Beyond Coronavirus: Positive Prognosis For China Healthcare Sector

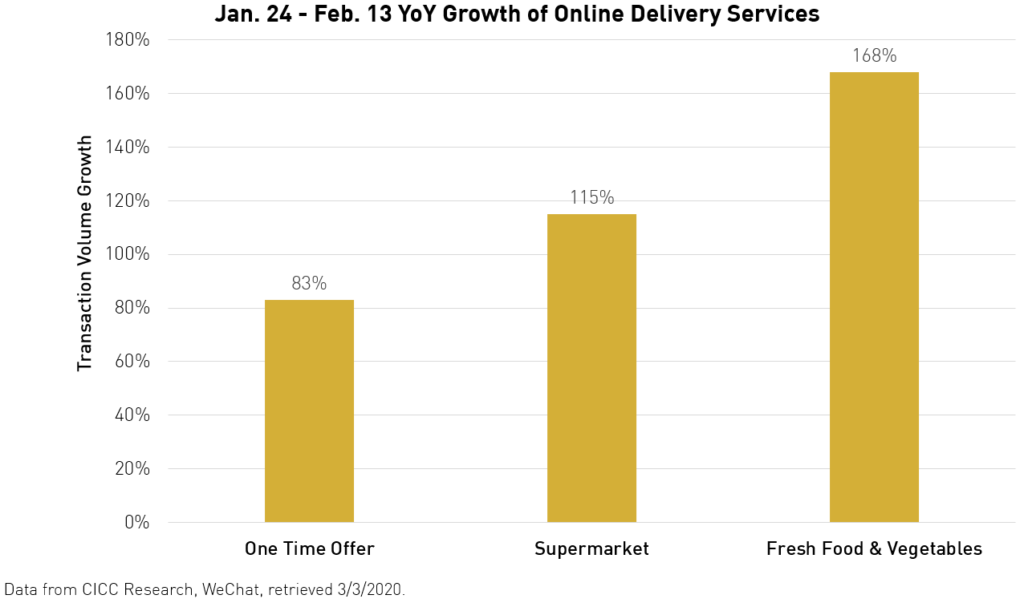

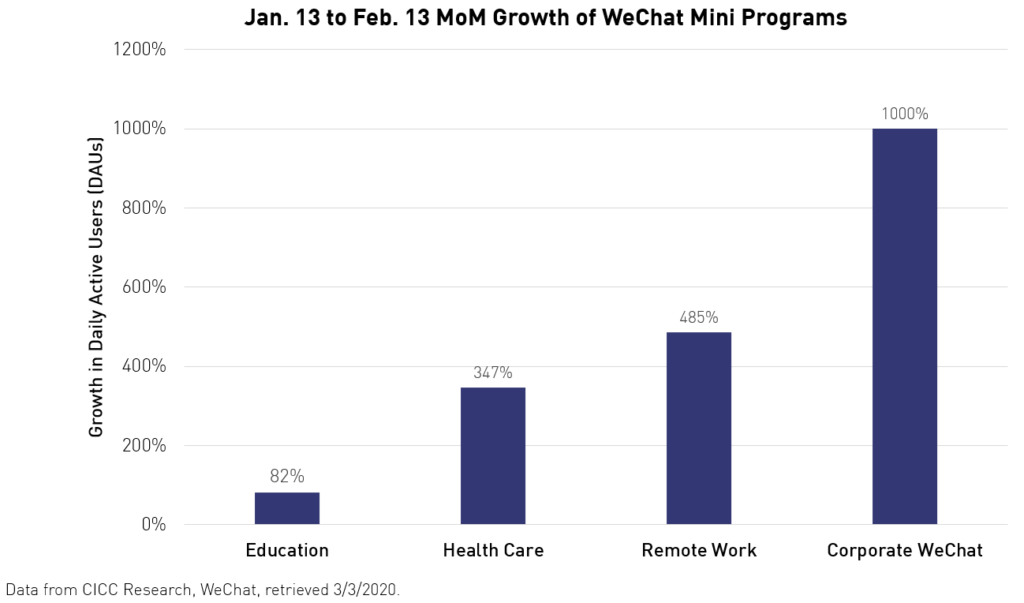

Although news surrounding the further spread of the coronavirus has been causing volatility in global markets, life on the ground in China is starting to stabilize. China’s population quickly took to a new stay-at-home lifestyle. Employees started relying more heavily on office collaboration platforms to work remotely from home, and students turned to China’s vast selection of online education courses to continue with their studies. To put this in perspective, daily active users of Tencent’s Enterprise WeChat office application have increased 10-fold since February 10th; and Alibaba’s communication platform, Ding Talk, has reached its highest levels in 5 years, with 200 million daily active users.1

During the height of the virus and particularly in more affected areas, locals adopted innovative ways of dealing with their new normal. Public buses were converted into mobile food markets, everyday items were creatively transformed into makeshift masks, and some companies like JD.com began using drones to drop off items direct to residents’ doorsteps. One woman captured her inventive at-home delivery technique on video: she remotely drives a toy car, installed with cameras and a loudspeaker, to pick up steamed buns at a nearby shop.

