KMLM: Interest Rate Shifts and Election Impacts

Index and Sector Performance

The KFA MLM Index, which is tracked by the Mount Lucas Managed Futures Index Strategy ETF (Ticker: KMLM), finished the fourth quarter down 2.8%. Currency (+0.7%) markets contributed to performance, while Commodity (-2.1%) and Global Fixed Income (-2.4%) markets detracted from results. Interest income added 116bps. For the twelve months ending December 2024, the Index was down 0.5%. Year to date, the Index is down 0.5%.

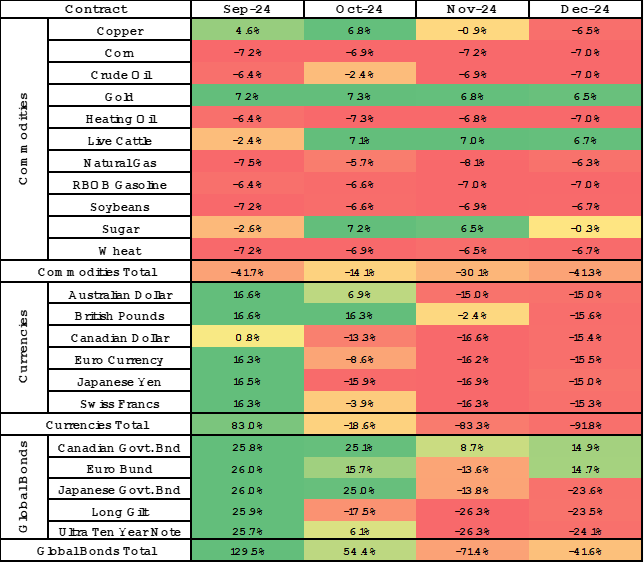

Index and Sector Exposures

Over the course of the quarter, Commodity exposures went from net short 42% to net short 41%, Currency exposures went from net long 83% to net short 92%, and Global Fixed Income exposures went from net long 130% to net short 42%.

Outlook

Entering Q4, pre-election index positioning reflected the shift in interest rate expectations during Q3. The Federal Reserve cut rates for the first time, and the market aggressively priced additional rate cuts over the next year. However, post-election, the market swiftly removed those anticipated cuts as 'animal spirits' invigorated the equity market. Simultaneously, bonds and foreign exchange markets experienced the effects of a booming stock market and increased fears of deficits and inflation expectations. Commodity markets did not participate in this “risk on” move, with prices mainly staying within recent ranges. The Index enters 2025 short bonds, long the Dollar, and primarily short commodities, with longs in Gold and Live Cattle.

In the Commodity sector, the top three contributors were Wheat, Soybeans, and Live Cattle, while the bottom three detractors were Sugar, Crude Oil, and Copper. In the grain markets, Soybean and Wheat prices remained at or near lows, while Corn prices saw a slight uptick by year-end, just crossing the one-year moving average. In metals, Gold rallied, peaking just before the election, then settled around 2600, while Copper prices fell from Q3 highs due to post-election China growth concerns. In the energy sector, Crude Oil, Heating Oil, and Unleaded Gas prices experienced a modest rise, buoyed by a rally in the last two weeks of the year. Natural Gas also rallied towards year-end, driven by forecasts for cold weather in the U.S. In agriculture, the Index shifted to a long position in Sugar mid-quarter, only to see prices drop by year-end, prompting a transition to a short position. Live Cattle prices were range-bound for most of the quarter, but the Index profited from a year-end rally. Significant shifts in exposure during the quarter included Copper (long to short), Live Cattle (short to long), and Sugar (short to long to short).

In the Currency sector, the top contributors were the Canadian Dollar, Euro, and Swiss Franc, while the British Pound was the primary detractor. Throughout the quarter, all markets transitioned from long to short positions due to hawkish U.S. interest rate expectations relative to global monetary policy. The major shifts in exposure during the quarter came in Australian Dollar (long to short), British Pounds (long to short), Canadian Dollar (long to short), Euro Currency (long to short), Japanese Yen (long to short), and Swiss Franc (long to short).

In the Global Fixed Income sector, the top performer was the UK Long Gilt, while the Euro Bund, Canadian Government Bond (CGB), and Japanese Government Bond (JGB) were the leading detractors. The Index started the quarter with long positions, but by the end of the year, most markets had seen prices fall. Specifically, the U.S. Ultra Ten Year (TY), Euro Bund, and JGB lost all their price gains, returning to levels seen in the summer before the Federal Reserve began cutting rates. The UK Long Gilts, on the other hand, hit new lows. The major shifts in exposure during the quarter came in the CGB (reduced long), Euro Bund (reduced long), JGB (long to short), Long Gilt (long to short), and TY (long to short).

Net Market Exposures

Holdings are subject to change.

For KMLM standard performance, top 10 holdings, risks, and other fund information, please click here.

Index returns are for illustrative purposes only and do not represent actual Fund performance. Index returns do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged,