After the US Election – Still a Strong Investment Case For China

Market volatility in China and broad emerging markets has been on the rise in the wake of the largely unexpected results of the US election. As investors in this dynamic asset class, we are accustomed to volatility, however during periods of headline risk, it is helpful for us to revisit our core investment beliefs and assess whether they still remain intact.

Our firm was founded on three core beliefs:

- China will play an increasing role in US investors’ portfolios

- The rise of the Chinese consumer is creating a long term growth opportunity

- Investors need a quality and reliable source of information on China in order to understand these dramatic changes

China’s increasing role in US investors’ portfolios

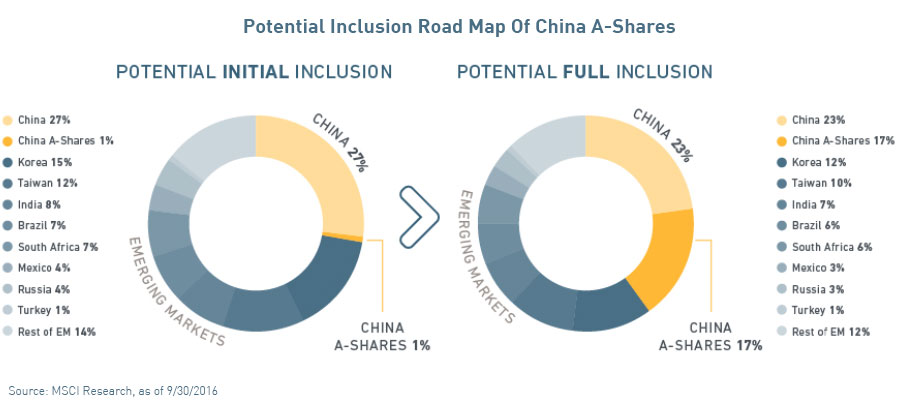

Many investors get their exposure to China through exchange traded funds (ETFs) that track indexes. The stocks theses ETFs buy are determined by the index provider. For a long time, index providers limited their China investment universe to about 150 Chinese companies listed in Hong Kong, excluding approximately 3,000 Mainland-listed Chinese companies and dozens of US-listed Chinese companies from their indexes.

Last year, on December 1st, 2015, MSCI, a leading provider of indexes globally, moved to include 14 US-listed Chinese companies into their Global Standard Indexes. This week in advance of their December 1st, 2016 rebalance, MSCI announced they will add US-listed Sina and Weibo to these indexes as well, which will require MSCI benchmarked passive managers around the world to purchase these stocks at the close on November 30th1.

MSCI has not yet included Mainland listed Chinese companies into their Global Standard Indexes, however there is a new development on the horizon that bodes well for their future inclusion. This month marks the two-year anniversary of the launch of the Shanghai Hong Kong Stock Connect Program, which allows investors to buy stocks listed in Shanghai via the Hong Kong Stock Exchange. There have been numerous reports that a companion program, the Shenzhen Hong Kong Stock Connect Program, will launch sometime this month2. We believe this could be the final catalyst for MSCI to include Mainland Chinese equities into their indexes because it alleviates accessibility concerns.

The Rise of the Chinese Consumer

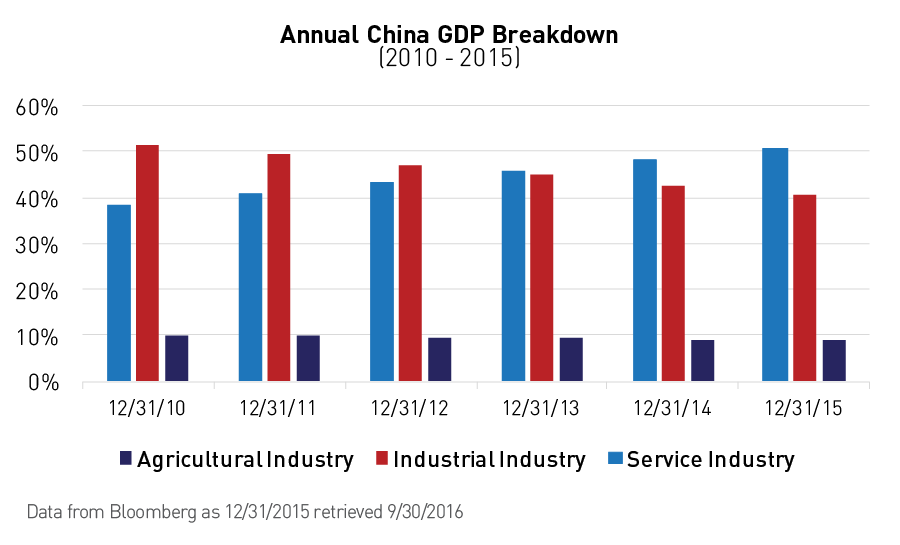

Investors are often surprised to learn over 50% of China’s 2015 GDP was driven by the services sector.

