The KEMQ Difference: A Sector-based Approach to Emerging Markets

In the first quarter of 2020, market volatility sent many investors on a wild ride. Actively managed Emerging Market funds were especially hard hit, “undershooting their respective benchmarks by some of the largest margins on record”1. Downside mitigation is often featured as a critical attribute of many active funds, making this underperformance during a period of exceptional volatility particularly noteworthy.

Broad-based EM, as represented by MSCI EM Index, as well as other alternative EM indexes (Ex- State-Owned Enterprises (SOE), Environmental Social Governance (ESG), and minimum volatility, to name a few) did not perform much better. Many of these actively managed funds and EM indexes were adversely impacted by their heavy exposure to value-oriented, commodity-dependent sectors, or what we refer to as “buying the blob.”

Growth sectors proved to be more resilient and largely outperformed value sectors. The wide dispersion between sectors last quarter has reinforced our belief that investors should target growth-oriented sectors and limit exposure to the "blob" of “old economy” sectors when investing in Emerging Markets.

Although past performance is not an indication of future results, and there may be times when value outperforms growth, we believe the more innovative, fast-growing consumer technology companies may be better positioned to capture the high growth potential that draws investors to EM in the first place. The KraneShares Emerging Markets Consumer Technology ETF (ticker: KEMQ), which tracks the Solactive Emerging Markets Consumer Technology Index, specifically focuses on growth sectors within EM, comprised of companies whose primary business includes E-Commerce, online software services, mobile payment processing, and social media platforms.

