Electric Vehicles & Future Mobility: Hockey Stick Growth Mode

Tesla’s entrance into the S&P 500 Index in December 2020 signaled the arrival of the electric vehicle (EV) ecosystem as a bona fide sector that investors can no longer ignore. Cost reduction, stricter emissions regulations, government incentives, and the rollout of new and affordable models are bringing EVs within reach of the mass consumer. One analogy commonly used to describe such an inflection point is “hockey stick growth,” where the distant awareness of a trend suddenly crystalizes into mainstream acceptance as the phenomenon takes off. In 2021, EVs finally appear poised to move out of the realm of the future and onto the driveways of the masses.

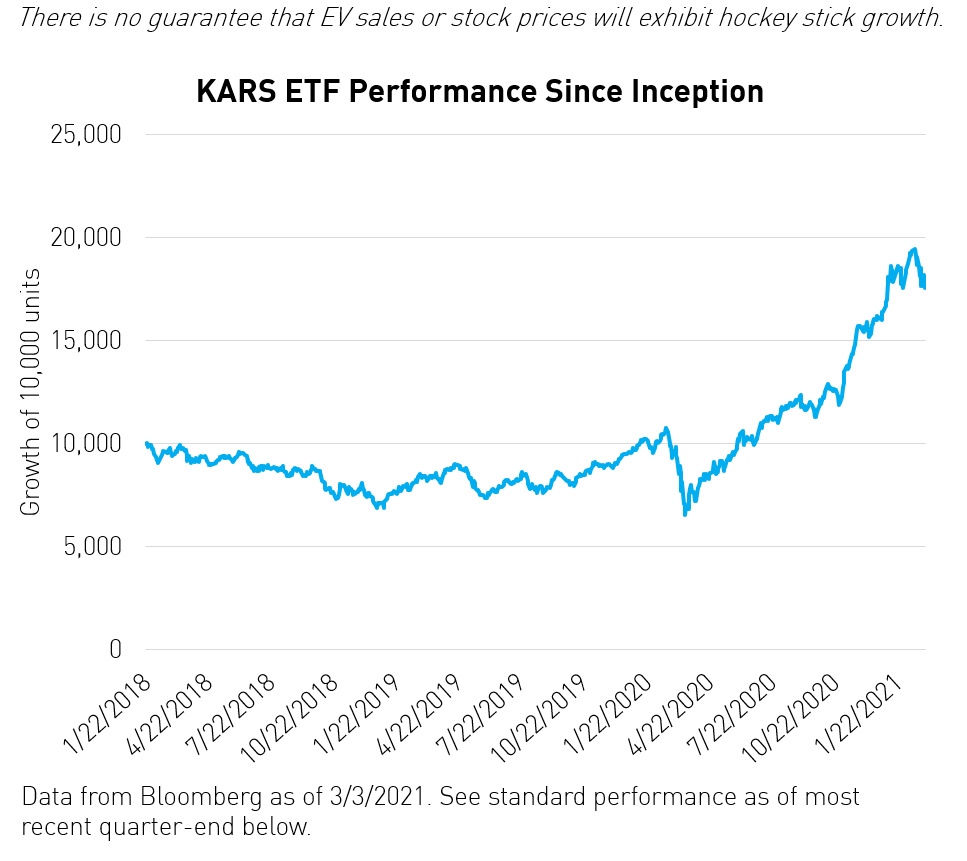

EVs are exhibiting “hockey stick growth” in terms of both sales and stock prices. A dramatic 2020 began with a drop in EV sales but ended with a sales boom. The end of February brought volatility back to the sector, but we believe the upward trend may continue.

