Could China Stocks Be The Ultimate Trump Trade?

By Henry Greene

Investors have identified several “Trump trades” following his November election victory based on campaign rhetoric. These include:

- Financial stocks, on expected deregulation, leading to an increase in mergers and acquisitions

- Oil & Gas, rising under the banner of “drill baby drill” policies.

- Bitcoin, on President Trump’s favorable view of cryptocurrencies.

- US Equities, on potential corporate tax reform, among other potential catalysts.

One element of campaign rhetoric that has fallen flat-footed with currency and fixed-income investors is the proposed implementation of tariffs on imported goods. The rhetoric has strengthened the US dollar exacerbated by strong US economic data, diminishing expectations for further Fed interest rate cuts.

We believe President Trump may implement limited broad tariffs as a starting point to negotiate with key trade partners, including China. The likelihood these tariffs will reach the 60% level previously proposed is low, in our opinion. The US economy and stock market would likely suffer from repeating policies that were last introduced during the Great Depression.

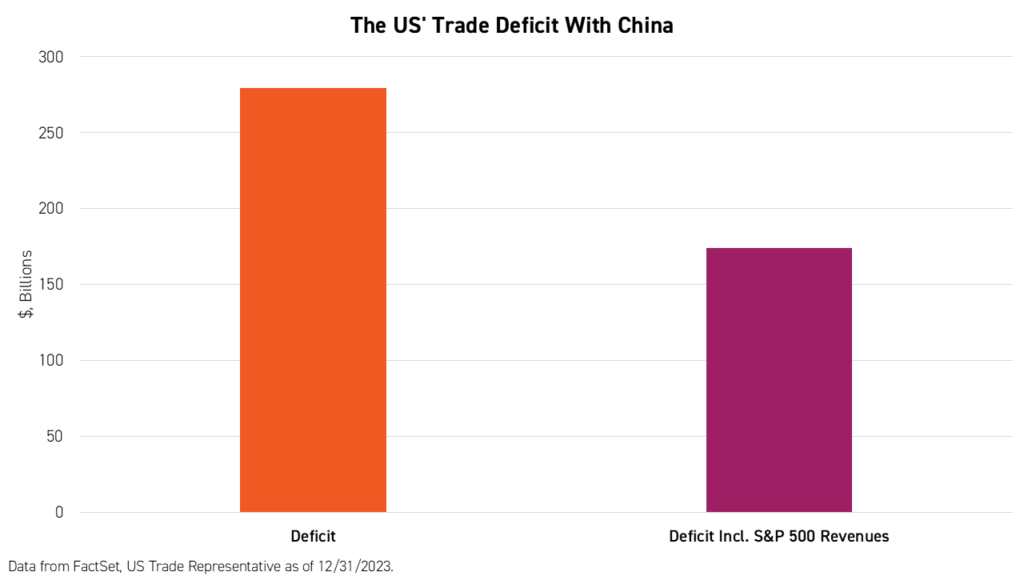

Many of the largest US companies generate significant revenue in China. S&P 500 companies generated over $100 billion worth of revenues in China in 2024. This income would cut the trade deficit with China almost in half if it were included in the overall export figure.

It is feasible the start of negotiations will involve raising tariffs on imports from China, up from the current 19% level. However, they could also be implemented incrementally, even month-to-month, according to some in the transition team, providing enough time for negotiations to occur. Like in Trump’s first term, many US manufacturers were able to receive exemptions from tariffs due to their inability to source those goods elsewhere.

Tariffs on goods that compete with high-end US manufacturing, such as automobiles, could be differentiated from imports of low-end inputs that support high-end US manufacturing. This would bolster US jobs, ensuring that they are not upended while also keeping supply chains intact.

Incoming Treasury Secretary Scott Bessent, a well-respected global macro investor, understands the consequence of tariffs and how intertwined the US and Chinese economies are. Advisor Elon Musk also understands the importance of China as the country accounts for 25% of Tesla’s revenue.

It is also crucial to note that Trump has proposed the same or even higher tariff levels on staunch US allies, including Canada and Mexico. This suggests that the Trump Administration will not differentiate between countries when it comes to securing better terms of trade for the United States. China’s leaders will likely welcome this approach, which does not target China discriminately.

Willing to Deal

There are recent indications of President Trump’s willingness to engage President Xi that have been largely ignored by investors or overshadowed by the outgoing administration’s escalation of tit for tat economic barbs between the US and Chinese governments.

President Trump invited President Xi to his inauguration. Because state visits require months of preparation, Xi did not attend himself. But, he sent China's Vice President Han Zheng.

After the House of Representative’s first attempt to pass a budget failed, the second version incorporated advice from President Trump and advisor Elon Musk that removed language tightening investment restrictions in China.

President Trump has extended the deadline for TikTok to be sold or banned in the United States. This issue goes beyond China due to the involvement of donors and many US investors’ ownership in the parent company Bytedance.

TikTok ban drama also contributed to a unique moment in the history of China’s internet sector, in which three of the top 10 most-downloaded apps in Apple’s US app store were China-based companies. As the short-lived ban took effect, Xiao Hong Shu, translated as “Little Red Book” or “Red Note”, which counts Singapore’s Temasek, Tencent, and Alibaba as its largest investors, became the most-downloaded app in Apple's US app store. The app, in which English-language content is sparse, was being downloaded by Americans in protest of the impending ban on TikTok. Presently, the number one most-downloaded spot is held by a China-based AI chat bot called DeepSeek, which has developed a chat GPT-like chat bot at a fraction of the cost, thanks to efficiency gains.1

We believe this is a watershed moment for China’s internet sector, where the top holdings in the KraneShares CSI China Internet ETF (Ticker: KWEB) are going global and having an impact in the United States that few could have imagined when we launched the fund.

China Equities: An Upside Surprise in The Making?

Combined with the last 15 years of US equity performance versus non-US equities, US stocks as a percentage of global markets have risen to an all-time high. We believe that investors globally are woefully under allocated to non-US equities, particularly Chinese equities, against the potential of President Trump negotiating another deal with President Xi in his second term.

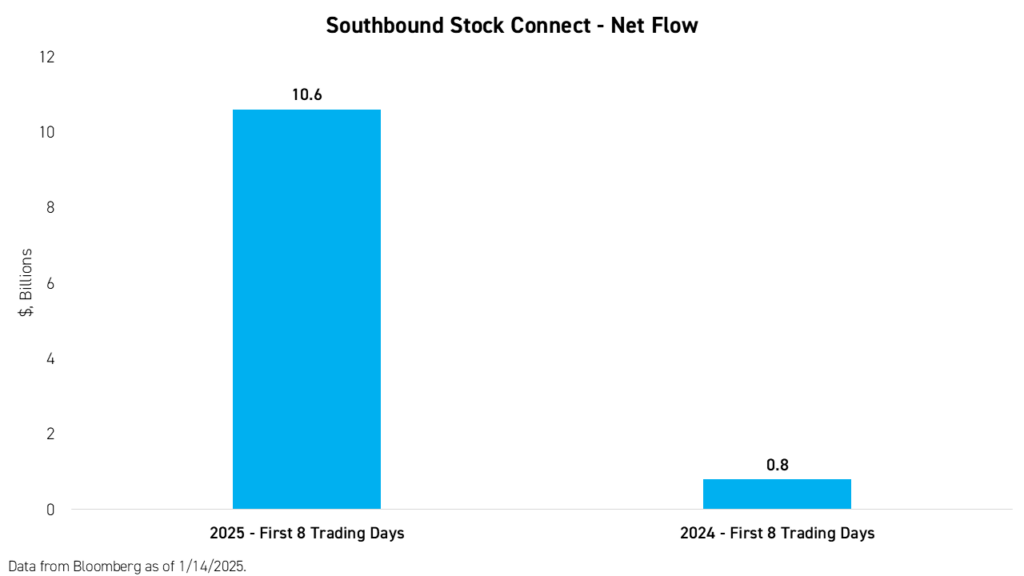

The only buyers of Chinese equities so far this year have been Mainland China investors buying Hong Kong-listed stocks, via the Southbound Stock Connect program, and Chinese companies, via buybacks.

China’s government has begun incrementally stimulating their economy which could be a tailwind for China equities, which may have bottomed in January of last year. Meanwhile, China’s risk-free rate has reached an all-time low while dividend yields are rising, making stocks more attractive than bonds. The opposite is true for US equities.

Conclusion

It’s often said that the market does what is least expected. A 2025 Chinese equity rally would surely fit the bill. The Trump Administration’s protectionist tone is likely only meant to bring China, and other countries, to the negotiating table, and may inject some near-term volatility into China’s equity market. However, striking a new deal with China would be a significant catalyst for China stocks.

Citation:

- Goldman, David. "A shocking Chinese AI advancement called DeepSeek is sending US stocks plunging," CNN Business. January 27, 2025.