A Journey to the New Heart of Urbanization in China

How A Planned City Creates Opportunities In China’s Mainland Markets

By Brendan Ahern and Grant DePoyster

The migration of people from rural to urban areas has been a cornerstone of China’s rapid growth for the past 30 years. Kraneshares’ CIO, Brendan Ahern, and Head of Capital Markets, Mark Schlarbaum, recently visited the site of what is slated to become the next chapter in China’s urbanization story: the Xiong’an New Area. Below, Brendan recounts how seeing this area first-hand underscores the incredible growth potential that China’s new cities possess for the Chinese people, the Chinese equity market, and for global investors.

The sun was just rising when my colleague, Mark Schlarbaum, and I left our hotel to visit the outskirts of Beijing. We headed out on a three-hour drive from the Central Business District to an area that most Beijing natives would have historically never had reason to visit.

Our destination is the site of China’s next megacity, the Xiong’an New Area, which was announced by the Chinese government on April 1, 20171. Xiong’an is located about 170 km (106 miles) southwest of Beijing by car. The area is being built to help stimulate economic growth in Northern China and combat overcrowding in Beijing2. It consists of mostly agricultural land today but is expected to eventually become a city covering more than 2000 square kilometers3. To put this in perspective, that’s almost three times the geographic size of New York City4.

Over the next three hours, we watched the urban landscape of Beijing transform into farmland and open fields. Looking out the window, I found myself thinking back to a speech given by President Barack Obama at a Joint Press Conference with China’s President, Xi Jinping, in 2015. In the speech, he remarked that China’s success in lifting hundreds of millions of people out of poverty has been “one of the most remarkable achievements in human history…”5.

I could see the results of China’s success in the hundreds of apartment buildings lining the highway. I believe these buildings are a testament to the positive effect that urbanization has had on China’s people and economy. Over the past thirty years, the number of Chinese people living in urban areas has increased from 22.9% to 56.8%6 of its current 1.3 billion citizens7. The World Bank estimates that around one billion Chinese people, or 70% of its population, will be living in cities by 20308.

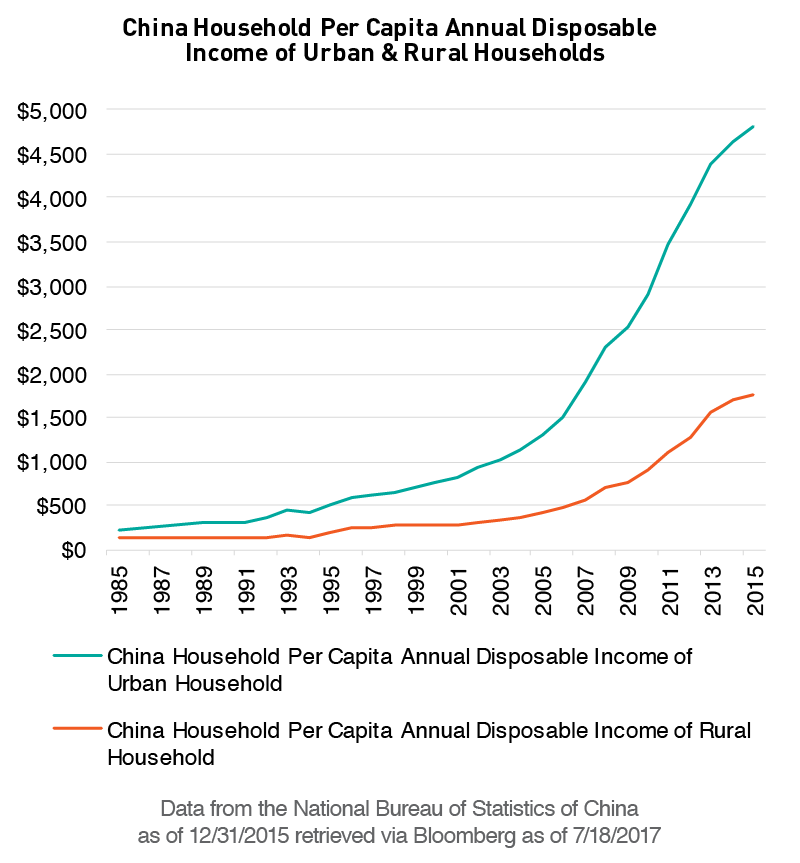

One primary reason for this movement of people into cities is that living in urban areas in China generally allows for a much greater standard of living. The graph below reflects the difference in quality of life between urban and rural areas, showing how the annual disposable income of urban households greatly exceeds that of rural households. Additionally, urban areas in China, on average, have greater access to electricity, running water, sanitation facilities9, healthcare10, and higher education11.

While the Xiong’an New Area might just be rural fields now, it has the potential to become a metropolis on the scale of other global economic urban center powerhouses.

