2019 Outlook: The Case for Rebalancing to China

Around this time of the year, 2019 forecasts are a hot topic as strategists, economists and research analysts lick a finger and attempt to predict the outcome of the highly complex and largely unpredictable stock market. A multitude of variables influence the market from rising interest rates to surprise tweets. One particular factor that we will be watching closely in 2019 is the trade relationship between the US and China. As tensions have escalated throughout the year, the economic impact of the tariffs has been felt by both countries, seeing their markets fall by about 6% year-to-date (YTD) in the US1 and 23% YTD in China2. However, we believe that both countries appear increasingly incentivized to make a deal on trade and that investors could potentially benefit from the comparatively low valuations of Chinese equities.

Trade Outlook

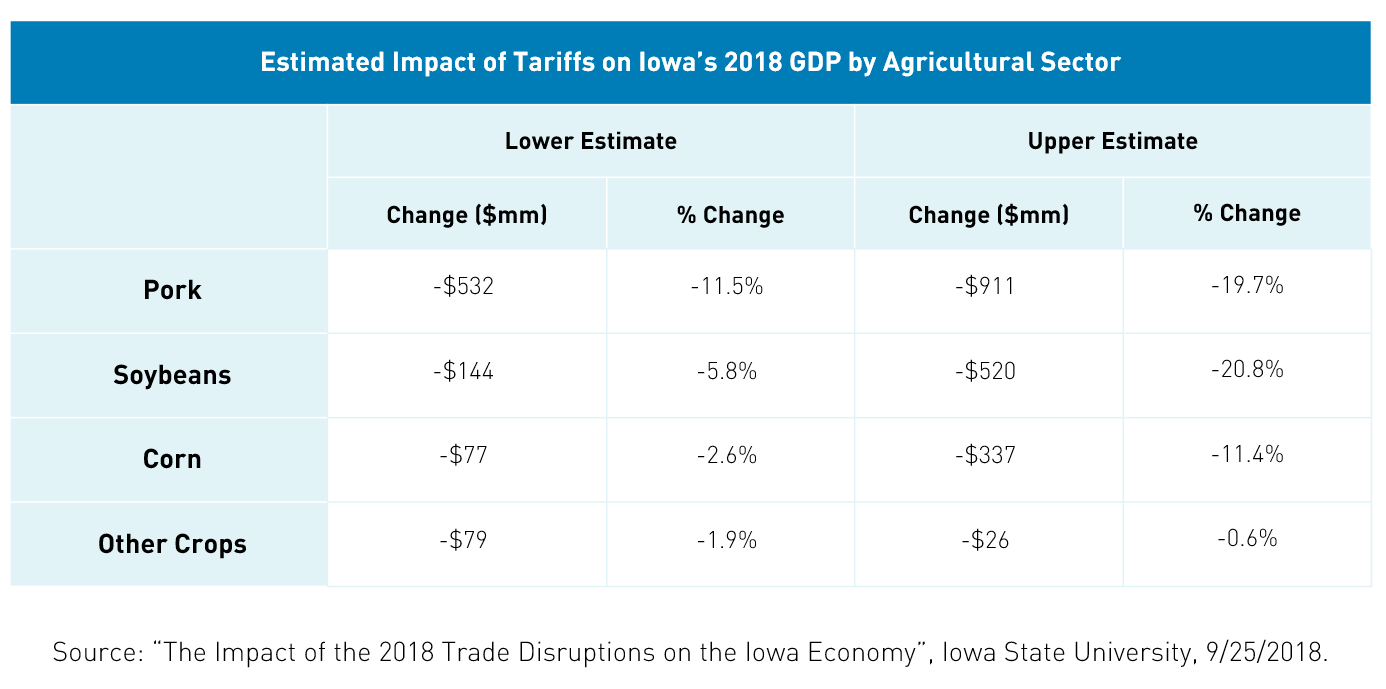

We believe the US and China are working toward a compromise on trade as the negative effects of the tariffs take hold. China’s recent third-quarter economic statistics put year-over-year GDP growth at 6.5%, slightly missing analyst expectations of 6.6%3, and the US stock market has erased all of its 2018 gains, having fallen about 15% since hitting its peak in September4. Chinese tariffs have had an especially negative impact on American farmers. A new study by Iowa State University estimates that trade disruptions due to tariffs have caused the gross domestic product of Iowa alone to decline by $1-2 billion in 20185.

