Policy Reform Lifts A-Share Market

By Anthony Sassine, CFA, Derek Yan, and Henry Greene

Executive Summary

- Recent policy reforms in China following the release of the 14th Five Year Plan have focused on the internet sector and represent the outcome of the latest five-year political cycle.

- We believe reforms, both past and present, represent meaningful tailwinds for key industries including health care, clean technology, 5G, and semiconductors, which are mostly represented by Mainland-listed “A-shares.”

- Despite the recent fine-tuning of policy, we believe China’s government remains committed to its long-term goal of supporting its broad capital markets, the development of the industries mentioned above, and its internet sector.

Introduction

Recent events have reminded investors of the potential for policy-driven volatility when investing in China. However, we believe it is paramount to consider the positive impact that structural reforms have had in the past and how reforms may lead to improved competitiveness, modernization, and sustainability in key industries. China is a market like no other, developed or emerging, and policy has an important role within it. In what follows, we analyze reforms to major industries in China and their potential outcomes.

A 5-Year Political Cycle With Long-Term Goals

Policy realignment tends to occur every half-decade following the release of a new 5-year plan. The ratification of the 14th 5-year plan in March of 2021 signaled the start of another round of broad reforms across multiple industries. We believe reforms to health care, 5G, artificial intelligence, clean technology, banking, and other industries, including the internet sector, may have a positive impact in the long run. The most recent 5-year plan reaffirmed China’s long-term commitment to supporting the development of these industries. These policies have particularly helped China’s A-share markets in its impressive run starting in 2019.

China’s policymakers aim to strike a balance between innovation and sustainability, globalization and national security, growth, and financial stability, all while ensuring social welfare. This is a difficult balance to maintain, and their approach is fine-tuned every five years.

Divergence Between Offshore and Onshore

While overseas-listed internet firms have been deeply devalued by investors, China’s Mainland markets have held their own as policy reforms continue to benefit sectors that are mostly represented by Mainland-listed equities. Also, we are seeing a divergence between the reactions of foreign and local investors to policy reforms, another reason the A-share market has outperformed offshore listings.

We believe diversifying one’s China exposure between onshore and offshore listings may help mitigate risk and provide exposure to long-term growth opportunities in China.

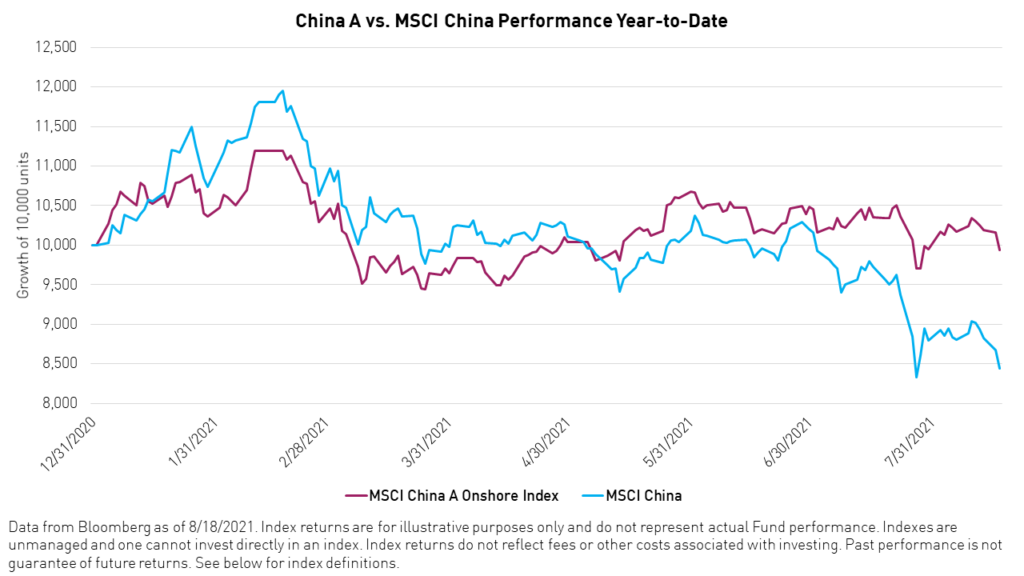

The performance divergence between Mainland-listed equities and offshore-listed equities is clearly illustrated by the year-to-date performance of the MSCI China A Onshore Index, which represents Mainland-listed “A-shares” and the MSCI China Index, which is skewed towards US and Hong Kong listings.

Health Care – How policy reform paved the way for a brand-new industry

China’s health care industry continues to expand and improve thanks to long-term regulatory overhauls that have made the industry more competitive on the world stage.

China’s long-term goal is to make health care accessible, affordable, and of high quality.

Health care reforms began in 2009 with the introduction of basic medical insurance (BMI), which extended health care coverage to approximately 99% of Chinese citizens. Following the introduction of BMI, China embarked on a journey that would overhaul and reshape the health care system.

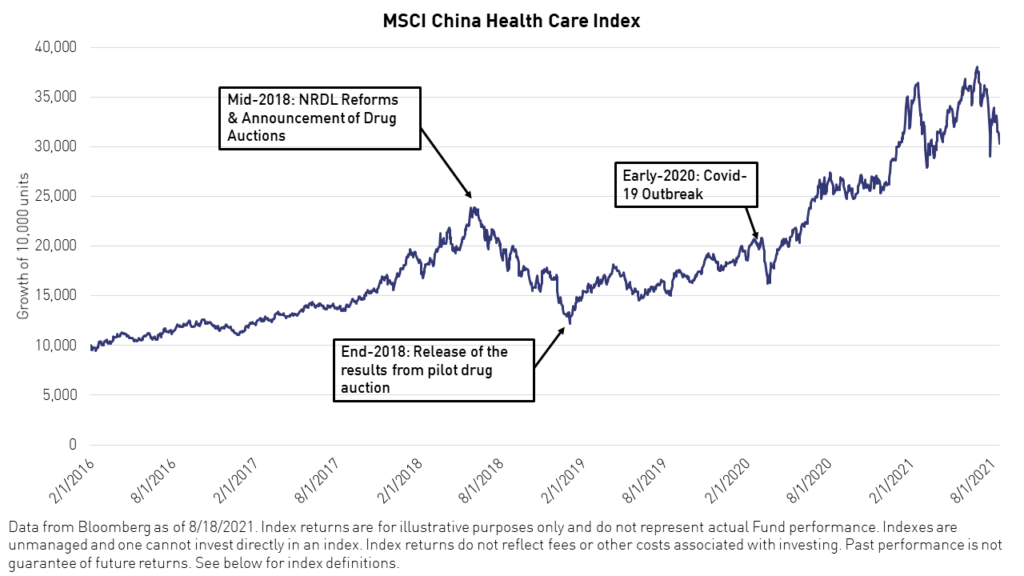

After a rocky period for health care stocks in 2018 and early 2019 following the establishment of the central procurement program, investors began to recognize the benefits reforms had to offer. Reforms proved efficient, and most importantly, gave birth to a highly productive biotechnology industry, which currently boasts a robust pipeline of world-class innovative drugs in the fields of oncology and the treatment of other non-communicable diseases, attracting the attention of multinational drug companies.

For more information on our outlook for the health care sector in China, read our recent publication China Health Care: A Rediscovered Sector Keeps Its Momentum.

Important health care directives over the past few years:

- The establishment of a Central Procurement (CP) program, an auction system aimed at reducing the cost of generic drugs and supporting a competitive drug market.

- The creation of the National Reimbursement Drug List (NDRL) to improve affordability of drugs

- The acceptance of clinical data from overseas by the China Food and Drug Administration (CFDA), allowing China to import innovative drugs.

- Making the drug approval process compatible with the US FDA

- The introduction of the Bioequivalent Test (BE) to improve the quality of drugs

- The introduction of policies favorable to contract research and marketing organizations (CROs/CMOs) to accelerate R&D

- The establishment of the “Double Invoice” system to remove excess drug costs by linking drug manufacturers to dispensers

- The introduction of zero mark-up policies for hospitals, shifting drugs sales to pharmacies.

- The promotion of telemedicine to improve access and reduce wait time from 3 hours to 8 minutes

- The promotion of online pharmacies

Environmental Policy Reform - A boom for clean technology

It was once remarked in The Economist that breathing the air in Beijing is as harmful to one’s health as smoking 40 cigarettes a day.1 China’s cities have paid the ultimate price for serving as the world’s factories.

