Tesla & Beyond: A Holistic Approach to Electric Vehicles & Future Mobility Ecosystem

Tesla1 is a world-famous company led by Elon Musk, a polarizing figure known for bold media campaigns like launching a Tesla Roadster into space or selling flame throwers on his website at $500 apiece to raise funds for his tunnel-digging business, the Boring Company. Even Musk’s strongest critics still credit his ability to generate out of the box ideas. This has made Tesla one of the first brands that comes to mind when investors think of electric vehicles and future mobility technology, but Tesla is only a single player in a diverse global ecosystem.

Future vehicle adoption is expanding, a process driven by public demand, favorable policies, and improvements in technology. In October of 2017, the UK announced a ban on gas and diesel powered vehicles going into effect in 2040, and France announced plans to phase out diesel and gas cars by the same year2. China has mandated that 10% of new car sales be electric by 2019, and 12% by 20203. In addition, advancements in power storage technology and production methods have made electric vehicles increasingly more cost competitive with traditional automobiles.

Bloomberg New Energy Finance projections predict that electric vehicles (EVs) will reach parity with internal combustion engine cars in most countries as soon as 20224 . However, less than 3% of the 6.3 million cars sold in the United States were electric in 20175. There is a lot of potential for change before we reach peak adoption of electric and future vehicles. This makes it difficult to know which company, commodity, or country will ultimately dominate the EV revolution. Investors with concentrated allocations to a single company, or commodity may be accepting a high degree of single stock or sector risk.

Consider Tesla once more. There is a wide disparity in analyst ratings and price targets for the stock. 30 sell side research firms cover TSLA according to Bloomberg6. 33.3% have a buy or strong buy rating, 36.7% have a hold rating, and 30.0% rate TSLA a sell7. Such divergent ratings reflect the difficulty of forming a consensus opinion for a leading company in a space that may take multiple decades to fully evolve. With recent production and safety questions affecting Tesla’s stock price, a diversified approach to the EV ecosystem seems prudent.

Auto manufacturers like BMW8, GM9, Ford10, and Daimler11 are investing heavily in research and development of electric vehicles. GM even announced its intention to completely phase out gas and diesel cars and introduce a pure electric lineup of vehicles by 202312. Many are breaking into the shared mobility space as well. GM’s Maven, Daimler’s Car2Go, and BMW’s ReachNow mobile ride sharing offerings are being rolled out on a limited scale in select cities. Here in New York City, Daimler’s Car2Go branded smart cars are a common sight across the borough of Brooklyn.

These automakers are globalized companies, and many are looking to expand into other important markets, especially China. China is already the largest electric vehicle market in the world, accounting for 40% of global EV sales in 201613. Tesla has made plans to construct manufacturing plants in mainland China. It is joined by other companies that are partnering with Chinese electric vehicle manufacturers including Daimler with Build Your Dreams (BYD)14, and BMW with Great Wall Motors15.

