KSTR: Getting Exposure to China’s IPO Market

The Great IPO Migration: China's Tech Companies Come Home

China is witnessing a fundamental shift in how its most innovative companies access capital. New Chinese tech companies are foregoing overseas listings. What was once a trickle of companies choosing domestic markets over New York or London has become a flood.

This could be a trend that's creating new investor access opportunities and reshaping how we think about accessing China's innovation economy. While it can seem like a challenge for international investors it could actually be an enormous opportunity for those who know where to look.

Understanding the STAR Market: China's Innovation Engine

The Shanghai Stock Exchange Science and Technology Innovation Board aka the STAR Market is China's answer to this new reality. Launched in July 2019, it was specifically designed to keep China's best and brightest companies at home.

Think of the STAR Market as China's NASDAQ. It targets domestic high-growth science and technology companies in sectors like new-generation information technology, biomedicine, new energy, and environmental protection. The key difference? Companies can avoid much of the bureaucratic red tape that have traditionally bogged down Chinese IPOs.

The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR) offers investors access to these STAR Market companies through U.S. exchanges. KSTR tracks companies on the platform, giving you a portfolio of some of China's tech innovators.

The Trade War Acceleration

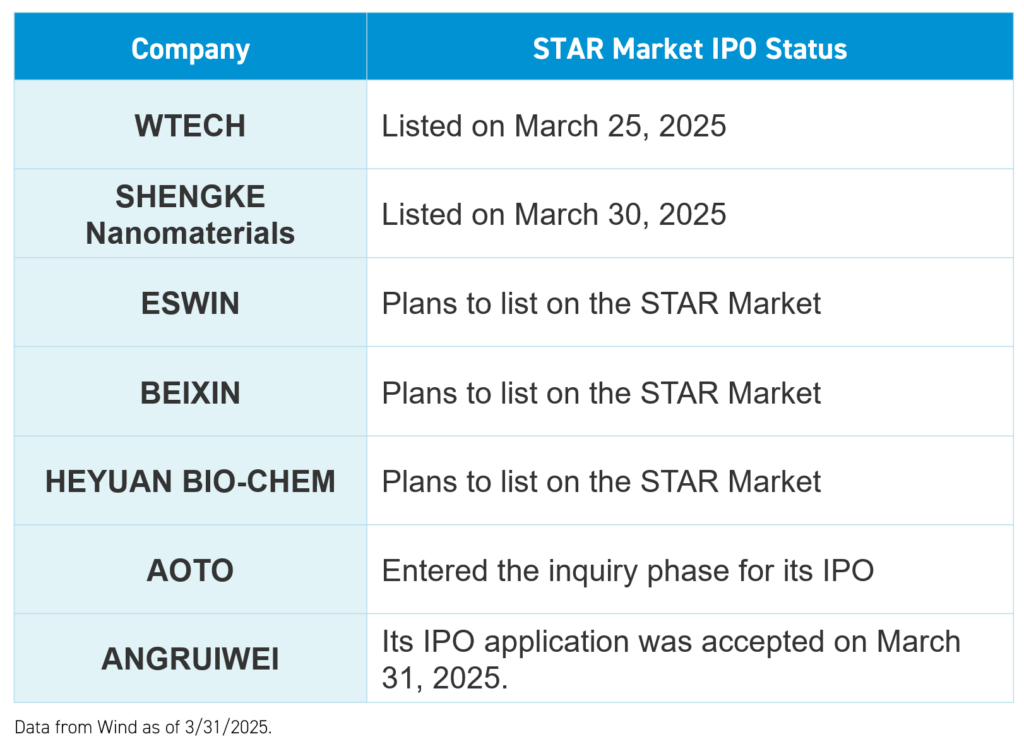

KSTR's investment thesis is based on what we're seeing happen in real-time: Chinese companies are choosing domestic listings over the uncertainty of overseas markets. The numbers tell the story clearly.

Trade tensions that started in 2018 have morphed into something much bigger. Tariffs have at one point soared to 145% on Chinese goods. Beijing has retaliated with its own punitive measures. The result? An environment where domestic markets suddenly look like safe harbors for capital raising.

But it's not just trade tensions driving this shift. Chinese regulators stepped in with new rules that pack serious punch. Companies must now register with the China Securities Regulatory Commission before pursuing overseas listings. The impact has been dramatic, the average time a Chinese company must wait for offshore approval has ballooned from 2-3 months up to 6 months or longer.

While there was a slowdown of IPOs in 2024, Chinese regulators have made it a priority to encourage IPOs and stimulate the Chinese stock markets.1

The Unicorn Pipeline: Where the Big Names Are Heading

Want more proof this trend is real? Look at China's most valuable tech unicorns.

Shein, the fast-fashion giant once targeting London, hit a regulatory wall when Chinese authorities withheld approval. Now? The company is pivoting toward Hong Kong, reportedly preparing to file a prospectus within weeks.

ByteDance tells a similar story. Despite commanding a $300 billion valuation, the TikTok parent company is considering domestic options for its core business. Hong Kong tops their preference list, though Shanghai's STAR Market remains in play.

This isn't just about two companies. It's about an entire generation of Chinese tech firms that previously would have automatically chosen New York or London. Now they're staying home.

Geopolitical Insulation: A Strategic Advantage

Unlike many other Chinese sectors, the STAR Market companies have a natural protective advantage. Many of these tech companies serve primarily domestic markets or have diversified global operations that aren't heavily dependent on U.S. market access.

The Chinese government views technological self-sufficiency as a strategic priority, providing policy support and investment that further insulates these companies from external pressures. This gives STAR Market companies a natural moat in their massive home market.

The KSTR Opportunity

The KraneShares SSE STAR Market 50 Index ETF (Ticker: KSTR) provides investors with diversified exposure to this compelling shift, offering access to Chinese innovation companies that increasingly can't be found anywhere else.

As Chinese companies and regulators continue favoring domestic listings and international market access routes face mounting constraints, KSTR may be well-positioned to benefit from both the regulatory shift and the massive innovation investment that lies ahead. This fund offers exposure to Chinese enterprises at precisely the moment when getting access to them through traditional channels is becoming nearly impossible.

Citations:

- https://www.ft.com/content/5cee4423-fbcd-46c0-836b-defdfb095322

For KSTR standard performance, top 10 holdings, risks, and other fund information, please click here.

Diversification does not ensure a profit or guarantee against a loss.