New Drivers For China Healthcare: AI Med-Tech Innovation, Cancer Treatment, & Favorable Balance of Trade

By Henry Greene, Investment Strategist

Executive Summary

- Biotechnology and medical devices firms in China have been on an innovation streak lately. Mindray has released an AI-powered care management system and Akeso has developed a new lung cancer treatment that could be twice as effective as the current global best-in-class treatments, based on clinical trial data.10

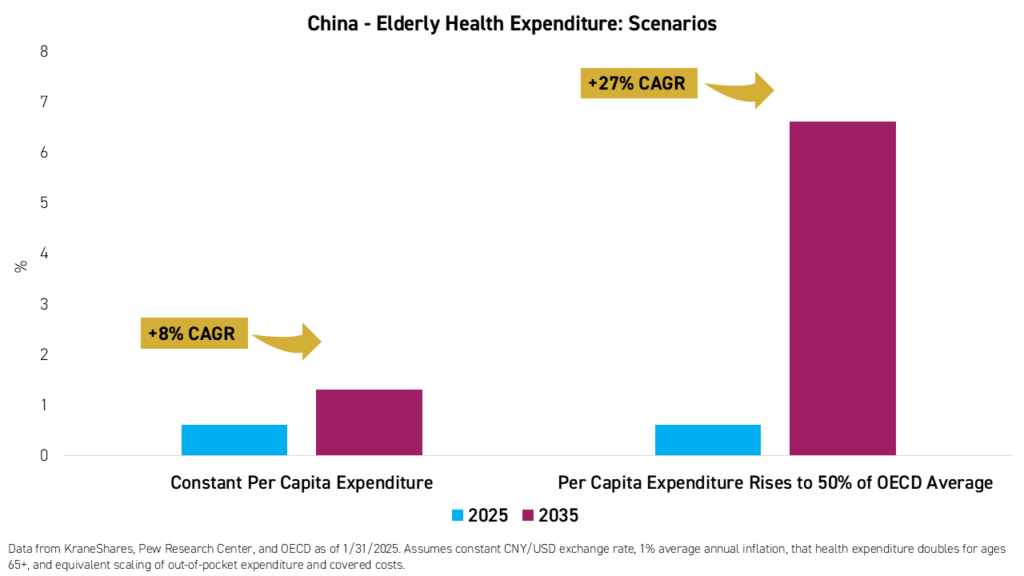

- China's monumental demographic shift could be a significant catalyst for the country's healthcare firms as spending on healthcare by China's rapidly growing elderly population could achieve a compound annal growth rate (CAGR) of 27% over the next ten years.

- The healthcare sector is a rare case in which the United States actually maintains a trade surplus with China and many China-based firms have developed a global footprint, employing large workforces in the United States. This could mean the sector is better insulated from geopolitical risks than others.

- China's regulators recently adopted a more supportive approach to the sector compared to the past, releasing plans to induce more private investments in innovative medicine and expand insurance programs to cover the costs of new drug development.

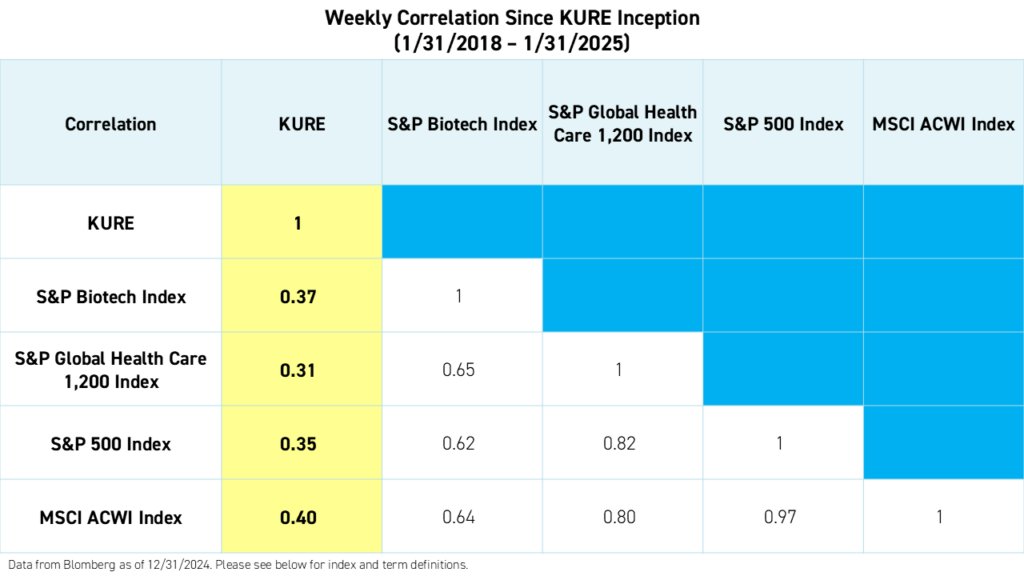

- The KraneShares MSCI All China Healthcare Index ETF (Ticker: KURE) provides comprehensive exposure to the top China-based healthcare companies. KURE gives investors access to major players in biotechnology, general pharmaceuticals, hospital management, and traditional Chinese medicine worldwide, including Mindray and Akeso. We believe KURE could complement any global healthcare portfolio, having demonstrated low correlations to global healthcare markets and providing exposure to under-owned stocks.

Introduction

Just as DeepSeek's AI innovation is causing a re-rating in China's internet and technology sectors, China's healthcare sector is seeing increased attention from investors. Government programs to catalyze biotechnology innovation, Mindray's release of an AI-powered care management system, Akeso's successful clinical trials for a new lung cancer treatment, and regulatory clarity around Wuxi Apptec and Wuxi Biologics being able to continue to serve American biotech firms, among other factors, could drive a re-rating of China's healthcare sector.

This sector could be an important global growth theme in the coming years and should not be ignored. China’s rapidly aging population could lead to unprecedented demand for various healthcare services and products. Meanwhile, many China-based firms have globally diversified businesses, especially in the lucrative medical devices and contract research industries. However, China’s healthcare sector is often excluded from global healthcare allocations, despite its importance to the world’s healthcare market and potential diversification benefits.*

Domestic Demand: A Secular Growth Trend Driven By Demographics, Rising Incomes

China’s population aged over 60 is expected to more than double by 2050 to more than the entire population of the United States,1 potentially driving unprecedented demand for healthcare. Elder spending on healthcare could increase from approximately $600 billion today to $1.3 trillion by 2035, suggesting a compound annual growth rate (CAGR) of over 8%2, assuming per capita spending remains constant.

Currently, per capita health expenditure in China is less than 10% of the average for the member states of the Organization for Economic Cooperation & Development (OECD)3, which include mostly developed and middle-income countries. If China’s per capita, out-of-pocket health expenditure were to reach just half of the OECD’s average of $4,986 in ten years, the CAGR of elder health expenditure would be nearly 27% through 2035.

Policy & Geopolitics: Improving Factors For An Insulated Industry

We believe China’s healthcare firms are more insulated from US-China tensions compared to other sectors. This is because the healthcare sector is a rare case in which the United States actually maintains a trade surplus with China and many China-based firms have developed a global footprint, employing large workforces in the United States.

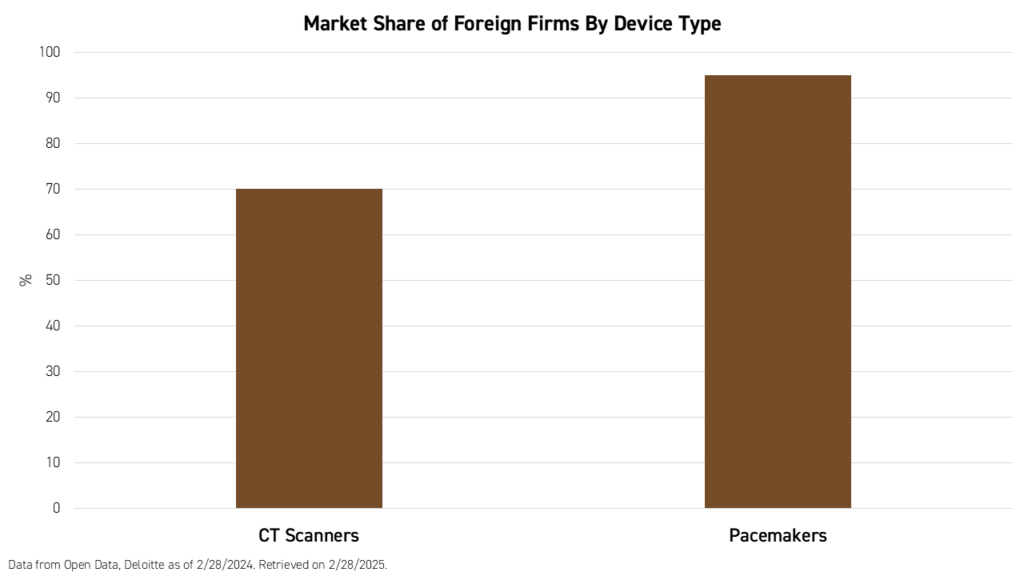

US and global companies possess high market share in many of the industries in which they compete with local Chinese peers. In medical devices, for example, global firms including General Electric, Philips, Siemens, Abbott Labs, and Boston Scientific enjoy a majority of the market share in China.4

Executives at Mindray, a China-based global medical devices powerhouse, told us that they are confident in their continuing ability to operate within and export to the United States without disruptions because they go head-to-head with US firms in the local market.

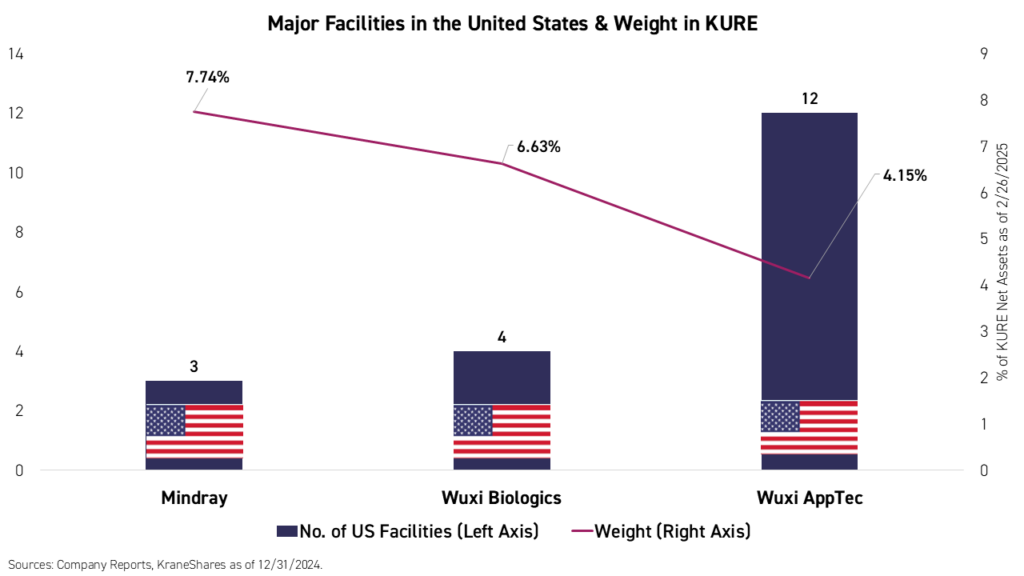

Beyond Mindray, top KURE holdings Wuxi Biologics, and Wuxi Apptec also have significant workforces in the United States. This also factors in US policymakers’ decisions to restrict or tariff their activity.

China healthcare companies received a significant reprieve in terms of geopolitical risks when the US Senate declined to include the provisions of the BIOSECURE Act, which passed in the House, in the National Defense Authorization Act at the end of 2024. The Act would have restricted American companies that receive federal Medicare and Medicaid funding from outsourcing drug research and development to contract research giants Wuxi Biologics and Wuxi Apptec. Wuxi Apptec alone is estimated to have been involved in the development of 25% of the drugs currently on the market in the US.6 As such, companies including Merch, Kyverna, and Iovance Biotherapeutics protested the BIOSECURE Act, saying that it could have a devastating effect on their production capacity for various drugs and treatments, both currently licensed and in the pipeline.7

Domestic regulations in China have also been challenging for the sector in recent years, but could represent an improving factor in 2025. In 2021, China’s government embarked on a campaign to both lower drug prices and reduce excess in the purchasing process for drugs, treatments, and devices by public hospitals. We believe the latter campaign concluded in the third quarter of last year, based on conversations with industry participants and official statements

Coinciding with this timeline, in September of last year, KURE holding and biotechnology pioneer Akeso released clinical trial data for its new lung cancer treatment. The trial data showed that, with this new treatment, tumors would take over 11 months before beginning to grow again compared to less than six months for the global leader in the space, Keytruda.10 The result of the clinical trial is a testament to the prowess of China's biotechnology industry, and the timing of its release may indicate a return of confidence within the industry, driven by a lighter regulatory touch.

In February of this year, regulators released two papers on improving the appetite for private equity and venture capital investors for investments in innovative drug development in China and expanding the medical insurance capital pool to cover the costs of innovative drug developments.8 These papers represent another positive signal from regulators for the biotechnology industry in China.

Investment Case: High Growth, Low Exposure, & Low Correlations

This sector, which we believe has high growth potential, is shockingly under-allocated by global investors based on weights in commonly-used global healthcare indexes. Despite China-based firms having global customers, many are left out of global healthcare indexes. The S&P Global Healthcare 1,200 Index, for example, has no exposure to China whatsoever.9

Furthermore, China healthcare tends to have a low correlation with the global healthcare sector, making its industry a potentially powerful source of diversification for your global healthcare portfolio.*

Mindray: Powering Healthcare Through AI & Technology Innovation

Mindray is a global medical devices manufacturer and a top holding in KURE. The company has been on an innovative streak lately, developing a host of new solutions for care professionals, including tablet-sized patient monitoring terminals, AI-powered blood testing, and systems for care management. Listed in Mainland China, Mindray is under-owned by global investors.

We were pleased to be invited to Mindray’s Annual Investor Day at their headquarters in Shenzhen this past June. There, we caught a glimpse of some of the groundbreaking innovations in medical technology occurring at this vibrant campus. The following are only a few examples of the new technologies offered by Mindray for medical care professionals across the globe.

Patient Monitoring

In emergency situations, patient monitoring can be a challenge as first responders are often unable to obtain a complete analysis of the patient's condition. To avoid this, some ambulances may possess a full-scale, in-hospital patient monitoring system. But, this requires an ambulance of a certain size and can be a burden for hospital networks in rural or underdeveloped areas.

Mindray is trying to change this through technology. Their tablet-sized patient monitoring device can monitor all the same indicators that a full-sized hospital patient monitoring system can. And, when the ambulance reaches the hospital, the tablet system can be connected to the hospital’s monitoring system with no data loss.

Care Management

Mindray executives told us that the use of AI can dramatically reduce the time spent doing paperwork and putting together patient records and diagnostics. This is what drove the launch of Mindray’s AI-powered M Connect service for care management. M Connect is a one-stop-shop for hospitals and doctors to house their data and efficiently collect and deliver patient records. The platform’s main value is that it allows care professionals to monitor multiple patients at the same time. M Connect is currently free-to-use, though a paid version may be made available soon.

Blood Testing

Mindray also uses AI in their latest blood testing equipment. The use of AI image recognition can now be used on blood samples, and Mindray claims to have achieved 95% accuracy in its AI-powered blood sample test. According to management, eventually, these blood testing devices will be able to perform hundreds of tests per day, saving doctors significant time and energy. They believe this innovation may help improve Mindray’s already-strong foothold in the hematology equipment industry. The company is the largest supplier of hematology equipment in China and the second largest globally.11

Bottom Line

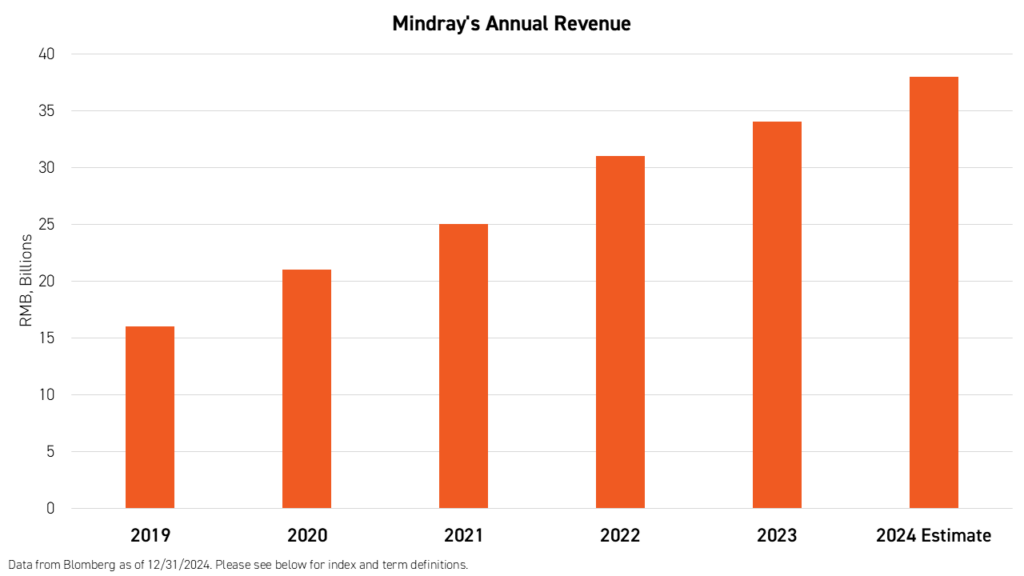

As a result of its global reach and relentless innovation, Mindray has been able to grow its revenue and net income consistently over the past five years. The adoption of AI technology may only help to accelerate this growth.

Conclusion

After a challenging two years, we believe it could be time to revisit China's healthcare sector. China's rapidly aging population is a secular growth driver for the sector. Meanwhile, the sector is relatively well insulated from geopolitical frictions, and the domestic policy may have turned positive for the sector once again. The basic investment case for the sector is also strong, with low correlations to global markets, offering potential diversification benefits, and low positioning in global healthcare portfolios.* Through KURE, investors can access healthcare stocks traded on local exchanges that may be difficult for offshore investors to purchase otherwise. These include Mindray, a key global player in medical devices that is rapidly deploying AI in its software products.

The KraneShares MSCI All China Healthcare Index ETF (Ticker: KURE) provides comprehensive exposure to the top China-based healthcare companies listed in New York, Hong Kong, Shanghai, and Shenzhen. KURE provides exposure to major players in biotechnology, general pharmaceuticals, hospital management, and traditional Chinese medicine worldwide.

*Diversification does not ensure a profit or guarantee against a loss.

Citations:

- Data from the National Bureau of Statistics of China as of 12/31/2024.

- Projection from the Pew Research Center as of 12/31/2022. Retrieved on 12/31/2024. Health spending data from OECD as of 12/31/2023.

- Data from OECD as of 12/31/2024.

- “Insights into Chinese Medical Device Companies Going Global – Popular Target Markets Overview and Key Success Factors,” Deloitte. February, 2024.

- “Biosecure act Fails to be Enacted,” MichBio. December 31, 2024.

- Adam, Jules. “Biotech under surveillance: The global impact of the WuXi Apptec controversy,” LA Biotech. April 18, 2024.

- Manalac, Tristan. “WuXi Mulls Sale of Some European Operations: FT,” BioSpace. October 3, 2024.

- “China healthcare: Market reacts positively to potential favorable policies,” Nomura Global Markets Research. February 23, 2025.

- Data from Bloomberg as of 12/31/2024.

- Chang, Wayne. "A little-known Chinese company made a drug that beat the world's biggest-selling medicine," CNN Business. February 25, 2025.

- Mindray as of 5/31/2024.

Index Definitions:

S&P Biotech Index: The S&P Biotechnology Select Industry Index comprises stocks in the S&P Total Market Index that are classified in the GICS Biotechnology sub-industry. The index was launched on January 27, 2006.

S&P Global Health Care 1,200 Index: The S&P Global Health Care Index consists of all members of the S&P Global 1,200 Index that are classified within the GICS health care sector. The index was launched on September 30, 1999.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

MSCI All Country World Index (ACWI): The MSC ACWI captures large and mid cap representation across 23 developed markets and 24 emerging markets countries. With 2,647 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Term Definitions:

Revenue: The total sales proceeds for a business over a given period of time before the deduction of the cost of goods sold and other expenses.

Health Expenditure: The total amount of money spent on health care products and services, including both insurance payments (covered costs) and out-of-pocket expenses.

Compound Annual Growth Rate (CAGR): A growth rate over a long period of time expressed as an annualized rate the is compounding.

Correlation: The degree to which two variables move in tandem with one another, usually expressed as a value between -1 and 1, with -1 indicating an inverse relationship and 1 indicating perfect coordination.

KURE Holdings Mentioned:

- Mindray (7.74% of KURE Net Assets as of 2/26/2025)

- Wuxi Biologics (6.63% of KURE Net Assets as of 2/26/2025)

- Wuxi AppTec (4.15% of KURE Net Assets as of 2/26/2025)

- Akeso (3.74% of KURE Net Assets as of 2/28/2025)

Holdings are subject to change.