China to South America: Consumer Technology Growth in Emerging Markets

By Brendan Ahern, Chief Investment Officer at KraneShares

I was recently invited to present on emerging growth opportunities from the China Internet sector to several of the largest institutional investors in South America. My trip brought me to Lima, Peru, Bogotá, Colombia and Santiago, Chile. The South American institutions’ natural enthusiasm for Chinese investments was refreshing. It is not surprising that South American investors are already comfortable with China. According to a 2018 report by the Economic Commission for Latin America and the Caribbean, China has invested close to $90 billion in the region between 2005 and 2016.1 While the South American investors were interested in emerging growth opportunities in China, locally I saw a business climate which I believe is compelling.

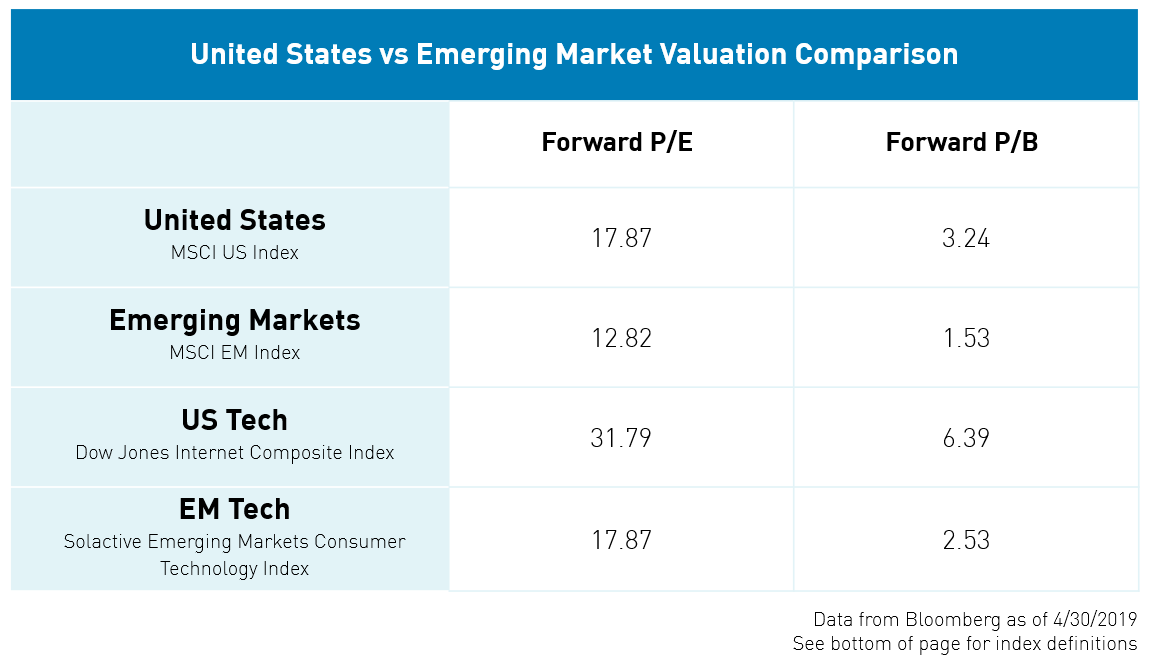

Many investors are attracted to emerging markets because of their low valuations relative to the United States. However, stocks with low valuations without a catalyst for growth do not necessarily make good investments. Broad-based emerging market funds are dominated by value sectors such as financials, industrials, energy and materials which do not typically include high-growth, innovative companies. This is why broad-based emerging markets have underperformed US stocks over the past decade. On the other hand, consumer technology firms tend to be entrepreneurial, disrupt traditional business models and often gain large market share over a short period of time. We believe emerging market consumer technology represents a high growth opportunity at an attractive valuation.

