California Cap-and-Trade: Navigating Real and Perceived Uncertainty

By Oktay Kurbanov, Partner at CLIFI

Please register to download this report

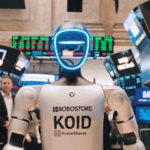

Carbon markets are unlike any other financial market, operating with their own unique set of performance drivers and risks. While this distinction is what makes California carbon allowances an attractive alternative investment opportunity for its uncorrelated diversification* benefits, it also means investors have to educate themselves on the key market drivers both at the individual program level and at the state / national level. Policy is one of their main drivers, including regular program regulatory reform as well as state and federal-level climate initiatives. The role of policy in cap-and-trade programs has received increasingly more attention as California finalizes its reform package and with the November election imminently on the horizon. In this report, Oktay Kurbanov, partner at Climate Finance Partners (CLIFI), explores how past political influences have shaped California’s carbon market and what could lie ahead with potential shifts in policy. For investors, the KraneShares California Carbon Allowance Strategy ETF (KCCA) offers exposure to California’s cap-and-trade market through the purchase of carbon futures, which makes understanding these policy shifts critical to capitalizing on potential market changes.

Report Contents:

- Impact of presidential elections on California’s carbon market

- Historical analysis of local state political trends

- Latest California market reform updates

*Diversification does not ensure a profit or guarantee against a loss.

For KCCA standard performance, top 10 holdings, risks, and other fund information, please click here.