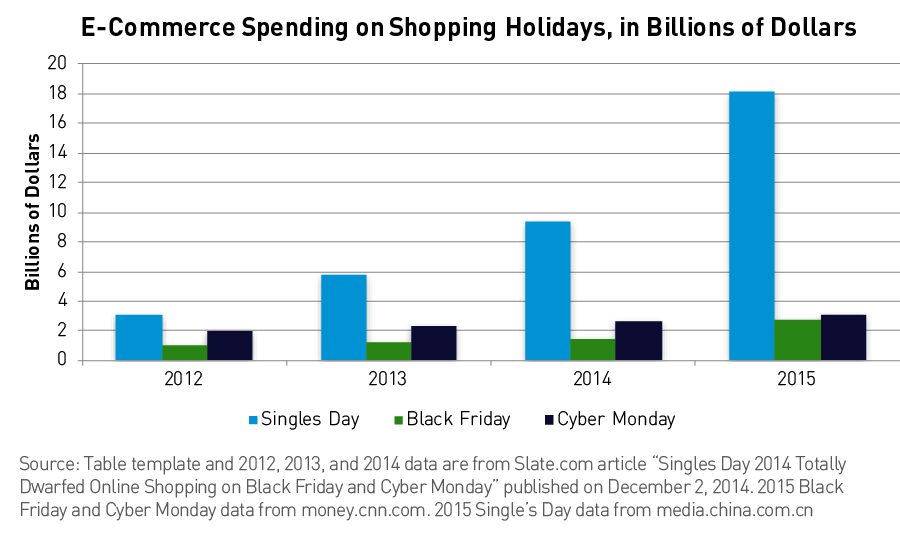

While some might argue China should rebalance their economy away from export driven manufacturing to domestic consumption, there is a strong case that this transition has already occurred. We see multiple signs that China’s consumer is alive and well. Singles Day, the largest E-Commerce sales event in the world, just took place on 11/11. Singles Day has grown exponentially larger than Black Friday and Cyber Monday combined.

2016 Singles Day results

Alibaba recently released their 2016 Singles Day results:3

- $17.79 billion worth of goods were sold (Gross Merchandise Volume (GMV))

- +32% GMV Year over Year

- 657 million delivery orders versus 467 million in 2015

- Orders through Mobile devices generated 82% of total GMV

- 235 countries bought/sold goods

- 100,000+ total merchants participated

While Alibaba’s competitors have yet to release their own Singles Day statistics, JD.com did report their Q3 earnings this week. JD reported that net revenues increased 38% to $9.1 billion, GMV increased 43% to $23.8 billion while annual active client accounts increased 57% to 198 million and fulfilled orders increased 55% to 401 million4.

Beyond JD’s earnings, there were additional notable statistics released this week as well. Online auto sales company, Autohome, released their Q3 earnings which reported revenue increased 64% to $221 million5. NetEase announced a $1 billion buyback of their stock after it dropped last week6. Tencent reported their Q3 earnings, with revenues growing 52% year over year to $6.0 billion, and net profit growing 42% to $1.6 billion7. Finally, China's National Bureau of Statistics released the country's official retail sales results on Monday, November 14th showing a 10% year over year gain in October8.

Singles Day results, corporate earnings, and economic data, all indicate that China’s consumer is alive and well.

We believe investors need a quality and reliable source of information on China

Every day we strive to provide a balanced perspective on China. We believe that the same media that largely misgauged the US political climate prior to the election, often fails to portray the economic environment in China accurately. In the Annual China GDP Breakdown chart above we showed how China has rebalanced its economy away from industrials / manufacturing toward services, yet most news reports ignore how much China has changed over the past decade.

For as much attention that has been paid to the detrimental effect US protectionist policies might play on companies engaged in global trade, very little has been reported on the domestically oriented nature of Chinese internet and technology companies. In an August 2016 article from the Economist titled: “China’s tech trailblazers”, the author equated China’s internet landscape to “a sort of technological Galapagos island a distinct and isolated environment in which local firms flourish”. China has made a concerted effort to reduce its dependency on the economic health, or political climate, of its trading partners, which could provide a buffer for these companies should the US implement trade tariffs.

In the coming weeks we believe the initial uncertainty stemming from the US election results will subside. China will continue to open up its economy and its weight within US investors’ portfolios will continue to grow. Meanwhile, we believe the growth of the Chinese consumer shows no sign of slowing, and Chinese internet and E-Commerce companies are well positioned to benefit from this continued growth.

- MSCI, "MSCI Equity Indexes November 2016 Index Review", 11/14/2016. Sina weights in KraneShares ETFs as of 9/30/2016: KWEB: 4.14%. Weibo weights in KraneShares ETFs as of 9/30/2016: KWEB: 3.25%

- Enoch Yiu, "Shenzhen-Hong Kong Stock Connect kicks off three-week test ahead of November launch" South China Morning Post, 10/17/2016

- Alibaba, "Alibaba Group Generated RMB 120.7 Billion (USD 17.8 Billion) of GMV on 2016 11.11 Global Shopping Festival" 11/12/2016. Alibaba weights in KraneShares ETFs as of 9/30/2016: KWEB: 12.36%, KEMP: 1.81%

- JD.com. "JD.com Inc 3Q2016 Financial and Operational Highlights" 11/2016. JD.com weights in KraneShares ETFs as of 9/30/2016: KWEB: 8.12%

- Autohome Inc. "Autohome Inc. Announces Unaudited Results for the Third Quarter Ended September 30, 2016" 11/14/2016. Autohome Inc weights in KraneShares ETFs as of 9/30/2016: KWEB: 1.84%

- Bloomberg News, "Netease Board Approves Share Buyback of as Much as $1 Billion" 11/15/2016. Netease inc weights in KraneShares ETFs as of 9/30/2016: KWEB: 7.10%, KFYP: 4.89%, KEMP: 0.85%

- Tencent, "Tencent Announces 2016 Third Quarter Results" 11/16/2016. Tencent weights in KraneShares ETFs as of 9/30/2016: KWEB: 10.22%, KFYP: 4.33%, KEMP: 3.18%.

- National Bureau of Statistics of China "Total Retail Sales of Consumer Goods in the First Ten Months of 2016" 11/15/2016

The Fund's holdings are subject to change.