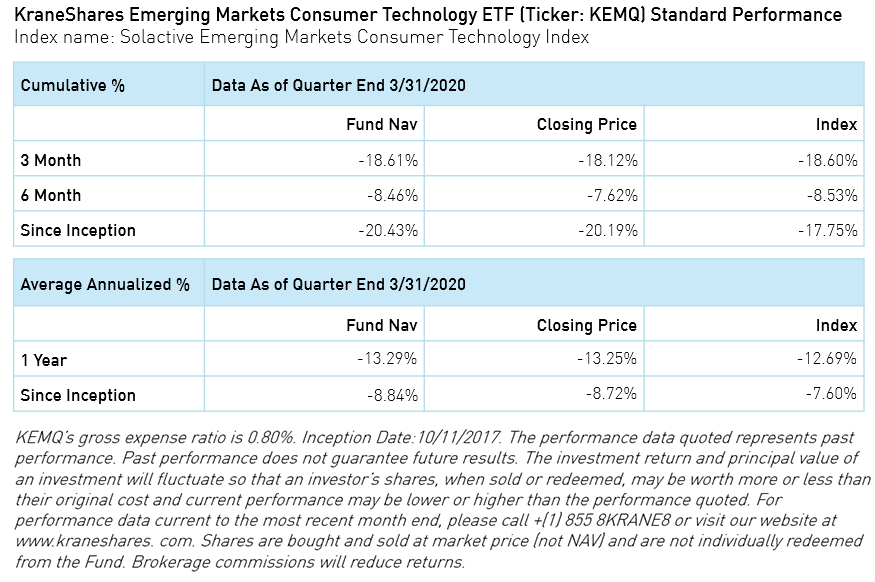

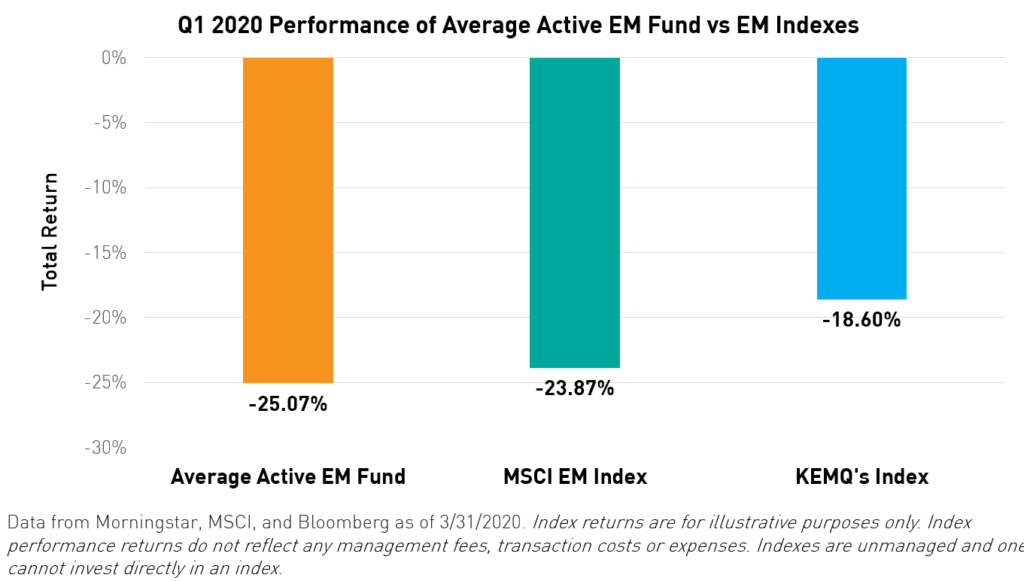

A Quarter in Review: EM Comparative Performance

Broad-based EM, as shown by the MSCI Emerging Markets Index, fell by -23.87% in the first quarter3, and actively managed EM funds largely underperformed this index. The average active EM fund within Morningstar’s US Active Fund Diversified Emerging Markets Category had a return of -25.07%, undershooting the MSCI EM Index by over 1%4 . While still in the red, KEMQ's Index beat MSCI EM by 5% with a return of -18.60%5.

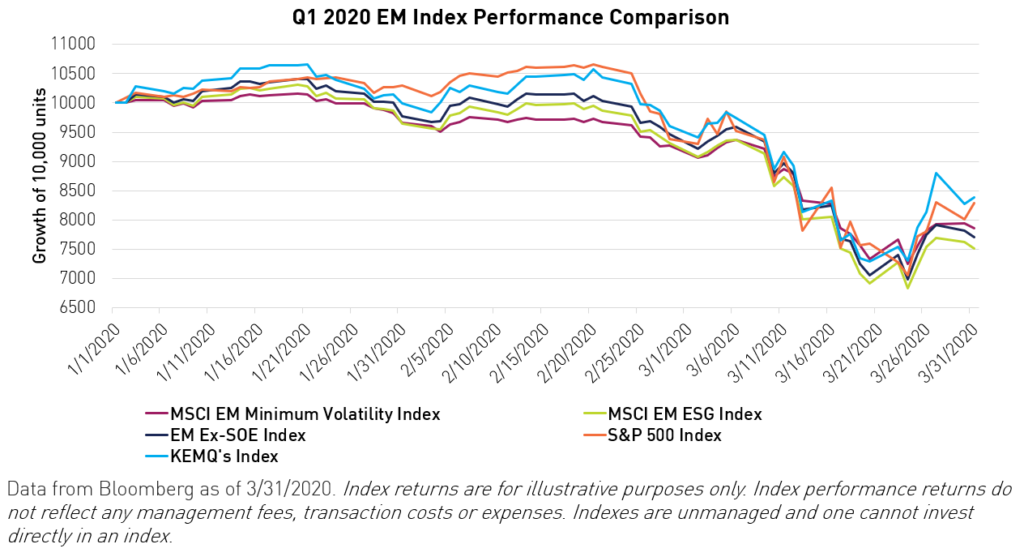

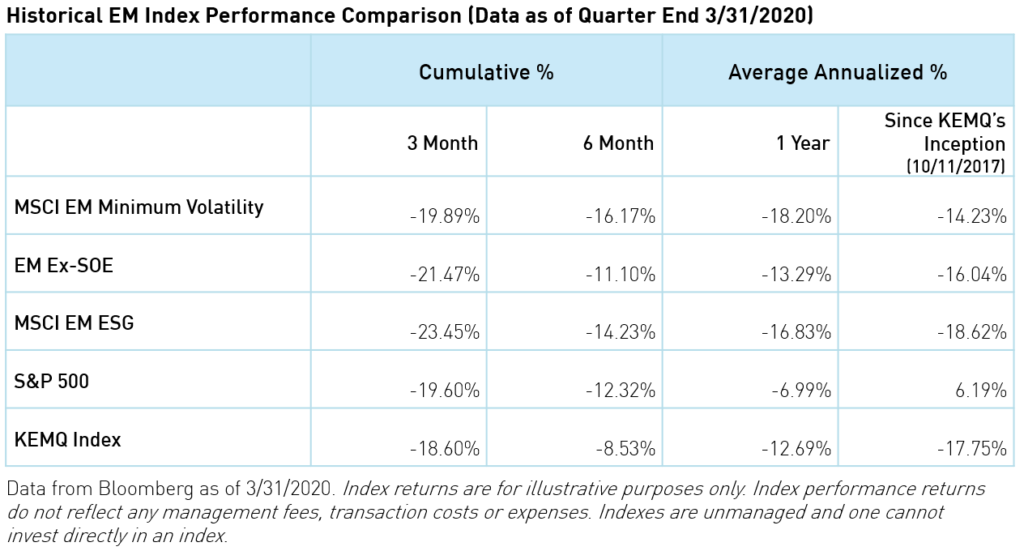

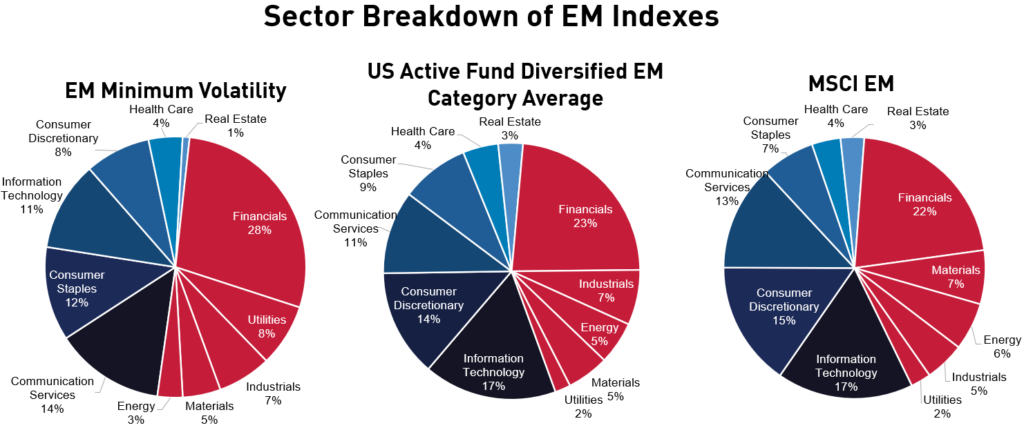

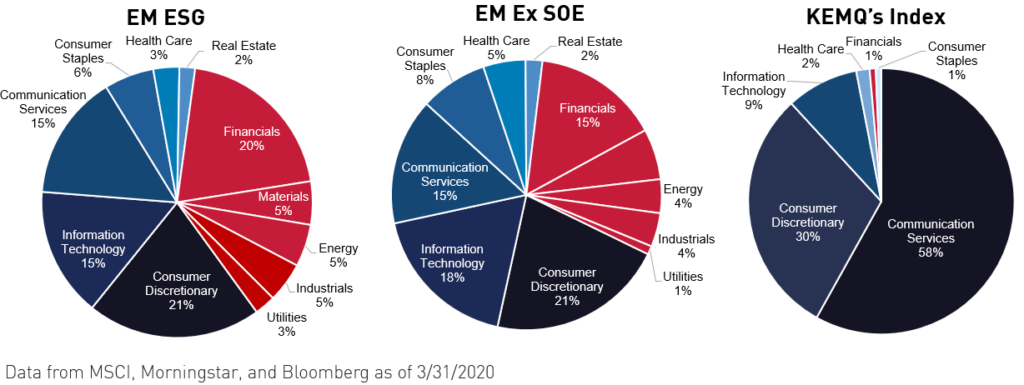

Beyond MSCI EM, many other EM indexes, such as minimum volatility, ESG, and Ex-SOE, still follow a similar, more broad-based sector breakdown, with large weightings toward financials and other value sectors6. Each of these indexes performed worse than both the S&P 500 and KEMQ's Index, which reinforces the idea that sector exposure is an important factor to consider when investing in EM.

The KEMQ Difference, Avoiding the “Blob”

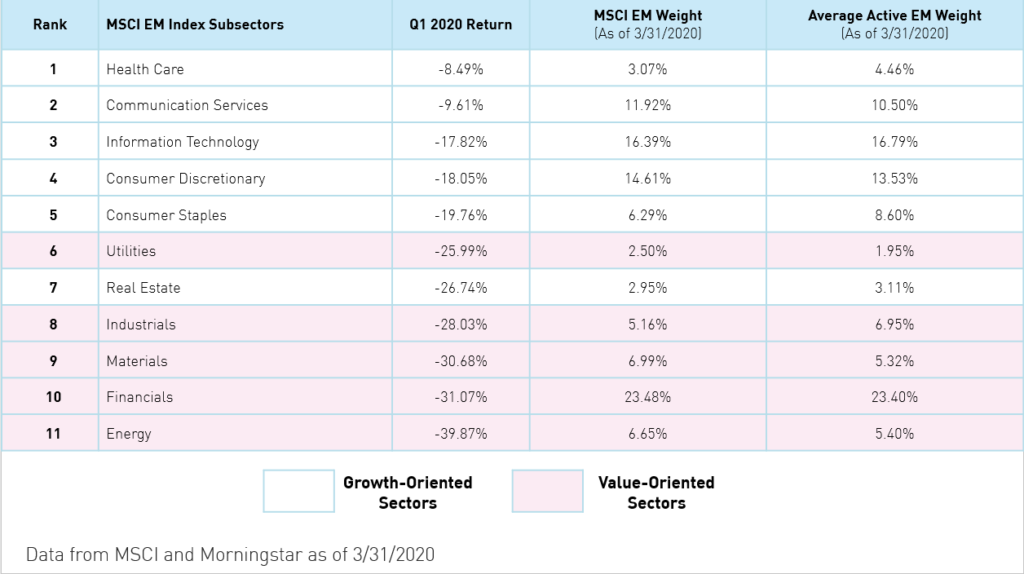

Markets experienced some of the highest dispersion in sector returns in years, with a clear split between growth and value sectors. Value-oriented sectors represented 4 of the 5 worst performing sectors in EM in the first quarter, while the top 5 best performers were all growth-oriented sectors. In total, value-oriented sectors make up 45% of MSCI EM and 43% of the average active EM fund within Morningstar’s US Active Fund Diversified Emerging Markets Category, with no single sector having a weight difference of more than 2.5%. This heavy exposure to the worst performing sectors helps to explain why broad-based EM performed poorly in Q1 2020.

Compared to KEMQ's Index, other popular EM indexes have much larger weightings to value sectors than growth sectors.

While it may seem counterintuitive, during Q1 2020, EM growth sectors proved more resilient than value sectors. It is important to note that narrowly focused indexes typically exhibit higher volatility and may have industry concentration and non-diversification risk.

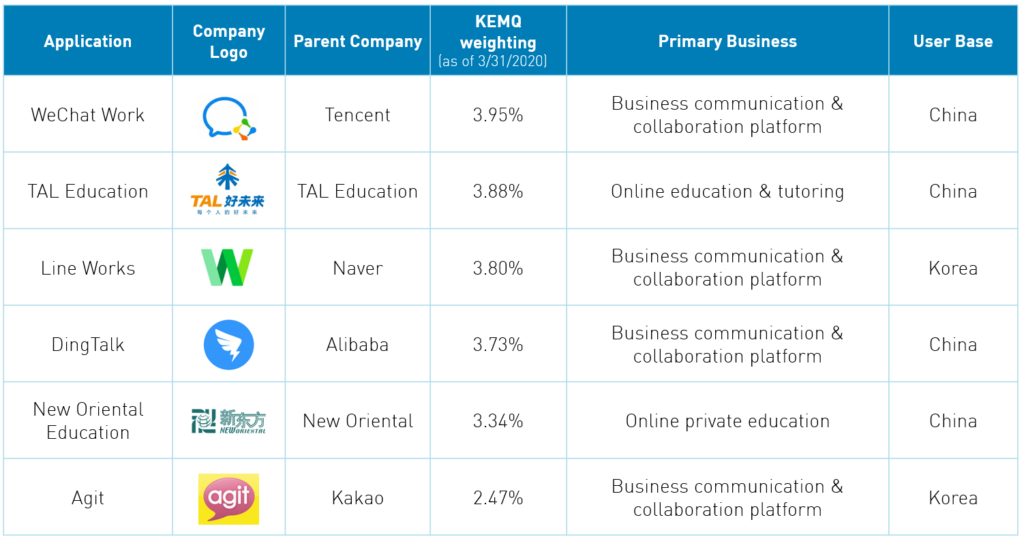

COVID-19 Push Toward Online Office and Education Services

The COVID-19 pandemic has only further fueled the EM consumer tech growth story, as global stay-at-home initiatives have resulted in a significant pivot toward online platforms. Online office and education services represent some of the most exciting growth opportunities as remote work and learning continue to be the new normal. White-collar workers will presumably be the last to return to their respective offices, so we believe platforms like Tencent’s WeChat Work and Alibaba-owned DingTalk in China as well as Naver's Line Works and Kakao's Agit in South Korea, could remain a mainstay for some time to come. In China, Tal Education and New Oriental Education have been building up their online learning programs for the past few years, but quarantine measures have made such services a necessity.

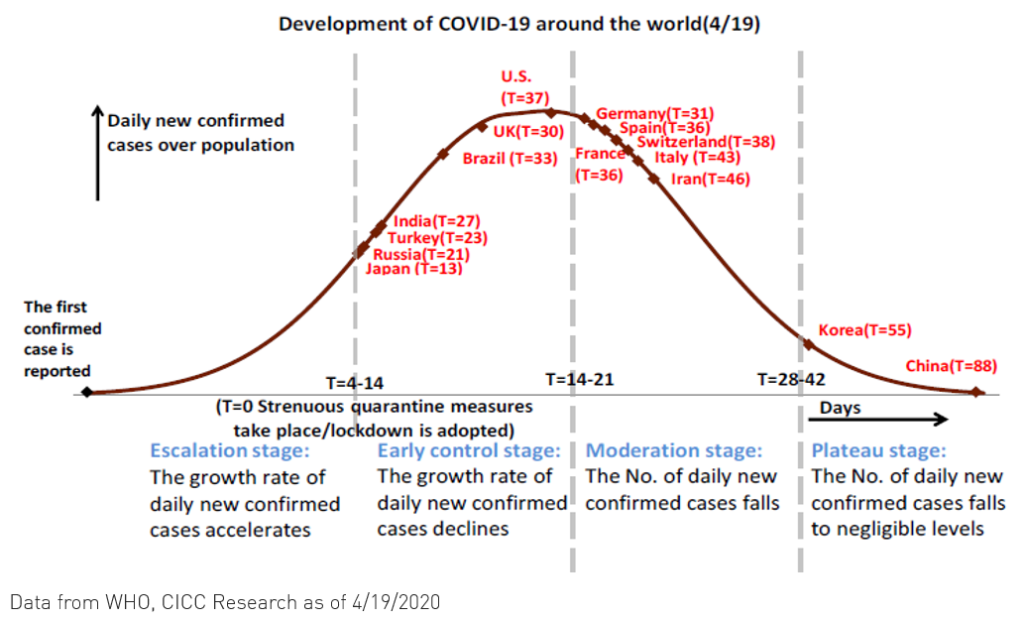

First-in-first-out

The top two country weights within KEMQ, China and Korea, have been the first to come out of their domestic COVID-19 outbreak. These economies will perhaps be the first to recover, which would potentially further boost overall consumption. After emerging from prolonged quarantines, we believe there is pent up demand for discretionary spending, especially as supply chain issues are rectified.

Conclusion

Admittedly, a single quarter cannot represent the entire long term performance history of an asset class, however, we do believe that the EM technology sector contains those companies with the greatest growth potential and adaptability in uncertain markets. In our belief portfolios weighed heavily toward value stocks would be less capable of capturing this potential. We believe investors should avoid "buying the blob" and take a growth sector approach to Emerging Markets. The KraneShares Emerging Markets Consumer Technology ETF (ticker: KEMQ) could be an attractive source of growth for Emerging Market investors into the future.

Citations:

- Financial Times, "Stockpickers failed to take 'big chance' in market rout", 4/20/2020.

- Data from Bloomberg as of 3/31/2020.

- MSCI, "MSCI Emerging Markets Index (USD) Factsheet" as of 3/31/2020.

- Data from Morningstar as of 3/31/2020.

- Data from Bloomberg as of 3/31/2020.

- Sector data from MSCI and Bloomberg as of 3/31/2020.

Index Definitions:

MSCI Emerging Markets Index: The Index is a free-float weighted equity index that captures large and mid-cap representation across Emerging Market (EM) countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country. All performance quoted is in USD. The index was launched on January 1, 2001.

S&P 500 Index: The Index is an American stock market index based on the market capitalization of the 500 largest companies having common stock listed on the NYSE or NASDAQ. The index was launched on March 4, 1957.

MSCI Emerging Markets (EM) Minimum Volatility (USD) Index: The Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid cap equities across 26 Emerging Markets countries*. The index is calculated by optimizing the MSCI Emerging Markets Index, its parent index, for the lowest absolute risk (within a given set of constraints).

MSCI Emerging Markets Extended ESG Focus Index: The Index is based on MSCI Emerging Markets Index, its parent index, which includes securities across Emerging Markets (EM) countries*. The Index is designed to maximize exposure to positive environmental, social and governance (ESG) factors while exhibiting risk and return characteristics similar to those of the MSCI Emerging Markets Index. The index is constructed by selecting constituents from MSCI Emerging Markets Index through an optimization process that aims to maximize exposure to ESG factors for a target tracking error budget set to 50bps under certain constraints. The index is sector-diversified and targets companies with high ESG ratings in each sector. Tobacco and Controversial Weapons companies and Producers of or ties with Civilian Firearms are not eligible for inclusion

WisdomTree Emerging Markets ex-State-Owned Enterprises Index: The Index measures the performance of emerging markets stocks that are not state-owned enterprises. State-owned enterprises are defined as government ownership of more than 20% of outstanding shares of companies. The index employs a modified float-adjusted market capitalization weighting process to target the weights of countries in the universe prior to the removal of state-owned enterprises while also limiting sector deviations to 3% of the starting universe.

Solactive Emerging Markets Consumer Technology Index: The Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transactions

Average Active EM Fund defined by active funds within the Morningstar's US Active Fund Diversified EM Category: Diversified emerging-markets portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than on those of the Middle East, Africa, or Europe. These portfolios invest at least 70% of total assets in equities and invest at least 50% of stock assets in emerging markets.

R_US_KS_SEI