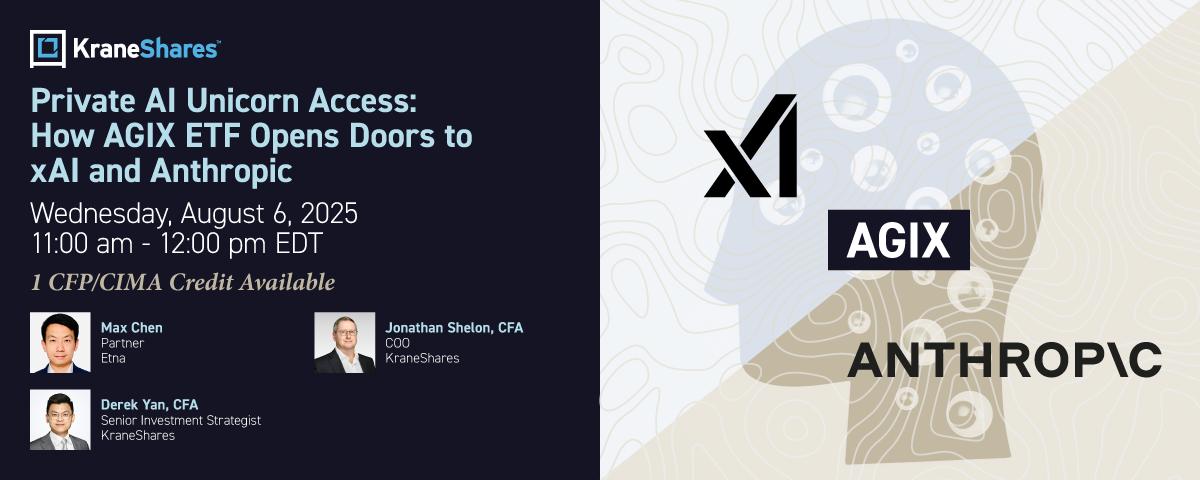

Replay: Private AI Unicorn Access: How AGIX ETF Opens Doors to xAI and Anthropic

Wednesday, August 6, 2025 11:00 am - 12:00 pm EDT

Please register below to view this replay

Event Details:

Replay: Private AI Unicorn Access: How AGIX ETF Opens Doors to xAI and Anthropic Wednesday, August 6, 2025 11:00 am - 12:00 pm EDT

Private artificial intelligence companies are contributing to changes in the investment landscape, with foundational model developers like xAI and Anthropic capturing global attention and significant capital. As valuations continue to climb and access remains limited, investors are seeking new ways to participate in the growth of these high-impact names.

In this context, the KraneShares Artificial Intelligence & Technology ETF (Ticker: AGIX) has taken a notable step forward by adding direct exposure to xAI, Elon Musk’s AI venture, alongside its existing position in Anthropic. AGIX now directly holds both companies, appearing on their respective cap tables.

Join Etna Partner Max Chen, KraneShares COO Jonathan Shelon, CFA, and Senior Investment Strategist Derek Yan, CFA, as they cover:

- The current landscape of private AI unicorns and Etna Capital’s portfolio strategy

- Valuation trends and the investment outlook for leading foundational model companies

- How AGIX delivers exposure to private AI companies like xAI and Anthropic

- Comprehensive Q&A

Investors can submit questions by emailing [email protected]

1 CFP/CIMA Credit Available

The webinar contains the speakers’ opinions. It is provided for informational purposes and should not be regarded as investment advice or a recommendation of specific securities. Holdings are subject to change. Securities mentioned do not make up the entire portfolio and, in the aggregate, may represent a small percentage of the funds.

While the discussion may highlight potential opportunities in a particular sector or strategy, investors should also consider the inherent risks associated with any investment—including economic, regulatory, market, and geopolitical uncertainties—that may affect performance and outcomes.

This presentation includes references to investments in privately held companies. These companies are not publicly traded, and therefore do not have readily available market prices. The valuations presented are based on internal assessments, third-party data sources, and recent transaction activity, including both primary market rounds—where new shares are issued—and secondary market rounds, where existing shares are traded between investors. These valuations are subject to change and may not reflect real-time market conditions.

This presentation is intended for a retail audience and is for informational purposes only. It does not constitute investment advice or a recommendation to buy or sell any security.

References to institutional investors are included solely to describe the investment landscape and do not imply endorsement, validation, or suitability of any investment strategy for retail investors.

Please note:

- Institutional investors often have access to different investment terms, share classes, and due diligence resources that are not available to retail investors.

- Their participation in a fund or strategy does not guarantee performance, reduce risk, or ensure suitability for individual investors.

- Retail investors should not interpret institutional involvement as a signal of safety, quality, or future success.

A balanced evaluation of both risks and potential rewards is essential when considering any investment.

For AGIX standard performance, top 10 holdings, risks, and other fund information, please click here.

Term Definitions:

AI Score – An AI Exposure Score is a proprietary score used by the Underlying Index (as defined below) that attempts to quantify the exposure of a company with regards to AI. It is measured in a range from 0 (no exposure) to 5 (highest exposure) and is based on the company’s public business descriptions, public filings, press releases, and financial disclosures that directly indicate involvement in AI-related business or the incorporation of AI technologies into their key operations, offerings and research and development activities.

Solactive Etna Artificial General Intelligence Index – designed to capture the performance of companies engaged in developing and applying artificial intelligence technologies.

SRP (Structured Retail Products) – financial instruments that combine derivatives with traditional assets to offer tailored investment outcomes, often linked to ETFs, indices, or baskets of securities.

Market Cap Table (Capitalization Table) – a record detailing a company’s ownership structure, including shares outstanding, investor stakes, and valuations.

Series Rounds – sequential stages of private company fundraising, such as Series A, B, and C, each affecting valuation and ownership distribution.

Tender Offers – formal proposals to buy shares from existing shareholders at a fixed price within a specified time frame.