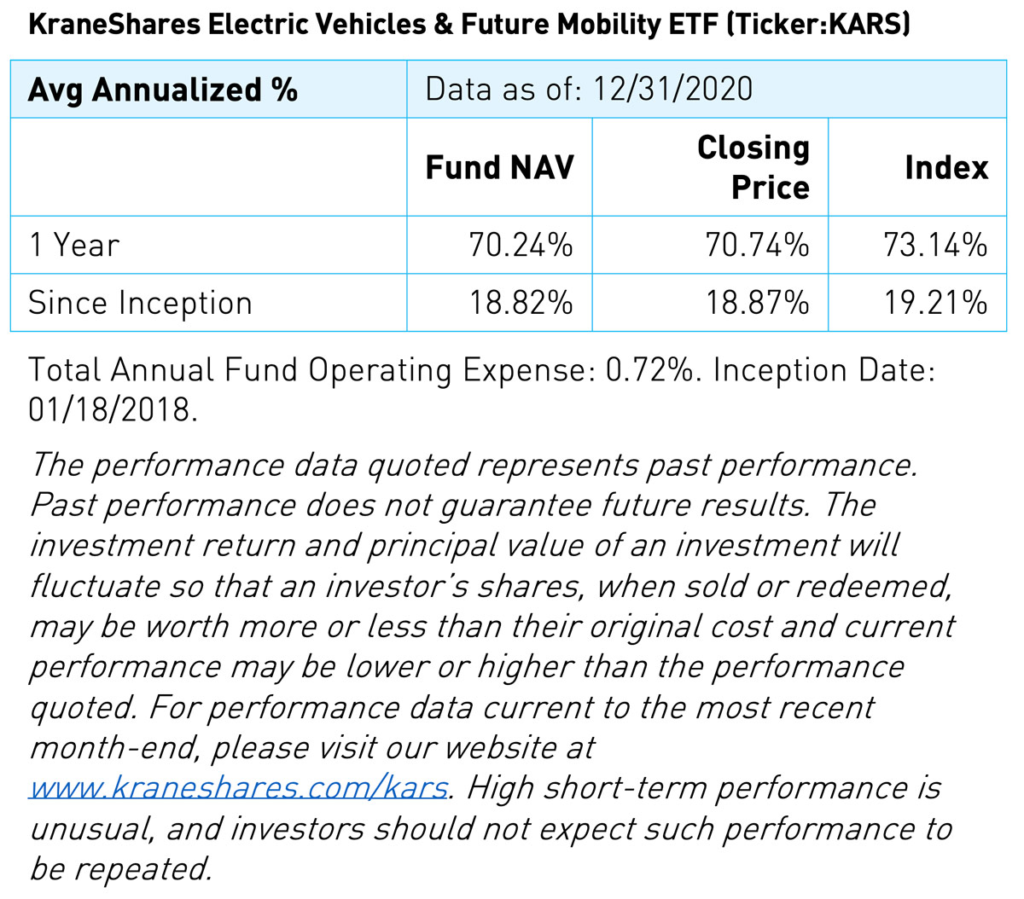

As a result of this surge in EV demand, the KraneShares Electric Vehicles & Future Mobility ETF (Ticker:KARS) returned 70.24% in 2020. The fund ranked first1 in the Morningstar US Industrials* ETF category, second1 in the World Large Stocks** category, and second1 in the Foreign Large Growth*** category.