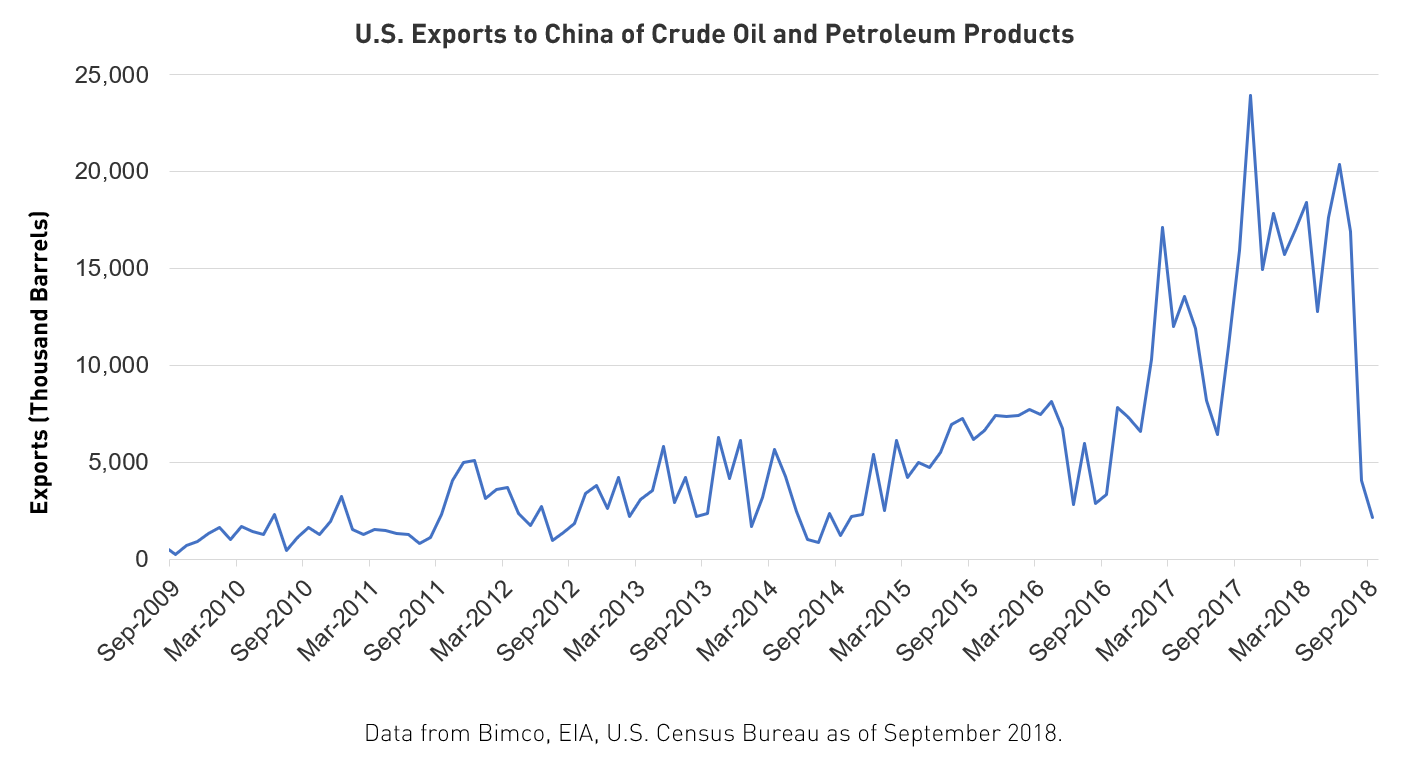

The US energy sector has also been greatly affected by trade tensions. Chinese imports of US natural gas and oil have increased dramatically in the last three years, but the onset of new tariffs has seen a complete reversal of this trend. On September 24, 2018, China imposed a 10% import tax on U.S. Liquefied Natural Gases, and Chinese buyers halted purchases of U.S. crude oil.

