2025 China Outlook: A Recipe For Re-Rating

Executive Summary

The unprecedented stimulus announced by China’s government was a significant catalyst for China’s equity market broadly in the second half of 2024. Stimulus measures in 2024 included:

- Broad rate cuts

- The lowering of down payment minimums on home purchases

- RMB 500 billion stock market stabilization fund

- Special lending facility for listed corporations to finance buybacks

- RMB 6 trillion in relief for local governments

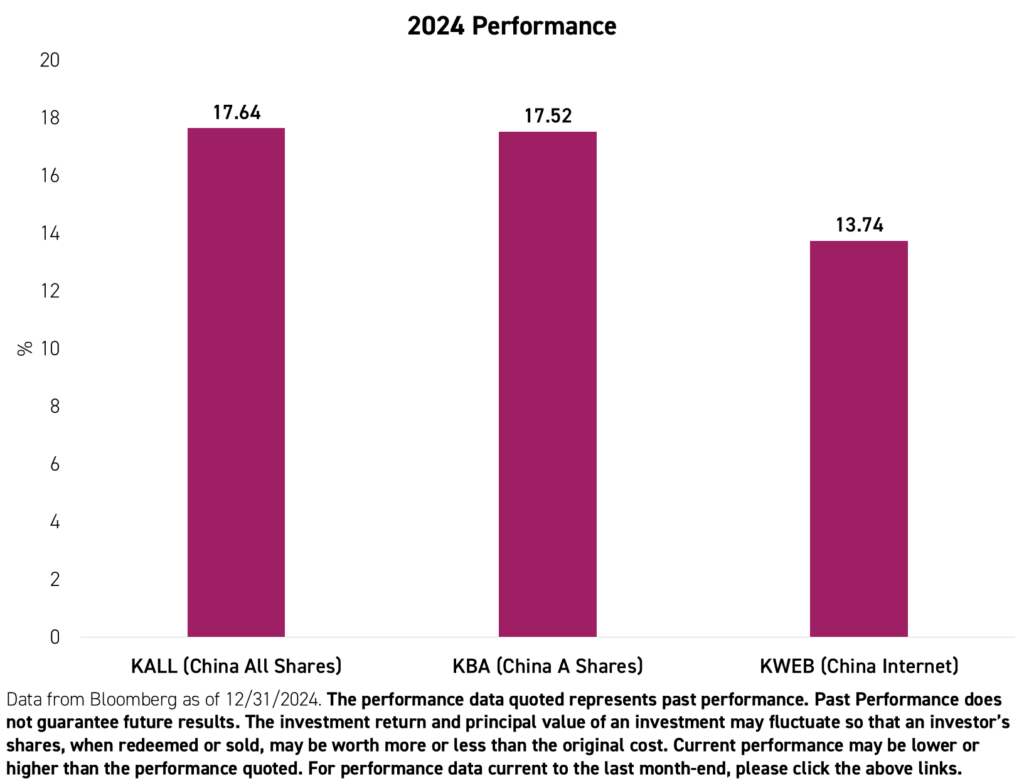

In 2024, the KraneShares MSCI All China Index ETF (Ticker: KALL) returned 16.33%, the KraneShares MSCI China A 50 Connect Index ETF (Ticker: KBA) returned 16.06%, and the KraneShares CSI China Internet ETF (Ticker: KWEB) returned 13.25%.1

For KALL, KWEB, and KBA standard performance, risks, and top 10 holdings, please visit

kraneshares.com/kall,

kraneshares.com/etf/kweb, or

kraneshares.com/etf/kba.

- We believe foreign capital will continue to return to China’s markets in 2025, accelerating the “re-rating” of China stocks, which began in 2024 with stimulus efforts.

- In 2025, we believe China’s equity market may continue its upward trend from 2024 as stimulus measures take hold and filter down into economic data and corporate earnings. We could also see another upside surprise on the stimulus front, which would also benefit equity prices.

- We believe a second Trump Administration may seek a “Grand Bargain” with China in 2025 after strengthening its position through tariff threats. In our opinion, Trump's election was the best possible outcome for the US-China relationship at the current juncture.

- Investors can access the Internet and E-Commerce ecosystem in China through the KraneShares CSI China Internet ETF (Ticker: KWEB) and in Emerging Markets more broadly through the KraneShares Emerging Markets Consumer Technology ETF (Ticker: KEMQ).

Introduction

Ice hockey legend Wayne Gretzky famously stated, “I skate to where the puck is going and not to where it has been.” After fifteen years of outperformance, it is understandable that global investors have become solely focused on a single asset class: US equities. But, are they lingering too long on where the puck has been?

If China equity allocations or non-US equity allocations more broadly, represent where the puck is going, current positioning does not reflect that. Allocations range from underweight to non-existent, to the extreme “un-investable” bucket. This is despite China’s significant role in the global economy and its importance to the bottom lines of both US and global multinationals.

Extreme declarations such as “uninvestable,” against the backdrop of light positioning and low valuations, have historically been the hallmark indicators of an asset class' bottom. However, as the saying goes, “The market can stay irrational longer than you can stay solvent.”

The reality is that the most widely held US stocks have significant China revenue, but little to no beta to the negative media narrative that continues to weigh on China equities and general investor sentiment toward China.

