Update: More China to Come for MSCI Investors

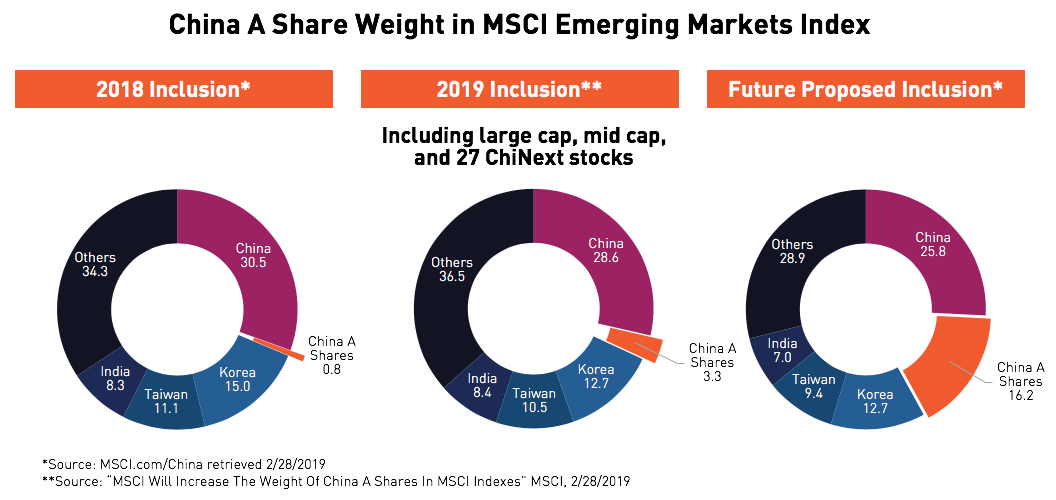

On February 28, 2019 at 5:00pm EST, MSCI announced they will quadruple the weight of the securities within the MSCI China A Inclusion Index in their Global Standard Indexes from 5% to 20% over three tranches starting May 31, 20191.

China A-Shares are stocks listed on the Shanghai and Shenzhen stock exchanges that together represent the second largest equity market in the world2. Despite the size of the market, China A-Shares are vastly underrepresented in global indexes. While the United States has a weight of 54.53% in the MSCI All Country World Index, China only has a weight of 3.71%3. MSCI is incrementally realigning China’s overall weight in their Global Standard Indexes through the inclusion process, and upon completion, China A-Shares are predicted to account for about 16% of the MSCI Emerging Market (EM) Index4 which is tracked by $1.8 trillion in assets5. This will gradually increase China's overall weight, including Hong Kong and US listed Chinese companies, from 30% to over 40% of the MSCI Emerging Market Index.4

In 2014, KraneShares was the first US asset manager to provide access to China’s Mainland market through an MSCI-linked ETF6: the KraneShares Bosera MSCI China A-Share ETF (ticker: KBA). KBA is benchmarked to the MSCI China A Inclusion Index which tracks the exact A-Share securities being incrementally included in the MSCI Emerging Markets Index. KBA currently has the longest track record and is the largest MSCI-linked China A-Share ETF in the United States. We believe KBA could potentially benefit from increased global inflows as a result of the inclusion.

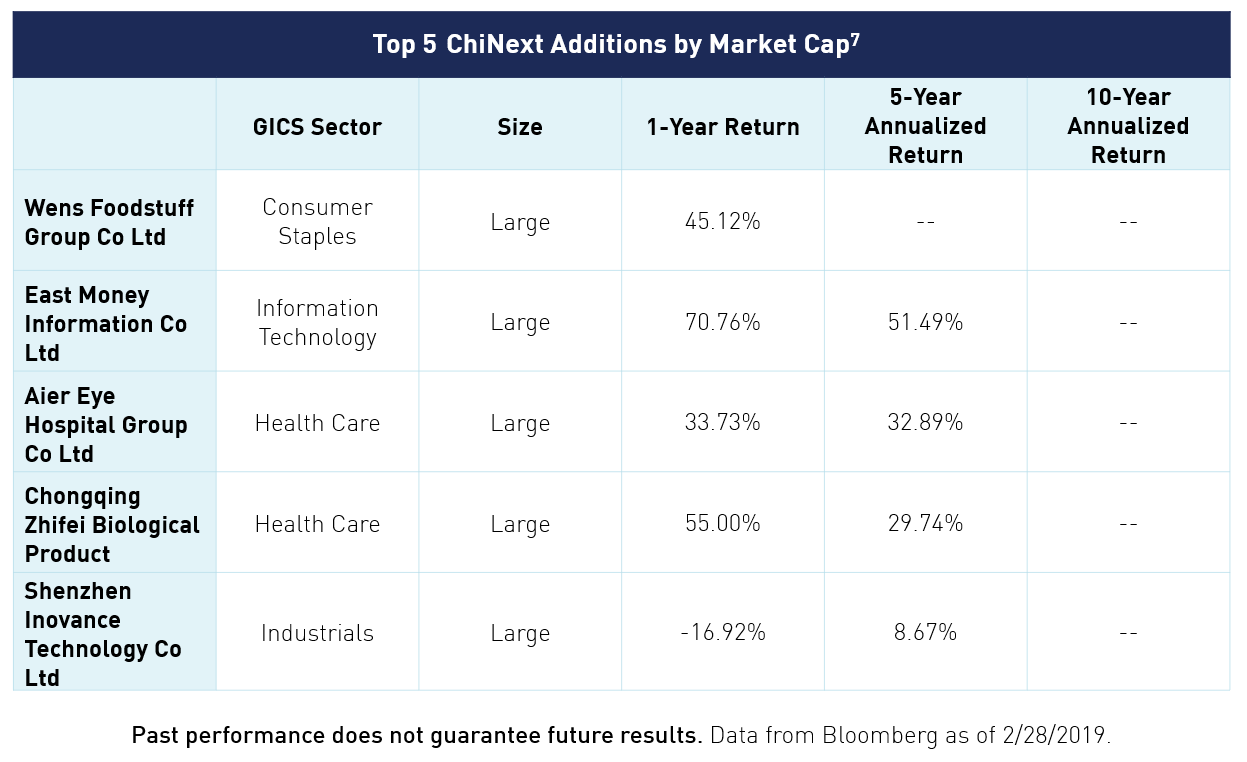

Beyond the 4x increase in the A-Share inclusion factor, one significant detail from yesterday’s announcement was the addition of 27 stocks from ChiNext to the MSCI China A Inclusion Index1. The ChiNext Market is a board of the Shenzhen Stock Exchange that was created to help encourage entrepreneurship, inspire creativity, and popularize innovative business models in China. The inclusion of these stocks will further diversify the constituents of the Index with securities from growth sectors such as information technology (IT) and healthcare.