Even though the virus has had a significant impact on the Chinese population and their day-to-day lives, we believe that videos such as these reflect the strength and resiliency of China’s people and businesses.

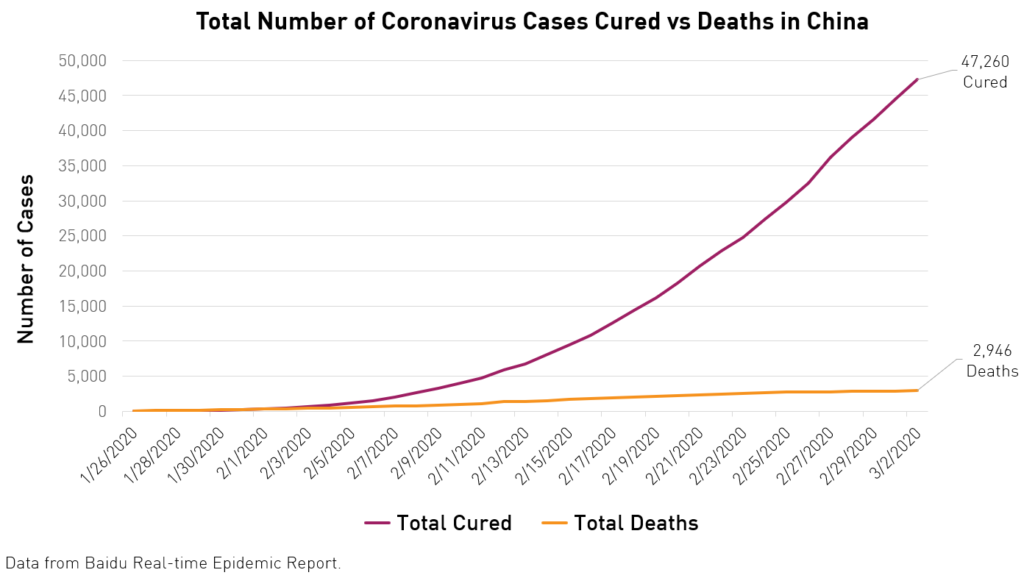

While global concern about the coronavirus is increasing with more cases emerging in places outside China like Italy, Iran, South Korea, and the United States, within China the outlook on the coronavirus appears to be improving. According to the latest WHO situation reports, the rate of new patients in China continues to decline and the number of those recovering appears to be rising.2 Over the past week, an increasing number of provinces have experienced no new confirmed cases. Moreover, details released on the deaths indicate that more than 80% are above the age of 60, with 75% having pre-existing health conditions.3 These stats appear to be true in China and elsewhere, where the most recent deaths reported in Italy, the country with the most cases in Europe, have all been among people above the age of 80.4