Several changes in the tone and tenor of government officials caught our attention in the first half of the year. However, it was not until after the People’s Bank of China (PBOC), China’s central bank, finally fired the proverbial fiscal policy “bazooka” on Tuesday, September 24th, that global investors recognized the change in trajectory. Notably, the release from the CPC Central Committee in December used the phrase “moderately loose” to describe monetary policy, refraining from using the word “stable” for the first time since 2011. Reasonably, scar tissue from internet regulation, the zero COVID policy, and geopolitical flare-ups kept many investors skeptical and on the sidelines of the resulting massive rally in China’s equity market.

In this outlook, we will explore the potential trajectory of China’s economic policy and equity market in 2025, why we think measures from 2024 will not be felt until later in 2025, important structural reforms that could begin this year, and global investors’ potential path to reallocation.

2024 Stimulus: More Than a Short-Term Bounce

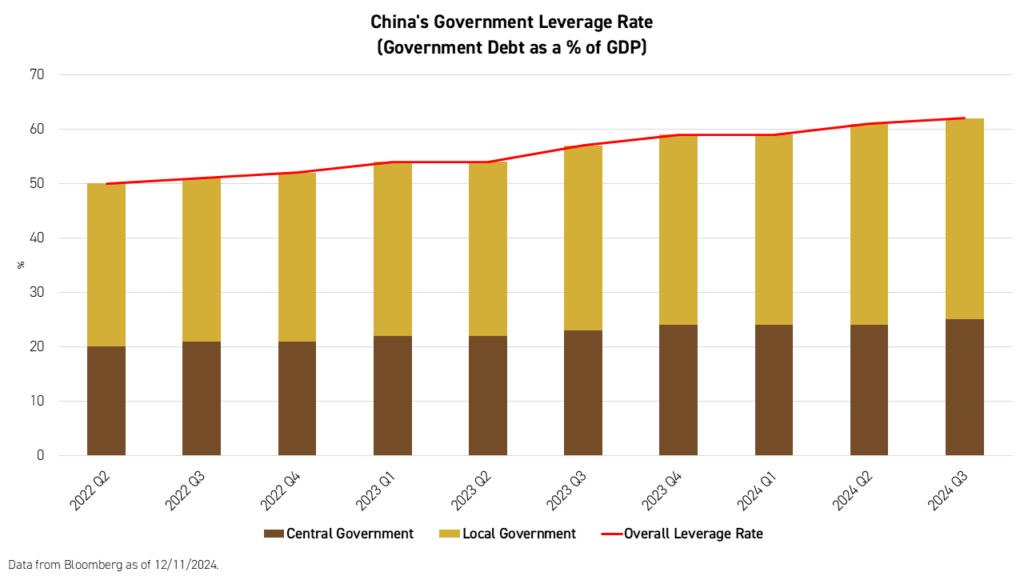

China’s government has ample dry powder after providing minimal stimulus during the pandemic. Even after the pandemic, when economic challenges persisted, China continued this fiscal conservatism.

As such, China’s overall government debt remains low at 62% of gross domestic product (GDP), with most of the debt coming from local governments. 2024’s stimulus is just a drop in the bucket in terms of China’s borrowing capacity before reaching 100% of GDP. To put this in perspective, the United States and Japan have government debt-to-GDP ratios of 122% and 255%, respectively.

As such, the PBOC is likely to continue its easing cycle by cutting the policy rates used to set bank deposit rates, home mortgage rates, and interbank lending. They are also likely to continue lowering the amount of money that banks must hold in reserve, rather than lend out. In theory, this increases borrowing.

However, as we have long observed, more supply of capital does not necessarily create more demand for it. China’s credit growth has remained sluggish throughout the recent rate cut cycle. China’s economic headwinds have been driven by lower housing prices and the resulting negative wealth effect, which has weighed on domestic consumption due to real estate accounting for an outsized portion of the average household’s wealth. Policymakers, therefore, need to do far more to revive consumer and business confidence. The 2024 stimulus measures were just the beginning, in our view.

China Equities Remain Attractive Over Bonds, US Equities

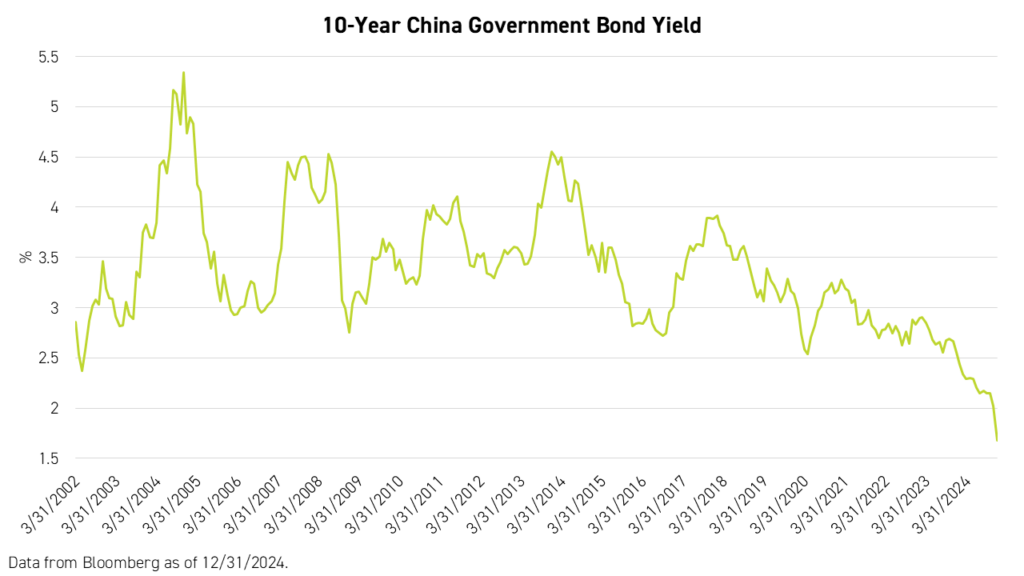

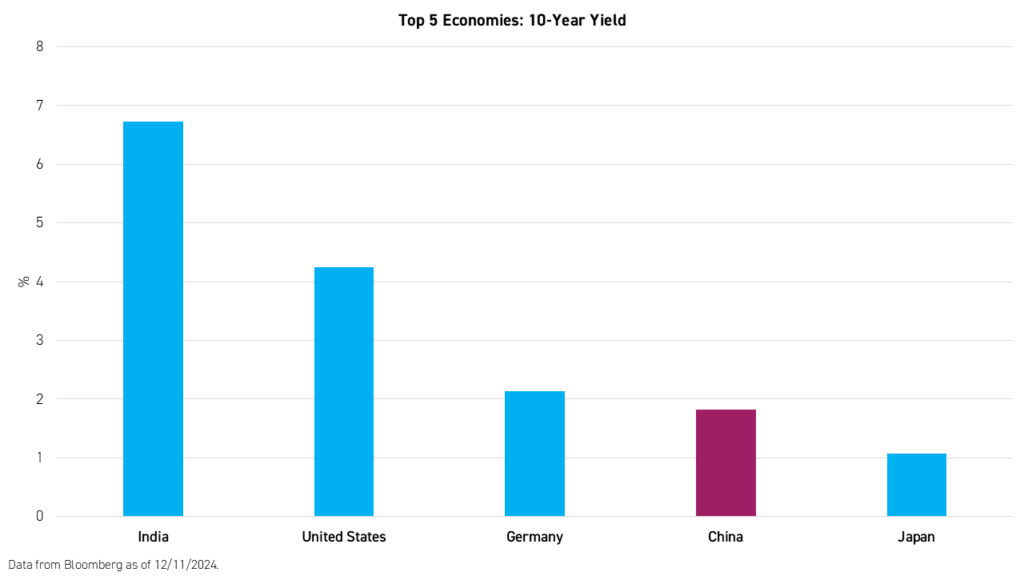

Going into 2025, China’s monetary policy stance is currently the most accommodative among the major economies. The yield on the 10-year government bond ended 2024 at a record low of 1.68%.

China’s current 10-year yield is the fourth lowest among the five largest economies globally. Only Japan’s is lower, but the Bank of Japan has begun what is likely a long-term rate hike cycle.