South African media conglomerate, Naspers, provides perhaps the best example of an investor benefitting from an emerging growth opportunity. In 2001 Naspers invested $32 million into Chinese consumer technology company, Tencent for a 33% stake in the company. Since 2001, Tencent has grown from a gaming company into a full online ecosystem, dominating mobile messaging and payment, social media and gaming. Tencent’s popular WeChat platform has over 1 billion monthly active users.2 In March 2018, Naspers achieved what Bloomberg characterized as one of the biggest VC payoffs in history when it sold a 2% stake in Tencent and realized a 60,000% return. As a result of Tencent’s growth, today Naspers' remaining investment is worth a remarkable $146 billion.3 As this example highlights, the market conditions in China allowed Naspers to achieve an outsized return on their investment. In South America, when discussing growth opportunities, two companies continued to come up in conversation with investors: MercadoLibre and Rappi. Each company has succeeded in establishing itself as a market leader in South America and as a mainstay service provider to consumers.

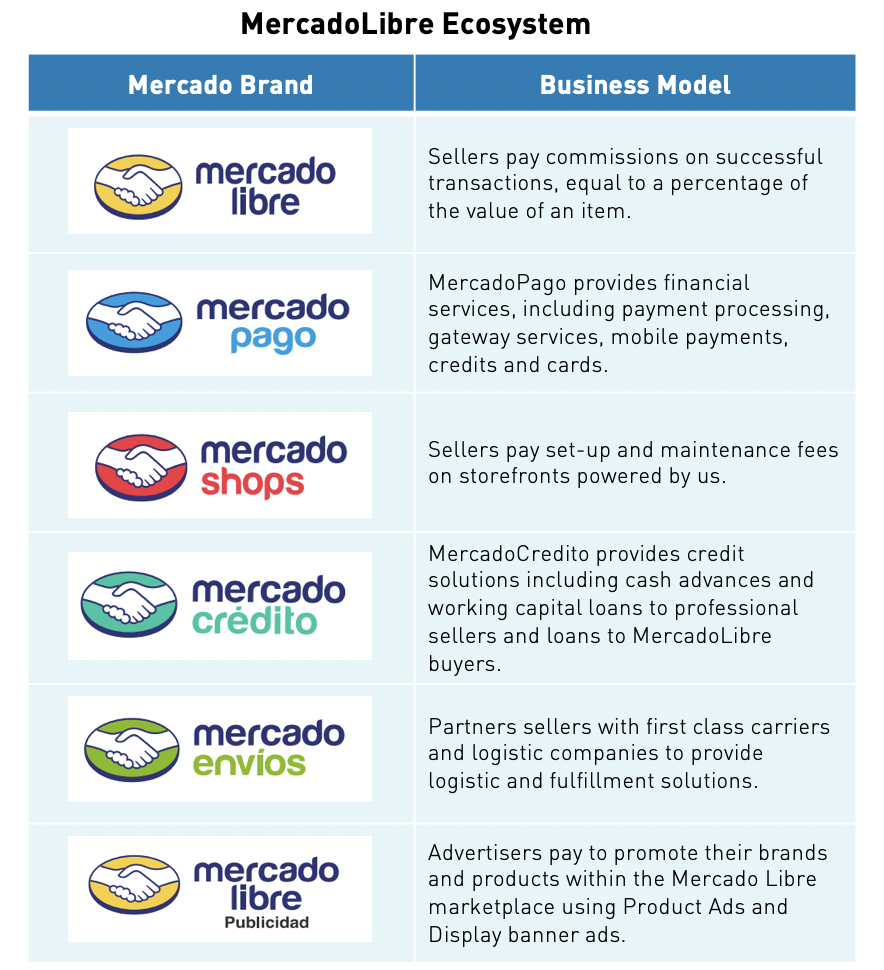

MercadoLibre is the largest e-commerce platform in South America, capturing nearly half of all online retail sales in the region. Their innovative business strategy prioritizes gaining market share over profitability, which has driven them to enter into markets deemed prohibitive by their competitors. For example, MercadoLibre continues to operate in Venezuela, accepting cryptocurrency after the Venezuelan Bolivar collapsed in August 2018. MercadoLibre has also set up operations in Central America, including Guatemala and Honduras, where competitor Amazon does not yet have a presence and where Walmart has only recently begun to provide service. Beyond MercadoLibre’s strategy for expansion, they have also positioned themselves competitively by vertically integrating their business to include logistics, credit solutions, digital storefronts, advertising and fintech services including payment processing, mobile payments and credit cards.