Strong EV Adoption in 2020

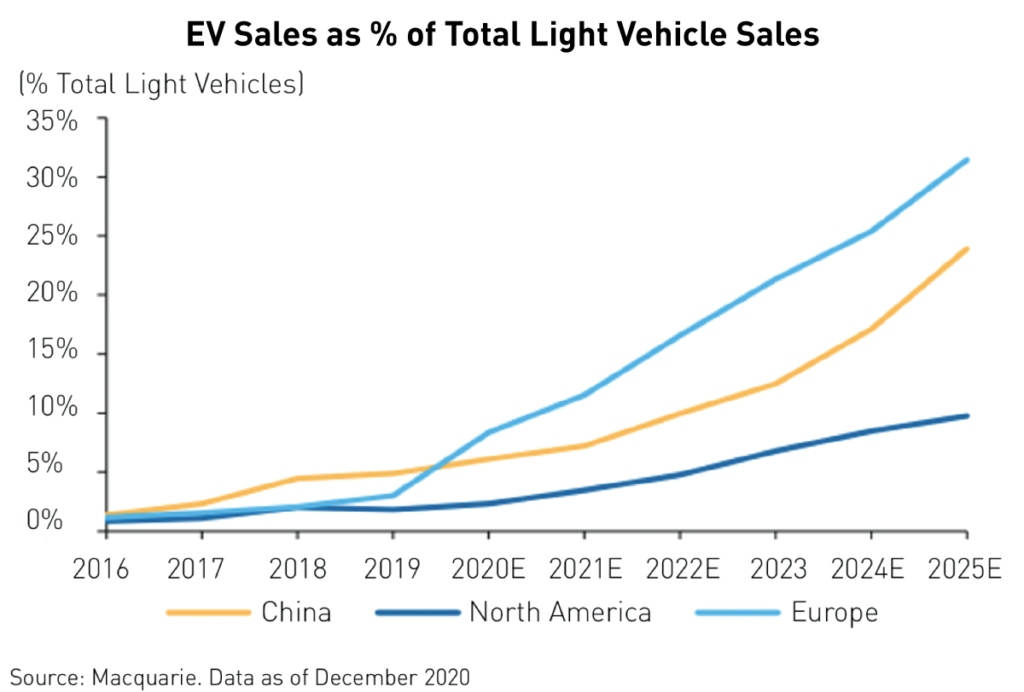

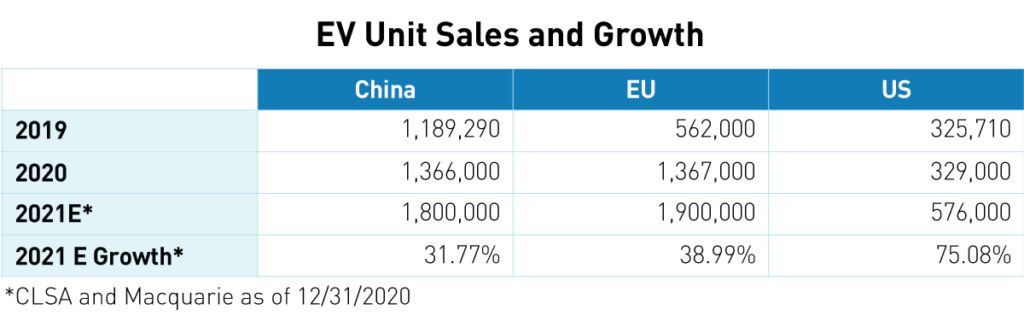

Despite the pandemic and a slumping global automotive industry, EV sales achieved 43%2 growth from 2019 to 2020, mostly due to strong adoption in Europe and China. For the first time in many years, Europe outpaced China in EV demand.

The COVID-19 pandemic and a short-lived reduction in government subsidies for EVs in China caused a mini-recession in EV sales at the beginning of 2020. However, sales turned around quickly to reach an unexpected record high in the fourth quarter of the year. In Europe, EV sales more than doubled from 562,0003 Battery Electric Vehicles (BEV) and Plug-In Hybrid Electric Vehicles (PHEV) in 2019 to 1.37 million3 in 2020. In China, EV sales also recovered during the fourth quarter, registering positive year-on-year growth with sales totaling 1.36 million4 units for 2020. U.S. sales were largely flat5 compared to 2019, with Tesla accounting for approximately 80%5 of EV sales.

Auto components companies are significant beneficiaries of rising EV adoption. The list includes makers and distributors of batteries, capacitors, heat management systems, motor controllers, electronic equipment, interior car designs, battery charging systems, and raw materials, among others.

We believe KARS is a useful tool for gaining exposure to the EV and future mobility ecosystem as the industry gains more prominence and potentially becomes an independent sector.

Growing Policy Support in China & The EU

Government policies implemented before and after the outbreak of COVID-19 were instrumental in setting the EV industry on a long-term growth path.

China's government quickly reinstated EV subsidies in 2020 and continues to encourage local governments to relax car permit quotas for EVs. In many of the largest metropolitan areas in China, there are strict limits imposed by local governments on the number of license plates that can be issued in order to reduce congestion. However, China's national government now mandates that such limits will not apply to the issuance of "green license plates," which are issued for electric vehicles, driving sales.10

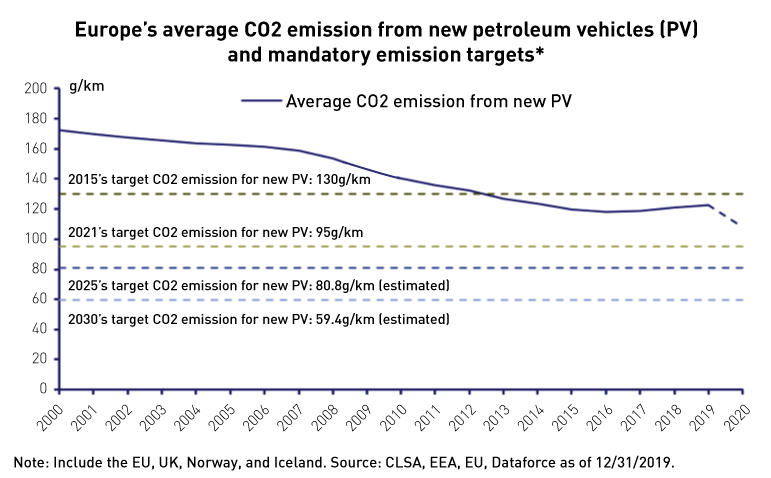

The European Union (EU) reiterated its support for EVs through tax benefits, incentives for EV purchases, and the installation of charging infrastructure. EU countries offer tax reliefs and purchase incentives that cover up to 35% of the cost of the car. The EU's strict emissions rules also incentivize carmakers to invest in new EV models to avoid fines. 2021 may see a record number of EV models hit the market. Furthermore, the EU's vehicle emission limits may continue to decline with time, from 95g/km3 currently towards the 2030 target of 60g/km3.