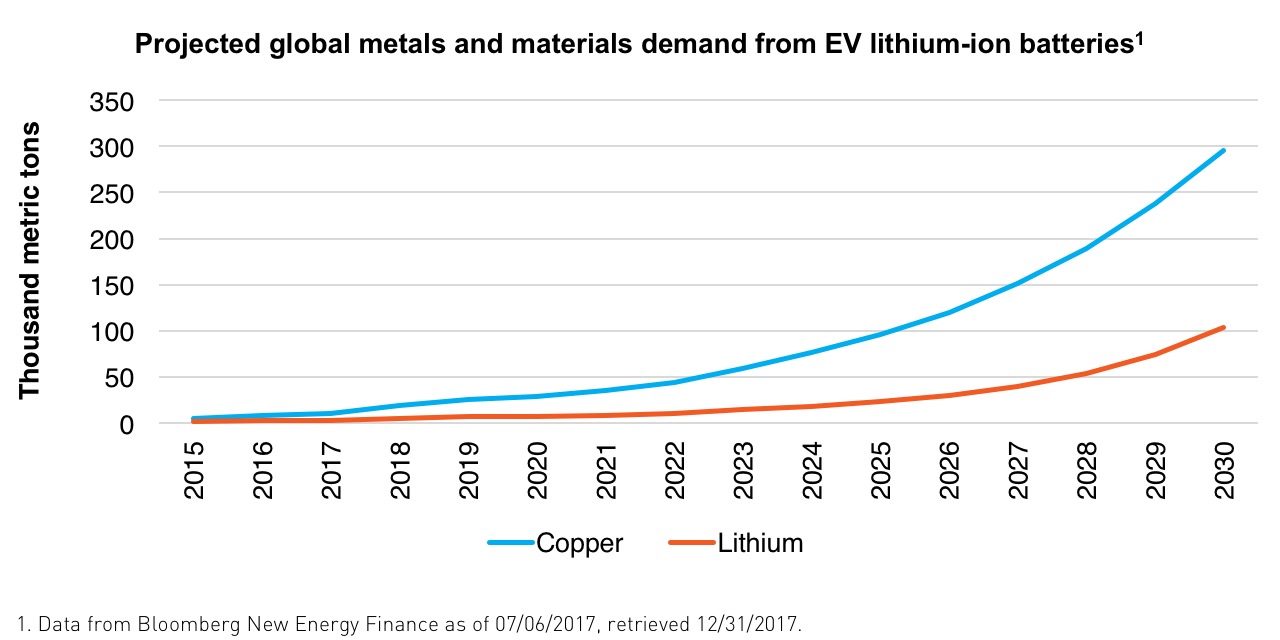

Electric vehicle sales are projected to reach 60 million per year by 204016. Each one of these vehicles will require a lithium ion battery to power it. Most EVs are utilizing new variations of lithium-ion chemistry that sacrifice energy and power density to provide fire resistance, environmental friendliness, rapid charges, and long lifespans. Battery manufacturers offering these types of lithium ion batteries, like Samsung SDI17, and Guoxuan High Tech18, are seeing increased demand and incorporation of their products. Samsung SDI batteries are being used to power the BMW i3 and Volkswagen EVs, and Guoxuan High Tech batteries currently power the first pure electric bus routes in China. The need for batteries will also drive demand for natural resources like lithium and copper. Many mining companies are preparing for this increased demand by expanding their operations globally.

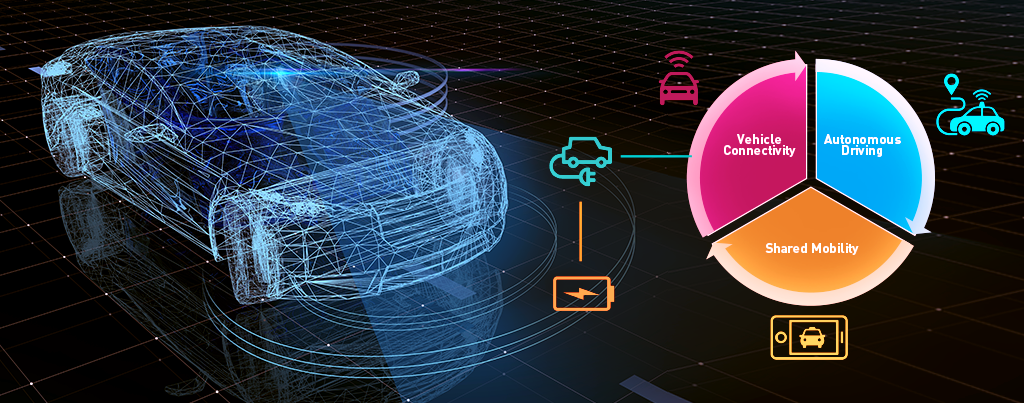

The quest for autonomous vehicles is being pursued by companies from various sectors. Tech giants like Baidu19 and Alphabet20 (parent company of Google) are leveraging their experience with data processing, artificial intelligence, and mapping to produce and improve self-driving car technology. Alphabet’s Waymo is already testing driverless vehicles on a limited scale in California, Wyoming, Arizona and Texas, and achieved 4 Million “self-driven” miles21. Baidu is planning on leveraging the information gathered from its Apollo program, the first open source simulator for autonomous vehicle developers, in order to mass produce self driving vehicles as soon as 202122. Automobile manufacturers including Tesla, GM, Daimler, Ford, and BMW are also pursuing their own autonomous driving programs.

Driverless vehicles are essentially mobile supercomputers. They require various sensors, radars, and incredibly powerful processing chips that run complex AI technology in order to operate. Nvidia23 specializes in manufacturing processing chips and integrating artificial intelligence technologies into cars. Nvidia Drive software is being used in vehicles made by Audi, Mercedes-Benz, Tesla, and Volkswagen. NXP Semiconductors24 manufactures processing chips as well as various sensors for autonomous vehicles. Their Vehicle to Everything (V2X) technology can communicate with other cars, traffic lights, and pedestrians to improve autonomous driving safety. They recently partnered with Changan Automobile*, a Chinese automobile company that has formed a joint venture with Ford, to achieve autonomous driving using NXP V2X communication.

The advent of future mobility technology is blurring the lines between traditional auto manufacturers and technology companies while creating new markets for producers of processing chips, batteries, and their raw material inputs. We believe a diverse set of new opportunities is emerging that makes a holistic approach to investing in the entire ecosystem more attractive than investing in a single company, commodity, or sector. We also believe a global approach is important, in particular allocating to mainland China listed companies (A-Shares) in the future mobility space.

Our fund, the KraneShares Electric Vehicle & Future Mobility ETF (NYSE: KARS), owns companies involved in all facets of electric and future vehicle production. We leverage our experience trading securities through the Shanghai and Shenzhen Stock Connect programs to include Mainland Chinese companies historically excluded from global benchmarks. Our goal is to provide a diversified, global exposure to the complete electric and future vehicle ecosystem that may benefit from the continued adoption of EVs and future mobility technology.

This article is intended for educational purposes only and should not be construed as investment advice. All opinions or views expressed in this article are current only as of the date of this article and are subject to change without notice.

* These companies represent 0% of KraneShares net assets as of 5/22/2018

- Tesla % of KARS net assets as of 5/22/2018: 3.27%

- Phys.org “UK to ban sale of petrol and diesel cars by 2040”, July 26, 2017

- Bloomberg, “China Gives Automakers More Time in World’s Biggest EV Plan”, September 28 2017

- Bloomberg New Energy Finance, “Electric vehicles to be 35% of global new car sales by 2040”, Feb 25 2016

- Statistica.com “U.S Car Sales from 1951 to 2017”, May 2018

- Data from Bloomberg as of 05/23/2018, retrieved 05/23/2018

- Data from Bloomberg as of 05/23/2018, retrieved 05/23/2018

- BMW % of KARS net assets as of 5/22/2018: 3.61%

- GM % of KARS net assets as of 5/22/2018: 3.6%

- Ford % of KARS net assets as of 5/22/2018: 3.6%

- Daimler % of KARS net assets as of 5/22/2018: 3.54%

- Interestingengineering.com “General Motors Is Planning to Produce All-Electric Vehicles by 2023”, October 5, 2017

- Data from Bloomberg New Energy Finance as of 07/06/2017, retrieved 12/31/2017

- Build Your Dreams Company % of KARS net assets as of 5/22/2018: 1.14%

- Great Wall Motors % of KARS net assets as of 5/22/2018: 1.24%

- Bloomberg New Energy Finance, “Electric Vehicle Outlook 2017”, July 2017

- Samsung SDI % of KARS net assets as of 5/22/2018: 1.56%

- Guoxuan High Tech % of KARS net assets as of 5/22/2018: 0.76%

- Baidu % of KARS net assets as of 5/22/2018: 3.45%

- Alphabet % of KARS net assets as of 5/22/2018: 3.63%

- Waymo team, “Waymo’s fleet reaches 4 million self-driven miles”, Nov 27, 2017

- Techcrunch.com “Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021”, October 13, 2017

- Nvidia % of KARS net assets as of 5/22/2018: 3.73%

- NXP Semiconductors % of KARS net assets as of 5/22/2018: 3.68%

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck.