China Health Care: A Rediscovered Sector Keeps Its Momentum

Introduction to China Health Care & The KURE ETF

The covid-19 pandemic put China’s health care sector back in the spotlight. We believe there are many reasons to be upbeat about the sector’s future growth beyond the pandemic.

The immediate health care needs stemming from the pandemic, together with the emergence of green shoots in biotech innovation, paved the way for a landmark year in the development of China’s health care system. Furthermore, government reforms are helping to set the sector on a path of long-term growth by encouraging innovation and technological advancement in the hope of building a globally competitive health care system that is accessible, affordable, and of high quality.

The blooming biotechnology industry was on full display in 2020 thanks to vaccine development, innovative drug approvals, record fundraising, and a record number of licensing deals with multinational companies including Roche and Novartis.1 While we believe pharmaceuticals, particularly biotechnology, present the greatest upside potential, all of China’s health care sub-industries enjoyed a year of growth and positive change.

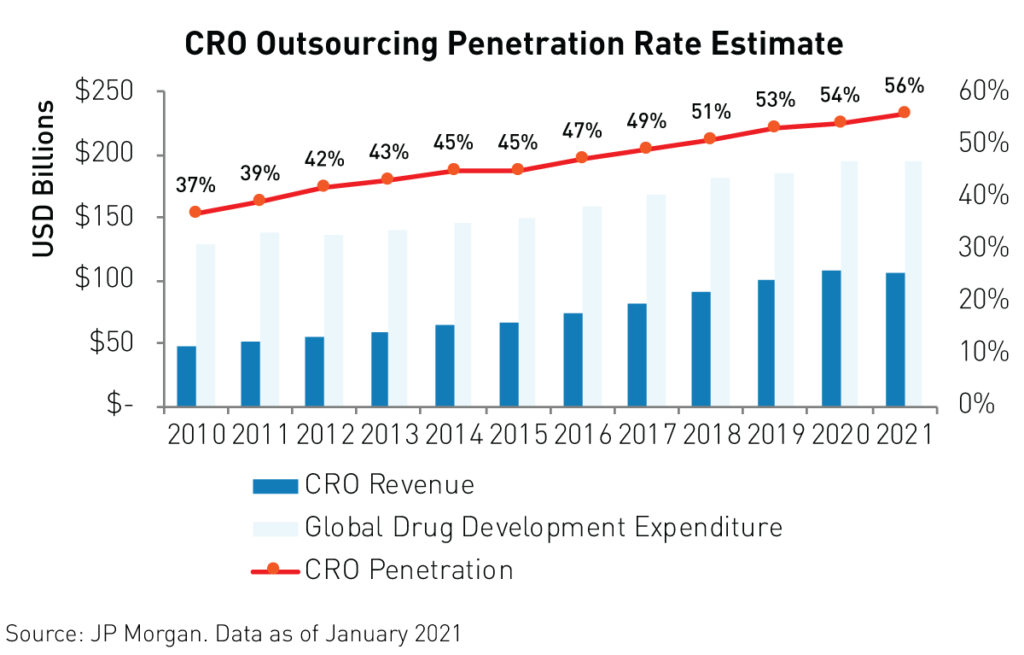

The KraneShares MSCI All China Health Care (KURE) invests in onshore and offshore listed China health care companies. The fund performed well in 2020, gaining 67.28% in net asset value (NAV) for the year. KURE investors may benefit from two secular opportunities: increasing health care demands from a 1.4 billion-strong, rapidly aging population, and a shift to a competitive health care model.

2020 in Review

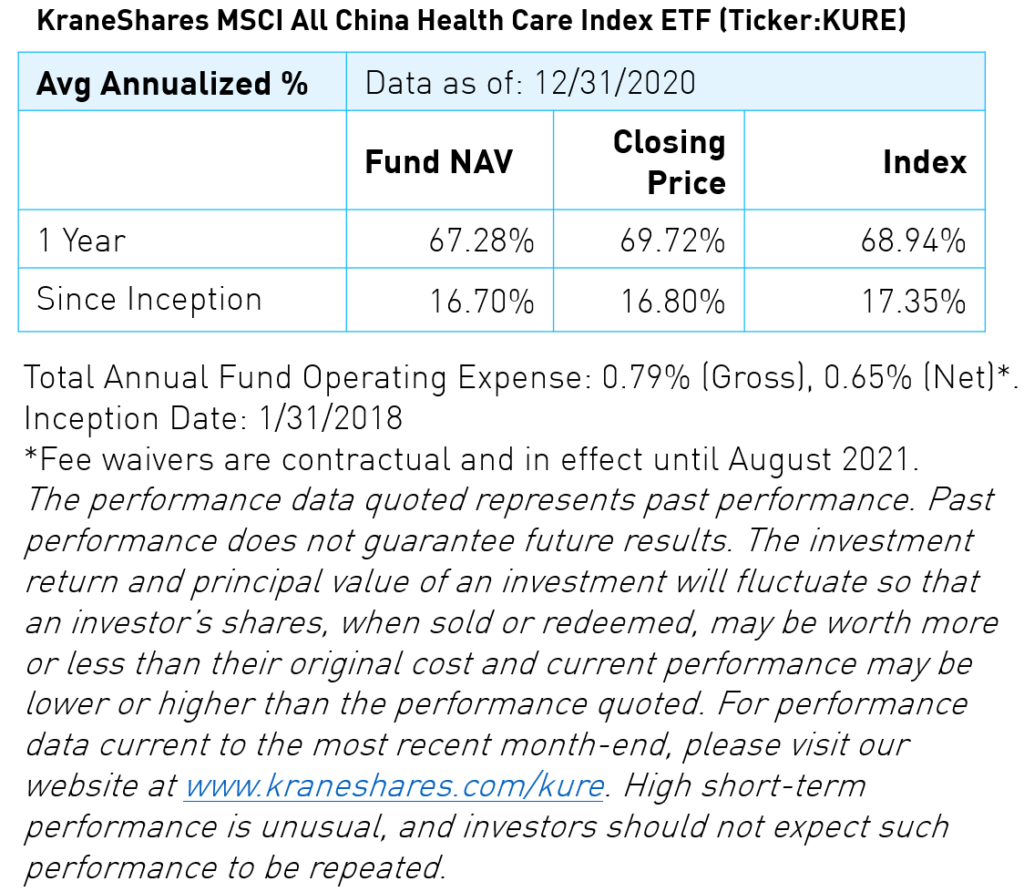

Health care was the second-best performing sector in China in 2020. Growth in China’s healthcare sector was broad as most sub-industries saw positive developments. Life sciences companies performed best in 2020 followed by medical devices, health care technology, and biotechnology. However, health care distribution companies’ operations were disrupted by the pandemic and struggled as a result. Meanwhile, the gulf between pharmaceutical companies with robust, innovative drug pipelines and those that remain dependent on generics widened.