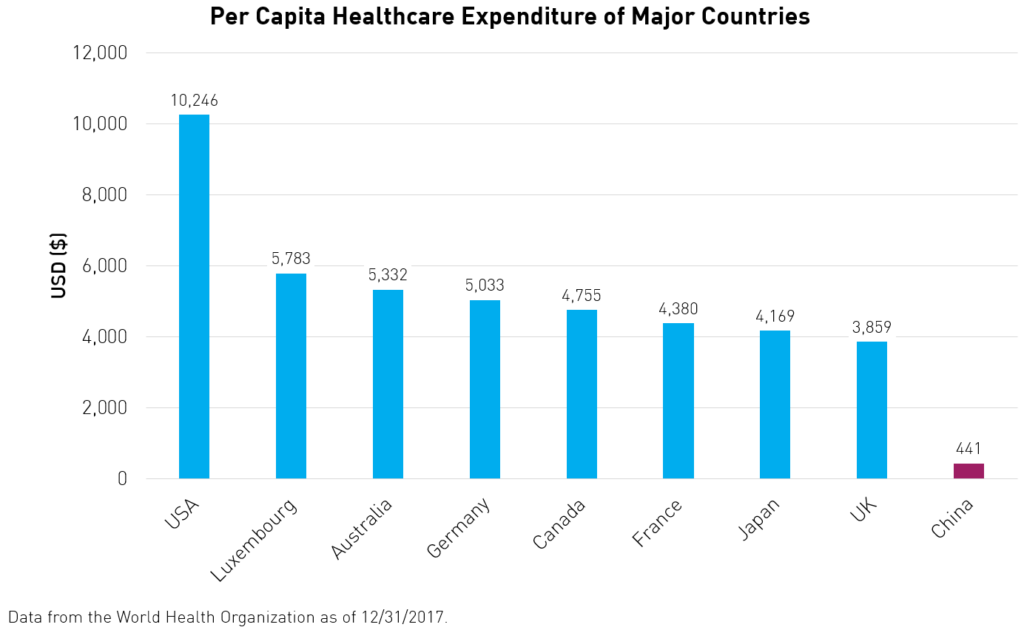

China has historically underinvested in healthcare, but it is reasonable to expect an upgrade to its healthcare spending plans following this public health crisis. In recent years, there has been an increased focus on expanding the number of China’s drug development facilities, an effort that has established China as one of the world’s top outsourcing destinations for biomanufacturing second only to the US. 5 We expect further growth as companies within China’s pharmaceutical sector continue to broaden their biomanufacturing footprint and accelerate their own drug development capabilities.

This outbreak may be a strong catalyst for growth, particularly for companies involved in healthcare IT, pharmaceuticals, and traditional Chinese medicine, which have had an outsized role in combating the virus.

To ease the burden of already overcrowded hospitals, leading online healthcare providers Alibaba Health and Ping An “Good Doctor” began offering their telemedicine services free of charge to encourage anyone with minor, non-coronavirus illnesses to seek treatment through their online doctor portals. These healthcare IT platforms, which allow patients to connect with doctors via app, have vastly expanded the reach and capabilities of China’s healthcare system. Over the last several weeks, leading online healthcare providers have seen a drastic growth in users. Alibaba Health had more than 400,000 visitors from Hubei province alone just two days after offering its no-fee service, and Ping An “Good Doctor” has seen 10 times the number of newly registered users since the onset of the outbreak.6

Even China’s top search engine, Baidu, entered the healthcare space, providing a service where users could monitor whether people on the same flight or train have tested positive for the virus. Many companies have experimented with ways to more accurately diagnose the coronavirus, but Baidu made great headway by creating an AI analysis system that reduced the detection time of the virus from nearly an hour to less than half a minute.6

With supplies of protective gear selling out in cities throughout China, it became especially critical that companies find solutions to supply-chain roadblocks. The Chinese conglomerate, Shanghai Fosun International, was quick to execute a global emergency contingency plan to expedite medical supplies from its branches in Germany, Portugal, and Japan, becoming among the first to import hundreds of thousands of face masks and hazmat suits to the most affected regions within China.7

A number of biotech companies around the world have joined the race to develop a coronavirus vaccine. Two notable Chinese pharma companies, Chongqing Zhifei Biological Products, and Shanghai Fosun International, were early to announce their active involvement in vaccine R&D.8 A team of over a hundred researchers under Wuxi Biologics is also currently testing multiple neutralizing antibodies for the coronavirus.9 However, the widespread availability of a coronavirus-specific vaccine is at least several months to a year away.