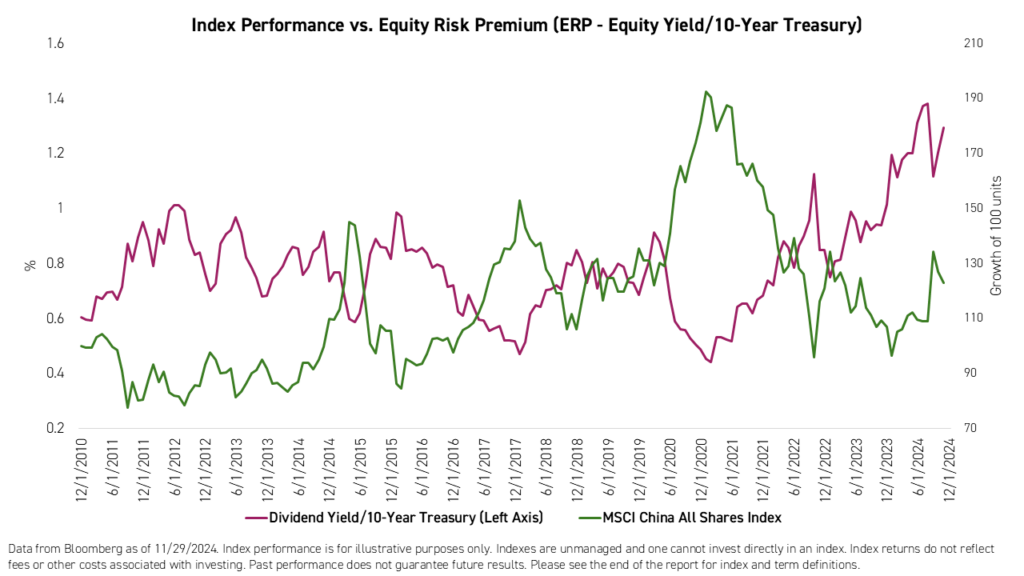

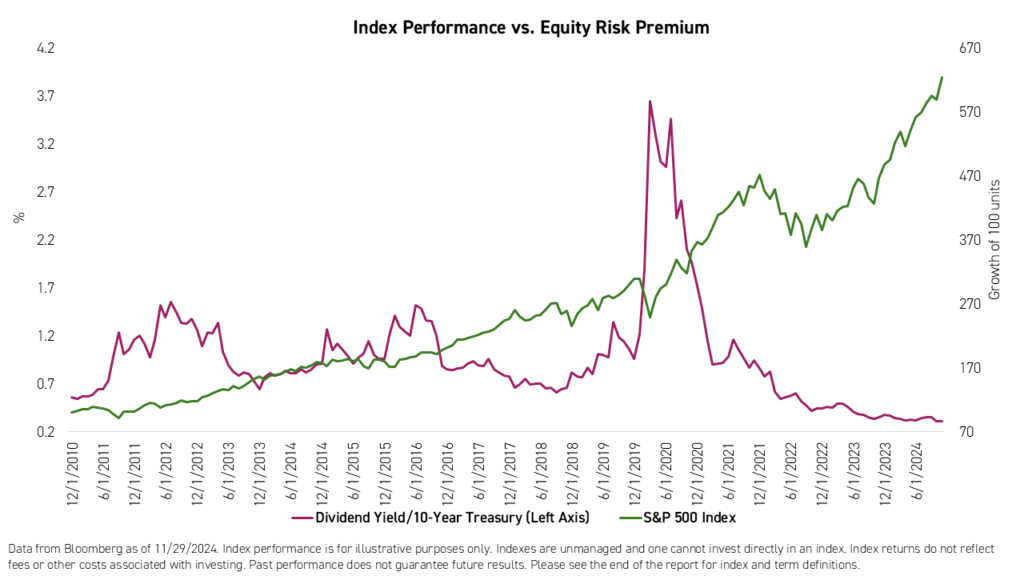

The combination of a low risk-free rate and high dividend yields make for an exceedingly attractive equity risk premium compared to the United States. Spikes in the equity risk premium, measured by the ratio between the average dividend yield within the MSCI China All Shares Index and the yield on the 10-Year China government bond, tend to precede equity bull runs in China. This is exactly what happened in September after the equity risk premium reached decade highs in August. As you can see in the chart below, the equity risk premium has a strong inverse correlation with stock market returns in China.

Meanwhile, the opposite is true in the United States, where the equity risk premium is hitting decade lows, and equity markets are reaching all-time highs.

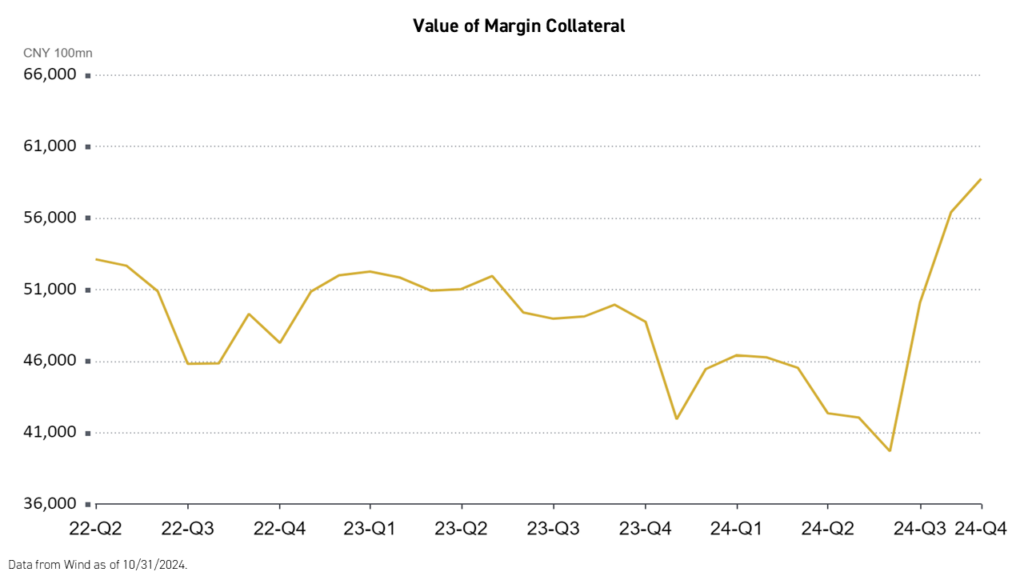

Investors in China are taking note and are already allocating to the stock market, as evidenced by a jump in margin collateral, which is used to make leveraged investments or simply trade in margin accounts.

2025 Could See The Expansion of Highly Successful Trade-In Subsidies

On the fiscal side, foreign investors have called for indiscriminate “helicopter money” to jumpstart domestic consumption in China. However, China’s policymakers are wary of the “sugar high” that comes from fiscal spending and its aftermath: massive amounts of debt and sticky inflation. Nonetheless, China is spending a considerable amount in a targeted manner and is likely to continue to do so in 2025.

