International Monetary Fund 2015 Forecast – China largest contributor to global GDP growth…

even at a 7% GDP growth rate

Executive Summary:

- We believe China's economy is healthy and will continue to dominate year over year global GDP growth market share in 2015.

- We believe total GDP value in U.S. dollar (USD) terms relative to other countries is a better way to assess China's economic performance vs year over year GDP growth percentage.

- We believe there are three tactical investment opportunities that align with China government policy. China's Internet Plus Strategy, state owned enterprise mergers & acquisitions (M&A) activity and Renminbi inclusion in the International Monetary Fund (IMF)'s currency reserve basket.

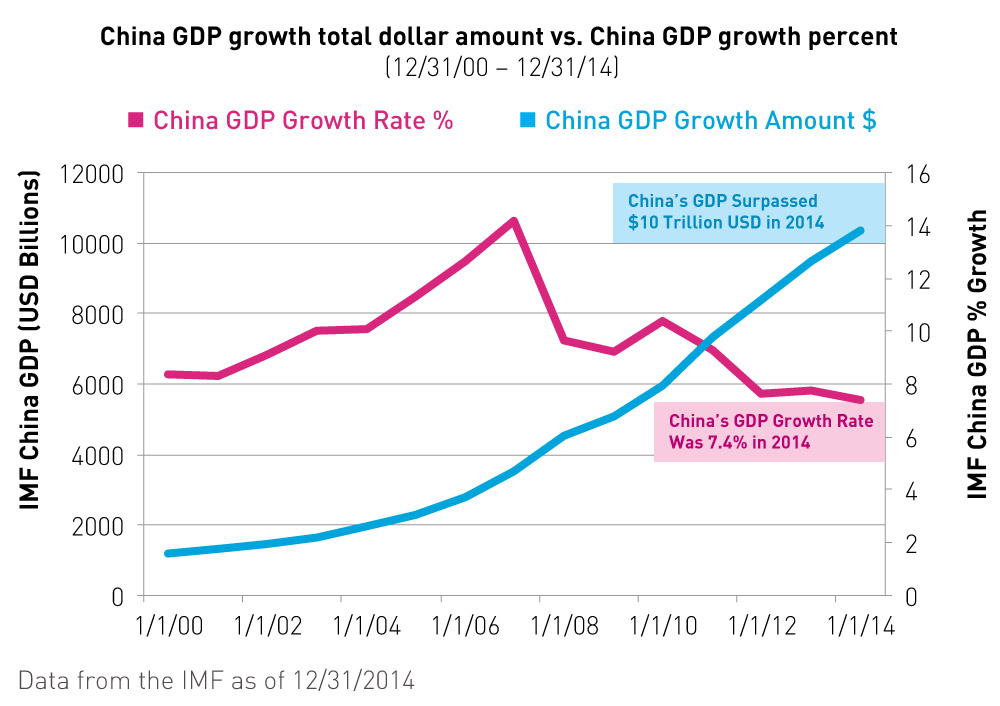

There has been a lot of talk about China’s slowing economy stemming from a lower 2015 GDP growth percentage target. This year’s target is 7%, which is down 0.4% from last year, and a far cry from its ten-year peak of 14% in 2007*. To the casual observer the shrinking growth percentage may suggest a grim outlook for the future of the world’s second largest economy. However, the current growth percentage reflects neither the exponential historic growth that has already occurred in China, nor the massive growth in absolute dollar terms that is still occurring there. When investors assess the state of China’s economy, we believe there are better metrics to measure its growth.

China’s GDP is over $10 trillion and is on course to add almost $5 trillion more over the next five years according to IMF forecasts*.