Life Sciences

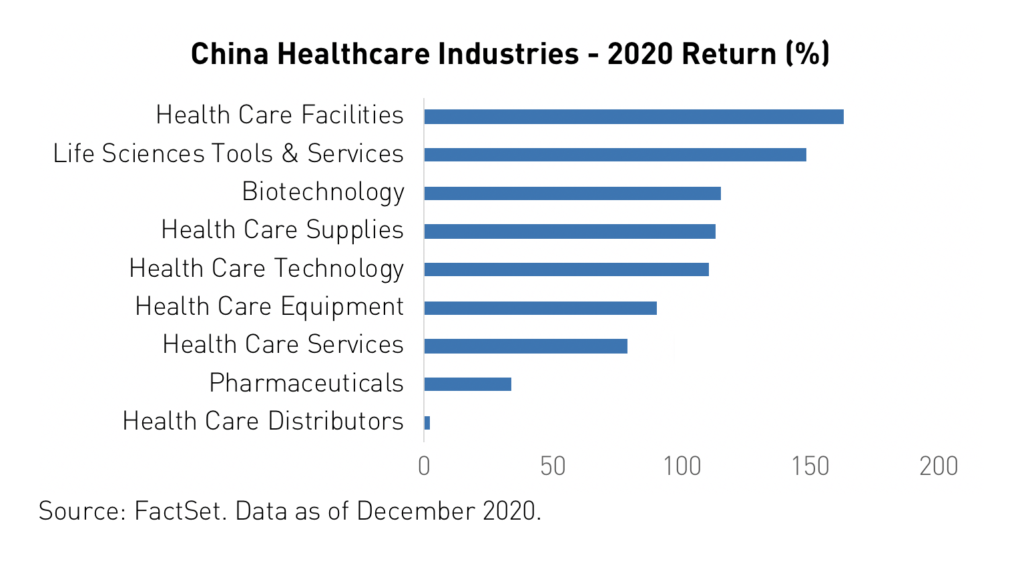

The pandemic had a negligible impact on life science companies’ operations and schedules as China re-opened rapidly following the outbreak of covid-19. Contract Research Organizations (CROs), are the key players in China’s life sciences industry. CROs use their state-of-the-art, turn-key labs with advanced technological capabilities, and access to a deep bench of scientists to develop new drugs and treatments for companies that wish to outsource their R&D processes. They are thereby able to profit from the R&D process without bearing as much risk, which makes for a defensive business model. Industry leaders Wuxi Biologics and Wuxi Apptec provide end-to-end support to pharmaceuticals from discovery to commercialization.

Contract organizations are the main beneficiaries of the strong growth in R&D spending in China as more companies outsource their R&D needs. The percentage of R&D spending flowing to contract organizations reached a staggering 56%4 in 2020 and is expected to grow to an even higher level in the years to come.

Health Tech

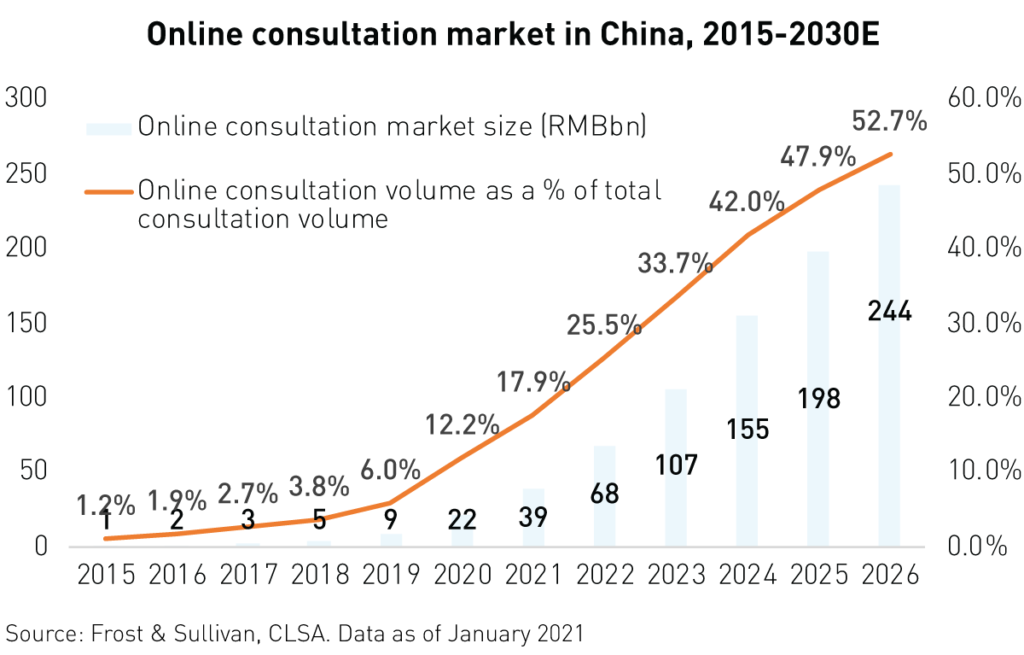

2020 saw the rapid expansion and development of healthcare technology or health tech. In our previous report China’s Healthcare System Uncovered, we discussed how the pandemic was leading to increased user adoption and innovation in this fascinating new sub-industry. In 2020, health tech proved vital in ensuring that routine, non-covid medical needs were met and aided in vaccine distribution and tracking.

As such, health tech has become an essential part of China’s health care system and is now receiving support from the highest levels of government. The government released a communique in December of 2020 reiterating the positive impact of Healthtech during the pandemic. As part of the 14th Five Year Plan, many recommendations to organize and expand the use of “Internet + medical services” have been suggested.

Health tech platforms offer telemedicine, online pharmacies, disease management, and health care cloud data services, among other services. Health tech leader Ali Health reported a 74%2 yearly increase in revenue for the 6 months ended September 30th, 2020. This phenomenal growth was mainly attributed to a surge in revenue from its pharmaceutical E-Commerce business. Meanwhile, rival Ping An Good Doctor reported 36% revenue growth for 2020 with 82%1 growth in telemedicine, 24%1 growth in consumer health care, and 28%1 growth in its “health mall” business.

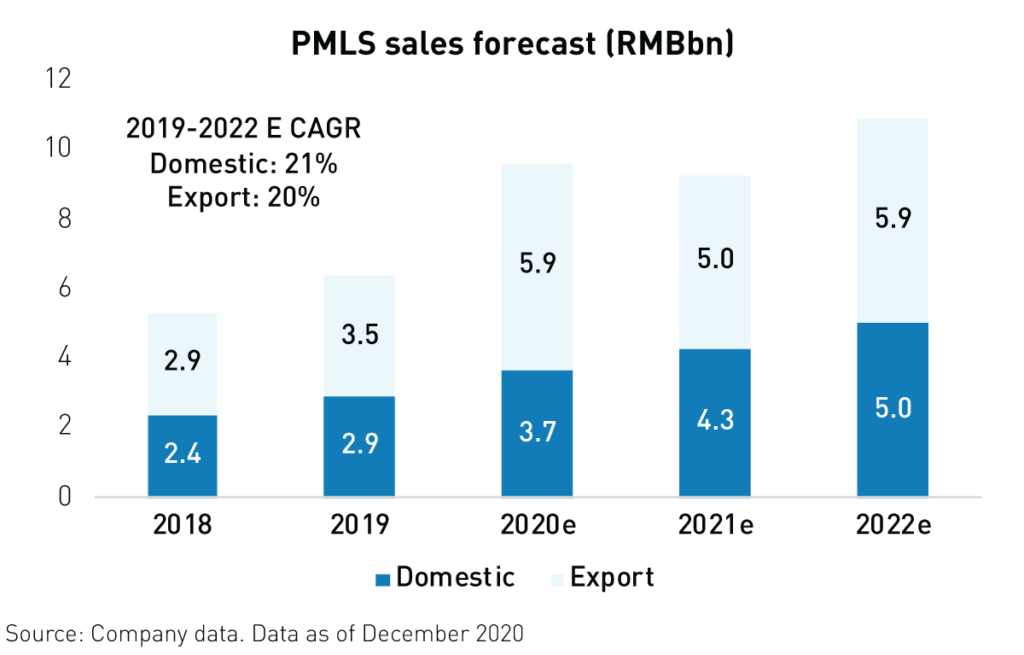

Medical Devices

China’s medical devices industry came to the rescue globally during the pandemic. After being called on to support new hospitals in Wuhan, which were built in only ten days to treat covid-19, China’s medical device companies helped fulfill the skyrocketing global need for their products. Exports of medical devices surged in 20202 as global demand for Patient Monitoring and Life Support (PMLS) devices including ventilators reached unprecedented levels. As a result, Shenzhen Mindray, the industry leader, is estimated to have grown revenues by 26%2 in 2020.

Unfortunately, the pandemic exposed some of the weaknesses in China’s health care infrastructure. However, as a result, the government has initiated a massive health care infrastructure upgrade with the goal of doubling ICU capacity4 over the next 3 years. The government has also committed more than RMB 45 (approx. $7 billion) to the expansion and upgrading of hospitals nationwide. In addition to benefitting from strong domestic demand, China’s top medical devices companies have established relationships with more than 4004 new hospitals overseas, boosting global sales.

Biotechnology: A Golden Age of Growth

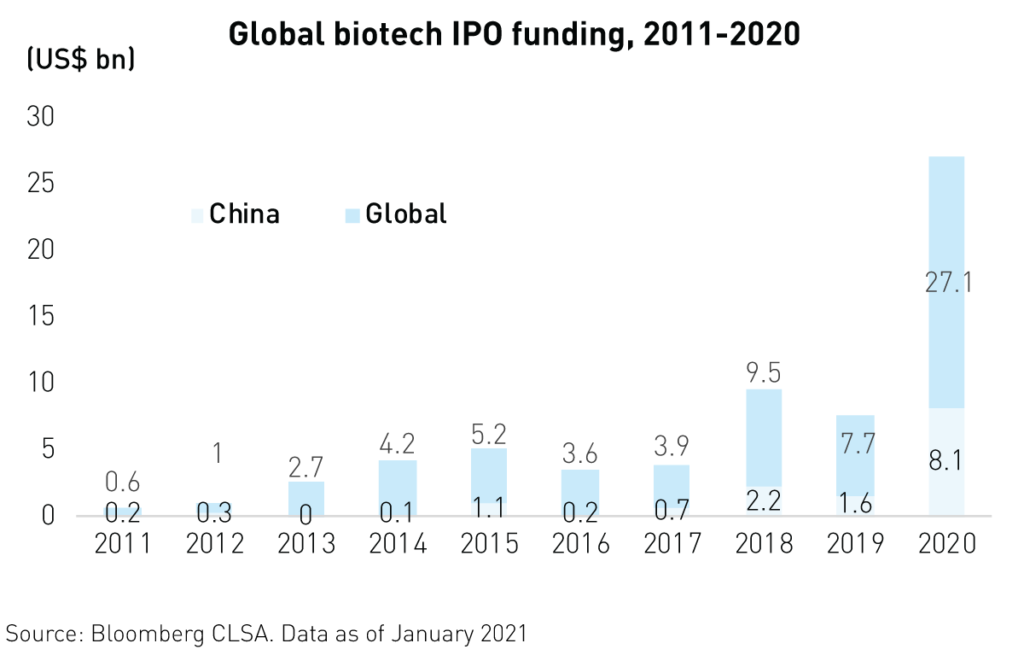

The transition from a generic health care model to one based on innovation and competition is being led by biotechnology and life science companies and is supported by public policy in China. We believe this tectonic shift is the most significant potential driver of long-term growth and has caught the attention of global investors and pharmaceutical companies.

Foreign investor interest in Chinese biotechnology IPOs has resulted in $8.1B3 in new funding in 2020 alone alongside strong private equity investment. Foreign investors are enticed by the massive opportunity that the sector represents. China’s rapidly aging, 1.4 billion-strong population often depends on the industry for quality-of-life improvements and relief from complex, noncommunicable diseases.

Another catalyst for the industry has been the growing number of international licensing deals involving Chinese firms. More and more Chinese biotech companies are building partnerships with global pharmaceutical companies to develop and commercialize innovative drugs in new markets. 2020 witnessed a surge in licensing-out deals with foreign and multinational firms, which means that drugs produced in China are now sought after across the globe. These deals yield hundreds of millions1 of dollars in upfront payments and may potentially generate billions in milestone and royalty payments down the road. More than 223 such deals were signed in 2020, compared to only 12 in 2019.

China-based biotechnology firm BeiGene licensed its Anti-PD-1 antibody immunotherapy drugs to Norvartis1. Meanwhile, Innovent Biologics announced a collaboration deal with Roche1 to use its platform to develop a new drug, granting Roche exclusive rights to ex-China sales and distribution.

As seen below, the number of license-out deals as a percentage of total China deals has risen substantially since 2017. This is a testament to the innovation and R&D prowess of China’s biotechnology firms.

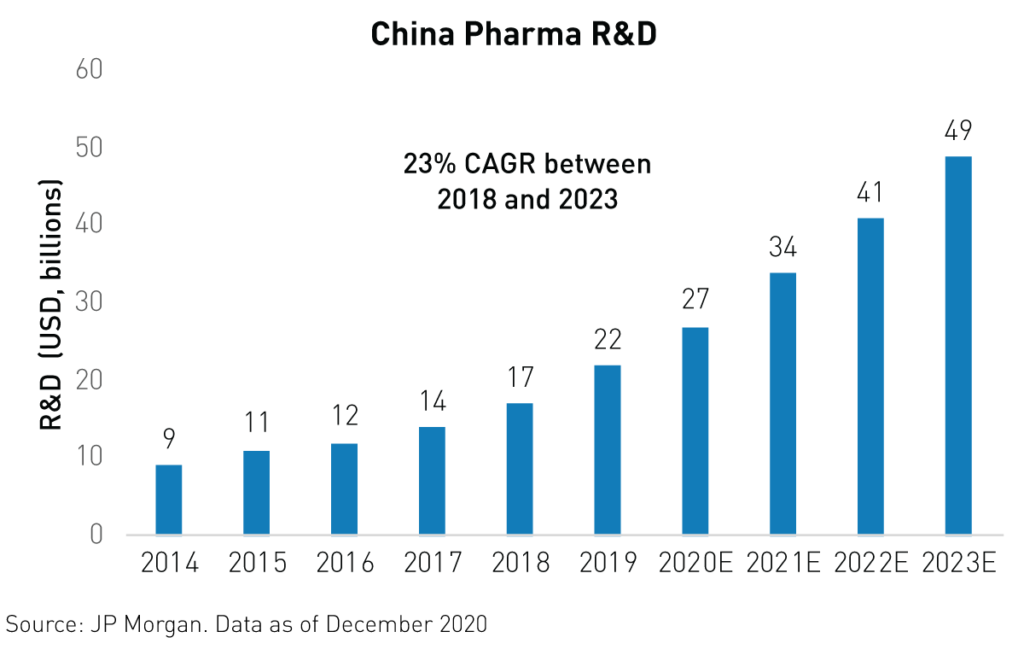

All indicators are pointing in the direction of a new golden age of growth for China’s biotechnology industry. R&D spending, patents, newly registered trials, and innovative drug approvals are all key indicators of progress for the industry. Furthermore, R&D spending is expected to grow by 23%3 from 2018 to 2023, exceeding global R&D spending growth. Approvals for innovative, non-generic drugs in China jumped from just 143 in 2019 to 203 in 2020 and many of the recently approved drugs were developed by smaller biotech companies, which may see valuation bumps in future funding rounds as a result. Additionally, trial registrations are on the rise. More than 1,4243 phase I/II/III trials were registered in 2020, up from 1,2183 in 2019.

In addition to the potential stemming from the unmet needs of an aging, 1.4 billion-strong population, innovative drugs have the potential to generate billions in new revenue for many of China’s biotechnology firms.

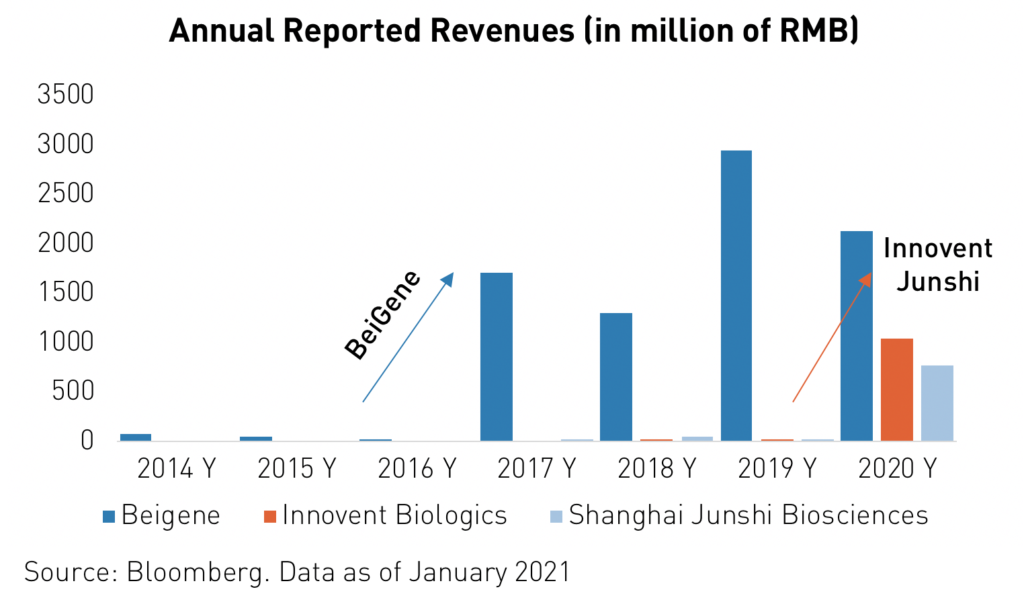

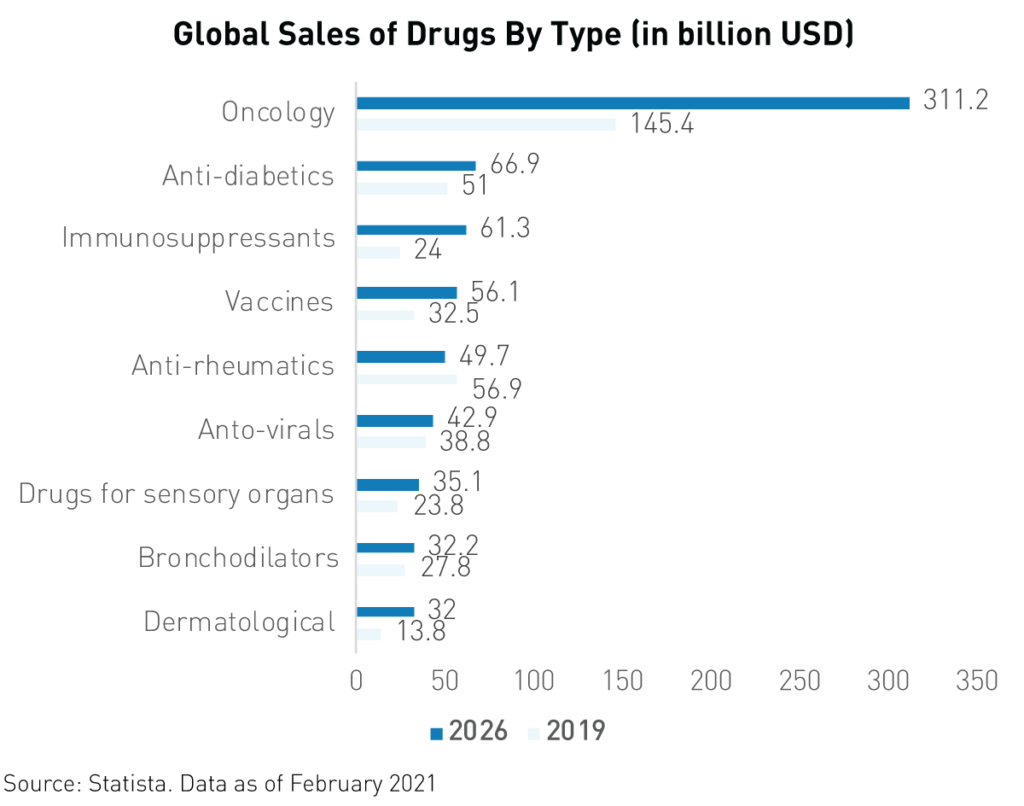

For instance, Innovent Biologics’ revenue jumped from RMB 21.8 million1 in 2019 to RMB 1.051 billion in 2020 following the approval of its TYVYT cancer drug. Oncology is by far the largest field of pharmaceuticals in terms of current and forecasted global spending. Analysts expect worldwide yearly spending on oncology drugs to reach $3116 billion by 2026, up from $1456 billion in 2019.

Conclusion

The massive potential of China’s health care sector was rediscovered in 2020. The covid-19 pandemic exposed gaps in China’s health care infrastructure that the government is determined to bridge, which may lead to a long-term increase in public spending on health care. While 2020 was a positive year for nearly all health care sub-industries, pharmaceuticals, particularly biotechnology, stand out from the rest. In biotechnology, vaccine development and a sharp rise in deal volume are positioning the sector for long-term growth. In pharmaceuticals more broadly, the shift from a generic-centric model to one based on innovation and competition is placing the sector on par with developed markets.

Citations

- Company Releases: Ping An Annual Results 2020 (February, 2021), Ali Health 2020 Interim Report (December, 2020), BeiGene News Release (January, 2011)

- Data from Bloomberg as of 12/31/2020.

- Yung, John. “Healthcare Outlook 2021,” CLSA. January, 2021.

- Wang, Ling. “Private and public measures to improve healthcare sector,” JP Morgan. January, 2021.

- Yang, Rachel. “Mindray,” HSBC. November, 2020.

- Data from Statista as of 12/31/2020.

- CLSA & McKinsey as of December, 2020.

- JP Morgan as of December, 2020.