In the meantime, people have become reliant on existing drugs to not only treat symptoms of the coronavirus but also for stockpiling supplies at home. Many of China’s pharma companies have been integral to aiding this current crisis through both drug research and provisions. Jiangsu Hengrui Medicine, China’s largest pharma company, sent $400,000 worth of its pegfilgrastim drug, which targets regrowth of white blood cells, direct to Wuhan in its first round of donations.10 At the same time, Jiangsu Hengrui’s stock has risen 35% over a 1 year period.11

In addition to pharmaceuticals, traditional Chinese medicine (TCM) is being used both at home and in hospitals to alleviate symptoms. Many have stocked up on over-the-counter Chinese cold medicine, like China Resources’ “999 Cold Remedy” and Beijing TongRenTang’s liquid herbal formulas. At hospitals, of the 80 clinical trials on potential treatments for the coronavirus, approximately 15 incorporate TCM practices.12 With people turning to more holistic remedies both for preventive care as well as to supplement their treatments, TCM may also see revenues increase.

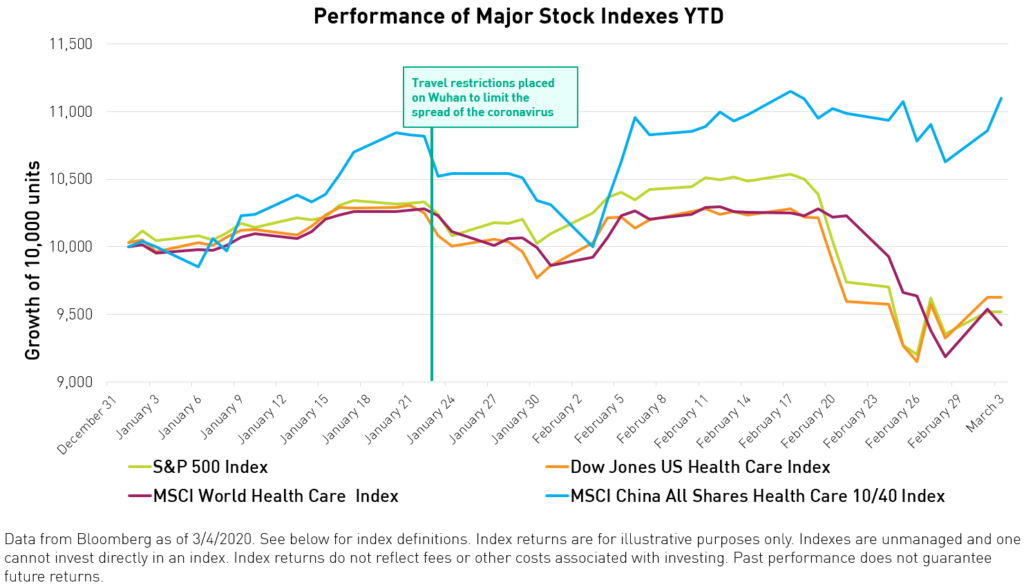

We believe that there is a positive growth trend developing for China healthcare in the wake of the coronavirus. The MSCI China All Shares Health Care 10/40 Index, which is the benchmark of KraneShares MSCI All China Health Care Index ETF (KURE), has gained over 11% since December 31, 2019 – the date the coronavirus outbreak was first reported in Wuhan, China, according to the World Health Organization.13 Click here to view KURE's standard performance.

The chart below features a comparison between the MSCI China All Shares Health Care 10/40 Index (KURE’s benchmark), S&P 500 Index, Dow Jones US Health Care Index, and MSCI World Health Care Index, which reinforces China healthcare’s strong performance relative to other key indexes.

Conclusion

Healthcare in China has room for growth as it continues to develop. Although China has historically underinvested in healthcare, we believe that this public health crisis will prompt an upgrading to its healthcare spending plans. Moreover, China is already leading in the adoption of digital healthcare technology. Healthcare IT platforms have gained a considerable number of new users in just the past few weeks as people delay hospital visits to avoid coronavirus exposure. We believe the current outbreak could serve as a catalyst for advancing research and technology across various China healthcare subsectors and may offer long-term growth potential for China healthcare as a whole.

Holdings of KURE mentioned in the article

- Alibaba Health Information Technology (HKG 241, 2.41% of KURE net assets as of 12/31/2019)

- Ping An Healthcare and Technology (HKG 1833, 1.43% of KURE net assets as of 12/31/2019)

- Shanghai Fosun International (SSE 600196, 1.37% of KURE net assets as of 12/31/2019)

- Chongqing Zhifei Biological Products (SSE 300122, 1.73% of KURE net assets as of 12/31/2019)

- Wuxi Biologics Cayman (HKG 2269, 4.27% of KURE net assets as of 12/31/2019)

- Jiangsu Pharmaceutical Medicine (SSE 600276, 8.50% of KURE net assets as of 12/31/2019)

- China Resources Sanjiu Medicine (SSE 000999, 0.81% of KURE net assets as of 12/31/2019)

- Beijing TongRenTang (SSE 600085, 0.99% of KURE net assets as of 12/31/2019)

Citations:

- Xinhua, "The Sound of the World's Factory Returning to Work", 2/20/2020. (Translated)

- WHO, ECDC

- Channel News Asia, “What we know about the people who died from the novel coronavirus”, 2/4/2020.

- The Local, "Italy confirms three more deaths from coronavirus", 2/25/2020.

- Contract Pharma, "Outsourcing in China: How far can it go?", 7/15/2019.

- Huatai Financial Holdings (Hong Kong) Limited, “Digitalization runs deeper during coronavirus outbreak”, 2/4/2020.

- Fosun, "First Batch of Fosun’s Donated Medical Supplies Arrives in Shanghai Amid Global Procurement", 1/28/2020.

- Bloomberg, “China’s Zhifei inks exclusive CAS tie-up to make world’s first coronavirus vaccine”, 2/3/2020; Bloomberg, China Business News, “GSK teams up with CEPU to develop vaccines for 2019-nCoV virus”, 2/4/2020.

- Contract Pharma, "WuXi Biologics Enters Fight Against Coronavirus", 1/29/2020.

- health.people.com.cn, "恒瑞在湖北将公司创新长效升白药免费捐助给癌症患者", 2/17/2020. (Translated)

- Bloomberg, as of 12/31/2019.

- Nature, "More than 80 clinical trials launch to test coronavirus treatments", 2/15/2020.

- Bloomberg, as of 3/5/2020.

Index Definitions:

MSCI China All Shares Health Care 10/40 Index: The index captures large and mid-cap representation across China A‐shares, B‐shares, H‐ shares, Red‐chips, P‐ chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. It is based on the concept of the integrated MSCI China equity universe with China Ashares included. All securities in the index are classified in the Health Care sector according to the Global Industry Classification Standard (GICS®). The 10/40 concentration constraints apply investment limits where the weight of each group entity in the index is capped at 10% and the cumulative weight of all group entities with a weight in excess of 5% does not exceed 40% of the Index by weight.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Dow Jones US Health Care Index: The index, a member of the Dow Jones Global Indices® family, is designed to measure the stock performance of U.S. companies in the health care industry.

MSCI World Health Care Index: The MSCI World Health Care Index is designed to capture the large and mid cap segments across 23 Developed Markets (DM) countries*. All securities in the index are classified in the Health Care as per the Global Industry Classification Standard (GICS®)

R_US_KS_SEI