSCI Emerging Markets Consumer Discretionary Index, and 5% the MSCI Emerging Markets Communication Services Index. After the reclassification, this is defined as 15% the MSCI Emerging Markets Information Technology Index, 14% the MSCI Emerging Markets Consumer Discretionary Index, and 11% the MSCI Emerging Markets Communication Services Index.

MSCI World Index: The MSCI World Index is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1969. The index includes developed world markets and does not include emerging markets.