Notes from China: Consumer Culture is Everywhere

Brendan Ahern gives a first-hand account of China's new economy at work.

Over the past week, KraneShares CIO Brendan Ahern was traveling in China meeting with KraneShares’ business partners in the Mainland. He visited Beijing and Shanghai, and met with some of the most well-known and prestigious financial institutions in China including: China Development Bank, Bosera Asset Management, and E Fund Asset Management.

During Brendan’s trip he was reintroduced to many of the macro trends we continuously write about at KraneShares including: the rise of domestic consumption, the proliferation of internet and ecommerce, and the evolution of China’s bond market.

China’s massive population and velocity of growth guarantee that statistics surrounding any of its popular trends are monumental. As impressive as the numbers may be, we believe it is equally enlightening to see how these trends are shaping actual people’s lives.

Over the next several weeks, KraneShares' CIO Brendan Ahern, will share observations from his recent trip to China of how these macro trends are impacting the life of Chinese people.

Domestic Consumption Trends

The thirteen-hour flight from New York to Beijing takes a toll on my knees and legs despite making sure I stand and stretch every two hours. Upon my arrival in Beijing, the eighteen-mile drive from the airport to my hotel does not help matters as it takes over an hour and I'm reacquainted with Beijing’s notorious traffic.

After checking in to my hotel and taking a warm shower, I stretch my legs with a walk to Shin Kong Place, a high-end mall with great restaurants. Shin Kong Place is a microcosm of what is going on across China, the eager shoppers and the stores that serve them are indicative of one of the most important macro trends in China: the rise of domestic consumption.

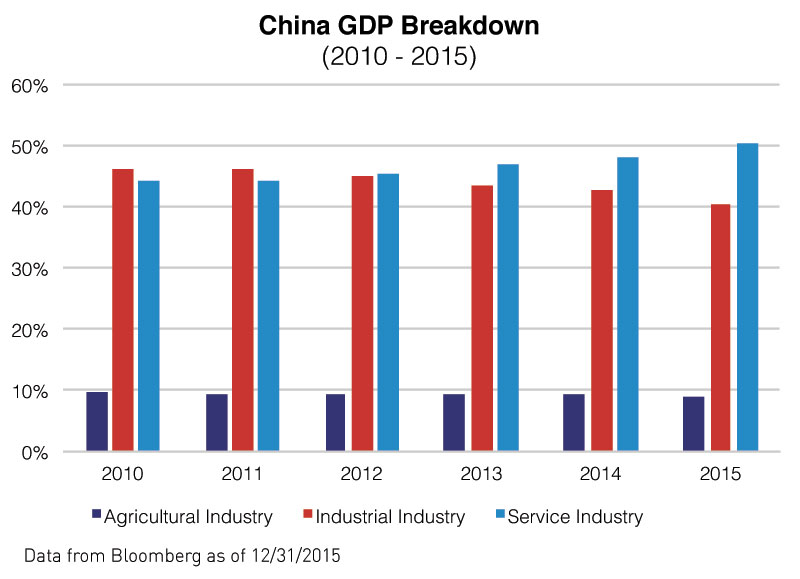

Since 2013, China's service industry has surpassed manufacturing as a percentage of GDP. The value of monthly retail sales has also been steadily increasing over the years.

My walk through Shin Kong Place on a Sunday night was evidence that China’s consumer is alive and well. The cleverly constructed mall’s restaurants are on the top floor, which forces shoppers to walk by all the luxury stores, and their high end goods, in order to get a meal at one of the bustling top-floor eateries.

After traveling west on Dawang Road toward the financial district, I am struck by how new the cars are; the streets are teaming with Buick minivans, Volkswagens, and even electric cars like Teslas and locally made BYD1.

I am greeted at the first meeting by a curious sight. Office workers are coming outside to claim their packages from delivery scooters. Scooters from Alibaba’s2 Taobao and their rival JD.com3 are surrounded by workers. As I traveled in Beijing the next two days, I could not help but notice the red JD.com scooters and vans, in addition to Alibaba’s network of delivery companies, driving on the streets and stopping in front of residential and office buildings.

Beijing and Shanghai are eight hundred miles apart, which in U.S. terms is approximately the distance between New York City and Chicago. I took the high-speed train from Beijing to Shanghai, not just for the novelty of traveling at two hundred miles per hour on the ground, but also for the convenience of avoiding delays at the airports due to the seasonal rains.

Covering the eight hundred miles between the two cities by any method other than high-speed rail would mean a twelve-hour drive or two-hour flight (minus security and departure times). The high-speed train arrives in just five hours. For perspective, the Amtrak line from New York City to Boston spans a mere two hundred twenty miles and takes over three and half hours to complete.

As my business trip concluded in Shanghai, I headed out to the busy Hongyi Plaza which is filled with retail stores including an Apple store and their Chinese rival Huawei. Both stores looked very crowded for a Wednesday night as I searched for gifts for my children. The Plaza was packed with fellow shoppers enjoying a beautiful night cooled by rain earlier in the day. Witnessing the rise of China’s consumer is hard to avoid as scooters and vans navigate the streets, and shoppers crowd the malls.

- BYD Co. has a .99% weight in the Kraneshares FTSE Emerging Market Plus ETF as of 6/30/2016.

BYD Co. has a .5% weight in the Kraneshares Bosera MSCI China A ETF as of 6/30/2016. - Alibaba has a 9.69% weight in the KraneShares CSI China Internet ETF as of 6/30/2016.

Alibaba has a 1.45% weight in the Kraneshares FTSE Emerging Market Plus ETF as of 6/30/2016. - JD.com has a 7.06% weight in the KraneShares CSI China Internet ETF as of 6/30/2016