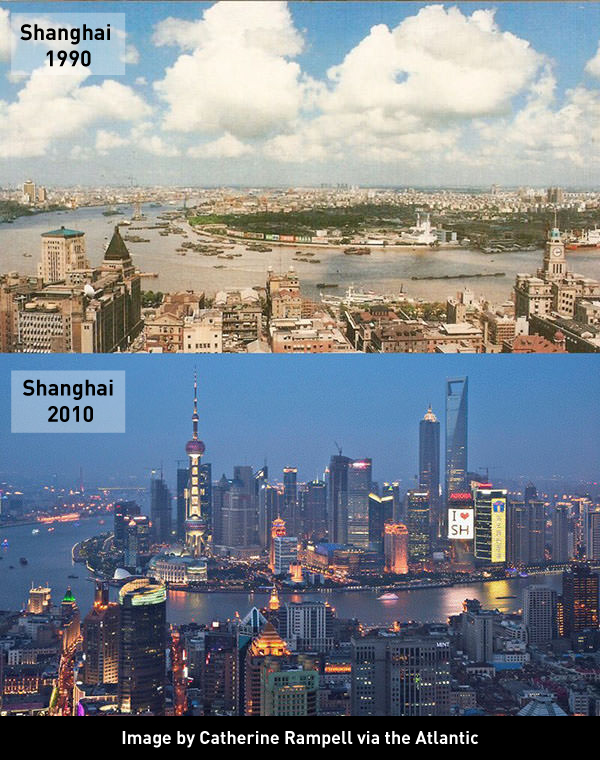

After all, this is not the first time China has planned and successfully constructed a megacity. Shenzhen and Shanghai’s Pudong District were just small villages in the 1980’s, but following their development by the Chinese government, they have grown to become some of the world’s largest economic centers12 and currently have more than 10 million people in each city13.

In the decade following Shenzhen’s development by the government, its GDP grew at an annual rate of 40%14 until its GDP reached $284 billion15 in 2016, greater than that of Portugal, Finland, and Vietnam16. Shenzhen is also home to the world’s 8th largest stock exchange17 with a market capitalization of about $3 trillion18. Shanghai had an even larger GDP than Shenzhen in 2016 at about $400 billion19, and the Shanghai Stock Exchange is now the 4th largest stock market in the world20 with a market capitalization of over $4.5 trillion21.

If Shenzhen and Shanghai Pudong were able to grow from villages to global economic centers in just 20 to 30 years, then I believe the future of the Xiong’an New Area looks promising, and based on all of the real estate developers, cement trucks, and construction equipment that we passed on the highway along the way, it looks like companies in China feel the same way.

We finally reached the village of Baiyangdian which will eventually be included in the Xiong’an New Area, and we marveled at the fact that the flat farms and roaming fields we found there will soon be transformed into a massive construction site. We drove around, took photos, and even ate dinner with some of the locals in the area. We got to see a village and experience a culture that could grow to become part of a thriving megacity in the near future.

When our trip was over and we returned to the United States, I told my family and friends about Xiong’an and many of them were amazed but also alarmed to hear that China is planning to build another megacity. They had heard the stories that China is full of “ghost cities” where buildings exist with no one living in them.

While constructing a planned megacity is not without risk, when people mention ghost cities to me, I refer them back to our previous article, “3 Misconceptions You Might Have About China.” In this article, we highlighted Zhengzhou city in China’s Henan Province, and how, in 2013, it was labeled as a ghost city in a “60 minutes” report titled “China’s Real Estate Bubble.” However, Zhengzhou now has over 9 million people living there, about the same amount of people as the Chicago metropolitan area22.

The Chinese government expects that its cities will continue to grow and urbanize, and while the Xiong’an New Area may seem to be in the middle of nowhere now, it will not remain that way for long.

The construction of this new megacity has significantly benefited investors in the Xiong’an New Area. Directly following the announcement on April 1, 2017, stocks of both national and regional cement companies soared. For example, Jidong Cement23 and BBMG Corp.24, two cement companies operating in the area, saw their stock prices grow by 69% and 95% respectively over the following two weeks25.

Similarly, the value of real estate in the area skyrocketed. Housing prices more than tripled overnight26, and real estate development companies saw the value of their stocks jump upward. China Fortune Land27 and RiseSun Real Estate28 are two such real estate companies that saw over 45% stock price growth across the same time period29.

Overall, about 40 companies30 related to the Xiong’an New Area had their stocks jump to the upper limit for daily gains on Mainland Chinese stock markets, and many continued to grow in the following weeks.

While the Xiong’an announcement spurred many Chinese companies to have sudden and explosive growth, the initial fervor to invest in the area will likely temper as the project takes shape over the next decade (the exact timeline has yet to be announced). The ultimate success of the project will require sustained attention and financial support from the Central government and the relaxation of domestic migratory policies which restrict some rural residents from leaving the countryside.

Ultimately, China's demographics make us optimistic about Xiong’an's success. Recall that the World Bank predicts one billion people will live in China's cities by 2030. With 780 million people in these cities today31, this number must grow by more than 200 million between now and 2030 to meet the World Bank's predictions. This leads us to believe that China will need many more megacities in addition to Xiong'an over the next ten to twenty years.

If Xiong’an and other planned cities follow the trend of their predecessors, each reaching a size of about 10 million people, then we believe China could need as many as 20 more megacities to sustain its rate of urbanization. The effect that 20 megacities might have on the Chinese Mainland equity markets could be massive, and hundreds of regional and national companies could potentially see growth as a result. For investors to pinpoint where and when these companies might experience gains would be very difficult; therefore, we believe an effective way to capitalize on the potential growth of China’s planned cities is to gain exposure to the Mainland China A-share market as a whole.

The KraneShares Bosera MSCI China A-Share ETF (KBA) is an exchange traded fund that holds all of the companies listed above and offers strategic exposure to the trends and opportunities in China’s larger Mainland equity market. We believe this basket approach can take advantage of the growth potential of companies in planned cities like Xiong’an while also potentially reducing volatility through holding a broad spectrum of companies throughout China.

Urbanization is a trend in China that shows no signs of slowing, as evident by the construction of the Xiong’an New Area. While today it is just a field outside of Beijing’s city limits, we believe that if China’s track record in establishing megacities holds up, twenty or thirty years from now people will be shocked to learn that I visited Xiong’an while it was just a field. We believe there is still much opportunity to be had for global investors in China’s planned cities and in the China Mainland equity market as a whole.

This article is intended for educational purposes only and should not be construed as investment advice. All opinions or views expressed in this article are current only as of the date of this article and are subject to change without notice.

Past performance does not guarantee future results. The Fund's holdings are subject to change.

- Xinhua News, “The Chinese Central Government’s State Council Decides to Build the Xiong’an New Area.” April 1, 2017. Note: Title translated from Chinese.

- The Economist, “The hype about China’s newest city.” April 12, 2017.

- Xinhua News, “The Chinese Central Government’s State Council Decides to Build the Xiong’an New Area.” April 1, 2017. Note: Title translated from Chinese.

- US Census Bureau, Quick Facts for New York City, New York. Retrieved 7/14/2017.

- The White House, Office of the Press Secretery, “Remarks by President Obama and President Xi of the People's Republic of China in Joint Press Conference.” September 25, 2015.

- World Bank, China Demographic Data. Retrieved 7/17/2017.

- Data from the World Bank. Retrieved 6/28/2017.

- World Bank publication, Urban China: Toward Efficient, Inclusive, and Sustainable Urbanization. Retrieved 7/17/2017

- World Bank, China Demographic Data. Retrieved 7/17/2017.

- The Diplomat, “China’s Unequal Health Coverage System.” September 12, 2014.

- Li, H., Loyalka, P., Rozelle, S., Wu, B., and Xie, J. (April 2013). “Unequal access to college in China: How far have poor, rural students been left behind?”. Stanford Rural Education Action Project. Stanford Working Paper 263.

- 2017 Global Financial Centers Index, GFCI 21 Financial Center Rankings.

- Demographia, World Urban Areas: 13th Annual Edition, April 2017.

- Wei Ge (1999). "Chapter 4: The Performance of Special Economic Zones". Special Economic Zones and the Economic Transition in China. World Scientific Publishing Co Pte Ltd. pp. 67–108.

- Xinhua News, “Shenzhen GDP up 9 pct, ranks fourth in mainland cities.” January 23, 2017.

- World Bank Data. Global GDP rankings. Retrieved 7/27/2017.

- World Federation of Exchanges, Monthly Report for June 2017. Retrieved 7/31/2017.

- World Federation of Exchanges, Monthly Report for June 2017. Retrieved 7/31/2017.

- China Daily, “Shanghai's economy grows 6.8% in 2016.” January 22, 2017.

- World Federation of Exchanges, Monthly Report for June 2017. Retrieved 7/31/2017.

- World Federation of Exchanges, Monthly Report for June 2017. Retrieved 7/31/2017.

- John Kasarda, PhD, “Zhenzhou Takes Off” Aiport World, 9/30/2016

- Tangshan Jidong Cement % of KBA net assets as of 07/31/2017: 0.09%.

- BBMG Corporation % of KBA net assets as of 07/31/2017: 0.19%.

- Bloomberg. Retrieved 07/31/2017.

- The Economist, “The hype about China’s newest city.” April 12, 2017.

- China Fortune Land % of KBA net assets as of 07/31/2017: 0.39%.

- RiseSun Real Estate % of KBA net assets as of 07/31/2017: 0.25%.

- Bloomberg. Retrieved 07/31/2017.

- Bloomberg. Retrieved 07/31/2017.

- World Bank, China Demographic Data. Retrieved 7/17/2017.

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck.