The March of Ida: A Modern Storm’s Impact on Carbon Prices

By Luke Oliver, Head of Strategy

Upcoming Webinar:

Pricing Carbon 2021-2022: Your Portfolio and the Clean Energy Transition

Join us on Tuesday, September 21, 2021 at 11:00 am - 12:00 pm EDT.

Click here to register.

With the recovery effort in force following Hurricane Ida’s devastating and fatal march across the US, the price of global carbon allowances has spiked to all-time highs. Coincidence? Nobel Prize-winning economist Robert Engel has written on the relationship between climate-related news and the price of carbon in a well-read and cited paper here. However, what is happening in the markets currently also has a mechanical, and highly sobering, cause and effect.

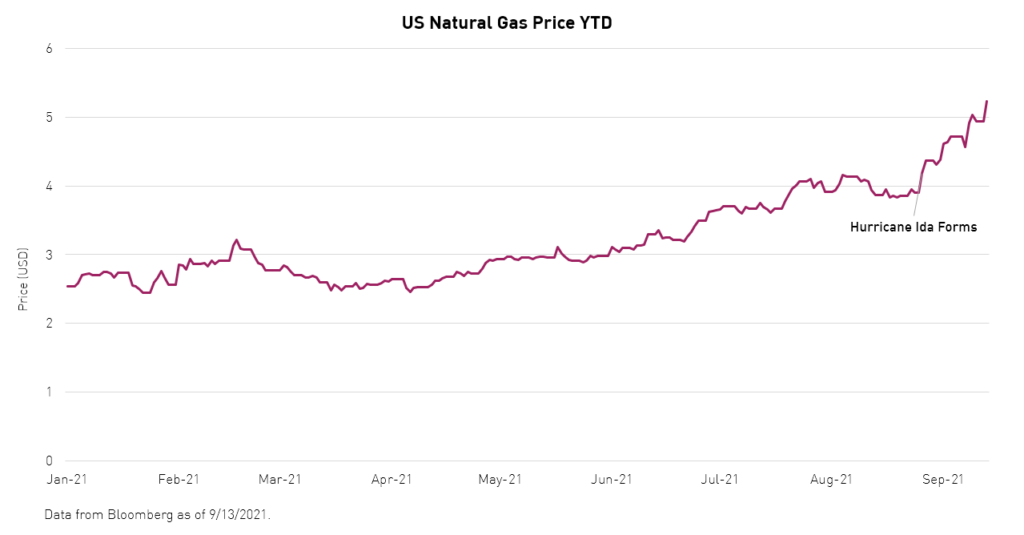

Louisiana, where Ida made landfall, is a major producer and exporter of natural gas. With 94% of the state’s gas production shut down because of the storm, US natural gas prices have spiked 23.66% since Ida formed on August 26th and 111.34% YTD. Today, almost 80% of oil and gas production is still offline in the region and could remain so for weeks, meaning up to 1.5 million barrels of oil and 1.7 billion cubic feet of gas are being lost to the market each day1. The result has been a surge in the price of US natural gas to levels not seen in 2.5 years.

With natural gas supply constrained, it becomes more difficult for energy providers to switch away from coal. While both natural gas and coal are fossil fuels, coal combustion produces about twice2 the carbon emissions of natural gas. This increase in coal consumption forces energy providers to buy more carbon allowances to offset their increased emissions from coal.