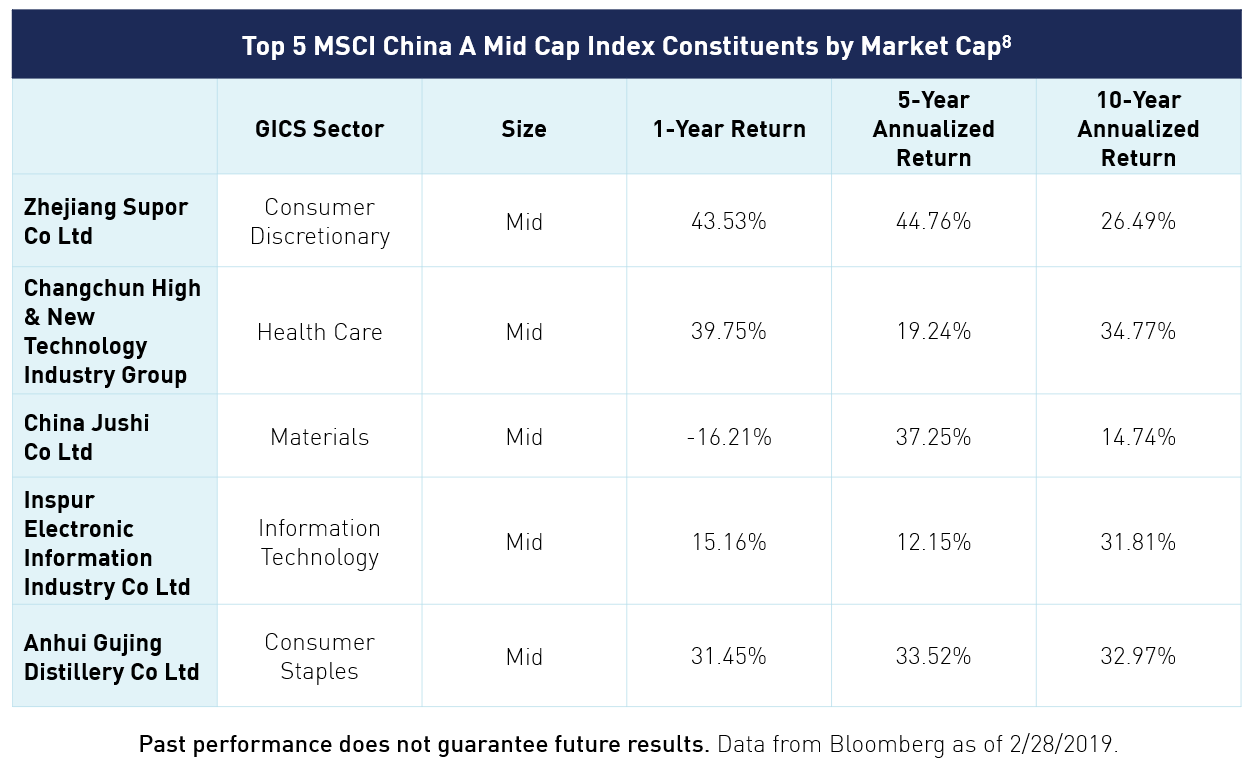

The biggest surprise from the announcement was MSCI's decision to include 168 Mid-cap stocks at a 20% inclusion factor beginning in November 2019.