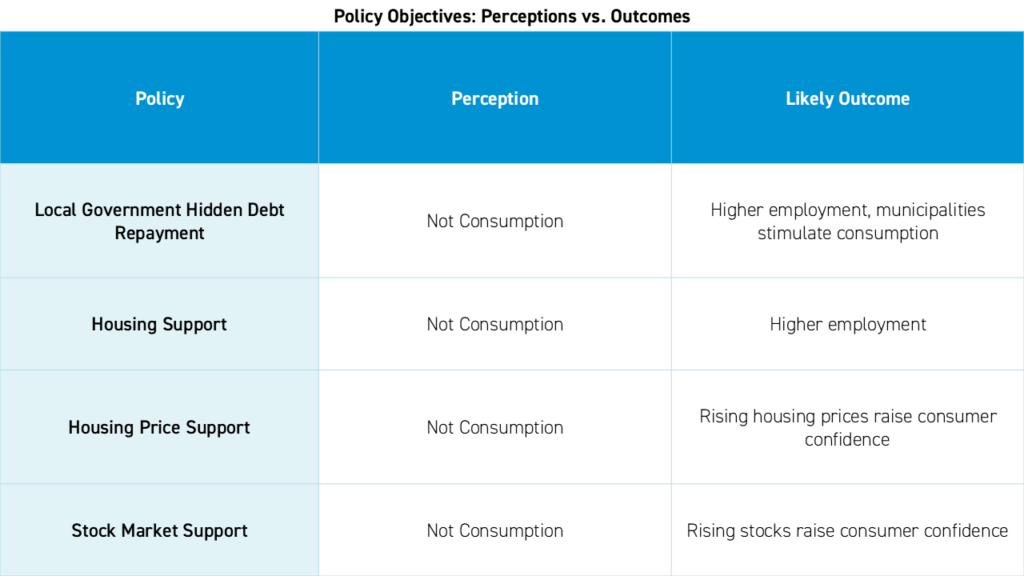

Global investors were disappointed by the follow-up announcement from the National People's Congress (NPC) after September’s stimulus round, saying that the additional measures were too focused on real estate and local government finances, rather than direct consumer transfers. However, this view misunderstands the great influence these factors have on domestic consumption.

By shoring up local government finances, China’s leaders are ensuring that municipalities can focus on improving business conditions in their districts, raising public sector hiring, and giving contracts to local companies. Shortly after the NPC, many local governments even offered vouchers for certain consumption activities. This was not happening when these municipalities were concerned about land sale revenue.

By raising housing prices, the government is reversing the negative wealth effect from the real estate deleveraging campaign. The collapse in housing prices also weighed on the real economy as the housing construction employment ecosystem contracted.

Although total retail sales have not yet recovered, we have seen the beginning of a recovery in real estate transaction volume and housing prices, which we believe is likely to continue in 2025.

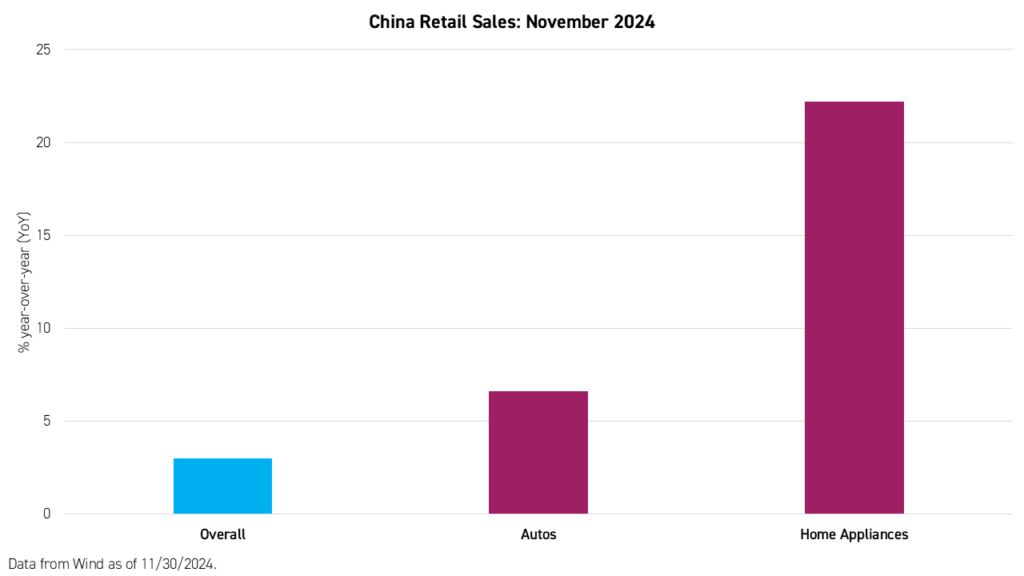

In July, the tax authorities rolled out a significant package of trade-in subsidies for autos and home appliances. Moreover, the policy has already produced results as the year-over-year growth in purchases of both home appliances and autos far exceeded overall retail sales growth in November.

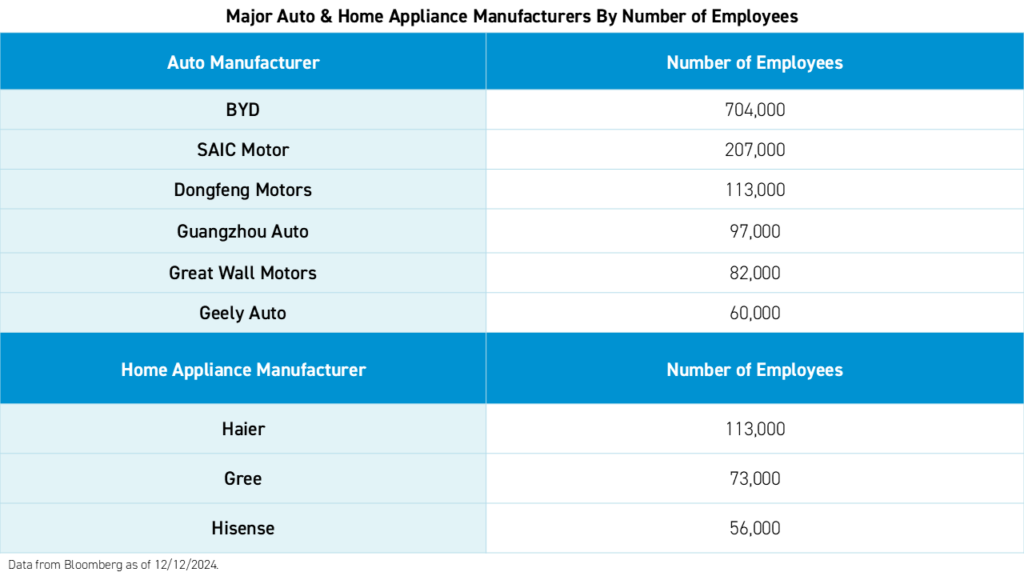

What categories could be next? We believe it will likely be the product categories that provide the most downstream employment. Auto and appliance manufacturers are major employers in China. BYD alone employs over half a million people.

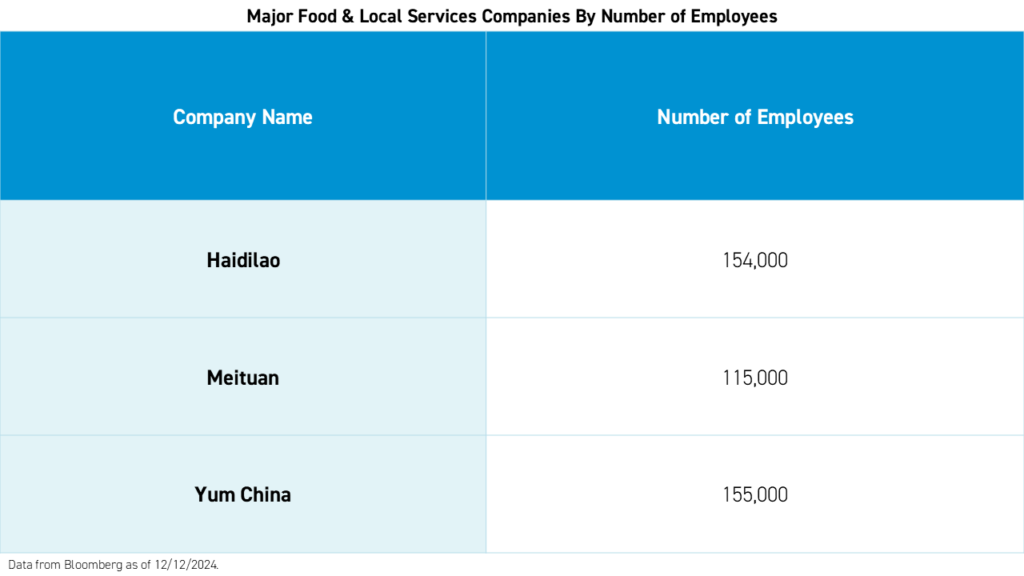

Using employment impact as a yardstick, trade-in subsidies may soon target technology and even the restaurant and food service industries, which have already been the targets of some local voucher programs.

Internet: A Key Beneficiary of Stimulus

Internet companies have become the transmission engines of China’s economy. This means they are likely to benefit from stimulus policies first, especially policies around consumption.

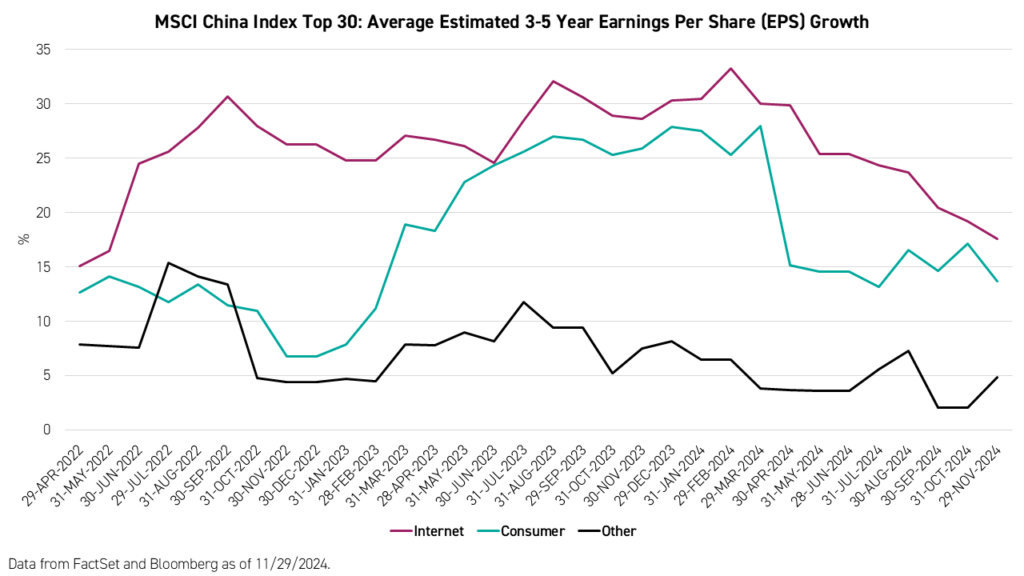

As a result, internet firms have some of the highest earnings expectations among companies in China.

We believe that 2025 could see China’s markets become more driven by fundamentals as it has now been confirmed that the government is determined to support the economy.

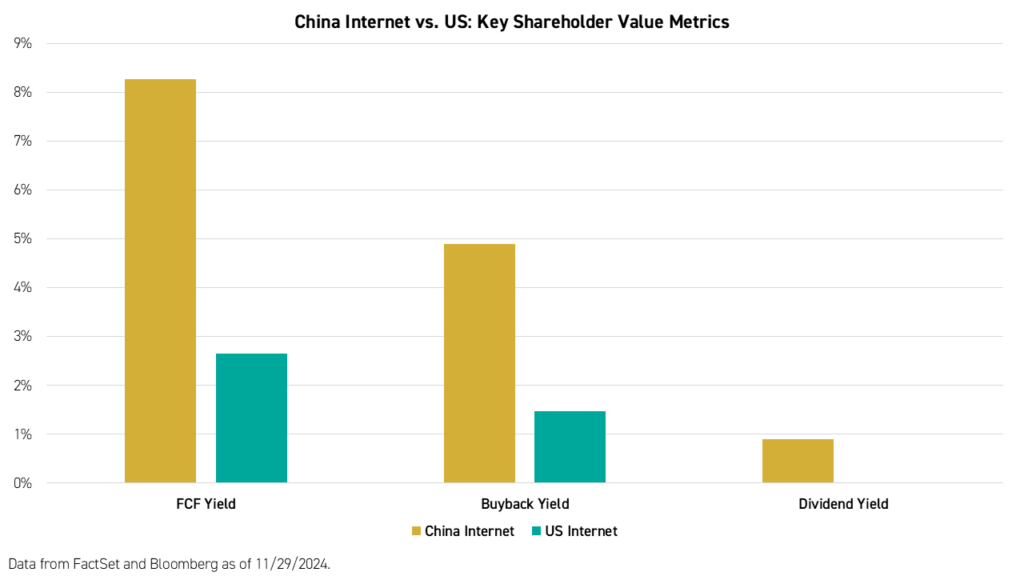

In China’s internet sector, free cash flow yield, buybacks, and dividends have stepped up significantly. We believe this is likely to continue into 2025, making China’s internet large caps potentially more attractive than their US counterparts.

This is compounded by the fact that China’s internet firms, despite the run-up in performance in 2024, remain undervalued compared to their US counterparts, trading at nearly one-half of the earnings multiple.

Could China Begin to Address Structural Challenges in 2025?

China has an exceedingly high savings rate, which means a lower propensity to consume. The high savings rate is a consequence of an individual’s responsibility for their own retirement and health care costs. Another structural factor that weighs on China’s economy and consumption level is the hukou system, which restricts migrant workers from utilizing public services in the cities where they live.

2025 could represent a turning point when China’s government is finished de-risking and deleveraging (Internet Regulation in 20-21 and Real Estate in 23– 24) and embarks on a journey to carry out long-awaited structural reforms to address the issues mentioned above. We believe the government did not have the confidence to do so when these areas, among others, were perceived to be overstretched.

This could lead to some near-term sentiment improvements but represents a long-term development. Through reforms, we believe China can effectively tackle issues such as lower consumer confidence and demographic decline.

Health Care Reform

Having successfully completed an antigraft campaign in the healthcare industry in 2024, based on official statements, the government may now be finally confident enough to improve the services offered by the public healthcare system. This would also boost consumer confidence, as middle-income and lower households would no longer find it necessary to pay for private health care.

Hukou System Reform

Under the current system, China’s migrant workers are prohibited from accessing public services such as education and health care in the tier-1 and tier-2 cities in which they are employed until they can establish at least five years of residency in those cities. As a result, many leave families behind in their villages so that their children can attend school. Meanwhile, those in need of medical care must bear the expense of returning to their hometowns, often to receive a lower standard of care than they would have in their cities of employment.

Making it faster and easier for these workers to establish residency and avail themselves of public services where they work would generate a significant boost to consumer confidence, as these workers would no longer have to maintain a high “rainy day fund”, a key driver of China’s high household savings rate. Meanwhile, they would be able to bring their children with them, who can then take advantage of better educational opportunities in tier-1 and tier-2 cities and eventually replace China’s rapidly aging skilled workforce.

Are China Stocks The Ultimate Trump Trade?

We believe there are solid reasons to believe that a second Trump Administration will end up being positive for the US-China relationship and China's equity market. Trump invited Xi Jinping himself to attend his inauguration. Although the leader is unlikely to be physically present at the event, we believe the invitation is symbolic of Trump's desire to bring Xi to the bargaining table. The Biden Administration, by contrast, kept all of Trump's tariffs intact, instituted more trade restrictions, and engaged in precious few strategic talks with China to relieve stress on the relationship.

There have been other signs of Trump's conciliatory, "Art of The Deal" approach to China. These include the removal, at the behest of Trump, Elon Musk, and their loyalists, of outbound China investment restrictions in the Continuing Resolution (CR), passed in December, to keep the government funded into the new year as well as Trump's stated resolve to reverse the ban on TikTok, the popular social media platform owned by the China-based technology company Bytedance. In our opinion, Trump's election was the best possible outcome for the US-China relationship at the current juncture.