The Secular EV Opportunity

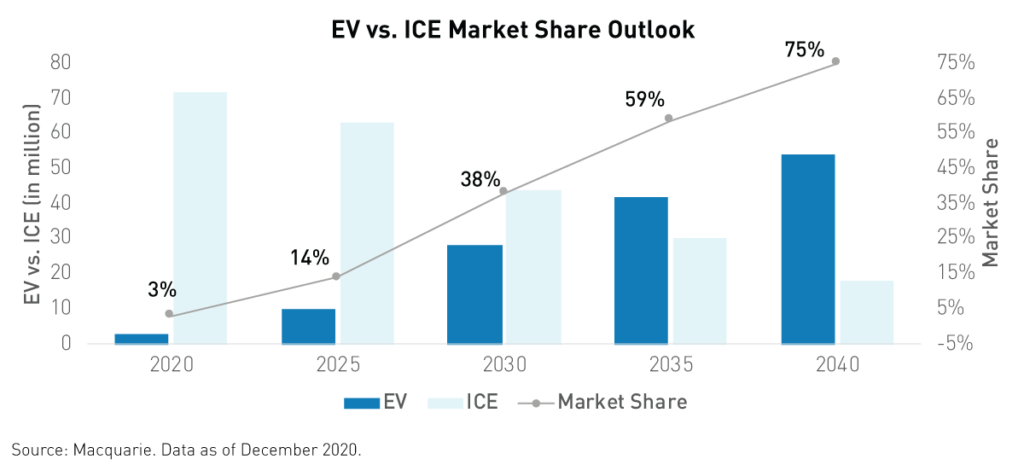

To understand EV and EV components companies' stock price movements, consider the secular EV opportunity. We are currently witnessing a significant shakeup in the transportation industry as EVs continue to replace Internal Combustion Engine (ICE) vehicles over the next 20 years. Many countries have already scheduled bans on the production of gas-powered cars for as early as 2025.

Approximately 75 million ICE vehicles were sold worldwide in 2019 compared to 3.262 million EVs in 2020, the best year yet for EV sales. EV sales are far from catching up with ICE vehicle sales, but technological improvements make EVs more economical and thereby more palatable to the mass market.

ICE Parity & Batteries

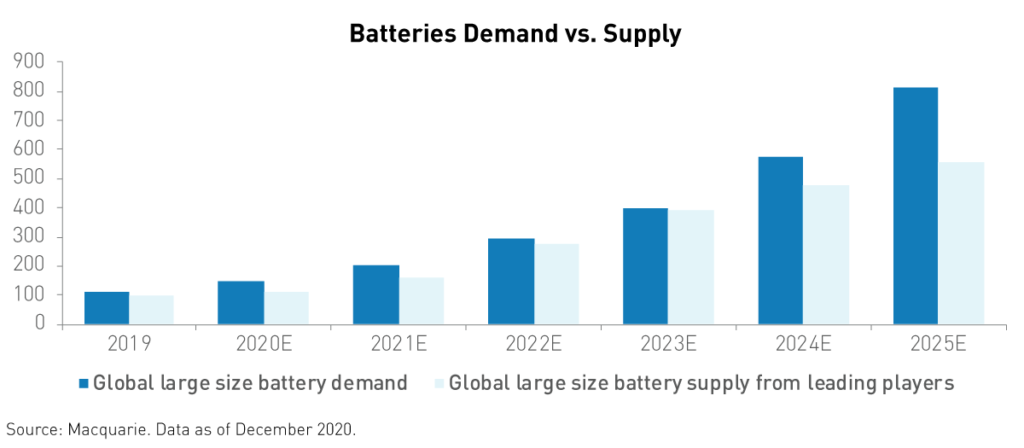

Technological advances and innovation in EV battery production may allow the industry to unshackle itself from government subsidies. EV production could achieve cost equivalence with combustion engine vehicles, or ICE parity, by 2023. Currently, the production cost of EVs is, on average, 20% to 25% more expensive than ICE vehicles measured by USD/KWh.8 Although consumers are presently willing to pay a lifestyle premium for EVs versus ICE vehicles, this will likely become unnecessary in the near future as battery costs fall.