However, with President Trump and President Xi Jinping’s Dec. 1 meeting at the G20 Summit in Argentina, we believe both sides have made their first steps towards a compromise on trade. The US agreed to a 90-day delay on increasing tariffs on $200 billion of Chinese goods and, in exchange, China agreed to purchase more American products. President Trump commented after the dinner that it was “an amazing and productive meeting”6, and a statement from China’s foreign ministry also characterized the meeting as very successful, adding that the two sides have proposed a series of plans on how to resolve existing differences and problems.7

The outcome of the G20 Summit caused the markets to rally the next day, increasing by 1.1% in the US markets8 and 2.4% in the Chinese markets9. Despite the news, critics believed that the probability of unforeseen circumstances jeopardizing the deal was high. Sure enough, a few days later, it was announced that, Meng Wanzhou, the CFO of Chinese telecommunications giant, Huawei, was arrested in Canada for allegedly violating US sanctions on Iran. Huawei is a Chinese telecommunications giant whose advanced smartphones and world-class 5G technology rival US companies like Apple and Verizon.10

Although the incident dampened positive sentiment following the G20 Summit, it simultaneously provided an important stress test to President Trump and President Xi Jinping’s desire to find a resolution. Both sides have continued towards a compromise on trade. On December 11, China reported plans to reduce counter tariffs on US goods by eliminating a 25 percent surcharge on US-made cars11. Then, the following day, Meng Wanzhou was released in Canada12. So far, the willingness to compromise has prevailed, and the Huawei situation has been kept separate from trade discussions. White House economic adviser, Larry Kudlow, echoed these sentiments in a recent interview stating, “It seems to me that there’s a trade lane . . . and there’s a law enforcement lane. They’re different channels, and I think they will be viewed that way for quite some time.”13 China’s former Vice Minister of Commerce, Wei Jianguo, said the incident “will cast a shadow over the trade talks, but both sides will work hard to avert that bad influence…”14. We believe there could be more positive announcements on trade talk resolutions soon.

Market Outlook

The effect of trade tensions on the performance of Chinese equities has been significant this year, and US equities have also started to feel the impact. Moreover, there are other factors on the horizon that could create skepticism about the continued rise of the US bull market. The Federal Reserve has hiked interest rates four times this year, increasing the federal funds rate to 2.25- 2.50% with two more rate hikes expected in 201915. Additionally, corporate buybacks have been slowing as 2018 comes to a close. Some analysts believe that corporate buyback activity has been a linchpin of both the market’s fading rally this year and the nine-year-old bull market; therefore, slowing buybacks could be worrisome16.

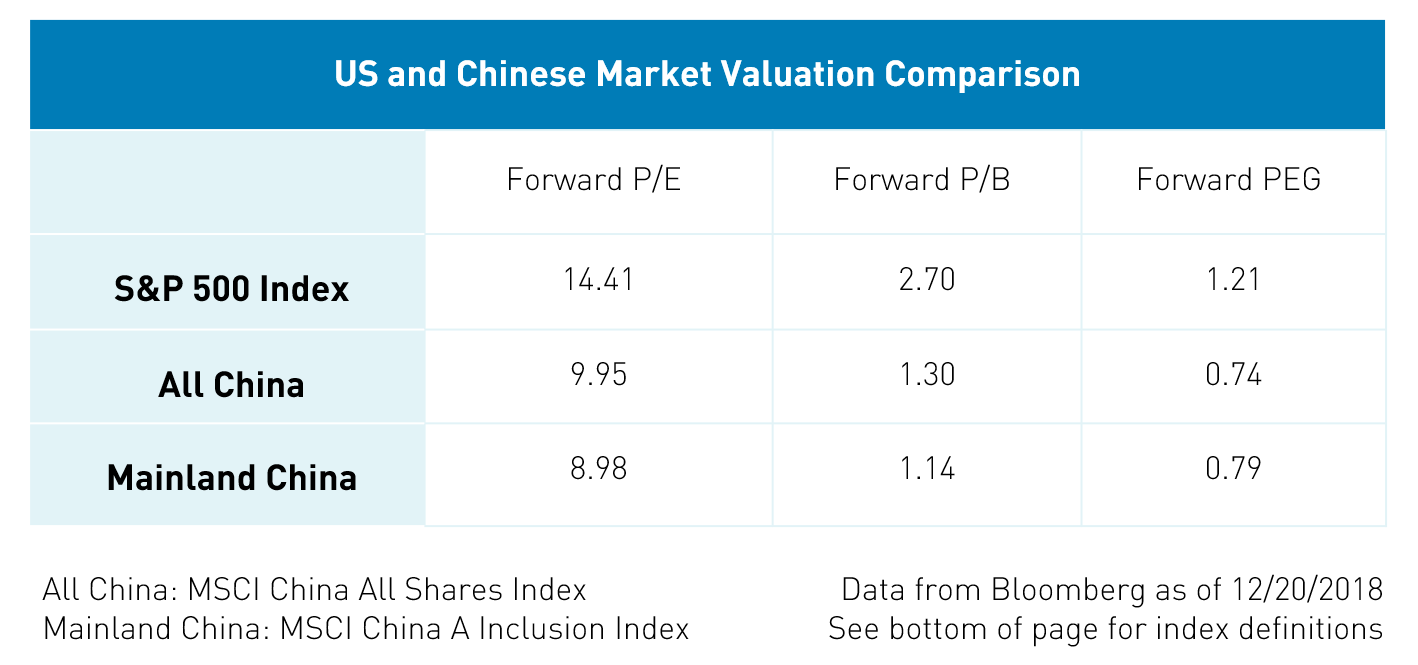

With the valuations of US companies still comparatively high, this could also mean that US equities are expensive from a valuation perspective. The key question in 2019 is what will be the S&P 500’s Earnings Per Share (EPS)? If corporate earnings remain strong, the S&P 500 could have an EPS of $176, making today’s US equities reasonably priced from a valuation basis. If several of the known variables such as rising US interest rates, slowing corporate buybacks, or escalating trade tensions come to fruition, analysts estimate that the S&P 500’s EPS could be in the range of $170 next year, making today’s valuation expensive.17

It is safe to say that Chinese equities are inexpensive compared to US equities. Chinese companies list across multiple exchanges including the Shanghai, Shenzhen, Hong Kong, New York and Nasdaq stock exchanges, but regardless of exchange, trade concerns have driven valuations of Chinese stocks lower18.

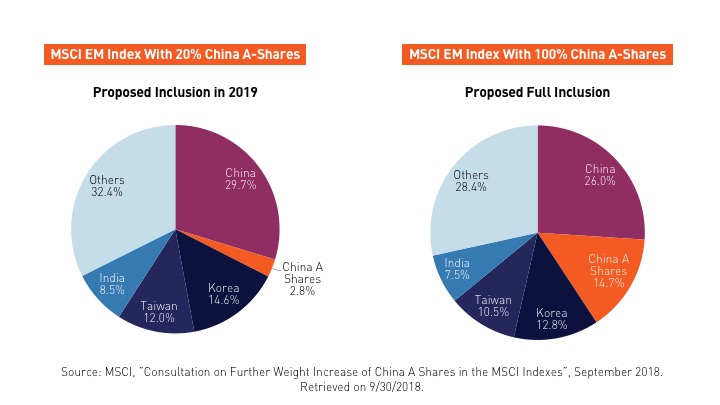

In the case of Mainland Chinese A-Shares, the comparativley low valuations come despite MSCI beginning the inclusion of the 235 Chinese A-Shares we hold in the KraneShares Bosera MSCI China A ETF (Ticker: KBA) to their broader indices. MSCI added 5% of the market cap from these 235 companies to their indices such as the MSCI Emerging Markets Index in 2018. They have subsequently proposed raising the 2019 inclusion to 20% of the market cap of the 235 KBA stocks19. We believe this reallocation to the stocks within KBA could have a positive effect on stock prices. It will also boost the influence of institutional investors, who are typically a more stable shareholder base.

Moreover, the weights of US equities in global indices has increased. Today, US stocks represent 55% of the MSCI All Country Index, up from 40% in 200820. Investors could potentially be overweight US equities and underweight China and may consider rebalancing to rectify this difference.

As we move into 2019, Chinese stocks appear inexpensive relative to US stocks, and there are factors that cast doubt on the continued rise of the US bull market. Additionally, this comes at a time that we believe could be a positive turning point in US-China trade talks, with the first compromises already confirmed. This by no means marks the end of the US bull market, but we believe investors could take advantage of the relatively attractive valuations of the stocks held in the KraneShares Bosera MSCI China A ETF (Ticker: KBA). For investors looking for a broad China solution the KraneShares MSCI China All Shares ETF (ticker KALL) holds Chinese companies on the Shanghai, Shenzhen, Hong Kong and US exchanges.

- The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries*. With 1,138 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

- The S&P 500 Index is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

- The MSCI China A Inclusion Index is designed to track the progressive partial inclusion of A-shares in the MSCI Emerging Markets Index over time. The index is designed for global investors accessing the A-shares market using the Stock Connect framework and is calculated using China A Stock Connect listings based on the offshore RMB exchange rate (CNH).

- MSCI China All Shares Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐ chips and foreign listings (e.g. ADRs). The index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen and outside of China. It is based on the concept of the integrated MSCI China equity universe with China A-shares included.

- Price-Earnings Ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

- Earnings per share (EPS) is the portion of a company's profit allocated to each share of common stock.

- Forward Price-to-Earnings (P/E) is a current stock's price over its estimated earnings per share.

- Forward Price-to-Booking (P/B) compares a firm's market to book value by dividing price per share by book value per share.

- Forward Price/Earnings to Growth (PEG) a stock's price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period.

- Data from Bloomberg as of 12/20/2018 referencing the S&P 500 Index (SPX)

- Data from Bloomberg as of 12/20/2018 referencing the MSCI China All Shares Index (M1CNAL)

- Data from Bloomberg as of 10/31/2018

- Data from Bloomberg as of 12/20/2018 referencing the S&P 500 Index (SPX)

- “The Impact of the 2018 Trade Disruptions on the Iowa Economy”, Iowa State University, 9/25/2018

- “Donald Trump and Xi Jinping declare trade truce at G20”, The Guardian, 12/1/2018

- “State Councilor and Foreign Minister Wang Yi's briefing to Chinese and foreign media on the outcome of the G20 Summit”, Ministry of Foreign Affairs of the People's Republic of China, 12/2/2018

- Data from Bloomberg as of 12/12/2018 referencing the S&P 500 Index (SPX)

- Data from Bloomberg as of 12/12/2018 referencing the MSCI China All Shares Index (M1CNAL)

- “China’s judgment on Huawei case: Anger, patriotism and iPhone boycotts”, Washington Post, 12/12/2018

- “China Move to Cut Duties on U.S. Imports Lifts Auto Stocks”, Bloomberg News, 12/11/2018

- “Facing extradition to the US, Huawei's CFO is released on bail in Canada”, CNN Business, 12/12/2018

- “Kudlow: Trump didn’t know about Huawei executive’s arrest before dining with Chinese leader”, The Washington Post, 12/9/2018

- “China Debates Pros and Cons of Retaliation After Huawei Arrest”, Bloomberg, 12/7/2018

- “Fed now sees just 2 rate hikes in 2019”, CNBC, 12/19/2018

- “Stock Buybacks Diminish, Leaving the Market With Less Fuel”, Barron’s, 10/24/2018

- "US Weekly Kickstart", Goldman Sachs Portfolio Strategy Research, 12/7/2018

- Data from Bloomberg as of 12/12/2018

- MSCI, “Consultation on Further Weight Increase of China A Shares in the MSCI Indexes”, September 2018. Retrieved on 9/30/2018

- “MSCI ACWI Index (USD)”, MSCI, retrieved 12/14/2018

This material represents the managers opinion. It should not be regarded as investment advice or recommendation of specific securities.

The KraneShares ETFs are distributed by SEI Investments Distribution Company (SIDCO), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with Krane Funds Advisors, LLC, the Investment Adviser for the Fund. Additional information about SIDCO is available on FINRA’s BrokerCheck.