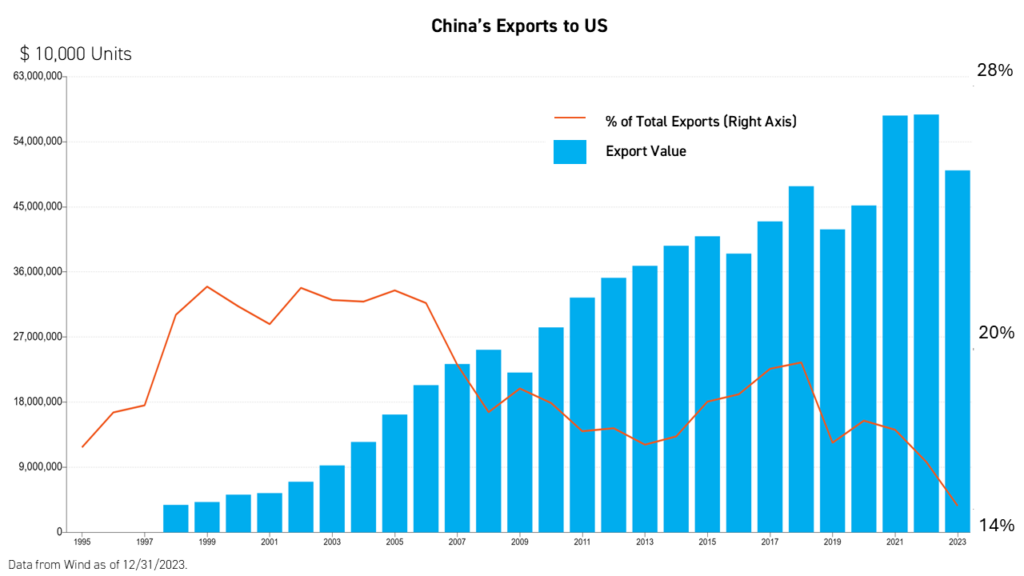

President-Elect Trump’s tariff threats have prevented many investors from allocating to China equities despite the compelling valuations and improving policy environment. However, the tariff lens should not be applied to China in a vacuum, as even Mexico and Canada were hit with similar tariff threats. Moreover, exports to the United States now represent only 14% of China’s total exports, down from 21% in 2006. As such, even assuming that some more tariffs are put on, the potential impact on China's economy overall is likely to be limited.

China’s trade with broader Asia has increased significantly as China-based companies have been de-risking away from the US, just as US companies claim they are doing vis-à-vis China.

We believe Trump is uniquely positioned to have a “Nixon goes to China” moment, striking a grand bargain that piggybacks off his Phase One trade deal from 2020 through an unconventional approach to diplomacy. Xi’s invitation to the inauguration is further evidence in support of our view.

The US needs China as much as China needs the US and tariffs have a history of being ineffective and even economically detrimental. Under the Hoover Administration following the stock market crash of 1929 and the onset of the Great Depression, the Smoot-Hawley Tariff Act was passed, which raised tariffs on over 20,000 goods entering the US by 20% or more. Many economic historians credit the Act with prolonging the Great Depression by keeping consumer prices high. As a businessperson, Trump knows that tariffs should not be a long-standing policy, rather, they should be a negotiating tool. This view is evidenced by the first Trump Administration's decision to cut instituted tariffs in half upon reaching the "Phase One" trade deal in 2020.

Will leverage be applied to get a great deal for the American people? 100%, but President Trump is very aware of the US stock market and the US economy’s strong position.

Conclusion

China’s equity markets are likely to continue the upward trend that began in 2024 on further stimulus, the delayed release of policies already implemented, and the potential kickstarting of badly-needed structural reforms. We believe internet companies may continue to outperform.

While policy error is always a risk, we remain confident that China’s government will continue down the path of accommodative fiscal and monetary policy in 2025 and that the Trump Administration will seek a “grand bargain” with China, albeit through some tough negotiation.

- Data from Bloomberg as of 12/31/2024.

Definitions

Dividend Yield: The dividend yield is a financial ratio that shows how much a company pays out in dividends relative to its stock price.

Earnings per Share (EPS): A company's earnings divided by its total shares outstanding.

Gross Domestic Product (GDP): The total value of all goods and services produced within a country over a specific period of time, in this case one year.

Housing Price Index (100 Cities): This index tracks the prices of housing in 100 major Chinese tier-1, tier-2, and tier-3 cities and is calculated and maintained by China's National Bureau of Statistics (NBS).

Shareholder Value Metrics: Metrics to track how well a corporation is returning value to shareholders.

Buyback Yield: The sum of the value of all announced share repurchase programs divided by the market capitalization of a corporation.

Market Capitalization: The total value of all issued shares of a corporation.

Price-to-Earnings (P/E) Ratio: A measure of how cheap a company's stock is relative to its earnings. It is calculated by dividing a company's price per share by a company's earnings per share (EPS).

MSCI China All Shares Index: The MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. It is based on the concept of the integrated MSCI China equity universe with China A-shares included. The index was launched on June 26, 2014.

S&P 500 Index: The S&P 500 Index is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 9.9 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 3.4 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. The index was launched on March 4, 1957.