Advancements in battery technology are vital to reaching ICE parity as batteries account for, on average, 40% of the cost of an EV.7 Carmakers must strike a balance between battery size, price, and driving range. Different battery recipes can yield different energy density results, essential for long-range batteries, and cost. Alternative battery chemistries are being researched extensively by battery manufacturers. Different chemistries may suit different markets depending on demands for range and economy.

For example, Tesla has historically produced cars using NCM (Lithium, Nickel, Manganese, Cobalt Oxide) batteries, which cost more and offer an extended range. However, last year Tesla launched the Model 3 SR in China using LFP (Lithium, Iron Phosphate) batteries, offering consumers a cheaper alternative, but with a lower range.

Consequently, surges in battery demand may have positive downstream effects on suppliers and the prices of the raw materials used in their production. Tesla has already instructed its battery suppliers to prepare for future demand.

The Future Mobility Ecosystem & The "Everest" of Autonomous Driving

The electrification of automobiles is only the first step in a long road towards energy efficiency, traffic and accident reduction, improved passenger driver experience, and enhanced transportation accessibility. Other elements of future mobility include vehicle connectivity, shared mobility, and autonomous driving. However, it remains uncertain who the long-term winners will be in future mobility given the sector's multifaceted nature and the tremendous growth ahead of it.

In a global survey conducted by McKinsey, 37% of respondents said they would consider switching car brands for better connectivity. In China, the percentage was even higher at 57%.9 The automobile looks increasingly like a smartphone. However, legacy automakers are largely inexperienced in building operating systems. Their inexperience represents a tremendous opportunity for new companies that develop an edge in improving vehicle connectivity.

Major technology and startup companies are conducting research into fully autonomous driving. While these companies have made significant advances, we are still far from a full-blown level 5 (L5) autonomous system, which does not require a driver at all. It is considered the "Everest" of autonomous driving.

Global governments' increased focus on environmental conservation and congestion reduction may be a turning point for shared mobility. Longer-term, the advent of autonomous vehicles is likely to benefit the industry.

While Covid-19 put some autonomous driving research and development on hold, the pandemic has also reinvigorated enthusiasm for the technology. As passengers have become more conscious of health and safety, the potential benefits of driverless vehicles, especially in the shared mobility space, have been compounded.

Conclusion

Electric vehicles have become a sector unto themselves. EVs no longer represent a niche market, fringe trend, or hobby. What began as a business of the distant future has become a formidable global economic engine today. As such, we believe that taking a basket approach to EV investing is increasingly important. To us, that means investing not only in multiple EV manufacturers - including those listed in China and beyond the US - but also in companies that support EV development and the entire future mobility ecosystem.

Citations

- Morningstar as of 12/31/2020

- EVVolumes.com

- European Automobile Manufacturers Association (ACEA) and European Alternative Fuels Observatory (EAFO).

- China’s Ministry of Industry and Information (MIIT) & the China Association of Automobile Manufacturers (CAAM)

- IHS Markit

- HSBC

- Macquarie and SNE Research

- Tesla’s Annual Conference in September 2020

- McKinsey Center for Future Mobility

- Lambert, Fred. "China boosts electric car sales by removing license plate quotas," Electrek. June 6, 2019.

Definitions

Kilowatt Hour or Kw/H: A measure of electrical energy use equivalent to the consumption of 1,000 watts for 1 hour.

*US Industrials ETF Category: Portfolios that seek capital appreciation by investing in equity securities of U.S. or non-U.S. companies that are engaged in services related to cyclical industries. This includes and is not limited to companies in aerospace and defense, automotive, chemicals, construction, environmental services, machinery, paper, and transportation.

**World Large Stock ETF Category: Portfolios that invest in a variety of international stocks that are larger. World-stock portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in developed markets, with the remainder divided among the globe’s smaller markets. These portfolios typically have 20%-60% of assets in U.S. stocks.

***Foreign large-growth ETF Category: Portfolios that focus on high-priced growth stocks, mainly outside of the United States. Most of these portfolios divide their assets among a dozen or more developed markets, including Japan, Britain, France, and Germany. These portfolios primarily invest in stocks that have market caps in the top 70% of each economically integrated market (such as Europe or Asia ex-Japan). Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). These portfolios typically will have less than 20% of assets invested in U.S. stocks.