While MercadoLibre’s primary business is e-commerce, their December 2018 earnings report showed that the biggest driver of growth came from MercadoPago, previously considered an ancillary service. All of these indicators lead us to believe that there is more growth is to come for MercadoLibre. As of May 3rd, 2018, MercadoLibre’s market cap reached an all-time high of $28.7 billion and the stock price year-to-date has gone up 98%.4

Looking beyond e-commerce to on-demand delivery and logistics, privately-owned Rappi is dominating the South American market. Rappi began as a food and restaurant delivery platform. Today it has expanded delivery service to include everything from groceries to prescription drugs to dog walkers. This business model is similar to Meituan-Diaping in China, where last mile logistics are provided by couriers on bike and motorcycle. While in Lima, one of the investors I met eagerly showed me a photo he had taken on Valentine’s Day with throngs of Rappi couriers outside of a florist waiting to pick up bouquets for delivery. I was blown away by the photo which drove home just how in demand Rappi has become in Lima. The company has a notable list of private equity investors including SoftBank and Sequoia Capital. Rappi recently announced that their latest funding round raised $1 billion in capital5 in preparation to expand offerings into additional product delivery categories. While an IPO is likely, the timeline is uncertain. What is certain, is that consumer acceptance is high for mobile technology platforms within South America and there will be continued demand.

The KraneShares Emerging Markets Consumer Technology ETF (ticker: KEMQ) provides broad exposure to growth in the consumer technology sector across emerging markets. KEMQ was created based on our experience developing the KraneShares CSI China Internet ETF (KWEB), the leading China internet sector ETF in the US in terms of assets under management.6 Through our experience with KWEB we understood that the massive market capitalization of Chinese internet companies would dominate any traditional market cap weighted emerging market consumer technology fund. In order to provide a diversified and balanced exposure to consumer technology across all emerging markets, we decided to cap the weight of individual holdings in KEMQ at 3.5% of net assets with semi-annual rebalances to maintain the 3.5% threshold. By capping the weight of individual holdings, KEMQ is not overweight China and instead gets even exposure to growth opportunities across emerging markets, including MercadoLibre, Naspers and companies similar to Rappi.

Besides meeting with investors who were enthusiastic about investment opportunities in China, South America served as a good reminder that consumer technology is taking root across emerging markets and compared to the US valuations look compelling with plenty of catalysts that could drive performance.

- Foreign Direct Investment in Latin America and the Caribbean Report 2018 (Economic Commission for Latin America and the Caribbean).

- "WeChat Revenue and Usage Statistics (2019)", businessofapps.com as of 2/27/2019

- Ownership data from Bloomberg as of Sept 6, 2018. Value based on Tencent closing price on Monday April 15th of Hong Kong dollars 388.20 and Hong Kong dollar spot price of 7.83

- Bloomberg research as of 5/20/2019

- Delivery firm Rappi to enhance "super-app" with $1bn funding", zdnet.com as of 5/3/2019

- Source: Bloomberg as of 5/20/2019

Weights of KEMQ Holding Mentioned:

- MercadoLibre % of KEMQ net assets as of 5/20/2019: 4.22%.

- Naspers % of KEMQ net assets as of 5/20/2019: 3.91%.

- Tencent Holdings Ltd % of KEMQ net assets as of 5/20/2019: 3.66%

Index Definitions:

- MSCI United States Index: The MSCI USA Index is designed to measure the performance of large and mid cap segments of the US market.

- MSCI Emerging Markets Index: Captures large and mid cap representation across 24 Emerging Markets (EM) countires.

- Dow Jones Internet Composite Index: The index is designed to measure the performance of the 40 largest and most actively traded stocks of U.S. companies in the internet industry.

- Solactive Emerging Markets Consumer Technology Index: The Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, or software for internet and E-Commerce transactions.