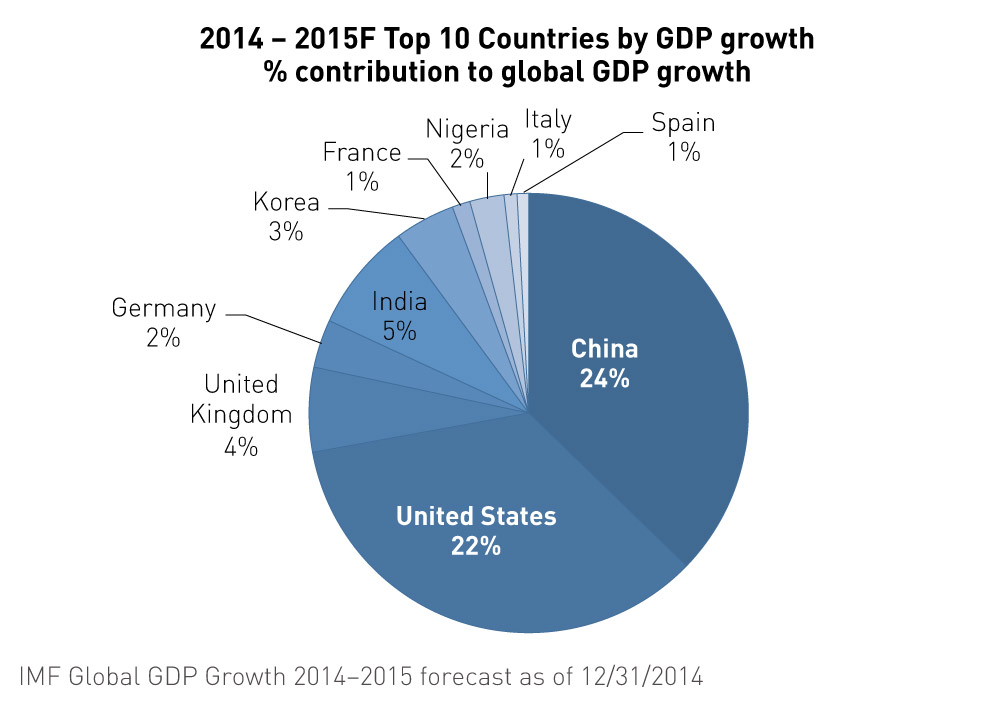

The IMF forecasts that China will continue to be the largest contributor to global GDP growth from 2014 to 2015. The IMF predicts China will contribute 24% to the growth of the world economy in 2015; 2% more than the United States*.

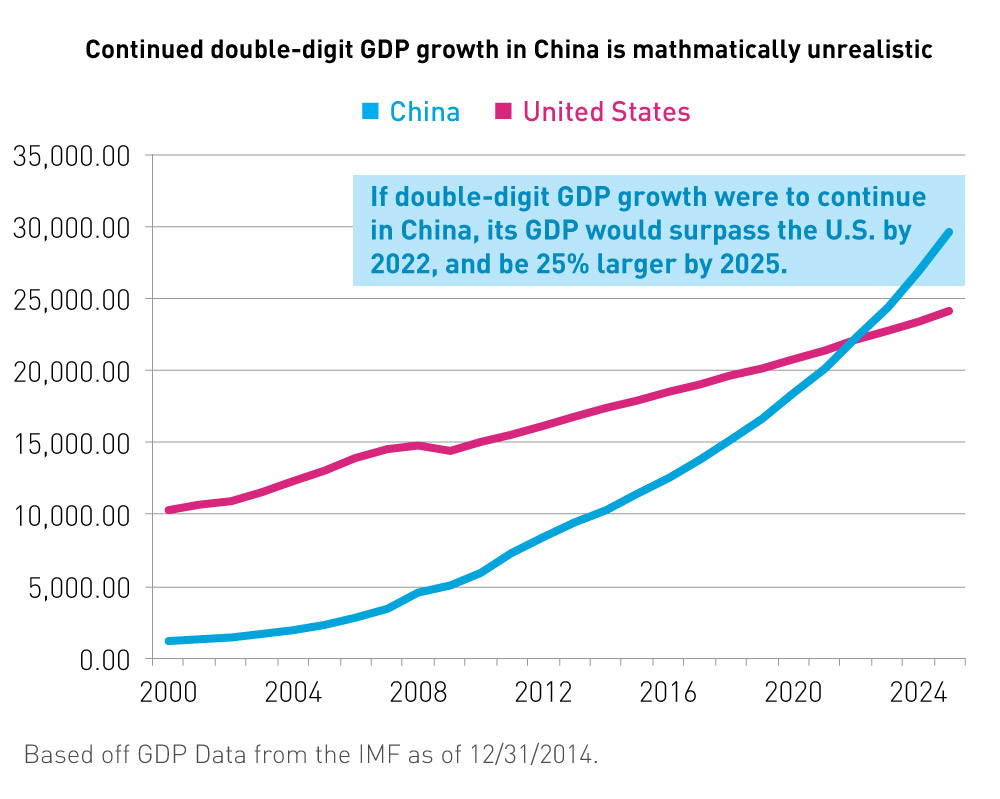

Due the current size of China’s economy, the prospect of a double-digit GDP growth rate is now mathematically unrealistic. If we apply a 3% annual GDP growth rate to the U.S.’s GDP and a 10% annual growth rate to China’s GDP, China’s GDP would surpass that of the U.S in 7 years, and be nearly 25% larger by 2025.