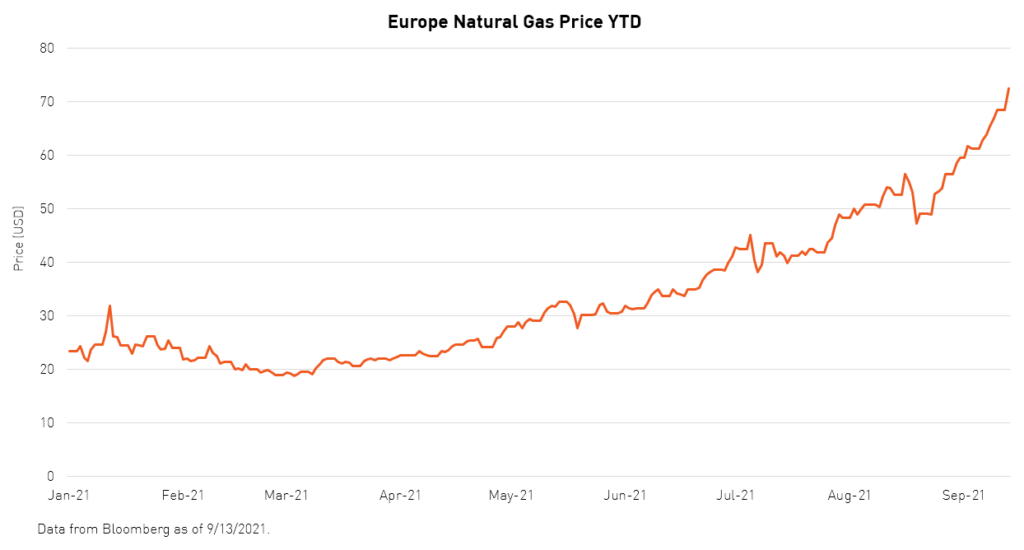

Natural gas prices are also surging in Europe, up 250.77% YTD. In part because of the reduction in supply from the US, but also due to Europe’s own supply/demand dynamics. European stockpiles are currently 20% below3 seasonal averages and supply via the Yamal-Europe pipeline from Russia has been reduced in recent weeks. Interestingly, this reduced supply appears to be the result of potential buyers holding back orders hoping for fresh, lower-cost supply, that could soon be available via the Nordstream 2 pipeline that is set to come online in the near future.

Another potential rationale for the reduced supply is that Russian gas-supplier Gazprom could be limiting the delivery of discretionary natural gas to Europe in order to build support for its new pipeline. Should that supply not come and a harsher winter set in, there could be a considerable squeeze that could see both natural gas and carbon prices rise dramatically. Again, the specter of extreme weather adds a new dynamic to market pricing. As this risk gets baked into natural gas prices, observers are now turning their attention to the carbon allowance market.

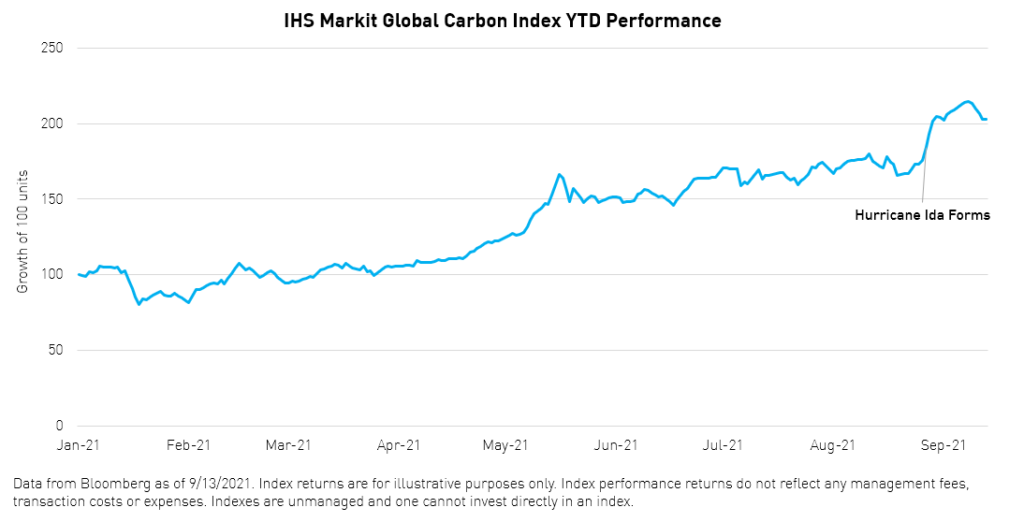

As a result of these higher natural gas prices in the US and Europe, global carbon allowances continue to make new highs. European Union Allowances (EUA) futures broke EUR 62 per ton ($73!) and futures on California carbon allowances (CCAs) hit a record $25 per ton. Even the Eastern US market, the Regional Greenhouse Gas Initiative (RGGI), is seeing its futures trading over $9 per ton down just 3% from their highs4.

These three markets are the current constituents of the IHS Markit Global Carbon Index (GLCARB), which is the underlying index for the KraneShares Global Carbon ETF (Ticker: KRBN). The index has soared 8.2% since Ida formed and 59.59% YTD4.

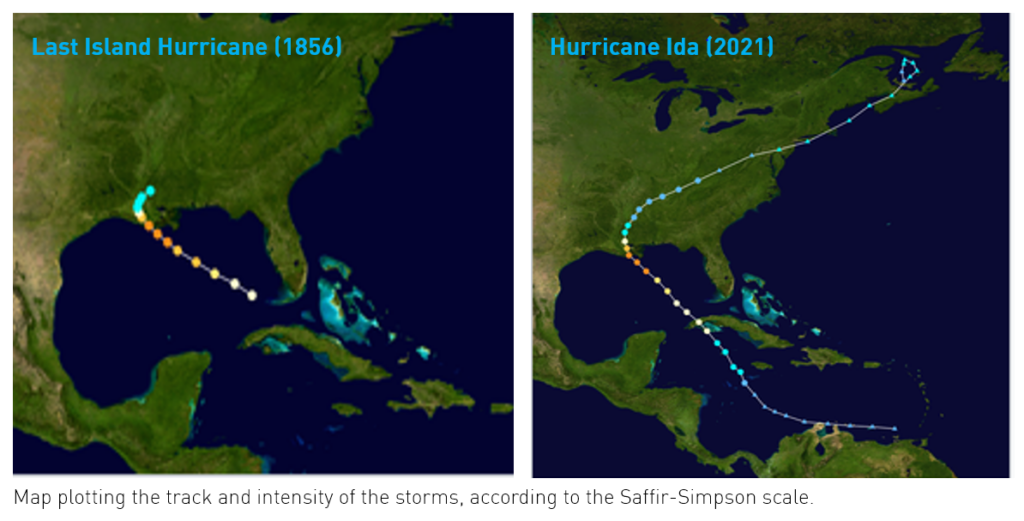

Hurricane Ida is just one storm, but storms like this are becoming more intense and happening more frequently. Some took comfort in the fact Ida was tied for landfall strength with the 1856 Last Island hurricane suggesting storms like this have historical precedent. The Last Island hurricane petered out in western Mississippi. Hurricane Ida, which was slightly less intense than 2005’s Katrina and similar in strength to 2020’s Laura, continued overland to NYC where it unleashed torrential rain that drowned people in their apartments and caused significant flooding in the subway system for the third time... this summer! This is a global phenomenon with hundreds killed in flooding in Germany5 and 13 people drowned in flash floods in Zhengzhou, China’s subway system6 both in July this year.

The increasing effects of climate change not only highlight the need for carbon prices to rise in order to catalyze change but simultaneously highlights the fragility of global supply chains which further challenges emission reduction. As climate policies tighten, increasing the scarcity of carbon allowances, and the natural gas supply becomes stretched, we could see continued strength in carbon allowance prices. While the current short-term squeeze on natural gas supply, in both Europe and due to the US storm, has been one of the strongest catalysts for carbon price action in recent weeks, the long-term implications are unmistakable. KRBN, the KraneShares Global Carbon ETF, gives investors a hedge to the potential impact of this ongoing crisis with potential upside exposure to the rising price of carbon allowances.

Citations:

- The Wall Street Journal, “Hurricane Ida’s Fallout Continues to Cripple U.S. Oil Production”, September 8, 2021.

- Union of Concerned Scientists, “Environmental Impacts of Natural Gas”, June 19, 2014.

- World Oil, “European natural gas futures hit new highs as Russian output dips”, September 7, 2021.

- Data from Bloomberg as of 9/14/2021.

- CNN, “More than 150 people still missing in German floods unlikely to be found, officials fear”, July 22, 2021.

- NPR, “NYC's Subway Flooding Isn't A Fluke. It's The Reality For Cities In A Warming World”, September 2, 2021.