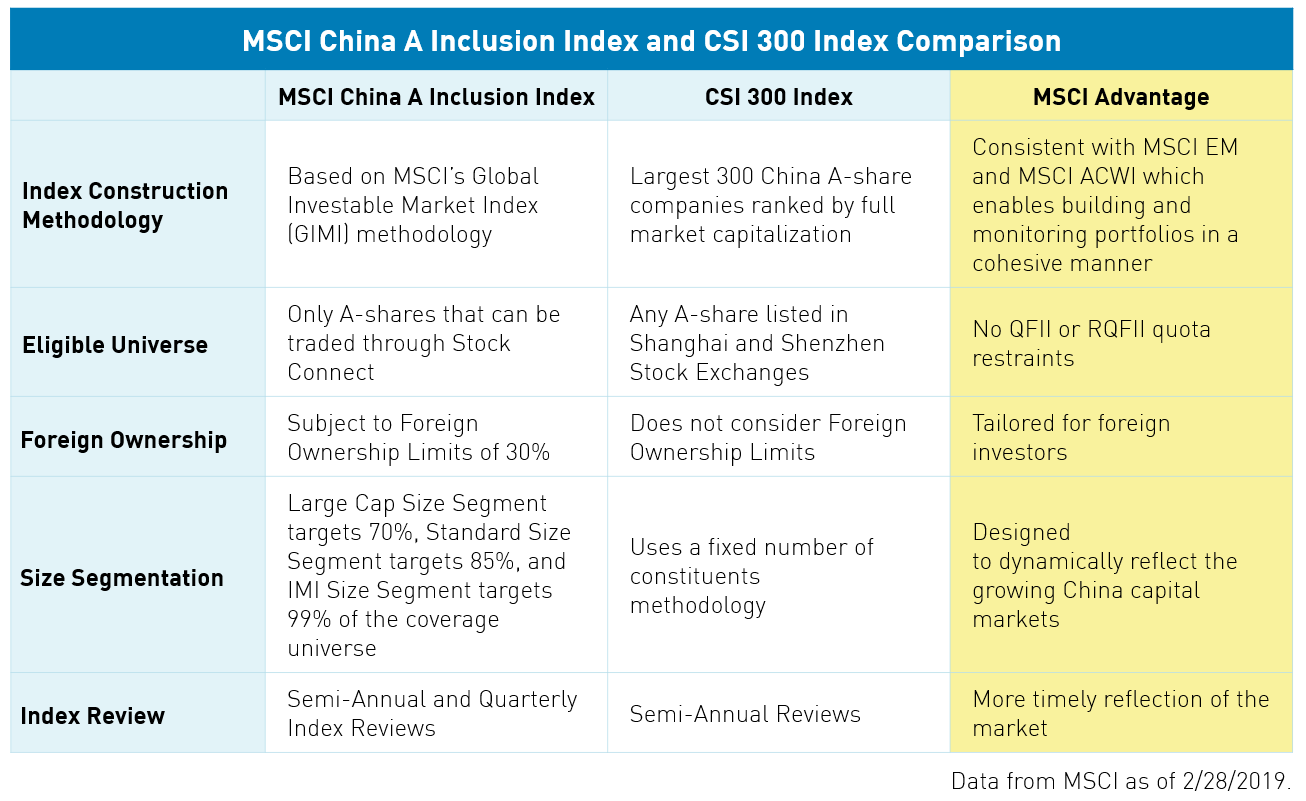

We believe that the MSCI China A Inclusion Index has distinct advantages over other popular Mainland China benchmarks, in particular, the CSI 300 Index. The CSI 300 Index, originally built for domestic Chinese investors, consists of the 300 largest China A-Share stocks ranked by market capitalization. In comparison, the MSCI China A Inclusion Index currently tracks 239 securities deemed most suitable for international investors by MSCI. Historically, these indexes have had a constituent count overlap of around 63%9, but the next three tranches of the China A-Share inclusion could further differentiate the MSCI China A Inclusion Index. By the end of 2019, there will be 253 Large Cap, 168 Mid Cap, and 27 ChiNext securities in the MSCI China A Inclusion Index1. This could potentially lower the Index constituent count overlap with the CSI 300 Index to around 51%9. We believe gaining exposure to China A-Shares through an MSCI index provides international investors with several distinct advantages:

- Availability of historical MSCI index data

- Adherence to the Global Investable Markets Index (GIMI) Methodology

- Modularity of indexes as building blocks

- Importance of Shanghai/Shenzhen Hong Kong Stock Connect eligibility for MSCI index inclusion

- MSCI’s adherence to foreign ownership limits

While the exact timeline for full inclusion has not been released, the one thing that is certain is that emerging market investors will see more China in their portfolios as a result of the China A-Share inclusion. Presently, we believe investors have a choice: gain increased exposure through passive rebalancing or proactively allocate to the inclusion names ahead of potential subsequent inflows. The KraneShares Bosera MSCI China A-Share ETF (ticker: KBA) provides exact exposure to the MSCI inclusion securities that could benefit from potential future inflows.

- The MSCI Emerging Markets Index captures large and mid cap representation across 23 Emerging Market countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country. (Start Date: Jan 1 2001)

- The MSCI China A Inclusion Index is designed to track the progressive partial inclusion of A shares in the MSCI Emerging Markets Index over time. The index is designed for global investors accessing the A shares market using the Stock Connect framework and is calculated using China A Stock Connect listings based on the offshore RMB exchange rate (CNH).

- CSI 300 Index consists of the 300 largest and most liquid A-share stocks. The Index aims to reflect the overall performance of China A-share market.

- Qualified Foreign Institutional Investor (QFII) is a program that allows specified licensed international investors to participate in mainland China's stock exchanges.

- Renminbi Qualified Foreign Institutional Investor (RQFII) is a program that allows the use of RMB funds raised in Hong Kong by the subsidiaries of mainland Chinese fund management companies and securities companies in Hong Kong to invest in the mainland Chinese securities market.

- MSCI, "MSCI Will Increase the Weight of China A Shares in MSCI Indexes”, February 28, 2019.

- Data from Bloomberg as of 2/28/2019

- Data from MSCI as of 1/31/2019.

- MSCI, “Consultation on Further Weight Increase of China A-Shares in the MSCI Indexes” September 2018, retrieved 2/28/2019.

- Data from MSCI as of 1/31/2019.

- Data from Morningstar as of 2/28/2019.

- MSCI, “Indicative List of Potential ChiNext Additions to the MSCI China Indexes”, 10/5/2018, retrieved on 2/28/2019.

- MSCI, “Consultation on Further Weight Increase of China A-Shares in the MSCI Indexes” and “Constituents of the MSCI China A Mid Cap Index”, September 2018, retrieved on 2/28/2019.

- Data from Bloomberg as of 2/28/2019, calculated by KraneShares.

This material represents the managers opinion. It should not be regarded as investment advice or recommendation of specific securities.

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck.