Think Pandemic Fueled Growth Trends in EM Are Over? Think Again.

Summary

The Covid-19 pandemic encouraged a rapid and broad-scale shift in consumption from offline to online, often as a safety precaution. This is not a phase, but what could be an inflection point for a long-term, secular trend as new users from emerging economies realize the advantages of online consumption beyond health concerns.

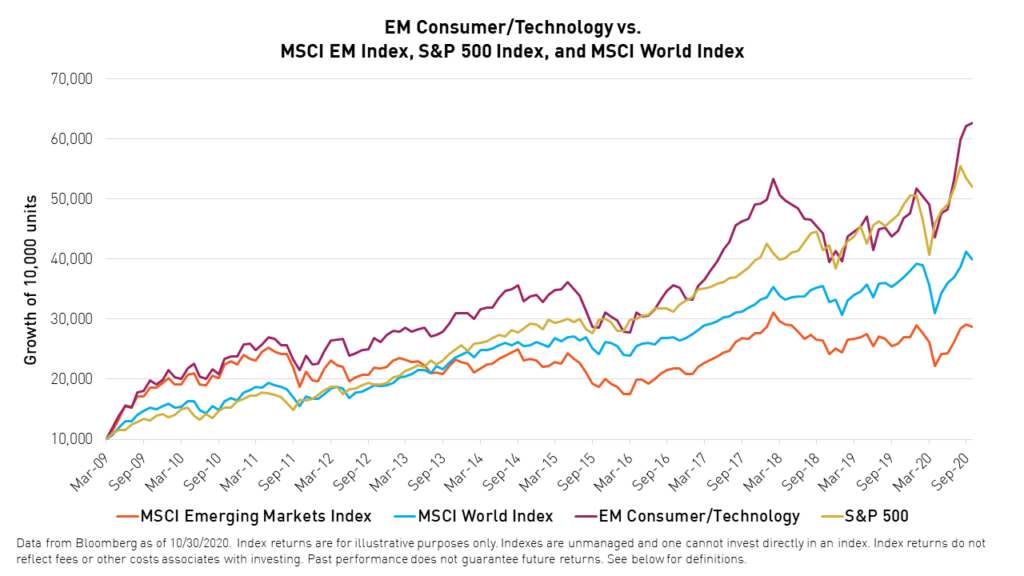

As investors consider moving away from stocks that have seen pandemic-fueled gains against the backdrop of vaccine progress and a rosier economic picture, it is important to remember that consumer technology may continue its strong record of outperformance in emerging markets.

Click here to view our EM growth exposure tool

We have developed a growth analysis tool allowing investors to dynamically illustrate how an allocation to the KraneShares Emerging Markets Consumer Technology ETF (Ticker: KEMQ) can affect their exposure to growth when paired with other emerging market strategies.

The Pandemic Effect

Consumer technology platforms all over the world saw tremendous expansion by all metrics during the pandemic. As people’s lives moved online, so did their spending habits, and fast. This has been a worldwide trend.

In China, Alibaba’s mobile app Taobao added over 50 million new users in only four months. JD, Pinduoduo, and Vipshop also acquired more users and at a faster pace than ever before.

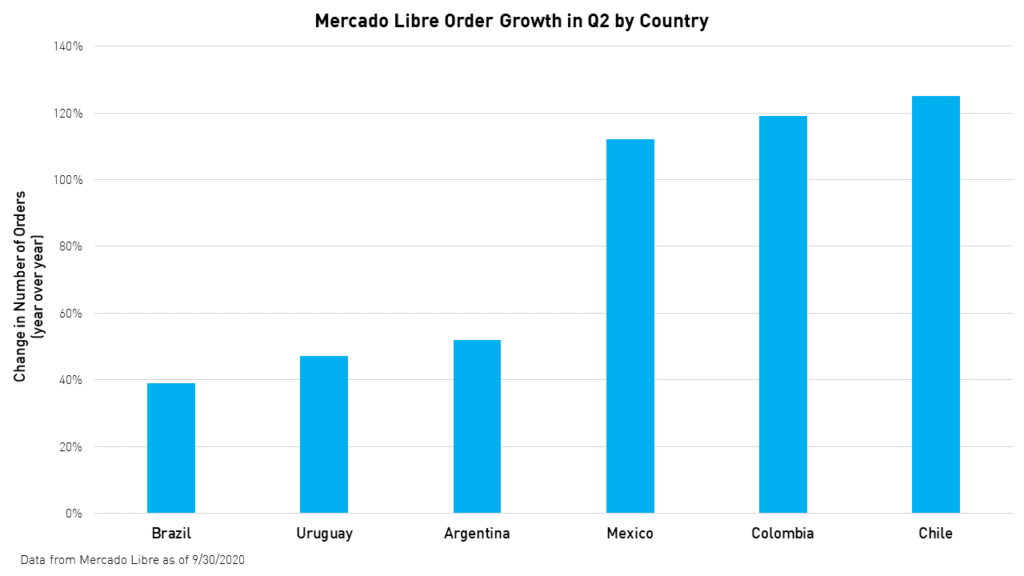

Mercado Libre, Latin America’s largest E-Commerce and digital payments platform, notched its highest ever annual increase in gross merchandise value (GMV) in the second quarter. The company also saw unique active users (UAU) nearly double over the past year1 along with online transaction volumes in the countries Mercado Libre serves: Mexico, Colombia, Argentina, and Chile.

Naver, South Korea’s leading online platform offering E-Commerce, cloud, payment, content streaming, and search services, also experienced tremendous growth in both active users and revenue as Koreans flocked online during the pandemic. The company reported +41% growth in E-Commerce sales in November of 2020, +67% growth in fintech, +67% in cloud, and +32% in content.

Furthermore, these platforms now provide an increasingly diverse array of services to a wider range of customers than they did before the pandemic.

JD.com mentioned that 80% of their new users during the quarter resided in lower-tier cities in China, which have historically seen low E-Commerce penetration rates compared to “first-tier” cities in the east.

Online health care, finance, education, entertainment, and work from home platforms have expanded their scope and reach during the pandemic as well. Naver noted in its Q2 earnings release that demand for cloud services grew by +140% from Q2 2019 as white-collar jobs moved online.

For KEMQ performance and full holdings, please visit https://www.kraneshares.com/kemq.

The Inflection Point

What makes this trend an inflection point instead of a pandemic-induced anomaly is that, in many cases, online platforms are better at providing these services in the developing world. New users may stick around for that reason.

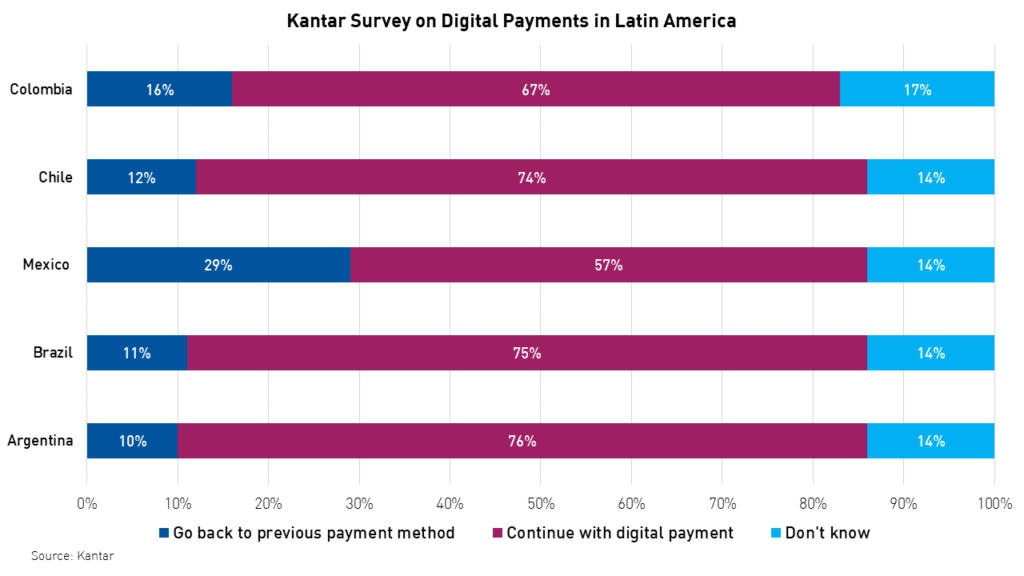

For example, in a survey conducted by research firm Kantar in Latin America regarding the use of digital payments, an average of seven out of every ten respondents from five countries (Argentina, Brazil, Mexico, Chile, and Colombia) said that they no longer prefer the payment method that they had been using before the pandemic.

In China, a survey conducted by HSBC found that nine out of ten users of online health care services said that they would continue to use these services for routine medical needs over the long-term.

In creating the KraneShares Emerging Markets Consumer Technology ETF, we applied our experiences in China to emerging markets more broadly. Chief among those experiences was seeing China’s consumers leapfrog past practices and technologies that are widely used in developed countries to adopt newer, more efficient practices and technologies.

For example, many went from having no bank account or payment card whatsoever to making payments with a smartphone and never had the need or want for a physical card. Meanwhile, physical payment cards remain the dominant form of payment in the United States.

Even before the pandemic, we observed the same trend emerging elsewhere in the developing world. The pandemic only accelerated and cemented a global trend that had already materialized and is likely to continue to develop.

Conclusion

Value stocks and those that tend to mirror the performance of the economy as a whole have been coming back into favor over the past month following the conclusion of the US presidential election and the announcement of positive results from multiple vaccine trials. The Russell 2000 Index, which is composed of small-cap US stocks, has risen nearly 11% over the past month and the MSCI Emerging Markets Value Index is not far behind, gaining about 9% over the same period.1 However, it is important to remember that value stocks are not always a safer bet, especially in emerging markets, where they tend to be more sensitive to commodity prices and political risks.

We believe long-term investors should retain an exposure to growth in emerging markets even as vaccines are distributed and the brick-and-mortar economy reopens. The shift to online consumption is a long-term trend everywhere. In emerging markets, this shift is especially transformative as first-time users from one of the fastest growing consumer groups leapfrog past legacy practices and technologies and develop online consumption habits that are likely to stick.

Users and sales data sourced from company releases

Citation

- Data from Bloomberg as of 11/23/2020.

Term Definitions

Emerging Markets Consumer/Technology: Prior to the GICS reclassification in October 2018, this is defined as 28% MSCI Emerging Markets Information Technology Index, 10% the MSCI Emerging Markets Consumer Discretionary Index, and 5% the MSCI Emerging Markets Communication Services Index. After the reclassification, this is defined as 15% the MSCI Emerging Markets Information Technology Index, 14% the MSCI Emerging Markets Consumer Discretionary Index, and 11% the MSCI Emerging Markets Communication Services Index.

Index Definitions

MSCI Emerging Markets USD Gross Index: The MSCI Emerging Markets Index is a free-float weighted equity index that captures large and mid cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. The index was launched on January 1, 2001.

MSCI World USD Gross Index: The MSCI World Index is a free-float weighted equity index. It was developed with a base value of 100 as of December 31, 1969. The index includes developed world markets and does not include emerging markets.

MSCI Emerging Markets Consumer Discretionary USD Gross Index: The MSCI Emerging Markets Consumer Discretionary Net Total Return USD Index is a free-float weighted equity index. The parent index is the MSCI Emerging Markets Index.

MSCI Emerging Markets Information Technology USD Gross Index: The MSCI Emerging Markets Information Technology Net Total Return USD Index is a free-float weighted equity index. The parent is the MSCI Emerging Markets Index.

MSCI Emerging Markets Communication Services USD Gross Index: The MSCI Emerging Markets Communication Services Net Total Return USD Index is a free-float weighted equity index. The parent index is the MSCI Emerging Markets Index. It is a GICS level 1 Index.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.

Russell 2000 Index: The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization, The real-time value is calculated with a base value of 100 as of December 19, 1978.

MSCI Emerging Markets Value USD Gross Index: The MSCI Emerging Markets Value Index (USD) captures large and mid-cap securities exhibiting overall value style characteristics across 26 Emerging Markets (EM) countries. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

Index returns are for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index. Index returns do not reflect any management fees, transaction costs, or expenses. Past performance does not guarantee future results.