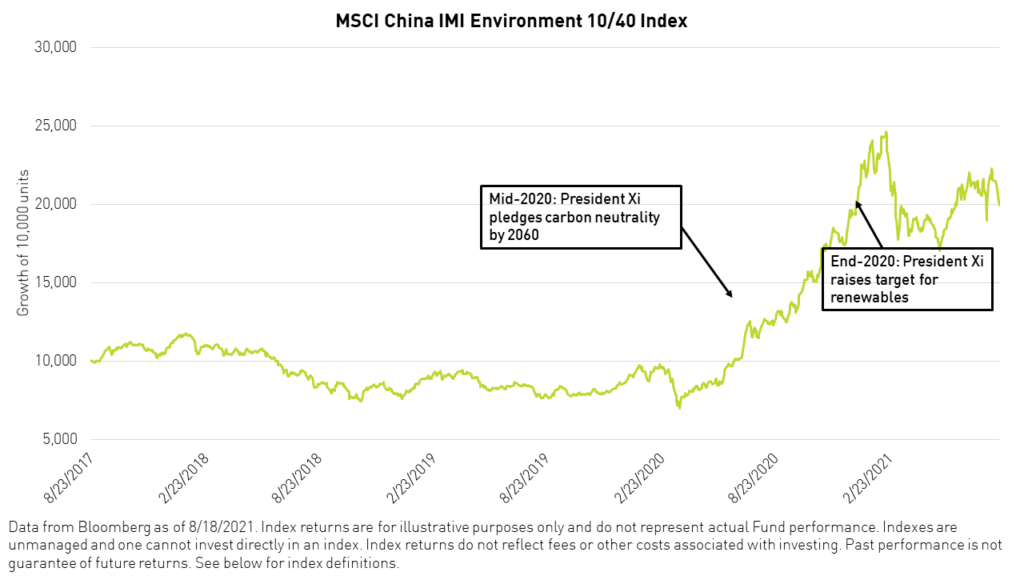

Signing the Paris Climate Agreement in 2017 was President Xi’s opening act before pledging carbon neutrality by 2060 during the 75th UN General Assembly in 2020. In December 2020, President Xi raised China’s climate commitment again during the Climate Ambition Summit by announcing a slew of environmental pledges, including reducing carbon intensity by 65% by 2030 versus the 2005 level, raising renewables to 25% of total energy production by 2030, raising total solar and wind capacity to 1200 gigawatts by 2030, and increasing China’s forest stock.2

Although ambitious climate pledges are leading to increased clean technology R&D and investments in new supply chains, China’s leaders are also attempting to tackle climate change through more concrete actions, including legislation, funding facilities, and technology improvements.

Climate change actions

- The establishment of the Ministry of Ecology and Environment (MEE), which has been tasked with climate-related project financing.

- The establishment of a green lending facility by the People’s Bank of China (PBOC), China’s central bank, which is available to firms in industries including construction, transportation, and renewable energy.

- The launch of a green building initiative by the Ministry of Housing and Urban and Rural Development (MHURD).

IRENA expects close to $135 trillion of investments to be poured into climate-related projects over the next three decades, with China being one of the main recipients.3

For more details on China's solar power industry, please read our recent publication China's Renewable Push Should Benefit Solar and Wind Companies. For our thoughts on electric vehicles, please read Electric Vehicles & Future Mobility: Hockey Stick Growth Mode.

Industrial Policy Reform - Focus on high-tech industries including 5G and semiconductors

China’s government believes that next-generation technologies are crucial if its economy is to remain competitive in the future. We have seen increasing US-China competition in the technologies such as 5G and Semiconductors. To protect the domestic industry ecosystem and further digitize the economy, China has provided policy support and tremendous resources to these sectors.

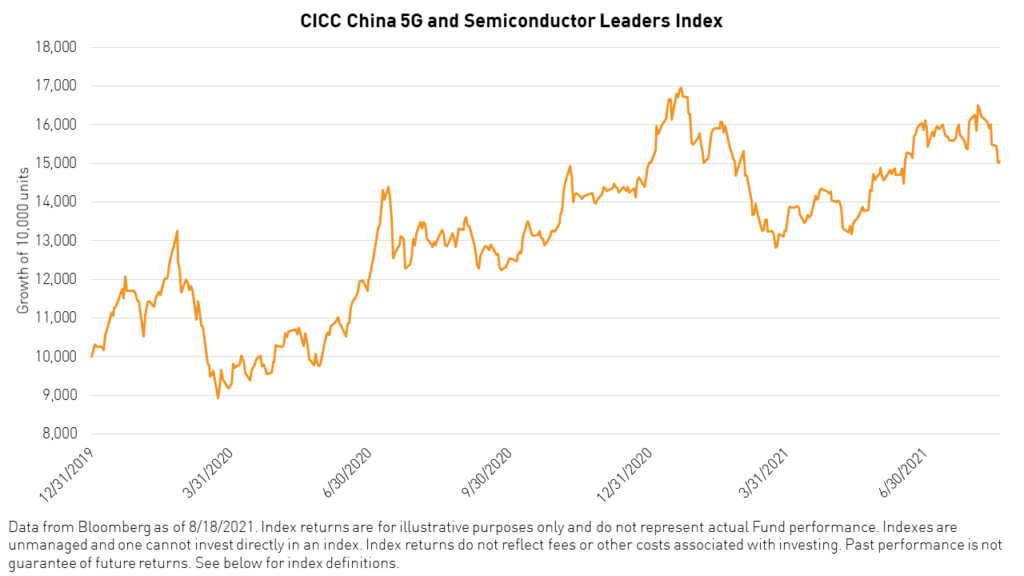

The Chinese government announced that 5G would be a national strategic priority in its March 2017 National Congress Report. Long-term strategic plans, including the 14th Five Year Plan and Made in China 2025, highlight the development of the 5G and semiconductor industries.

Top-level guidance has been echoed by many government departments. China’s Ministry of Industry and Information Technology (MIIT) published a 5G development guideline in March 2018. Multiple Public-Private Partnership (PPP) funds for 5G investment have been established, these include the National Integrated Circuit Industry Investment Fund (target size CNY 200B) and 5G Innovation Industrial Fund (target size CNY 30B).4

China is a world leader in 5G spending and adoption. China has announced plans to spend $1.2 trillion yuan ($180 billion USD) to establish over 5 million 5G base stations throughout the country between 2020 and 2025.5 By 2025, China is projected to have over 400 million 5G users, accounting for 40% of total global use.6 As 5G will facilitate the growth of internet companies’ businesses, these investments may have multiple positive externalities, especially when it comes to the internet sector.

China is the largest consumer of semiconductors. However, it currently relies on imports to meet its massive demand for chips. Therefore, achieving self-sufficiency in this arena is a key strategic objective. As part of the “Made in China 2025” initiative, China aims to produce 70% of the semiconductors used domestically by 2025 and achieve complete import substitution by 2030.7 To advance this goal, China established a new national semiconductor fund worth $28.9 billion in 2019. China’s government has also instated policies to further promote the semiconductor industry, including providing tax exemptions for the next 10 years.8

Capital Markets Reform - Redirecting Investments and savings to the stock market

Real estate investment accounts for, on average, nearly 60% of Chinese household savings compared to 33% in the United States.9 This stems from the fact that even middle class or lower middle-class households in China often purchase one or more investment properties in addition to their own homes. China International Capital Corporation (CICC) analysts predict real estate as a percentage of household assets to fall in the near term.

New regulations are making it more difficult to speculate on real estate and easier for households to enter the stock market. At the end of 2020, China’s banking regulators announced bank balance sheets caps on real estate loans sending a strong signal that housing is for living, not speculating.

At the same time, China’s asset management and investment advisory industry is growing following a slew of reforms, which include welcoming foreign firms to an industry that was previously closed to them. Many major US asset financial institutions are in the early stages of offering asset management products to the Chinese public. In May, Goldman Sachs entered a partnership with the Industrial and Commercial Bank of China (ICBC) to provide wealth management services in Mainland China.10

The recent reforms to real estate and equity investing follow reforms over the past decade that have modernized China’s capital markets and opened them up to foreign investment. The establishment of the Northbound Stock Connect in 2014 allowed foreign investors to participate in Mainland China’s equity markets through accounts in Hong Kong and with fewer restrictions. The STAR Board on the Shanghai Stock Exchange, which was launched in 2019, allows pre-profit science and technology companies to bypass China’s traditionally stringent listing requirements, creating China’s equivalent of the Nasdaq.

One industry’s pain can be another industry’s gain. This adage was proven once again with the announcement of the new fintech regulations, which reshuffled the cards for online lending in favor of traditional banks including China Merchants Bank and Ping An Bank. The new policy dictated that fintech companies must now apply for a banking license and team up with traditional banks to provide consumer lending services and lenders risk assessment.

Policy Outlook - "Common Prosperity" strategy

For a broader picture of the potential scope of future regulations, in the 14th Five-Year Plan, the government laid out a “Common Prosperity” strategy consisting of four pillars of prosperity it wishes to protect. These pillars include health care, livelihood, education, and housing. We believe these areas, especially housing, may be subject to more regulation in the future. On the housing side, we may see real estate taxes or affordable housing mandates being introduced. As for health care, we do not expect major changes. We believe the central procurement program will serve as a mechanism to keep health care costs in check. However, we may see some regulations to fine-tune the operations of private hospitals and prevent price gauging and over-prescription by doctors. We also believe that the development of the biotechnology industry is a long-term goal for the government as the alternative would be dependence on multinationals.

Conclusion

As the examples presented herein show, policy reforms to major industries may have a positive impact in the long term after causing an initial bout of uncertainty. China tends to follow a five-year political cycle, meaning that its approach to the “balancing act” between encouraging innovation and growth and managing risks is fine-tuned every five years. We believe this is precisely what is occurring in the internet sector now. Investors may want to look to Mainland-listed equities, or “A-Shares”, specifically to sectors such as health care, clean technology, high-tech, and banking, for which reforms have been a tailwind.

Citations

- "The Environment: Mapping the invisible scourge," The Economist. August 15, 2015.

- "Xi Jinping Addresses Climate Ambition Summit," Ministry of Foreign Affairs of the People's Republic of China. December 15, 2020.

- International Renewable Energy Agency (IRENA) as of 12/31/2020.

- Data from MIIT as of 6/30/2021.

- "China's digital plan will help it leapfrog US as tech leader," Nikkei Asia. June 11, 2020.

- "The China 5G Opportunity," UBS. September 30, 2020.

- "Made in China 2025: Global Ambitions Built on Local Protections," US Chamber of Commerce. 2017.

- Kubota, Yoko. "China Sets Up New $29 Billion Semiconductor Fund," October 25, 2019.

- Data from CICC Research as of February 9, 2021.

- "China Approves Goldman Sachs, ICBCS joint wealth management venture," Reuters. May 25, 2021.

Index Definitions

MSCI China Index: The MSCI China Index captures large and mid-cap representation across China A-shares, H shares, B shares, Red chips, P chips, and foreign listings (e.g. ADRs). With 703 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid-Cap A-shares represented at 20% of their free float-adjusted market capitalization. The index was launched on October 31, 1995.

MSCI China A Onshore Index: The MSCI China A Onshore Index captures large and mid-cap representation across China securities listed on the Shanghai and Shenzhen exchanges. The index was launched on May 10, 2005.

MSCI China IMI Environment 10/40 Index: The MSCI China IMI Environment 10/40 Index is designed to measure the performance of securities with the country of classification as China comprising of large, mid, and small market cap segments. The Index is comprised of securities that derive at least 50% of their revenues from environmentally beneficial products and services. The Index is based on five Environmental Impact themes: Alternative Energy, Sustainable Water, Green Building, Pollution Prevention, and Energy Efficiency. The Index aims to serve as a benchmark for investors seeking exposure to companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. Constituent selection is based on data from MSCI ESG Research. The 10/40 concentration constraints apply investment limits where the weight of each group entity is capped at 10% and all group entities with a weight of more than 5% should not exceed 40% of the Index by weight. The index was launched on August 23, 2017.

CICC 5G and Semiconductor Leaders Index: CICC China 5G and Semiconductor Leaders Index is a market value-weighted index that measures the performance of 30 Chinese stocks within 5G and Semiconductor-related industries in terms of long-term financial performance and growth of market value. The index was launched on November 15, 2020.

MSCI China Health Care Index: The MSCI China Health Care Index captures large and mid-cap representation across China H shares, B shares, Red chips, and P chips. Currently, the index also includes Large Cap A shares represented at 10% of their free float-adjusted market capitalization. All securities in the index are classified in the Health Care sector as per the Global Industry Classification Standard (GICS®). The index was launched on January 1, 2001.