We believe this is an unlikely scenario and that China’s GDP growth rate has to slow down.

Three tactical investment opportunities that align with China government policy:

Three tactical investment opportunities that align with China government policy:

We believe that "co-investing" with the Chinese government, or investing in alignment with China government policy, can be a smart way to leverage China's capital markets. During the National People's Congress (NPC), held in March, government leadership announced several policies that are pertinent to investors. In Q2 2015, we like three investment themes and encourage investors to consider emerging market or China-only fund allocations with these exposures; (1) the China Internet Plus Strategy, (2) China state owned enterprise M&A activity and (3) Renminbi inclusion in the IMF's currency reserve basket.

Internet Plus Strategy:The Internet Plus Strategy, announced by Premier Li Keqiang at this year’s NPC, focuses on internet-powered start-ups and applying new technology to traditional sectors. The strategy aims to facilitate growth and innovation by giving research and development grants and tax-credits to companies in the internet and technology sector.

The founders of the big three internet companies, Baidu1, Alibaba2, and Tencent3, were all very publicly in attendance at the NPC meeting.

Based on this news, we believe investors may want to consider a position in the KraneShares CSI China Internet ETF (ticker : KWEB) for pure China internet exposure, or the KraneShares FTSE Emerging Markets Plus ETF (ticker : KEMP) for China internet exposure as a part of a diversified emerging markets ETF.

Unlocking shareholder value in State Owned Enterprises (SOEs):State owned enterprises are some of the largest companies in China and primarily consist of utilities and manufacturers in key industries. As China opens up its economy and expands abroad, SOEs are exposed to new opportunities in foreign markets. In order to unlock shareholder value in SOEs, China is taking several measures to make them become more efficient, including: merging similar companies, allowing private capital investment, and spinning off non-core businesses.

One example of unlocking SOE shareholder value was the recent merger of China North Railroad with China South Railroad. The new streamlined company can better compete internationally with companies like Siemens and Bombardier.

State Owned Enterprises are primarily listed on the mainland stock exchanges of Shanghai and Shenzhen, though they often have a dual listing in Hong Kong as well. Ahead of the implementation of these improvements, investors may want to consider taking a position in the KraneShares Bosera MSCI China A share ETF (ticker : KBA) for pure mainland Chinese equity exposure, or KEMP for mainland Chinese equity exposure as a part of a diversified emerging markets ETF.

Currency appreciation and potential inclusion in the International Monetary Fund’s reserve currency basket:As we wrote before, China’s currency is eligible for inclusion within the International Monetary Fund’s Special Drawing Rights (SDR), a basket of reserve currencies. China’s leadership announced its desire to keep its currency, the Renminbi (RMB), stable ahead of the IMF’s decision later this year. If the RMB is included, there could be significant demand for the currency as every IMF member country’s central bank would be required to hold RMB in reserve.

Please note; most emerging market equity and bond funds have no exposure to the RMB.

We believe the RMB is poised to appreciate ahead of the IMF's decision. Fixed income investors may want to consider gaining RMB exposure through the KraneShares E Fund China Commercial Paper ETF (ticker : KCNY) to benefit from this potential appreciation ahead of the decision. Equity investors can gain RMB exposure through KEMP (broad EM) or KBA (China only)

The above examples are just a few ways China will continue to innovate and evolve its economy. We welcome the lower GDP growth percentage as a natural next step in China’s development and the government's desire for steady, consistent long-term growth. We are confident that as China continues to open up its capital markets there will be countless new opportunities for global investors.

*Annual data from the IMF as of 12/31/2014

1.) Baidu was 7.28% of KWEB net assets as of 3/31/2015

2.) Alibaba was 7.89% of KWEB net assets as of 3/31/2015

3.) Tencent was 10.57% of KWEB net assets as of 3/31/2015