KURE: Capitalizing on China’s Healthcare Revolution

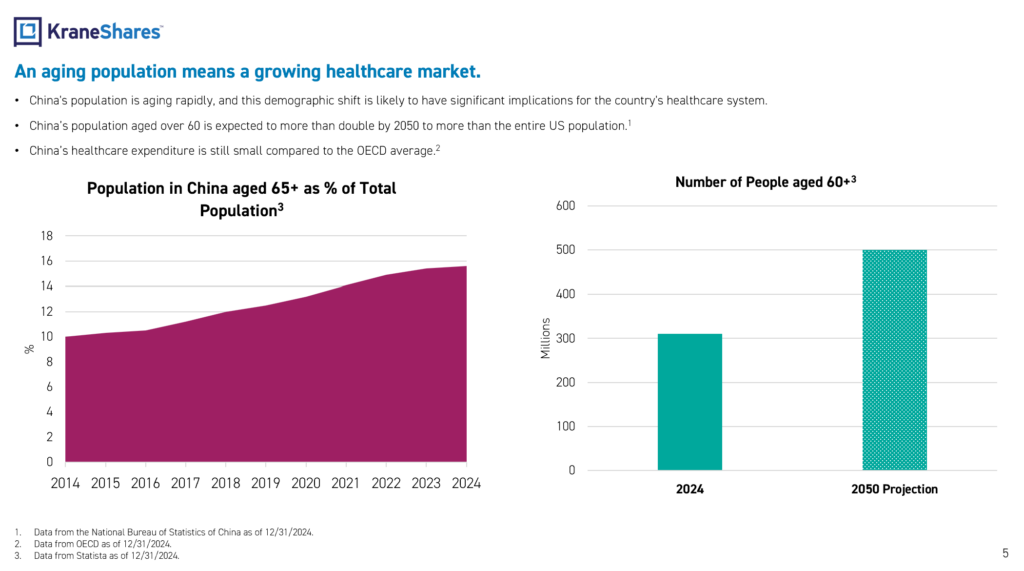

The Silver Tsunami

China is staring down a huge demographic shift. This shift is starting to fundamentally reorder their economic priorities and that is likely to increase over the next twenty years.

China's population is aging. More importantly, it’s aging at an accelerated pace. The number of citizens over sixty is expected to nearly double by 2040 and make up nearly 30% of the population versus almost 16% today. This shift represents a challenge for China’s healthcare system but also an enormous opportunity for investors.

This aging trend is accelerated due to China's former one-child policy. The large cohort of Chinese citizens born in the 1960’s and 1970’s was restricted to a single child per couple which created an inverted population pyramid, there are simply fewer young people than old people. This outsized cohort is creating unprecedented demand for healthcare services, pharmaceuticals, medical devices, and long-term care solutions.

While it may seem like it, this isn't a temporary demographic blip. It is going to be a sustained, multi-decade trend that will require massive healthcare infrastructure investment beyond anything China currently has in place.

China differs from many developed nations in that other nations had decades or centuries to prepare and adapt their healthcare systems to account for a growing elderly population. This investment must happen and it must happen quickly. This rapid expansion is going to have winners and losers but above all else it will present a massive investment opportunity.

The KraneShares MSCI All China Health Care Index ETF (Ticker: KURE) presents investors with a compelling opportunity to capitalize on this unique growth opportunity.

Let’s explore why this is a great time to consider exposure to the Chinese healthcare sector.

The Spending Gap

KURE’s investment thesis is based on what can be gleaned by looking at China's current healthcare spending relative to economic development. China is currently spending just 5-6% of GDP on healthcare. This is well below the OECD (Organization for Economic Co-operation and Development) median of between 9-10%. Though 4-5% doesn’t sound monumental, when you couple it to the sheer scale of China’s GDP, the numbers get large quickly.

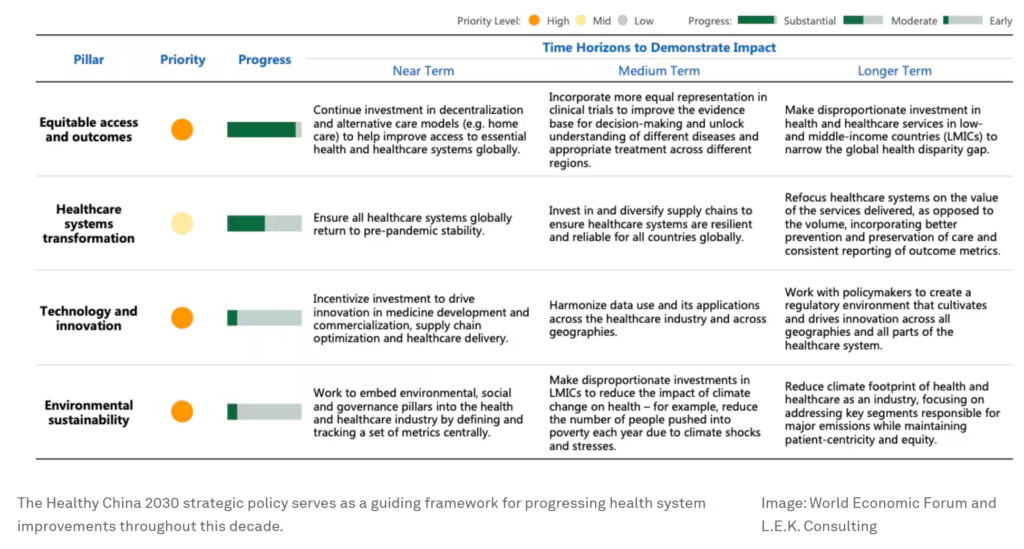

China’s GDP is projected to be over $19 trillion in 20251. If China increases their spending by 1% to 6.5%, that’s an increased absolute dollar investment of $1.9 trillion. Each percentage point towards the OECD median adds the same amount. These are enormous numbers. The other important piece is that this isn’t a theoretical investment. The Chinese government has committed to spending on healthcare with their “Healthy China 2030” initiative2.

While the spending increase won't be uniform across all healthcare segments, the entire sector will benefit from the overall investment. The growth, given the signals from the Chinese government, is likely to concentrate in biotech, medtech, digital health solutions and age-related pharmaceuticals.

Geopolitical Insulation

Unlike many other industries in China, healthcare is far less exposed internationally. This means these sectors should be well insulated from any fallout from the current US-China trade tensions.

Also, healthcare is inherently local in many respects. While pharmaceutical research may be done globally, healthcare delivery, medical devices tailored to local populations, and most other healthcare services are provided domestically. This gives Chinese healthcare companies a natural protective moat in their massive home market.

As we noted with the “Health China 2030” initiative, the Chinese government views healthcare as a strategic priority for domestic self-sufficiency, providing policy support and investment that further insulates the sector from external pressures.

The KURE Opportunity

KURE provides investors with diversified exposure to this compelling opportunity, offering access to Chinese healthcare companies across the entire value chain. As China's healthcare revolution unfolds over the coming decades, KURE is positioned to benefit from both the aging demographic trend and the massive spending normalization that lies ahead.

Diversification does not ensure a profit or guarantee against a loss.

For KURE standard performance, top 10 holdings, risks, and other fund information, please click here.

Citations: